Learning Goal 5

ST7-2

a. Use the free cash flow valuation model to estimate the value of Envin's entire Active Shoe Division.

b. Use your finding in part a along with the data provided to find this division's common stock value.

c. If the Active Shoe Division as a public company will have 500.000 shares outstanding, use your finding in part b to calculate as value per share.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

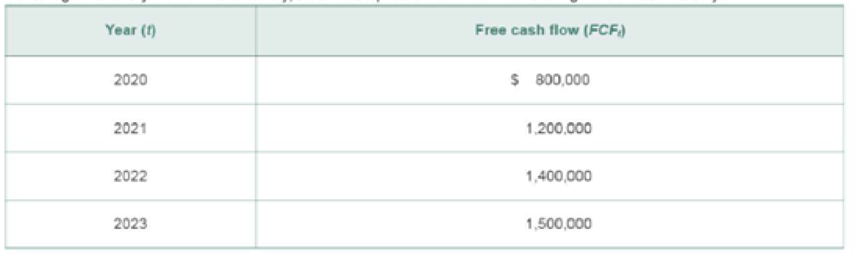

- The pictures is the formula and example. Compute the additional funds needed. JHOPE "I am your hope" Company has 10% net profit margin on sales in previous years and expects to maintain the same next year. The Business is expected to increase its sales level from P1,000,000 to P1 255 000. The percentages of current sales and current liabilities that have direct relationship with sales are 60% and 35%, respectively. Out of the total earnings at are expected to be realized next year, 25% will be retumed to the shareholders in the form of dividends. Compute the following: 5. Projected increase in current assets 6. Spontaneous increase in current liabilities 7. Increase in retained earings 8. Additional fund needed.arrow_forwardAFN Equation Refer to Problem 9-1. What would be the additional funds needed if the companys year-end 2018 assets had been 7 million? Assume that all other numbers, including sales, are the same as in Problem 9-1 and that the company is operating at full capacity. Why is this AFN different from the one you found in Problem 9-1? Is the companys capital intensity ratio the same or different?arrow_forwardFree Cash Flow Valuation Dozier Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFs) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dozier’s weighted average cost of capital is WACC = 13%. What is Dozier’s horizon value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) What is the current value of operations for Dozier? Suppose Dozier has $10 million in marketable securities, $100 million in debt, and 10 million shares of stock. What is the intrinsic price per share?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning