Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 18.3EP

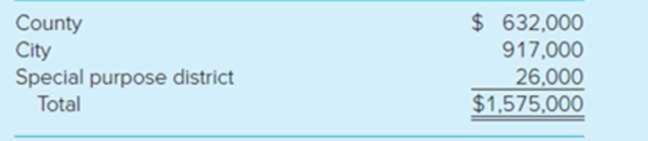

The county collects taxes on behalf of the county, city, and a special purpose district. For 2020, the taxes to be levied by the government are

What type of fund will the county use to account for tax collection and distribution?

- a. The county will use a trust fund.

- b. The county will use a custodial fund.

- c. The county will use a special revenue fund.

- d. The county will use the General Fund.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In 2019, a state government collected income taxes of $8,000,000 for the benefit of one of its cities that imposes an income tax on its residents. The state periodically remitted these collections to the city. The state should account for the $8,000,000 in the a. general fund. b. agency funds. c. internal service funds. d. special assessment funds.

Please help solve the below: see picture attached.

The county collector of Sun County is responsible for collecting all property taxes levied by funds and governments within the boundaries of the county. To reimburse the county for estimated administrative expenses of operating the tax custodial fund, the custodial fund deducts 5 percent from the collections for the town, the school district, and the other towns. The total amount deducted is added to the collections for the county and remitted to the Sun County General Fund.

The following events occurred during the year:

Current-year tax levies to be collected by the custodial fund were

County General Fund

$

10,443,000

Town of Bayshore

4,895,000

Sun County Consolidated School District

6,605,000

Total

$

21,943,000

During the year, $13,810,000 of the current year's taxes was collected.

The 5 percent administrative collection fee was recorded. A schedule of amounts collected for…

Benton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place:1. The County levied taxes as follows:

Benton County General Fund

$

26,600,000

School District

14,100,000

Towns

4,100,000

Total

$

44,800,000

2. The property taxes levied in part (a) were collected.3. The amounts collected were paid to the school district and towns.Required:a. Prepare journal entries for Benton County and the Benton County Independent School District—identify the funds.

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 8 - What are the criteria for determining if a...Ch. 8 - Prob. 2QCh. 8 - Identify the different types of trust funds and...Ch. 8 - Describe the basic activities conducted by a tax...Ch. 8 - Explain how the financial reporting of fiduciary...Ch. 8 - Prob. 6QCh. 8 - How are external investment pool activities...Ch. 8 - What is a private-purpose trust fund? There are...Ch. 8 - Prob. 9QCh. 8 - Prob. 10Q

Ch. 8 - What is OPEB and how is OPEB reported by...Ch. 8 - Prob. 12CCh. 8 - Prob. 13CCh. 8 - Prob. 14CCh. 8 - Prob. 15CCh. 8 - Prob. 17.1EPCh. 8 - Which of the following is not a fiduciary fund? a....Ch. 8 - Prob. 17.3EPCh. 8 - Fiduciary fund activities are not included in the...Ch. 8 - Prob. 17.5EPCh. 8 - Prob. 17.6EPCh. 8 - The city has installed sidewalks using special...Ch. 8 - Prob. 17.8EPCh. 8 - Fiduciary funds a. Are accounted for using the...Ch. 8 - Prob. 17.10EPCh. 8 - Prob. 17.11EPCh. 8 - An investment trust fund would report in the...Ch. 8 - Prob. 17.13EPCh. 8 - Which pension fund financial statement or schedule...Ch. 8 - Prob. 17.15EPCh. 8 - Prob. 18.1EPCh. 8 - Prob. 18.2EPCh. 8 - The county collects taxes on behalf of the county,...Ch. 8 - Prob. 18.4EPCh. 8 - Prob. 18.5EPCh. 8 - At the date of the creation of the investment...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - Prob. 18.9EPCh. 8 - Prob. 18.10EPCh. 8 - Tax Custodial Fund. (LO8-2) The county collector...Ch. 8 - Special Assessment Debt. (LO8-2) Residents of...Ch. 8 - Identification of Fiduciary Funds. (LO8-2, LO8-3,...Ch. 8 - Investment Trust Fund. (LO8-3) The Albertville...Ch. 8 - Pass-through Custodial Funds. (LO8-2) Evergreen...Ch. 8 - Fiduciary Financial Statements. (LO8-4) Ray County...Ch. 8 - Fiduciary Fund Financial Statements. (LO8-4)...Ch. 8 - Prob. 26EPCh. 8 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The City of Sweetwater maintains in trust the Employees’ Retirement Fund, a single-employer defined benefit plan that provides annuity and disability benefits. The fund is financed by actuarially determined contributions from the city’s General Fund and by contributions from employees. Administration of the retirement fund is handled by General Fund employees, and the retirement fund does not bear any administrative expenses. The Statement of Fiduciary Net Position for the Employees’ Retirement Fund as of July 1, 2023, is shown here: CITY OF SWEETWATER Employees’ Retirement Fund Statement of Fiduciary Net Position As of July 1, 2023 Assets Cash $145,000 Accrued Interest Receivable 59,200 Investments, at Fair Value: Bonds 4,507,000 Common Stocks 1,313,000 Total Assets 6,024,200 Liabilities Accounts Payable and Accrued Expenses 384,000 Fiduciary Net Position Restricted for Pensions $5,640,200 During the year ended June 30, 2024, the following…arrow_forwardUnlike Illinois, the Village of Maple Park is located in a state in which property taxes are levied and collected in the same fiscal year. The information below pertains to the Village’s general fund for the year ended December 31, 2022: $9,819,000 of property tax revenue was included in the estimated revenues budget for 2022; Property taxes were levied in February, 2022, and $171,000 of the levy was expected to be uncollectible; On the two property tax collection dates, a total of $9,600,000 was collected; At December 31, 2022, the Village expected property tax collections during the first 60 days of 2023 to be $38,000. Required: 1. On the December 31, 2022, balance sheet for the Village’s general fund, what is the amount reported under assets for property taxes receivable(net)? 2. On the Village’s general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2022, what is the amount reported for property…arrow_forwardBenton County includes an independent school district and two individually chartered towns within the County. Benton County’s Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2024, the following transactions took place: The County levied taxes as follows: Benton County General Fund $23,700,000 School District 10,500,000 Towns 3,510,000 Total $37,710,000 The property taxes levied in part (a) were collected. The amounts collected were paid to the school district and towns. Required: a1. Record the transactions in the books of the Benton County Tax Agency Fund. a2. Record the transactions in the books of the Benton County General Fund. a3. Record the transactions in the books of the Benton County Independent School District General Fund.arrow_forward

- The following information pertains to Hempstead City which has a December 31st year-end. Fiscal year 2020 governmental fund property tax revenues that are measurable and available equaled $12,000,000. Sales taxes collected by merchants in 2020 but not remitted to Hempstead City until January 2021 equaled $4,000,000. For the year ended December 31, 2020, Hempstead City should recognize revenues in its governmental fund financial statements of: A. $18,000,000. B. $16,000,000. C. $14,000,000. D. $12,000,000.arrow_forwardProperty taxes levied on the citizens of the Hill County would most appropriately be budgeted in which of the following budgets? Select one :- a. expenditures budget b. Capital budget. c. Flexible budget. d. Operating budget. Unreserved Fund Balance in Governmental entities is equal to which of the following in commercial entities: Select one : a. Capital Stock b. Bond sinking Fund c. Unearned revenue d. Retained earningsarrow_forwardThe following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation. The budget prepared for the fiscal year 2020 was as follows: Estimated Revenues: Taxes $ 1,957,000 Licenses and permits 374,000 Intergovernmental revenue 399,000 Miscellaneous revenues 64,000 Total estimated revenues 2,794,000 Appropriations: General government 475,200 Public safety 890,200 Public works 654,200 Health and welfare 604,200 Miscellaneous 88,000 Total appropriations 2,711,800 Budgeted increase in fund balance $ 82,200 Encumbrances issued against the appropriations during the year were as follows: General government $ 60,000 Public safety 252,000 Public works 394,000 Health and…arrow_forward

- Al Shahri community, located in the City of Duqm, voted to form a local improvement district to fund the construction of a new community center. The city agreed to construct the community center and administer the bond debt; however, the community was solely responsible for repaying the bond issue. To administer the bond debt, the city established the Local Improvement District Fund. Following are several events connected with the Local Improvement District Fund. 1. On June 30, 2019, the city assessed levies totaling OMR3,000,000. The levies are payable in 10 equal annual installments with 4.5 percent interest on unpaid installments. 2. All assessments for the current period were collected by June 30, 2020, as was the interest due on the unpaid installments. 3. On July 1, 2020, the first principal payment of OMR 300,000 was made to bond holders as was interest on the debt. Required Make journal entries for each of the foregoing events that affected the Local Improvement District Fund.arrow_forwardA city issues a 60-day tax anticipation note to fund operations until taxes have been collected. What recording should it make? Choose the correct.a. The liability should be reported in the government-wide financial statements; an other financing source should be shown in the fund financial statements.b. A liability should be reported in the government-wide financial statements and in the fund financial statements.c. An other financing source should be shown in the government-wide financial statements and in the fund financial statements.d. An other financing source should be shown in the government-wide financial statements; a liability is reported in the fund financial statements.arrow_forwardThe City of Sweetwater maintains an Employees’ Retirement Fund, a single-employer defined benefit plan that provides annuity and disability benefits. The fund is financed by actuarially determined contributions from the city’s General Fund and by contributions from employees. Administration of the retirement fund is handled by General Fund employees, and the retirement fund does not bear any administrative expenses. The Statement of Fiduciary Net Position for the Employees’ Retirement Fund as of July 1, 2019, is shown here: CITY OF SWEETWATER Employees’ Retirement Fund Statement of Fiduciary Net Position As of July 1, 2019 Assets Cash $ 137,000 Accrued Interest Receivable 57,800 Investments, at Fair Value: Bonds 4,506,000 Common Stocks 1,307,000 Total Assets 6,007,800 Liabilities Accounts Payable and Accrued Expenses 351,300 Fiduciary Net Position Restricted for Pensions $ 5,656,500 During the year ended…arrow_forward

- The general principles of revenue recognition are the same for both governmental and government-wide statements. For each of the following situations, indicate the amount of revenue that the government should recognize in an appropriate governmental fund as well as in its government-wide statement of activities in its fiscal year ending December 31, 2021. Briefly justify your response, making certain that, as appropriate, you identify the key issue of concern. 1. In October 2020, a state received a federal grant of $300 million (in cash) to assist local law enforcement efforts. The federal government has established specific criteria governing how the funds should be distributed and will monitor the funds to ensure that they are used in accordance with grant provisions. The grant is intended to cover any allowable expenditure incurred in the calendar years 2021 through 2022. In 2021, the state incurred $160 million of allowable expenditures. 2. In December 2020, a city levied property…arrow_forwardFor each of the following events or transactions, prepare the necessacry journal entries and identify the fund or funds that will be affected. 1. A governmental unit collects fees totaling $4,500 at the municipal pool. The fees are charged to recover costs of pool operation and maintenance 2. A county government that serves as a tax collection agency for all towns and cities located within the county collects county sales taxes totaling $125,000 for the month. 3. A $1,000,000 bond offering was issued, with a premium of $50,000, to subsidize the construction of a city visitor center. 4. A town receives a donation of $50,000 in bonds. The bonds should be held indefinitely, but bond income is to be donated to the local zoo. The zoo is associated with the town. 5. A central printing shop is established with a $150,000 nonreciprocal transfer from the general fund. 6. A $1,000,000 revenue bond offering was issued at par by a fund that provides water and sewer services to…arrow_forwardFor each of the following events or transactions, prepare the necessacry journal entries and identify the fund or funds that will be affected. 1. A governmental unit collects fees totaling $4,500 at the municipal pool. The fees are charged to recover costs of pool operation and maintenance 2. A county government that serves as a tax collection agency for all towns and cities located within the county collects county sales taxes totaling $125,000 for the month. 3. A $1,000,000 bond offering was issued, with a premium of $50,000, to subsidize the construction of a city visitor center. 4. A town receives a donation of $50,000 in bonds. The bonds should be held indefinitely, but bond income is to be donated to the local zoo. The zoo is associated with the town. 5. A central printing shop is established with a $150,000 nonreciprocal transfer from the general fund. 6. A $1,000,000 revenue bond offering was issued at par by a fund that provides water and sewer services to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License