Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7.3P

Learning Goal 2

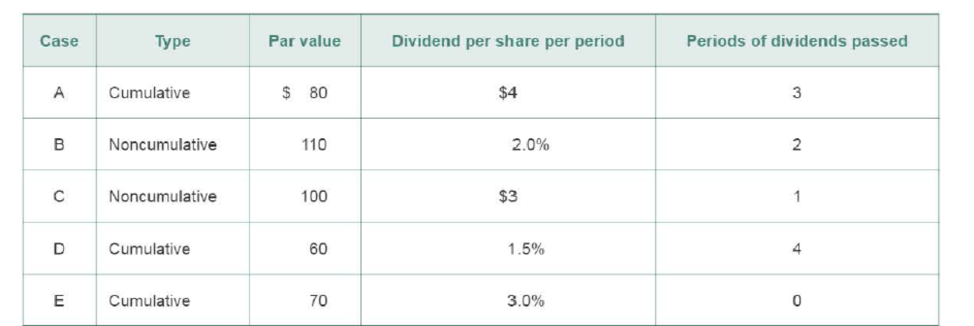

P7-3 Preferred dividends In each case in the following table, how many dollars of preferred dividends per share must be paid to preferred stockholders in the current period before common stock dividends are paid?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

(Learning Objective 2: Describe the effect of a stock issuance on paid-in capital)Saltwell Industries received $11,500,000 for the issuance of its stock on May 14. The par valueof the Saltwell stock was only $11,500. Was the excess amount of $11,488,500 a profit to Saltwell? If not, what was it?Suppose the par value of the Saltwell stock had been $2 per share, $4 per share, or $7 pershare. Would a change in the par value of the company’s stock affect Saltwell’s total paid-incapital? Give the reason for your answer.

Need help with 3 and 4

3. If two years’ preferred dividends are in arrears at the current date, what is the book value per share of common stock?

4. If two years’ preferred dividends are in arrears at the current date and the board of directors declares cash dividends of $13,800, what total amount will be paid to the preferred and to the common shareholders?

Requirement 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred stockholders and to common stockholders for 2018 and 2019 if total dividends are $12,840in 2018 and $49,000 in 2019. Assume no changes in preferred stock and common stock in 2019. (Assume all preferred dividends have been paid prior to

2018. Complete all input boxes. Enter a "0" for zero amounts. For the current year preferred dividend, be sure to enter the calculated dividend on the "current year dividend" line and the paid out dividend on the "total dividend to preferred stockholders" line.)

New England's

2018

dividend would be divided between preferred and common stockholders in this manner:

Total Dividend—2018

12,840

Dividend to preferred stockholders:

Dividend in arrears

0

Current year dividend

15840

Total dividend to preferred stockholders

12,840

Dividend to common stockholders

0

New…

Chapter 7 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 7.1 - What are the key differences between debt and...Ch. 7.2 - What risks do common stockholders take that other...Ch. 7.2 - Prob. 7.3RQCh. 7.2 - Explain the relationships among authorized shares,...Ch. 7.2 - Prob. 7.5RQCh. 7.2 - Prob. 7.6RQCh. 7.2 - Explain the cumulative feature of preferred stock....Ch. 7.3 - Describe the events that occur in an efficient...Ch. 7.3 - Prob. 7.9RQCh. 7.3 - Describe, compare, and contrast the following...

Ch. 7.3 - Describe the free cash flow valuation model, and...Ch. 7.3 - Explain each of the three other approaches to...Ch. 7.4 - Prob. 7.13RQCh. 7.4 - Assuming that all other variables remain...Ch. 7 - Prob. 7.1STPCh. 7 - Learning Goal 5 ST7-2 Free cash flow valuation...Ch. 7 - Prob. 7.1WUECh. 7 - Prob. 7.2WUECh. 7 - Prob. 7.3WUECh. 7 - Prob. 7.4WUECh. 7 - Prob. 7.5WUECh. 7 - Prob. 7.6WUECh. 7 - Authorized and available shares Aspin...Ch. 7 - Preferred dividends Acura Labs Inc. has an...Ch. 7 - Learning Goal 2 P7-3 Preferred dividends In each...Ch. 7 - Learning Goal 2 P7-4 Convertible preferred stock...Ch. 7 - Learning Goal 4 P7-5 Preferred stock valuation TXS...Ch. 7 - Prob. 7.6PCh. 7 - Preferred stock valuation Jones Design wishes to...Ch. 7 - Learning Goal 4 P7-8 Common stock value: Constant...Ch. 7 - Common stock value: Constant growth McCracken...Ch. 7 - Learning Goal 4 P7- 11 Common stock value:...Ch. 7 - Prob. 7.12PCh. 7 - Prob. 7.13PCh. 7 - Learning Goal 4 P7-14 Common stock value: Variable...Ch. 7 - Prob. 7.15PCh. 7 - Prob. 7.16PCh. 7 - Learning Goal 5 P7-17 Free cash flow valuation...Ch. 7 - Prob. 7.20PCh. 7 - Prob. 7.21PCh. 7 - Prob. 7.22PCh. 7 - Prob. 7.23PCh. 7 - Integrative: Risk and valuation Hamlin Steel...Ch. 7 - Prob. 7.25P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q2. a) Why companies are issuing stock dividend? What are the influential factors and the impact of it to the business and stockholders’ point of view. b) The board of directors of ABC Company recently announced a 24% stockdividend. Assuming that the current stock price is OMR 8 and there are 700,000 total ordinary shares outstanding of OMR 0.600 each.You are required to determine the following:i) Determine the market capitalization of the Company before the stock dividend.ii) Determine the increase in shares outstanding due to a 20% stock dividend.iii) Determine the new total shares outstanding.iv) Determine the price per share of the Company after stock dividendarrow_forwardMatch (by letter) the following terms with their definitions. Each letter is used only once.Terms_____ 1. PE ratio._____ 2. Stockholders’ equity section of the balance sheet._____ 3. Accumulated deficit._____ 4. Growth stocks._____ 5. 100% stock dividend._____ 6. Statement of stockholders’ equity._____ 7. Treasury stock._____ 8. Value stocks._____ 9. Return on equity._____ 10. Retained earnings.Definitionsa. A debit balance in Retained Earnings.b. Priced high in relation to current earnings as investors expect future earnings to be higher.c. Effectively the same as a 2-for-1 stock split.d. The earnings not paid out in dividends.e. The stock price divided by earnings per share.f. Summarizes the changes in the balance in each stockholders’ equity account over a period of time.g. Priced low in relation to current earnings.h. Measures the ability of company management to generate earnings from the resources that owners provide.i. Shows the balance in each equity account at a point in…arrow_forwardHi there, could you please check if my answers were correct? Testbank Exercise 136 Indicate the effect of each of the following transactions on total stockholders' equity by placing an "X" in the appropriate column. Increase Decrease No Effect 1. Treasury stock is resold at more than cost. X 2. Operating loss for the period. X 3. Retirement of bonds payable at more than book value. X 4. Declaration of a stock dividend. x 5. Acquisition of machinery for common stock. X 6. Conversion of bonds payable into common stock. X 7. Not declaring a dividend on cumulative preferred stock. x 8. Declaration of cash dividend. X 9. Payment of cash dividend. Xarrow_forward

- Requirement 1. Compute AustinAustin Company's earnings per share for 20182018. Assume the company paid the minimum preferred dividend during 20182018. Round to the nearest cent. Select the formula, then enter the amounts to calculate the company's earnings per share for 20182018. (Abbreviations used: Ave. = average, OS = outstanding, SE = stockholders' equity, shrs = shares.) ( - ) / = Earnings per share ( - ) / = Choose from any list or enter any number in the input fields and then click Check Answer. 2 parts remaining Clear All Check Answer Data Table 2018 2017 Income Statement—partial: Net Income $6,660 $20,000 Dec. 31, 2018 Dec. 31, 2017 Balance Sheet—partial: Total Assets $200,000 $265,000 Paid-In Capital: Preferred Stock—9%, $6 Par Value;…arrow_forwardTreasury Stock A company purchases 1,980 shares of treasury stock for $5 per share. Enter your answers as positive numbers. Required: 1. How will this transaction affect stockholders' equity? If there is no effect, choose "No effect" and enter zero ("0"). 2. How will this transaction affect net income? If there is no effect, choose "No effect" and enter zero ("0").arrow_forwardMatch (by letter) the following terms with their definitions. Each letter is used only once.Terms_____ 1. Cumulative._____ 2. Retained earnings._____ 3. Outstanding stock._____ 4. Limited liability._____ 5. Treasury stock._____ 6. Issued stock._____ 7. Angel investors._____ 8. Paid-in capital._____ 9. Authorized stock._____ 10. Redeemable.Definitionsa. The amount invested by stockholders.b. Shares available to sell.c. Shares can be returned to the corporation at a predetermined price.d. The earnings not paid out in dividends.e. Shares actually sold.f. Shares receive priority for future dividends if dividends are not paid in a given year.g. Shares held by investors.h. Shareholders can lose no more than the amount they invested in the company.i. Wealthy individuals in the business community willing to risk investment funds on a promising business venture.j. The corporation’s own stock that it acquired.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Dividend explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Wy7R-Gqfb6c;License: Standard Youtube License