Reconstruct Missing Data

A tornado struck the only manufacturing plant of Toledo Farm Implements (TFI) on June 1. All work-in-process inventory was destroyed, but a few records were salvaged from the wreckage and from the company’s headquarters. If acceptable documentation is provided, the loss will be covered by insurance. The insurable value of work-in-process inventory consists of direct materials, direct labor, and applied

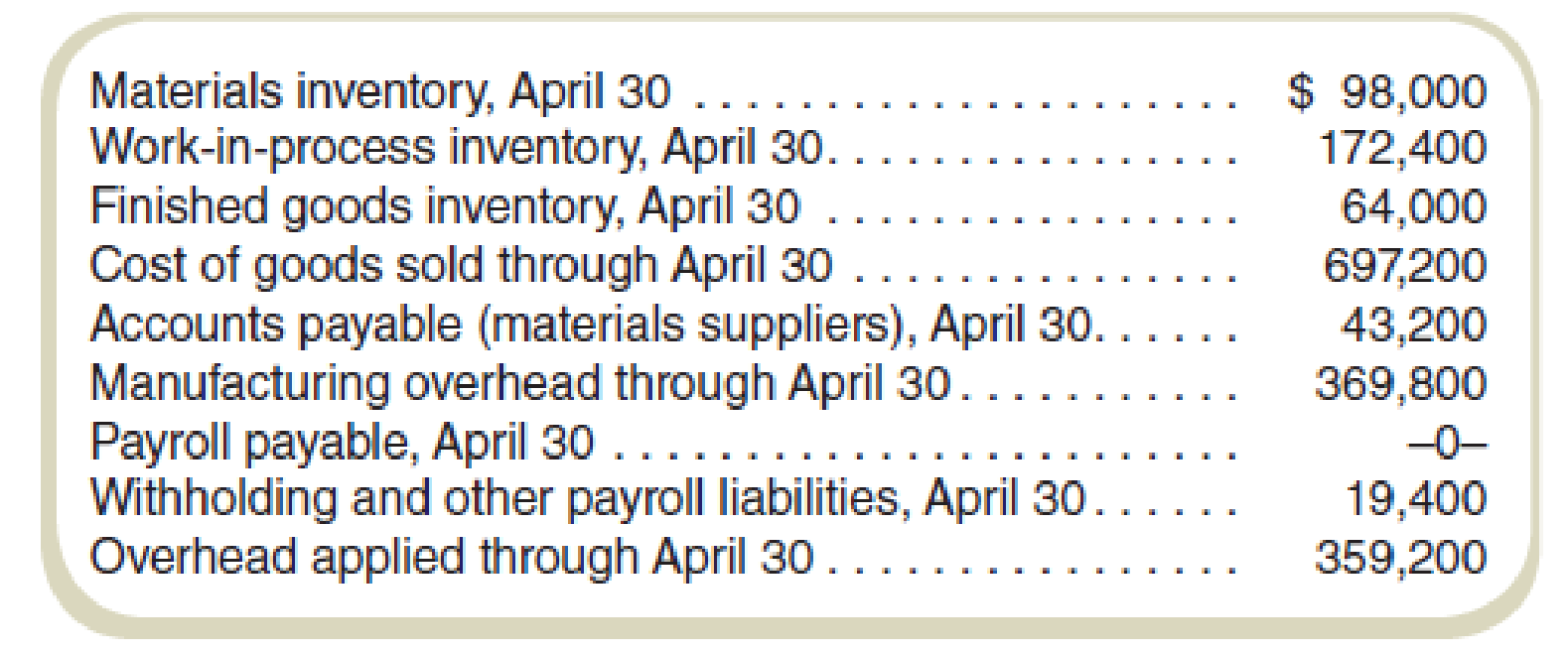

The following information about the plant appears on the April financial statements at the company’s downtown headquarters:

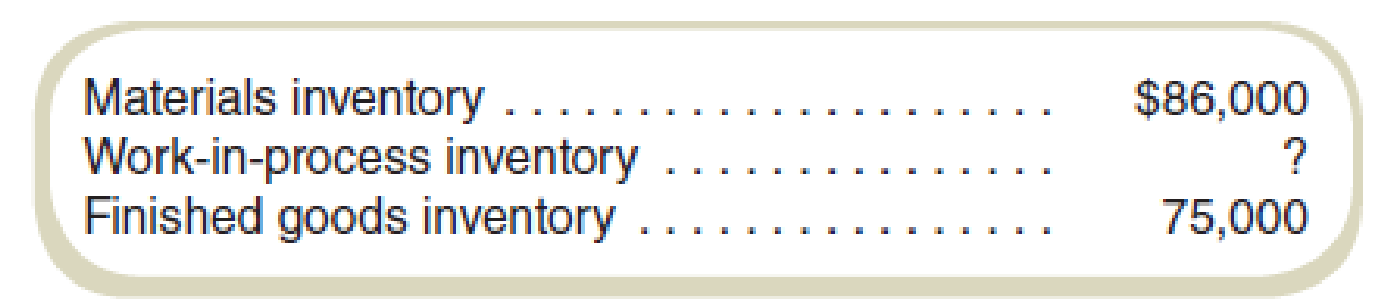

A count of the inventories on hand May 31 shows the following:

The accounts payable clerk tells you that outstanding bills to suppliers totaled $100,200 and that cash payments of $75,800 were made to them during the month. She informs you that the payroll costs last month for the manufacturing section included $164,800, of which $29,400 was indirect labor.

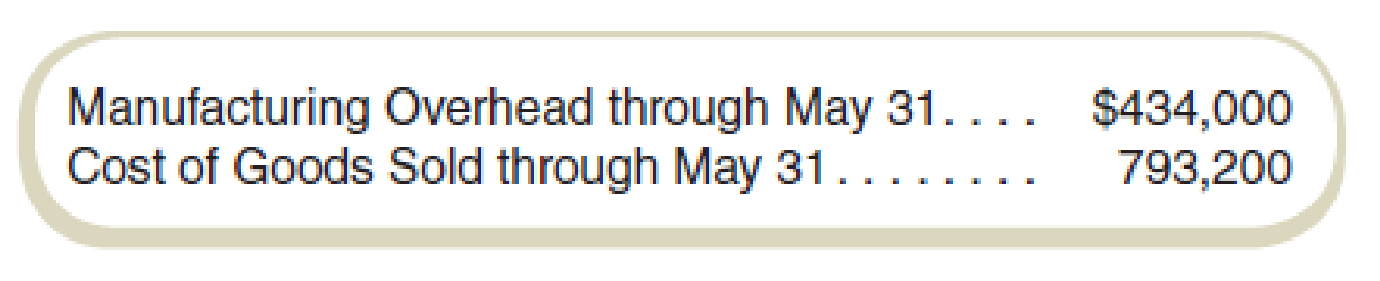

At the end of May, the following balances were available from the main office:

Recall that each month there is only one requisition for indirect materials. Among the fragments of paper, you located the following information, which you have neatly typed for your records:

From scrap found under desk: indirect materials → $4,172

You also learn that the overhead during the month was overapplied by $2,400.

Required

Determine the cost of the work-in-process inventory lost in the disaster.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Recognition of loss from spoilage. Spheres Toys manufactures globes at its San Fernando facility. The company provides you with the following information regarding operations for April 2017: Total globes manufactured 20,000 Globes rejected as spoiled units 750 Total manufacturing cost $800,000 Assume the spoiled units have no disposal value. Q. IIf the spoilage is considered abnormal, prepare the journal entries for the spoilage incurred.arrow_forwardThe Quadrangle Fabrication Plant suffered a fire incident at the beginning of the year, which resulted in the loss of property including the accounting records. Some data for the year were retrieved, and extracts from it are shown below: Total manufacturing overhead costs estimated at the beginning of the year $102,940 Total direct labor costs estimated at the beginning of the year $184,000 Total direct labor hours estimated at the beginning of the year 3,300 direct labor hours Actual manufacturing overhead costs for the year $98,770 Actual direct labor costs for the year $150,000 Actual direct labor hours for the year 2,500 direct labor hours The company's manufacturing overhead allocation is based on direct labor hours. How much manufacturing overhead was allocated to production during the year? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) Question content area…arrow_forwardThe work-in-process inventories of ABC Manufacturing, Inc. were completely destroyed by fire on June 1, 2021. Amounts for the following accounts have been established. Accounts payable, Jan. 1, 2021: 117,000 Accounts payable, Jun. 1, 2021: 135,000 Raw materials, Jan. 1, 2021: 15,000 Raw materials, Jun. 1, 2021: 18,000 Work in process, Jan. 1, 2021: 60,000 Finished goods, Jan. 1, 2021: 69,000 Finished goods, Jun. 1, 2021: 87,000 The following additional information was determined: Payments to suppliers for purchases on account: 60,000. Freight on purchases: 3,000. Purchase returns: 7,500. Direct labor: 48,000. Production overhead: 18,000. Sales from January 1 to May 31: 225,000. Sales returns: 45,000. Sales discounts: 15,000. Gross profit rate based on sales: 25%. How much is the work in process destroyed by fire?arrow_forward

- Conrad, Inc. recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 65,000 Work-in-Process Inventory, Beginning 10,500 Work-in-Process Inventory, Ending 9,000 Selling and Administrative Expense 15,000 Finished Goods Inventory, Ending 15,000 Finished Goods Inventory, Beginning ? Direct Materials Used ? Factory Overhead Applied 12,000 Operating Income 14,000 Direct Materials Inventory, Beginning 11,000 Direct Materials Inventory, Ending 6,000 Cost of Goods Manufactured 60,000 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The CFO of Conrad, Inc. has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of direct materials purchased?arrow_forwardConrad, Inc. recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 65,000 Work-in-Process Inventory, Beginning 10,500 Work-in-Process Inventory, Ending 9,000 Selling and Administrative Expense 15,000 Finished Goods Inventory, Ending 15,000 Finished Goods Inventory, Beginning ? Direct Materials Used ? Factory Overhead Applied 12,000 Operating Income 14,000 Direct Materials Inventory, Beginning 11,000 Direct Materials Inventory, Ending 6,000 Cost of Goods Manufactured 60,000 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The CFO of Conrad, Inc. has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of total manufacturing cost?arrow_forwardThe work in process inventories of Jungkook Manufacturing, Inc. were completely destroyed by fire on June 1, 2021. Amounts for the following accounts have been established.· Accounts payable, Jan. 1, 2021- P117,000· Accounts payable, Jun. 1, 2021- P135,000· Raw materials, Jan. 1, 2021- P15,000 · Raw materials, Jun. 1, 2021- P18,000· Work in process, Jan. 1, 2021- P60,000 · Finished goods, Jan. 1, 2021- P69,000 · Finished goods, Jun. 1, 2021- P87,000 The following additional information was determined: · Payments to suppliers for purchases on account, P60,000. · Freight on purchases, P3,000. · Purchase returns, P7,500. · Direct labor, P48,000. · Production overhead, P18,000. · Sales from January 1 to May 31, P225,000. · Sales returns, P45,000. · Sales discounts, P15,000. · Gross profit rate based on…arrow_forward

- The financial records for the Harrison Manufacturing Company have been destroyed in a fire. The following information has been obtained from a separate set of books maintained by the cost accountant. The cost accountant now asks for your assistance in computing the missing amounts. Direct Materials Inventory Beg. Bal. 8,900 ? Transferred Out Purchases ? End. Bal. 7,300 Cost of Goods Sold 66,000 Work-in-Process Inventory Beg. Bal. 8,400 ? Transferred Out Materials 19,800 Labor 14,400 Overhead 8,900 End. Bal. ? Finished Goods Inventory Beg. Bal. ? ? Transferred Out Transferred in 40,400 End. Bal. 5,100 What is the value of the ending Work-in-Process inventory balance? 1 8900 2 11100 3 5100 4 0arrow_forwardThe work in process inventories of Love Manufacturing, Inc. were completely destroyed by fire on June 1, 2021. Amounts for the following accounts have been established.· Accounts payable, Jan. 1, 2021- P117,000· Accounts payable, Jun. 1, 2021- P135,000· Raw materials, Jan. 1, 2021- P15,000 · Raw materials, Jun. 1, 2021- P18,000· Work in process, Jan. 1, 2021- P60,000 · Finished goods, Jan. 1, 2021- P69,000 · Finished goods, Jun. 1, 2021- P87,000 The following additional information was determined: · Payments to suppliers for purchases on account, P60,000. · Freight on purchases, P3,000. · Purchase returns, P7,500. · Direct labor, P48,000. · Production overhead, P18,000. · Sales from January 1 to May 31, P225,000. · Sales returns, P45,000. · Sales discounts, P15,000. · Gross profit rate based on…arrow_forward33. The work in process inventories of Jungkook Manufacturing, Inc. were completely destroyed by fire on June 1, 2021. Amounts for the following accounts have been established.· Accounts payable, Jan. 1, 2021- P117,000· Accounts payable, Jun. 1, 2021- P135,000· Raw materials, Jan. 1, 2021- P15,000 · Raw materials, Jun. 1, 2021- P18,000· Work in process, Jan. 1, 2021- P60,000 · Finished goods, Jan. 1, 2021- P69,000 · Finished goods, Jun. 1, 2021- P87,000 The following additional information was determined: · Payments to suppliers for purchases on account, P60,000. · Freight on purchases, P3,000. · Purchase returns, P7,500. · Direct labor, P48,000. · Production overhead, P18,000. · Sales from January 1 to May 31, P225,000. · Sales returns, P45,000. · Sales discounts, P15,000. · Gross profit rate based…arrow_forward

- On June 30, 2019, a flash flood damaged the warehouse and factory of Padway Corporation, completely destroying the work-in-process inventory. There was no damage to either the raw materials or finished goods inventories. A physical inventory taken after the flood revealed the following valuations: Raw materials $ 62,000 Work in process 0 Finished goods 119,000 The inventory on January 1, 2019, consisted of the following: Raw materials $ 30,000 Work in process 100,000 Finished goods 140,000 $270,000 A review of the books and records disclosed that the gross profit margin historically approximated 25% of sales. The sales for the first six months of 2019 were $340,000. Raw material purchases were $115,000. Direct labor costs for this period were $80,000, and manufacturing overhead was historically applied at 50% of direct labor. Required: Compute the value of the work-in-process inventory lost at June 30, 2019.arrow_forward15. The work in process inventories of Jungkook Manufacturing, Inc. were completely destroyed by fire on June 1, 2021. Amounts for the following accounts have been established.· Accounts payable, Jan. 1, 2021- P117,000· Accounts payable, Jun. 1, 2021- P135,000· Raw materials, Jan. 1, 2021- P15,000 · Raw materials, Jun. 1, 2021- P18,000· Work in process, Jan. 1, 2021- P60,000 · Finished goods, Jan. 1, 2021- P69,000 · Finished goods, Jun. 1, 2021- P87,000 The following additional information was determined: · Payments to suppliers for purchases on account, P60,000. · Freight on purchases, P3,000. · Purchase returns, P7,500. · Direct labor, P48,000. · Production overhead, P18,000. · Sales from January 1 to May 31, P225,000. · Sales returns, P45,000. · Sales discounts, P15,000. · Gross profit rate based…arrow_forwardTaylor Industries had a fire and some of its accounting records were destroyed. Available information is presented below for the year ended December 31. Materials inventory, December 31 $ 15,000 Direct materials purchased 28,000 Direct materials used 22,900 Cost of goods manufactured 135,000 Additional information: Factory overhead is 150% of direct labor cost. Finished goods inventory decreased by $18,000 during the year. Work in process inventory increased by $12,000 during the year. a. Calculate Materials inventory, January 1.$ b. Calculate direct labor cost.$ c. Calculate factory overhead incurred.$ d. Calculate cost of goods sold.$arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education