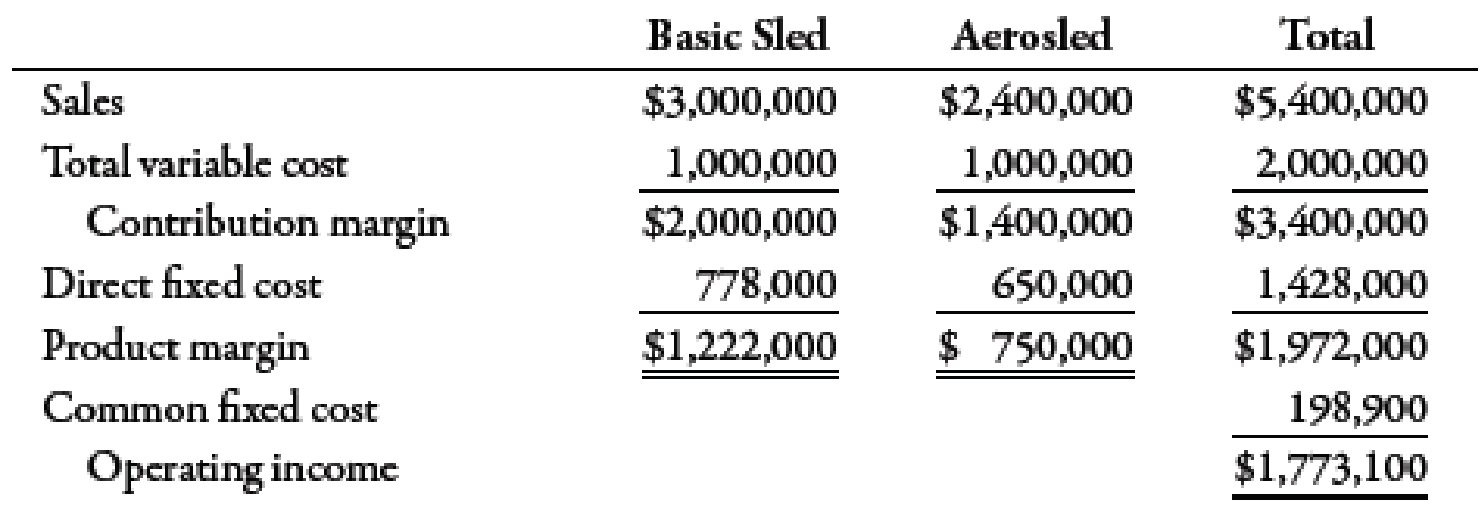

Basu Company produces two types of sleds for playing in the snow: basic sled and aerosled. The projected income for the coming year, segmented by product line, follows:

The selling prices are $30 for the basic sled and $60 for the aerosled. (Round break-even packages and break-even units to the nearest whole unit.)

Required:

- 1. Compute the number of units of each product that must be sold for Basu to break even.

- 2. Assume that the marketing manager changes the sales mix of the two products so that the ratio is five basic sleds to three aerosleds. Repeat Requirement 1.

- 3. CONCEPTUAL CONNECTION Refer to the original data. Suppose that Basu can increase the sales of aerosleds with increased advertising. The extra advertising would cost an additional $195,000, and some of the potential purchasers of basic sleds would switch to aerosleds. In total, sales of aerosleds would increase by 12,000 units, and sales of basic sleds would decrease by 5,000 units. Would Basu be better off with this strategy?

1.

Calculate break-even units for basic sled and aerosled.

Answer to Problem 54P

Break-even quantity for basic sled and aerosled are 47,850 units and 19,140 units respectively.

Explanation of Solution

Break-Even Point:

The point or situation where the amount of total cost is equivalent to total revenue is known as the break-even point. It is the point where there is no loss or no profit.

The package of basic sled and aerosled is given below:

| Product |

Price ($) A |

Unit Variable Cost ($) B |

Unit Contribution Margin ($) C |

Sales Mix D |

Package Unit Contribution Margin ($) |

| Basic sled | 30 | 103 | 20 | 55 | 100 |

| Aerosled | 60 | 254 | 35 | 25 | 70 |

| Total | 170 |

Table (1)

Use the following formula to calculate break-even quantity:

Substitute $1,626,9006 for total fixed cost and $170 for contribution margin in the above formula.

Therefore, break-even quantity is 9,570 units.

Use the following formula to calculate break-even quantity for basic sled:

Substitute 9,570 units for number of units and 55 for sales mix in the above formula.

Therefore, the break-even quantity for basic sled is 47,850 units.

Use the following formula to compute break-even point for aerosled:

Substitute 9,570 units for number of units and 25 for sales mix in the above formula.

Therefore, the break-even motorcycle helmet is 19,140 units.

Working Note:

1. Calculation of units sold of basic sled:

2. Calculation of units sold of aerosled:

3. Calculation of variable cost per unit for basic sled:

4. Calculation of variable cost per unit for aerosled:

5. Calculation of sales mix:

Ratio for basic sled:

Ratio for aerosled:

The sales mix ratio for basic sled and aerosled is 5:2.

6. Calculation of total fixed cost:

2.

Calculate the break-even units for basic sled and aerosled if the sales mix is 5:3.

Answer to Problem 54P

Break-even quantity for basic sled and aerosled are 39,680 units and 23,808 units respectively.

Explanation of Solution

Break-Even Point:

The point or situation where the amount of total cost is equivalent to total revenue is known as the break-even point. It is the point where there is no loss or no profit.

The package of basic sled and aerosled is given below:

| Product |

Price ($) A |

Unit Variable Cost ($) B |

Unit Contribution Margin ($) C |

Sales Mix D |

Package Unit Contribution Margin ($) |

| Basic sled | 30 | 103 | 20 | 5 | 100 |

| Aerosled | 60 | 254 | 35 | 3 | 105 |

| Total | 205 |

Table (1)

Use the following formula to calculate break-even quantity:

Substitute $1,626,9006 for total fixed cost and $205 for contribution margin in the above formula.

Therefore, break-even quantity is 7,936 units.

Use the following formula to calculate break-even quantity for basic sled:

Substitute 7,936 units for number of units and 5 for sales mix in the above formula.

Therefore, the break-even quantity for basic sled is 39,680 units.

Use the following formula to compute break-even point for aerosled:

Substitute 7,936 units for number of units and 3 for sales mix in the above formula.

Therefore, the break-even motorcycle helmet is 23,808 units.

3.

State whether the strategy is profitable.

Explanation of Solution

| Particulars | Amount ($) |

| Increase in contribution margin of aerosled | 420,0007 |

| Decrease in contribution of basic sled | (100,000)8 |

| Increase in total contribution margin | 320,000 |

| Less: Additional fixed cost | 195,000 |

| Increase in income | 125,000 |

Table (1)

The strategy will earn Person B $125,000. Therefore, the strategy is beneficial for Person B.

Working Notes:

7. Calculation of increase in contribution margin of aerosled:

8. Calculation of decrease in contribution margin of basic sled:

Want to see more full solutions like this?

Chapter 7 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling 44,000 shelves for $32 each. Cutrate Furniture approached Jansen about buying 1,200 shelves for bookcases it is building and is willing to pay $26 for each shelf. No packaging will be required for the bulk order. Jansen usually packages shelves for Home Depot at a price of $1.50 per shell. The $1.50 per-shelf cost is included in the unit variable cost of $27, with annual fixed costs of $320.000. However, the $130 packaging cost will not apply in this case. The fixed costs will be unaffected by the special order and the company has the capacity to accept the order. Based on this information, what would be the profit if Jansen accepts the special order? A. Profits will decrease by $1,200. B. Profits will increase by $31,200. C. Profits will increase by $600. D. Profits will increase by $7,200.arrow_forwardShelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?arrow_forwardDimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitris normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitris other operations. What will be the impact on profits of accepting the order?arrow_forward

- Brahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardKeleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:arrow_forwardPolaris Inc. manufactures two types of metal stampings for the automobile industry: door handles and trim kits. Fixed cost equals 146,000. Each door handle sells for 12 and has variable cost of 9; each trim kit sells for 8 and has variable cost of 5. Required: 1. What are the contribution margin per unit and the contribution margin ratio for door handles and for trim kits? 2. If Polaris sells 20,000 door handles and 40,000 trim kits, what is the operating income? 3. How many door handles and how many trim kits must be sold for Polaris to break even? 4. CONCEPTUAL CONNECTION Assume that Polaris has the opportunity to rearrange its plant to produce only trim kits. If this is done, fixed costs will decrease by 35,000, and 70,000 trim kits can be produced and sold. Is this a good idea? Explain.arrow_forward

- More-Power Company has projected sales of 75,000 regular sanders and 30,000 mini-sanders for next year. The projected income statement is as follows: Required: 1. Set up the given income statement on a spreadsheet (e.g., ExcelTM). Then, substitute the following sales mixes, and calculate operating income. Be sure to print the results for each sales mix (a through d). 2. Calculate the break-even units for each product for each of the preceding sales mixes.arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardOat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently. The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. Should Oat Treats make or buy the oat bars?arrow_forward

- Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.arrow_forwardReubens Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided, If Reuben accepts the offer, what will the effect on profit be?arrow_forwardCountry Diner currently makes cookies for its boxed lunches. It uses 40,000 cookies annually in the production of the boxed lunches. The costs to make the cookies are: A potential supplier has offered to sell Country Diner the cookies for $0.85 each. If the cookies are purchased, 10% of the fixed overhead could be avoided. If Jason accepts the offer, what will the effect on profit be?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning