Analyzing Special-Order Decision

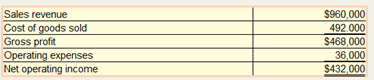

Camino Company manufactures designer to-go coffee cups. Each line of coffee cups is endorsed by a high-profile celebrity and designed with special elements selected by the celebrity. During the most recent year. Camino Company had the following operating results while operating at 80 percent (96,000 units) of its capacity:

Camino’s cost of goods sold and operating expenses are 80 percent variable and 20 percent fixed. Camino has received an offer from a professional wrestling association to design a coffee cup endorsed by its biggest star and produce 20,000 cups for $8 each (total $160,000). These cups would be sold at wrestling matches throughout the United States. Acceptance of the order would require a $60,000 endorsement fee to the wrestling star, but no other increases in fixed operating expenses.

If Camino were operating at full capacity, would your answer in requirement 2 change? If so, what price would Camino require for the special order?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

WHITECOTTON MGRL ACCTG (LL)

- Gaston Company manufactures furniture. One of its product lines is an economy-line kitchen table. During the last year, Gaston produced and sold 100,000 units for 100 per unit. Sales of the table are on a bid basis, but Gaston has always been able to win sufficient bids using the 100 price. This year, however, Gaston was losing more than its share of bids. Concerned, Larry Franklin, owner and president of the company, called a meeting of his executive committee (Megan Johnson, marketing manager; Fred Davis, quality manager; Kevin Jones, production manager; and Helen Jackson, controller). LARRY: I dont understand why were losing bids. Megan, do you have an explanation? MEGAN: Yes, as a matter of fact. Two competitors have lowered their price to 92 per unit. Thats too big a difference for most of our buyers to ignore. If we want to keep selling our 100,000 units per year, we will need to lower our price to 92. Otherwise, our sales will drop to about 20,000 to 25,000 per year. HELEN: The unit contribution margin on the table is 10. Lowering the price to 92 will cost us 8 per unit. Based on a sales volume of 100,000, wed make 200,000 in contribution margin. If we keep the price at 100, our contribution margin would be 200,000 to 250,000. If we have to lose, lets just take the lower market share. Its better than lowering our prices. MEGAN: Perhaps. But the same thing could happen to some of our other product lines. My sources tell me that these two companies are on the tail end of a major quality improvement programone that allows them significant savings. We need to rethink our whole competitive strategyat least if we want to stay in business. Ideally, we should match the price reduction and work to reduce the costs to recapture the lost contribution margin. FRED: I think I have something to offer. We are about to embark on a new quality improvement program of our own. I have brought the following estimates of the current quality costs for this economy line. As you can see, these costs run about 16 percent of current sales. Thats excessive, and we believe that they can be reduced to about 4 percent of sales over time. LARRY: This sounds good. Fred, how long will it take for you to achieve this reduction? FRED: All these costs vary with sales level, so Ill express their reduction rate in those terms. Our best guess is that we can reduce these costs by about 1 percent of sales per quarter. So it should take about 12 quarters, or three years, to achieve the full benefit. Keep in mind that this is with an improvement in quality. MEGAN: This offers us some hope. If we meet the price immediately, we can maintain our market share. Furthermore, if we can ever reach the point of reducing the price below the 92 level, then we can increase our market share. I estimate that we can increase sales by about 10,000 units for every 1 of price reduction beyond the 92 level. Kevin, how much extra capacity for this line do we have? KEVIN: We can handle an extra 30,000 or 40,000 tables per year. Required: 1. Assume that Gaston immediately reduces the bid price to 92. How long will it be before the unit contribution margin is restored to 10, assuming that quality costs are reduced as expected and that sales are maintained at 100,000 units per year (25,000 per quarter)? 2. Assume that Gaston holds the price at 92 until the 4 percent target is achieved. At this new level of quality costs, should the price be reduced? If so, by how much should the price be reduced, and what is the increase in contribution margin? Assume that price can be reduced only in 1 increments. 3. Assume that Gaston immediately reduces the price to 92 and begins the quality improvement program. Now, suppose that Gaston does not wait until the end of the three-year period before reducing prices. Instead, prices will be reduced when profitable to do so. Assume that prices can be reduced only by 1 increments. Identify when the first future price change should occur (if any). 4. Discuss the differences in viewpoints concerning the decision to decrease prices and the short-run contribution margin analysis done by Helen, the controller. Did quality cost information play an important role in the strategic decision making illustrated by the problem?arrow_forwardBienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardAssume that at the beginning of 20x2, Cicleta trained the 2 assembly workers in a new approach that had the objective of increasing the efficiency of the assembly process. Cicleta also began moving toward a JIT purchasing and manufacturing system. When JIT is fully implemented, the demand for expediting is expected to be virtually eliminated. It is expected to take two to three years for full implementation. Assume that receiving cost is a step-fixed cost with steps of 1,500 orders. The other three activities employ resources that are acquired as used and needed. At the end of 20x2, the following results were reported for the four activities: Required: 1. Prepare a trend report that shows the non-value-added costs for each activity for 20x1 and 20x2 and the change in costs for the two periods. Discuss the reports implications. 2. Explain the role of activity reduction for receiving and for expediting. What is the expected value of SQ for each activity after JIT is fully implemented? 3. What if at the end of 20x2, the selling price of a competing product is reduced by 27 per unit? Assume that the firm produces and sells 20,000 units of its product and that its product is associated only with the four activities being considered. By virtue of the waste-reduction savings, can the competitors price reduction be matched without reducing the unit profit margin of the product that prevailed at the beginning of the year? If not, how much more waste reduction is needed to achieve this outcome? In this case, what price decision would you recommend?arrow_forward

- Boston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardBrahma Industries sells vinyl replacement windows to home improvement retailers nationwide. The national sales manager believes that if they invest an additional $25,000 in advertising, they would increase sales volume by 10,000 units. Prepare a forecasted contribution margin income statement for Brahma if they incur the additional advertising costs, using this information:arrow_forwardAlmond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $22,000 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: The manufacturing overhead consists of $2,000 of variable costs with the balance being allocated to fixed costs. Should Almond Treats make or buy the almond cereal?arrow_forward

- Product costing and decision analysis for a service company Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month: Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs: The size of the companys ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation: Three recent representative flights have been selected for the profitability study. Their characteristics are as follows: Instructions Determine the fuel, crew, and depreciation cost per mile flown. Determine the cost per arrival or departure by terminal city. Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.arrow_forwardA furniture company manufactures desks and chairs. Each desk uses four units of wood, and each chair uses three units of wood. A desk contributes $250 to profit, and a chair contributes $145. Marketing restrictions require that the number of chairs produced be at least four times the number of desks produced. There are 2,000 units of wood available. Use Solver to maximize the company's profit. a. What is the optimized company's profit? Use SolverTable to see what happens to the decision variables and the total profit when the availability of wood varies from 1,000 to 3,000 in 100-unit increments. Based on your findings, how much would the company be willing to pay for each extra unit of wood over its current 2,000 units? How much profit would the company lose if it lost any of its current 2,000 units? Round the answer to a whole dollar amount.arrow_forwardPremier Printing produces custom labels and stationary for companies. In conducting CVP analysis of its Personalized Package, management decided to determine how many of the packages would need to be sold in order to justify continuing the product line. Management determined that fixed costs direct related to this particular product amounted to $27,000 annually. Premier reported $120,000 of gross sales related to this product and variable product costs of $90,000. Assuming that each Personalized Package sells for $12 per unit, what is the minimum number of Personalized Packages that Premier needs to sell to break even and therefore justify the product line?arrow_forward

- Mirabella Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Lupe, a potential investor in the business. Help Mr. Lupe understand Mirabella Beauty's cost structure. Mirabella Beauty Operating Income Statement, June 2020 Units sold $10,000 Revenues $200,000 Cost of goods sold Variable manufacturing costs $70,000 Fixed manufacturing costs $32,900 Total 102,900 Gross margin 97,100 Operating costs Variable marketing costs $58,000 Fixed marketing and administrative costs 17,500 Total operating costs 75,500 Operating income $21,600 Recast the income statement to emphasize contribution margin. Calculate the contribution margin percentage and breakeven point in units and revenues for June2020. What is the margin of safety (in units) for June 2020? If sales in June were only 8,500 units and Mirabella's tax rate is 30%, calculate its net income.arrow_forwardNotson, Inc. produces several models of clocks. An outside supplier has offered to produce the commercial clocks for Notson for $420each. Notson needs 1,200 clocks annually. Notson has provided the following unit costs for its commercial clocks: Direct materials $100 Direct labor 140 Variable overhead 80 Fixed overhead (40% avoidable) 150 Prepare an incremental analysis which shows the effect of the make-or-buy decision. Please solve this if any more information is needed let me know.arrow_forwardTiffany Cosmetics manufactures, and sells a variety of makeup and beauty products. Thecompany has come up with its own patented formula for a new anti-aging cream The companypresident wants to make sure the product is priced competitively because its purchase will alsolikely increase sales of other products. The company anticipates that it will sell 400,000 units ofthe product in the first year with the following estimated costs:Product design and licensing $ 1,000,000Direct materials 1,800,000Direct manufacturing labor 1,200,000Variable manufacturing overhead 600,000Fixed manufacturing overhead 2,000,000Fixed marketing 3,000,000The company believes that it can successfully sell the product for $38 a bottle. The company’s targetoperating income is 40% of revenue. Calculate the target full cost of producing the 400,000 units.Does the cost estimate meet the company’s requirements? Is value engineering needed ?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,