CORPORATE FINANCE- ACCESS >C<

12th Edition

ISBN: 9781307447248

Author: Ross

Publisher: MCG/CREATE

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 13CQ

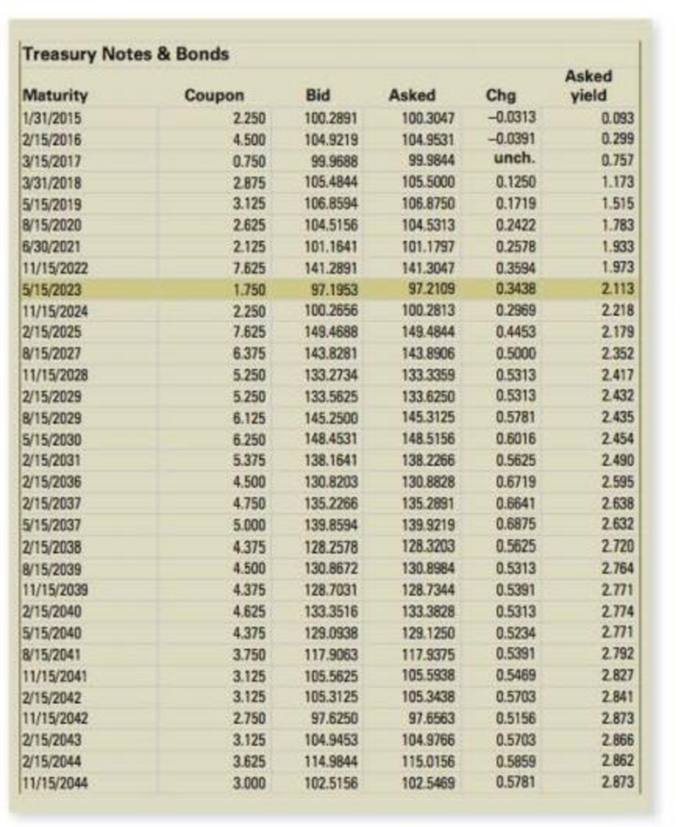

Treasury Market Take a look back at Figure 8.4. Notice the wide range of coupon rates. Why are they so different?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The yield curve varies over time based the relative riskiness of buying a single long-term bond versus purchasing multiple short-term bonds. This explanation of the yield curve is most consistent with

A.the Fisher Effect theoryB.the market segmentation theoryC.the unbiased expectations theoryD.the liquidity preference theory

We discussed the expectations theory of the term structure of interest rates. What does it says about the factors that influence the shape (upward, downward or flat) of the yield curve. Why does the yield curve sometimes inverts (become downward sloping) even though most of the time it is upward sloping?

What is the difference between the WAC and the pass-through coupon rate?

Chapter 8 Solutions

CORPORATE FINANCE- ACCESS >C<

Ch. 8 - Prob. 1CQCh. 8 - Prob. 2CQCh. 8 - Prob. 3CQCh. 8 - Yield to Maturity Treasury bid and ask quotes are...Ch. 8 - Coupon Rate How does a bond issuer decide on the...Ch. 8 - Real and Nominal Returns Are there any...Ch. 8 - Prob. 7CQCh. 8 - Prob. 8CQCh. 8 - Term Structure What is the difference between the...Ch. 8 - Crossover Bonds Looking back at the crossover...

Ch. 8 - Municipal Bonds Why is it that municipal bonds are...Ch. 8 - Prob. 12CQCh. 8 - Treasury Market Take a look back at Figure 8.4....Ch. 8 - Prob. 14CQCh. 8 - Bonds as Equity The 100-year bonds we discussed in...Ch. 8 - Bond Prices versus Yields a. What is the...Ch. 8 - Interest Rate Risk All else being the same, which...Ch. 8 - Prob. 1QAPCh. 8 - Prob. 2QAPCh. 8 - Prob. 3QAPCh. 8 - Prob. 4QAPCh. 8 - Prob. 5QAPCh. 8 - Prob. 6QAPCh. 8 - Prob. 7QAPCh. 8 - Prob. 8QAPCh. 8 - Prob. 9QAPCh. 8 - Prob. 10QAPCh. 8 - Prob. 11QAPCh. 8 - Prob. 12QAPCh. 8 - Prob. 13QAPCh. 8 - Prob. 14QAPCh. 8 - Prob. 15QAPCh. 8 - Prob. 16QAPCh. 8 - Prob. 17QAPCh. 8 - Prob. 18QAPCh. 8 - Prob. 19QAPCh. 8 - Prob. 20QAPCh. 8 - Prob. 21QAPCh. 8 - Prob. 22QAPCh. 8 - Prob. 23QAPCh. 8 - Prob. 24QAPCh. 8 - Prob. 25QAPCh. 8 - Prob. 26QAPCh. 8 - Prob. 27QAPCh. 8 - Prob. 28QAPCh. 8 - Prob. 29QAPCh. 8 - Prob. 30QAPCh. 8 - Prob. 31QAPCh. 8 - Prob. 32QAPCh. 8 - Prob. 33QAPCh. 8 - Prob. 34QAPCh. 8 - Prob. 35QAPCh. 8 - Prob. 1MCCh. 8 - Prob. 3MCCh. 8 - Prob. 5MCCh. 8 - Prob. 6MCCh. 8 - Prob. 7MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Exploring Finance: The Security Market Line and Inflation Changes Security Market Line: Inflation Changes Conceptual Overview: Explore how inflation changes the security market line. The Security Market Line defines the required rate of return for a security to be worth buying or holding. The line, depicted in blue in the graph, is the sum of the risk-free return (rf in the slider) and a risk premium determined by the market-risk premium (RPM) multiplied by the security's beta coefficient for risk. Drag the slider below the graph to change the amount of the risk-free return. These changes reflect changes in inflation. Drag left or right on the graph to move the cursor to evaluate securities with different beta coefficients. In this graph, the market-risk premium is fixed at 5%. r = r_{RF} + RP_M * beta = 6\% + 5\% * 1 = 6\% + 5.00\% = 11.00\%r=rRF+RPM∗beta=6%+5%∗1=6%+5.00%=11.00% 1. If the risk-free return were 4.0% and a security's beta coefficient were 2.0, what would be…arrow_forwardQuestion 1: a. The risk structure of interest rates and the term structure of interest rates are identical. True or False? Explain. b. The yield curve is a forecasting tool for inflation, the business cycle, and monetary policy. True or False? Explain.arrow_forwardUsing the money market diagram, explain the effect Of this policy measure on the real interest rate.arrow_forward

- Do solve all parts A. What risk premium do you use? Why? B. Why is the geometric mean lower than the arithmetic mean for both bonds and bills? C. If you had to use a risk premium with the longer periods, what biases will the investor have?arrow_forward2. Find the coupon ratearrow_forwardIf the yield curve in the bond market shows a flat curve, what do you think about the prediction of the liquidity premium in explaining this phenomenon? Then do you prefer the prediction of expectation theory in explaining this phenomenon?arrow_forward

- For the cost of equity (stock) is it better to use the current US Treasury bill rate or a longer-termgovernment bond rate as the risk-free rate of return?arrow_forwardAccording to the ,long-term interest rates are a function of expected short-term interest rates Maturity theory Expectations theory Market segmentation theory Preferred habitat theoryarrow_forwardAn efficient capital market is best defined as a market in which security prices reflect which one of the following? Multiple Choice A Current inflation B A risk premium C All available information D The historical arithmetic rate of return E The historical geometric rate of returnarrow_forward

- 1. Explain how interest rate risk works?2. Explain the difference between a positively sloping and inverted (downward sloping) yield curve.3. What is the duration and why do we measure it?arrow_forwardWhat happens when investors rate of return is greater than YTM and coupon rates?arrow_forwardConsider a financial market consisting of a bank account So(t) and a stock S₁ (t) modelled on a probability space (, F, P) with the time indices t = 0, 1, 2, ..., T. Give conditions under which a market is arbitrage-free. Explain what it means to say that a market is complete. Give conditions under which an arbitrage-free market is complete.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY