>Practice Set

P7-31 Using all journals

This problem continues the Crystal Clear Cleaning problem. Crystal Clear Cleaning has decided that, in addition to providing cleaning services, it will sell cleaning products. Crystal Clear uses the perpetual inventory system. During December 2017, Crystal Clear completed the following transactions:

Dec. 2 Purchased 475 units of inventory for $2,850 on account from Sparkle, Co. on terms 3/10, n/20.

5 Purchased 600 units of inventory from Borax on account with terms 2/10, n/30. The total invoice was for $4,500, which included a $150 freight charge.

7 Returned 75 units of inventory to Sparkle from the December 2 purchase (cost, $450).

9 Paid Borax.

11 Sold 285 units of goods to Happy Maids for $3,990 on account on terms 3/10, n/30. Crystal dear's cost of the goods was $1,710.

12 Paid Sparkle.

15 Received 22 units with a retail price of $308 of goods back from customer Happy Maids. The goods cost Crystal Clear $132.

21 Received payment from Happy Maids, settling the amount due in full.

28 Sold 265 units of goods to Bridget, Inc. for cash of $3,975 (cost, $1,691).

29 Received bill and paid cash for utilities of $415.

30 Paid cash for Sales Commission Expense of $550.

31 Recorded the following

a. Physical count of inventory on December 31 showed 428 units of goods on hand, $3,148

b.

c. Accrued salaries expense of $725

d. Prepared all other adjustments necessary for December. (Hint: You will need to review the adjustment information in Chapter 3 to determine the remaining adjustments.) Assume cleaning supplies at December 31 are $30.

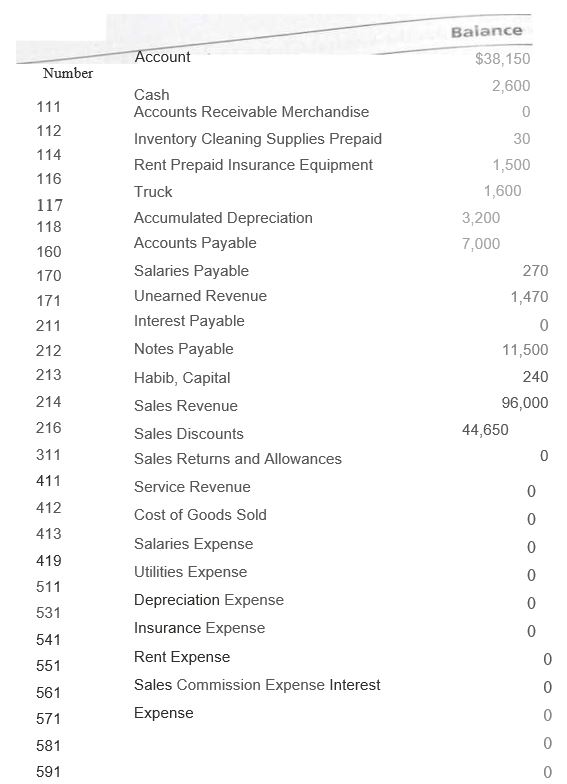

Crystal Clear Cleaning had the following selected accounts with account numbers and normal balances:

Requirements

1. Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

2. Total each column of the special journals. Show that total debits equal total credits in each special journal.

3. Show how postings would be made from the journals by writing the account Numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Accounting, Student Value Edition (11th Edition)

- Qualcomm Incorporated (QCOM) is a leading developer and manufacturer of digital wireless telecommunications products and services. Qualcomm reported the following inventories (in millions) in the notes to recent financial statements: a.Why does Qualcomm report three different inventories? b. What costs are included in each of the three inventory accounts?arrow_forwardRescue Sequences LLC purchased inventory by issuing a 30,000, 10%, 60-day note on October 1. Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a perpetual inventory system and a 360-day calendar fiscal year. Rescue Sequences LLC uses a perpetual inventory system.arrow_forwardInventory analysis Costco Wholesale Corporation (COST) and Wal-Mart Stores Inc. (WMT) compete against each other in general merchandise retailing, gas stations, pharmacies, and optical centers. Below is selected financial information for both companies from a recent year's financial statements (in millions): a. Determine for bom companies (1) the inventory turnover and (2) the days' sales in inventory. Round to one decimal place. b. Compare and interpret the inventory metrics computed in (a).arrow_forward

- Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases of welding rods that had been purchased for S88 per case. Welding Products purchased 1,150 cases at a cost of $95 per case on June 3. On June 19, the company purchased another 950 cases at a cost of $112 per case. Sales data for the welding rods are: Welding Products uses a perpetual inventory system, and the sales price of the welding rods was $130 per case. Required: 1. Compute the cost of ending inventory and cost of goods sold using the FIFO method. 2. Compute the cost of ending inventory and cost of goods sold using the LIFO method. 3. Compute the cost of ending inventory and cost of goods sold using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 4. CONCEPTUAL CONNECTION Assume that operating expenses are $21,600 and Welding Products has a 30% tax rate. How much will the cash paid for income taxes differ among the three inventory methods? 5. CONCEPTUAL CONNECTION Compute Welding Products' gross profit ratio (rounded to two decimal places) and inventory turnover ratio (rounded to three decimal places) under each of the three inventory costing methods. How would the choice of inventory costing method affect these ratios?arrow_forwardRefer to the information in E22-13. Required: Prepare the correcting journal entries if the company discovers each error 2 years after it is made and it has closed the books for the second year. Ignore income taxes. E22-13: The following are independent errors made by a company that uses the periodic inventory system: a. Goods in transit, purchased on credit and shipped FOB destination, 10,000, were included in purchases but not in the physical count of ending inventory. b. Purchase of a machine for 2,000 was expensed. The machine has a 4-vear life, no residual value, and straight-line depreciation is used. c. Wages payable of 2,000 were not accrued. d. Payment of next years rent, 4,000, was recorded as rent expense. e. Allowance for doubtful accounts of 5,000 was not recorded. The company normally uses the aging method. f. Equipment with a book value of 70,000 and a fair value of 100,000 was sold at the beginning of the year. A 2-year, non-interest-bearing note for 129,960 was received and recorded at its face value, and a gain of 59,960 was recognized. No interest revenue was recorded and 14% is a fair rate of interest.arrow_forwardLower of Cost or Market Garcia Company uses FIFO, and its inventory at the end of the year was recorded in the accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year? 2. Prepare the journal entry required to value the inventory at the lower of cost or market.arrow_forward

- Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: May 1. Paid rent for May, 5,000. 3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, 36,000. 4. Paid freight on purchase of May 3, 600. 6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, 68,500. The cost of the merchandise sold was 41,000. 7. Received 22,300 cash from Halstad Co. on account. 10. Sold merchandise for cash, 54,000. The cost of the merchandise sold was 32,000. 13. Paid for merchandise purchased on May 3. 15. Paid advertising expense for last half of May, 11,000. 16. Received cash from sale of May 6. 19. Purchased merchandise for cash, 18,700. 19. Paid 33,450 to Buttons Co. on account. 20. Paid Korman Co. a cash refund of 13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was 13,500 and the cost of the returned merchandise was 8,000. Record the following transactions on Page 21 of the journal: 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, 110,000. The cost of the merchandise sold was 70,000. 21. For the convenience of Crescent Co., paid freight on sale of May 20, 2,300. 21. Received 42,900 cash from Gee Co. on account. May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, 88,000. 24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for 5,000. 26. Refunded cash on sales made for cash, 7,500. The cost of the merchandise returned was 4,800. 28. Paid sales salaries of 56,000 and office salaries of 29, 000. 29. Purchased store supplies for cash, 2,400. 30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, 78,750. The cost of the merchandise sold was 47,000. 30. Received cash from sale of May 20 plus freight paid on May 21. 31. Paid for purchase of May 21, less return of May 24. Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). f. The adjustment for customer returns and allowances is 60,000 for sales and 35,000 for cost of merchandise sold. 5. (Optional) Enter the unadjusted trial balance on a IO-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forwardContinuing problem Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account Balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: 110 Cash 83,600 112 Accounts Receivable 233,900 115 Merchandise Inventory 624,400 116 Estimated Returns Inventory 28,000 117 Prepaid Insurance 16,800 118 Store Supplies 11,400 123 Store Equipment 569,500 124 Accumulated DepreciationStore Equipment 56,700 210 Accounts Payable 96,600 211 Salaries Payable 212 Customers Refunds Payable 50,000 310 Common Stock 100,000 311 Retained Earnings 585,300 312 Dividends 135,000 313 Income Summary 410 Sales 5,069,000 510 Cost of Merchandise Sold 2,823,000 520 Sales Salaries Expense 664,800 521 Advertising Expense 281,000 522 Depreciation Expense 523 Store Supplies Expense 529 Miscellaneous Selling Expense 12,600 530 Office Salaries Expense 382,100 531 Rent Expense 83,700 532 Insurance Expense 539 Miscellaneous Administrative Expense 7,800 During May, the last month of the fiscal year, the following transactions were completed: May 1. Paid rent for May, 5,000. 3. Purchased merchandise on account from Martin Co. terms 2/10t n/30, FOB shipping point, 36,000. 4. Paid freight on purchase of May 3, 600. 6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, 68,500. The cost of the merchandise sold was 41,000. 7. Received 22,300 cash from Halstad Co. on account. 10. Sold merchandise for cash, 54,000. The cost of the merchandise sold was 32,000. 13. Paid for merchandise purchased on May 3- 15. Paid advertising expense for last half of May, 11,000. 16. Received cash from sale of May 6. 19. Purchased merchandise for cash, 18,700. 19. Paid 33,450 to Buttons Co. on account 20. Paid Korman Co. a cash refund of 13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was 13,500 and the cost of the returned merchandise was 8,000. Record the following transactions on Page 21 of the journal: 20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, 110,000. The cost of the merchandise sold was 70,000. 21. For the convenience of Crescent Co., paid freight on sale of May 20. 2,300. 21. Received 42,900 cash from Gee Co. on account. May 21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination. 88,000. 24. Returned of damaged merchandise purchased on May 21, receiving a credit memo from the seller for 5,000. 26. Refunded cash on sales made for cash. 7,500. The cost of the merchandise returned was 4,800. 28. Paid sales salaries of 56,000 and office salaries of 29,000. 29. Purchased store supplies for cash, 2,400. 30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping point, 78,750. The cost of the merchandise sold was 47,000. 30. Received cash from sale of May 20 plus freight paid on May 21. 31. Paid for purchase of May 21. less return of May 24. Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). a. Merchandise inventory on May 31 570,000 b. Insurance expired during the year 12,000 c. Store supplies on hand on May 31 4,000 d. Depreciation for the current year 14,000 e. Accrued salaries on May 31: Sales salaries 7,000 Office salaries 6,600 13,600 f. The adjustment for customer returns and allowances is 60,000 for sales and 35,000 for cost of merchandise sold. 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardRefer to the information for Morgan Inc. above. If Morgan uses a perpetual inventory system, what is the cost of ending inventory under FIFO at April 30? a. $32,500 b. $38,400 c. $63,600 d. $69,500arrow_forward

- ( Appendices 6A and 6B) Inventory Costing Methods Edwards Company began operations in February 2019. Edwards accounting records provide the following data for the remainder of 2019 for one of the items the company sells: Â Edwards uses a periodic inventory system. All purchases and sales were for cash. Required: 1. Compute cost of goods sold and the cost of ending inventory using FIFO. 2. Compute cost of goods sold and the cost of ending inventory using LIFO. 3. Compute cost of goods sold and the cost of ending inventory using the average cost method. ( Note: Use four decimal places for per-unit calculations and round all other numbers to the nearest dollar.) 4. Prepare the journal entries to record these transactions assuming Edwards chooses to use the FIFO method. 5. CONCEPTUAL CONNECTION Which method would result in the lowest amount paid for taxes? 6. CONCEPTUAL CONNECTION Refer to Problem 6-67B and compare your results. What are the differences? Be sure to explain why the differences occurred.arrow_forwardBasga Company uses the periodic inventory system. Beginning inventory amounted to 241,072. A physical count reveals that the latest inventory amount is 256,339. Record the adjusting entries, using T accounts.arrow_forwardJohn Neff owns and operates Waikiki Surf Shop. A year-end trial balance is provided on page 561. Year-end adjustment data for the Waikiki Surf Shop are shown below. Neff uses the periodic inventory system. Year-end adjustment data are as follows: (a, b)A physical count shows that merchandise inventory costing 51,800 is on hand as of December 31, 20--. (c, d, e)Neff estimates that customers will be granted 2,000 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,200. (f)Supplies remaining at the end of the year, 600. (g)Unexpired insurance on December 31, 2,600. (h)Depreciation expense on the building for 20--, 5,000. (i)Depreciation expense on the store equipment for 20--, 3,000. (j)Wages earned but not paid as of December 31, 1,800. (k)Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is 3,000. Required 1. Prepare a year-end spreadsheet. 2. Journalize the adjusting entries. 3. Compute cost of goods sold using the spreadsheet prepared for part (1).arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning