Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 18.7EP

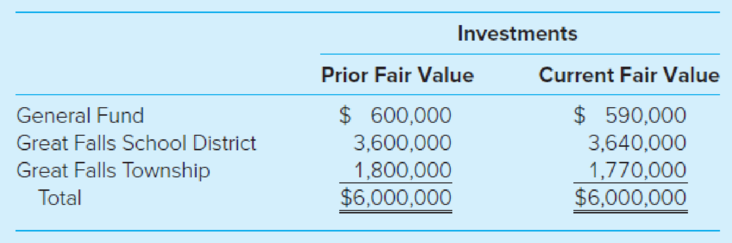

The city council of the City of Great Falls decided to pool the investments of its General Fund with those of Great Falls School District and Great Falls Township, each of which carried its investments at fair value as of the prior balance sheet date. All investments are revalued to current fair value at the date of the creation of the pool. At that date, the prior and current fair value of the investments of each of the participants were as follows:

One day after creation of the pool, the investments that had belonged to Great Falls Township were sold by the pool for $1,760,000.

- a. The loss of $40,000 is borne by each participant in proportion to its equity in the pool.

- b. The loss of $10,000 is borne by each participant in proportion to its equity in the pool.

- c. The loss of $40,000 is considered to be a loss borne by Great Falls Township.

- d. The loss of $10,000 is considered to be a loss borne by Great Falls Township.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Al Shahri community, located in the City of Duqm, voted to form a local improvement district to fund the construction of a new community center. The city agreed to construct the community center and administer the bond debt; however, the community was solely responsible for repaying the bond issue. To administer the bond debt, the city established the Local Improvement District Fund. Following are several events connected with the Local Improvement District Fund.

1. On June 30, 2019, the city assessed levies totaling OMR3,000,000. The levies are payable in 10 equal annual installments with 4.5 percent interest on unpaid installments.

2. All assessments for the current period were collected by June 30, 2020, as was the interest due on the unpaid installments.

3. On July 1, 2020, the first principal payment of OMR 300,000 was made to bond holders as was interest on the debt.

Required

Make journal entries for each of the foregoing events that affected the Local Improvement District Fund.

The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements?

Fund balance—unassigned goes down and fund balance—restricted goes up.

Fund balance—assigned goes down and fund balance—committed goes up.

Fund balance—unassigned goes down and fund balance—assigned goes up.

Fund balance—assigned goes down and fund balance—restricted goes up.

The citizens of a geographic area of the National City authorized a special assessment to be imposed on their properties to finance the reconstruction of the infrastructure of the sewerage system that serves the area. The city will solicit bids, oversee the reconstruction, issue the debt in the city's name, and pay the debt. The city is not bound in any way by the debt, but will collect special assessments and make principal and interest payments to bondholders.

1. Explain the use and purpose of the Capital Projects Fund for the National City construction project.

Chapter 8 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 8 - What are the criteria for determining if a...Ch. 8 - Prob. 2QCh. 8 - Identify the different types of trust funds and...Ch. 8 - Describe the basic activities conducted by a tax...Ch. 8 - Explain how the financial reporting of fiduciary...Ch. 8 - Prob. 6QCh. 8 - How are external investment pool activities...Ch. 8 - What is a private-purpose trust fund? There are...Ch. 8 - Prob. 9QCh. 8 - Prob. 10Q

Ch. 8 - What is OPEB and how is OPEB reported by...Ch. 8 - Prob. 12CCh. 8 - Prob. 13CCh. 8 - Prob. 14CCh. 8 - Prob. 15CCh. 8 - Prob. 17.1EPCh. 8 - Which of the following is not a fiduciary fund? a....Ch. 8 - Prob. 17.3EPCh. 8 - Fiduciary fund activities are not included in the...Ch. 8 - Prob. 17.5EPCh. 8 - Prob. 17.6EPCh. 8 - The city has installed sidewalks using special...Ch. 8 - Prob. 17.8EPCh. 8 - Fiduciary funds a. Are accounted for using the...Ch. 8 - Prob. 17.10EPCh. 8 - Prob. 17.11EPCh. 8 - An investment trust fund would report in the...Ch. 8 - Prob. 17.13EPCh. 8 - Which pension fund financial statement or schedule...Ch. 8 - Prob. 17.15EPCh. 8 - Prob. 18.1EPCh. 8 - Prob. 18.2EPCh. 8 - The county collects taxes on behalf of the county,...Ch. 8 - Prob. 18.4EPCh. 8 - Prob. 18.5EPCh. 8 - At the date of the creation of the investment...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - The city council of the City of Great Falls...Ch. 8 - Prob. 18.9EPCh. 8 - Prob. 18.10EPCh. 8 - Tax Custodial Fund. (LO8-2) The county collector...Ch. 8 - Special Assessment Debt. (LO8-2) Residents of...Ch. 8 - Identification of Fiduciary Funds. (LO8-2, LO8-3,...Ch. 8 - Investment Trust Fund. (LO8-3) The Albertville...Ch. 8 - Pass-through Custodial Funds. (LO8-2) Evergreen...Ch. 8 - Fiduciary Financial Statements. (LO8-4) Ray County...Ch. 8 - Fiduciary Fund Financial Statements. (LO8-4)...Ch. 8 - Prob. 26EPCh. 8 - Prob. 27EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The City of Fox is evaluating which of its funds it will present as a major fund in its fund financial statements on December 31, Year 1. The city presents the following partial listing of asset data at December 31, Year 1: Total Governmental Fund Type Assets $ 3,000,000 Total Enterprise Fund Assets 2,000,000 General Fund Assets 280,000 Community Development Special Revenue Fund 290,000 Faberville River Bridge Capital Project Fund 100,000 Faberville Water & Sewer Utility Fund 1,800,000 Faberville Landfill 200,000 Based purely on assets, how many funds should be displayed as major funds? A.) Four B.) Five C.) TWO D.) Threearrow_forwardThe City of Grinders Switch Maintains its books in a manner that facilitates the preparation of fund accounting statements and uses worksheet adjustments to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations. General fixed assets as of the beginning of the year, which had not recorded, were as follows: Land $ 7,554,000 Buildings $33,355,000 Improvements Other Than Buildings $14,820,000 Equipment $11,690,000 Accumulated Depreciation, Capital Assets $25,800,000 2. During the year, expenditures for Capital outlays amounted to $7,500,000. Of that amount $4,800,000 was for buildings; the remainder was for improvements other than buildings. 3. The Capital…arrow_forwardIn response to a petition signed by the property owners of Riverdale Subdivision, the city of Pewaukee will oversee the installation of sidewalks, curbs, and gutters in the subdivision, to be accounted for in the city’s capital projects fund. Pewaukee reports on a calendar-year basis. Construction is estimated to cost $900,000 and will be financed by a $100,000 county grant, a $50,000 transfer from the city’s general fund, and special assessments of $750,000 to be levied against subdivision property owners. One-third of the levy is to be due on February 1 of each year, starting with 2018. The first $250,000 installment will be received by the capital projects fund directly. The remaining installments will be collected by the debt service fund and will be used to service the related bond debt. The project is to begin on January 15, 2018, and is to take 18 months to complete. It is estimated that 70% of the work will be completed during 2018.To cover construction costs, a 6%, $500,000…arrow_forward

- The City of Algonquin maintains its books to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: Deferred inflows of resources—property taxes of $73,500 at the end of the previous fiscal year were recognized as property tax revenue in the current year's Statement of Revenues, Expenditures, and Changes in Fund Balance. The City levied property taxes for the current fiscal year in the amount of $13,789,400. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $309,200 is thought to be uncollectible, $365,000 would likely be collected during the 60-day period after the end of the fiscal year, and $52,800 would be collected after that time. The City had recognized the maximum of property taxes allowable under modified accrual accounting. In addition to the expenditures…arrow_forwardOn April 1, 2020, the City purchased a swimming pool from a private operator for $500,000 and created a Swimming Pool (Enterprise) Fund. The city has a calendar year as its fiscal year. During the year ended December 31, 2020, the following transactions occurred related to the City’s Swimming Pool Fund: On April 1, 2020, $300,000 was provided by a one-time contribution from the General Fund, and $200,000 was provided by a loan from a local bank (secured by a note), both of which were received in cash. The loan (Notes Payable) has an annual interest rate of 5%, payable semiannually on October 1 and April 1. The purchase of the pool was recorded (paid in cash). Based on an appraisal, it was decided to allocate $100,000 to the land, $300,000 to improvements other than buildings (the pool), and $100,000 to the building. Charges for services amounted to $270,000, all received in cash. Salaries paid to employees amounted to $172,500, all paid in cash, of which $100,000 was cost of services…arrow_forwardFor each of the following, indicate whether the statement is true or false and include a brief explanation for your answer.a. A pension trust fund appears in the government-wide financial statements but not in the fund financial statements.b. Permanent funds are included as one of the governmental funds.c. A fire department placed orders of $20,000 for equipment. The equipment is received but at a cost of $20,800. In compliance with requirements for fund financial statements, an encumbrance of $20,000 was recorded when the order was placed, and an expenditure of $20,800 was recorded when the order was received.d. The government reported a landfill as an enterprise fund. At the end of Year 1, the government estimated that the landfill will cost $800,000 to clean up when it is eventually full. Currently, it is 12 percent filled. At the end of Year 2, the estimation was changed to $860,000 when it was 20 percent filled. No payments are due for several years. Fund financial statements for…arrow_forward

- The City of Greystone maintains its books so as to prepare fund accounting statements and prepares worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: The City levied property taxes for the current fiscal year in the amount of $8,000,000. At year-end, $720,000 of the taxes had not been collected. It was estimated that $330,000 of that amount would be collected during the 60 days after the end of the fiscal year and that $360,000 would be collected after that time and the balance would be uncollectible. The City had recognized the maximum of property taxes allowable under modified accrual accounting. $255,000 of property taxes had been deferred at the end of the previous year and was recognized under modified accrual as revenue in the current year. In addition to the expenditures reported under modified accrual accounting, the city computed that an additional $104,000…arrow_forwardThe City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of the municipal building. Which of the following is true for reporting the gift within the government-wide financial statements?a. A capital asset of $240,000 must be reported.b. No capital asset will be reported.c. If conditions are met, recording the sculpture as a capital asset is optional.d. The sculpture will be recorded but only for the amount paid by the city.arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forward

- The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of the municipal building. Which of the following is true for reporting the gift within the government-wide financial statements? A capital asset of $240,000 must be reported. No capital asset will be reported. If conditions are met, recording the sculpture as a capital asset is optional. The sculpture will be recorded but only for the amount paid by the city.arrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License