Concept explainers

Spreadsheet Exercise

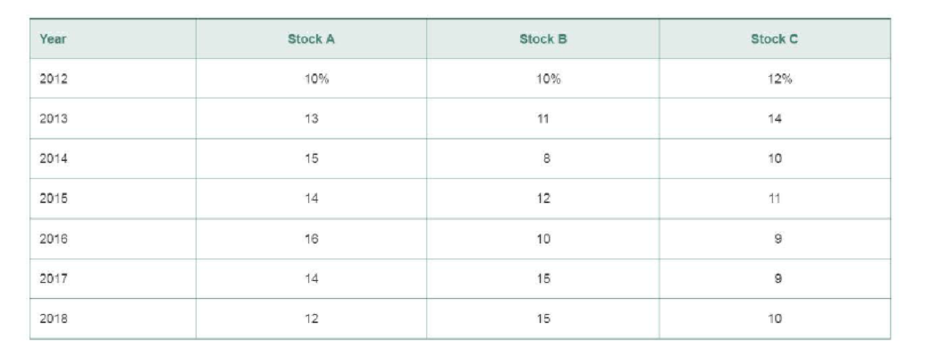

Jane is considering investing in three different stocks or creating three distinct two-stock portfolios. Jane views herself as a rather conservative investor. She is able to obtain historical returns for the three securities for the years 2012 through 2018. The data are given in the following table.

In any of the possible two-stock portfolios, the we1ght of each stock m the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC.

To Do

Create a spreadsheet similar to Tables 8.6 and 8.7 to answer the following:

- a. Calculate the average return for each individual stock.

- b. Calculate the standard deviation for each individual stock.

- c. Calculate the average returns for portfolios AB, AC, and BC.

- d. Calculate the standard deviations for portfolios AB, AC, and BC.

- e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint

- f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint

My Lab Finance Visit www.pearson.com/mylab/finance for Chapter Case: Analyzing Risk and Return on Chargers Products’ Investments, Group Exercises, and numerous online resources.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.500 42.00% Li Corp. (LC) 15% 1.100 45.00% Baque Co. (BC) 30% 0.300 49.00% Brandon calculated the portfolio’s beta as 0.818 and the portfolio’s required return as 8.4990%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Brandon’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required return change?…arrow_forward. Portfolio beta and weights Brandon is an analyst at a wealth management firm. One of his clients holds a $5,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.750 38.00% Arthur Trust Inc. (AT) 20% 1.500 42.00% Li Corp. (LC) 15% 1.100 45.00% Baque Co. (BC) 30% 0.300 49.00% Brandon calculated the portfolio’s beta as 0.818 and the portfolio’s required return as 8.4990%. Brandon thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Baque Co. The risk-free rate is 4%, and the market risk premium is 5.50%. Suppose instead of replacing Atteric Inc.’s stock with Baque Co.’s stock, Brandon considers replacing Atteric Inc.’s stock with the equal…arrow_forwardPortfolio beta and weights Rafael is an analyst at a wealth management firm. One of his clients holds a $10,000 portfolio that consists of four stocks. The investment allocation in the portfolio along with the contribution of risk from each stock is given in the following table: Stock Investment Allocation Beta Standard Deviation Atteric Inc. (AI) 35% 0.900 23.00% Arthur Trust Inc. (AT) 20% 1.400 27.00% Li Corp. (LC) 15% 1.100 30.00% Transfer Fuels Co. (TF) 30% 0.300 34.00% Rafael calculated the portfolio’s beta as 0.850 and the portfolio’s required return as 8.6750%. Rafael thinks it will be a good idea to reallocate the funds in his client’s portfolio. He recommends replacing Atteric Inc.’s shares with the same amount in additional shares of Transfer Fuels Co. The risk-free rate is 4%, and the market risk premium is 5.50%. According to Rafael’s recommendation, assuming that the market is in equilibrium, how much will the portfolio’s required…arrow_forward

- Portfolio risk and return Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.00% Water and Power Co. (WPC) $1,125 1.10 16.00% Makissi Corp. (MC) $2,250 0.50 28.50% If the risk-free rate is 7% and the market risk premium is 8.5%, what is Emma’s portfolio’s beta and required return? Fill in the following table: If the risk-free rate is 7% and the market risk premium is 8.5%, what is Emma’s portfolio’s beta and required return? Fill in the following table: BETA 0.9750 REQUIRED RETURN 0.8288 867.50% 0.6533 2,232.50% 1.4625 15.29% 1,895.96%arrow_forwardPortfolio risk and return Emma holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 15.00% Kulatsu Motors Co. (KMC) $1,500 1.90 11.00% Water and Power Co. (WPC) $1,125 1.10 16.00% Makissi Corp. (MC) $2,250 0.50 28.50% Suppose all stocks in Emma’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Kulatsu Motors Co. Makissi Corp. Andalusian Limited Water and Power Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Water and Power Co. Makissi Corp. Andalusian Limited…arrow_forwardTareen investing company invested equal amount in five stocks to form investment portfolio which has a Beta value 1.2, Tareen is considering to sell the riskiest stock in the portfolio which has Beta co-efficient to 2 and replace it with another stock. If Tareen replace the stock with Beta = 2 with a stock with Beta = 1, what will be the new Beta of his investment portfolio. Assume that equal amount is invested in each stock in the portfolio?arrow_forward

- Portfolio risk and return Ariel holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Andalusian Limited (AL) $2,625 0.80 9.00% Kulatsu Motors Co. (KMC) $1,500 1.90 12.00% Water and Power Co. (WPC) $1,125 1.20 16.00% Makissi Corp. (MC) $2,250 0.30 28.50% Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Makissi Corp. Water and Power Co. Andalusian Limited Kulatsu Motors Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Kulatsu Motors Co. Andalusian Limited Water and Power Co. Makissi Corp. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Ariel’s portfolio’s…arrow_forwardfinancial advisor evaluates four stocks for inclusion in an investor's portfolio. A orrelation matrix showing each stock's correlation with the other stocks is shown below Stock ALK CMN BTY DLE ALK 0.40 0.58 1.00 -0.25 BTY 0.40 1.00 0.16 -0.04 CMN -.25 .16 1.00 .37 DLE .58 .04 .37 1.00 f the goal is to reduce the investor's overall portfolio risk, which two stocks should the advisor recommend? a. ALK and DLE b. ALK and CMN c. BTY and DLE BTY and CMarrow_forwardAll of the parts are under one question and therfore can be answered per your policy. 8. Portfolio risk and return Ariel holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock’s beta, is listed in the following table: Stock Investment Beta Standard Deviation Omni Consumer Products Co. (OCP) $3,500 0.90 18.00% Tobotics Inc. (TI) $2,000 1.70 11.00% Three Waters Co. (TWC) $1,500 1.10 18.00% Flitcom Corp. (FC) $3,000 0.60 25.50% A. Suppose all stocks in Ariel’s portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Tobotics Inc. Three Waters Co. Flitcom Corp. Omni Consumer Products Co. B. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Flitcom Corp. Tobotics Inc. Omni Consumer Products Co. Three Waters Co.…arrow_forward

- PORTFOLIO BETA An individual has $20,000 invested in a stock with a beta of 0.6 and another $75,000 invested in a stock with a beta of 2.5. If these are the only two investments in her portfolio, what is her portfolio’s beta?arrow_forwardMrs. Landis has a 2-stock portfolio with a total value of $520,000. $175,000 is invested in Stock A with a beta of 1.25 and the remainder is invested in Stock B with a beta of 1.25. What is her portfolio's beta?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. Group of answer choices 1.01 1.30 1.25 1.39 1.15arrow_forwardQUESTION 2 (a,b) Aisyah, a new investor cannot decide whether to invest in Stock Media Prima or Stock Astro, or in a portfolio which is a combination of both stocks. She has approached RHB securities and the firm has provided her with the following information. Probability (%) Expected return (%) Stock Media Prima Stock Astro 30 13 15 20 14 13 20 15 12 30 16 11 Using these stocks, she has identified two investment portfolio alternatives: Alternatives Portfolio 1 100% Stock Media Prima 2 40% of Media Prima and 60% of Astro a) Calculate the expected return for Stock Media Prima and Stock Astro b) Calculate the standard deviation for Stock Media Prima and Stock Astroarrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning