Concept explainers

Refer to the information given in the preceding case for Lehighton Chalk Company.

Required:

- 1. Reconcile Lehighton’s operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement:

- Cost of goods sold

- Fixed cost (expensed as a period expense)

- 2. What was Lehighton’s total operating income across both years under absorption costing and under variable costing?

- 3. What was the total sales revenue across both years under absorption costing and under variable costing?

- 4. What was the total of all costs expensed on the operating income statements across both years under absorption costing and under variable costing?

- 5. Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3)]: (a) under absorption costing and (b) under variable costing.

- 6. Comment on the results obtained in requirements (1), (2), (3), and (4) in light of the following assertion: Timing is the key in distinguishing between absorption and variable costing.

1.

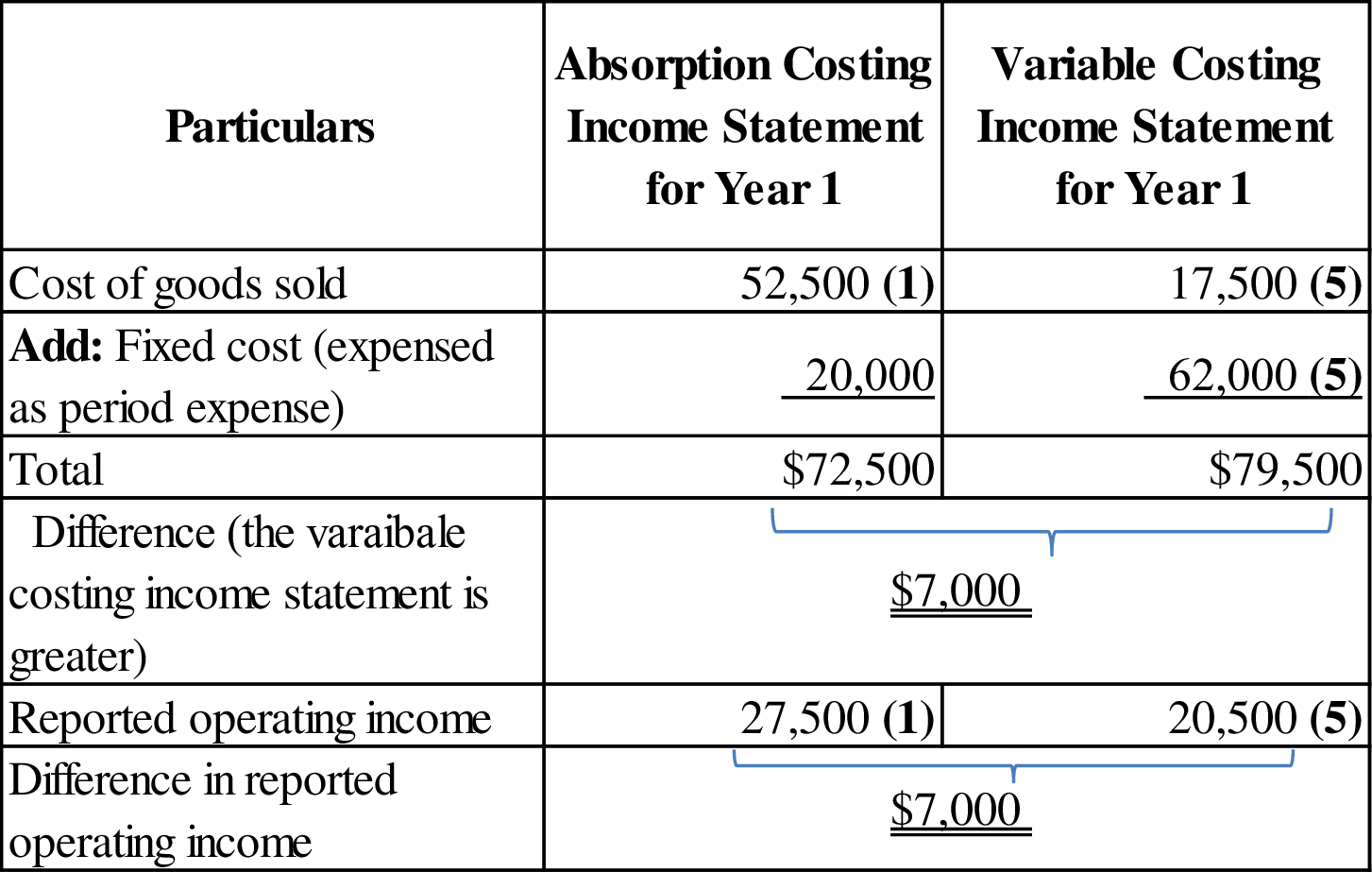

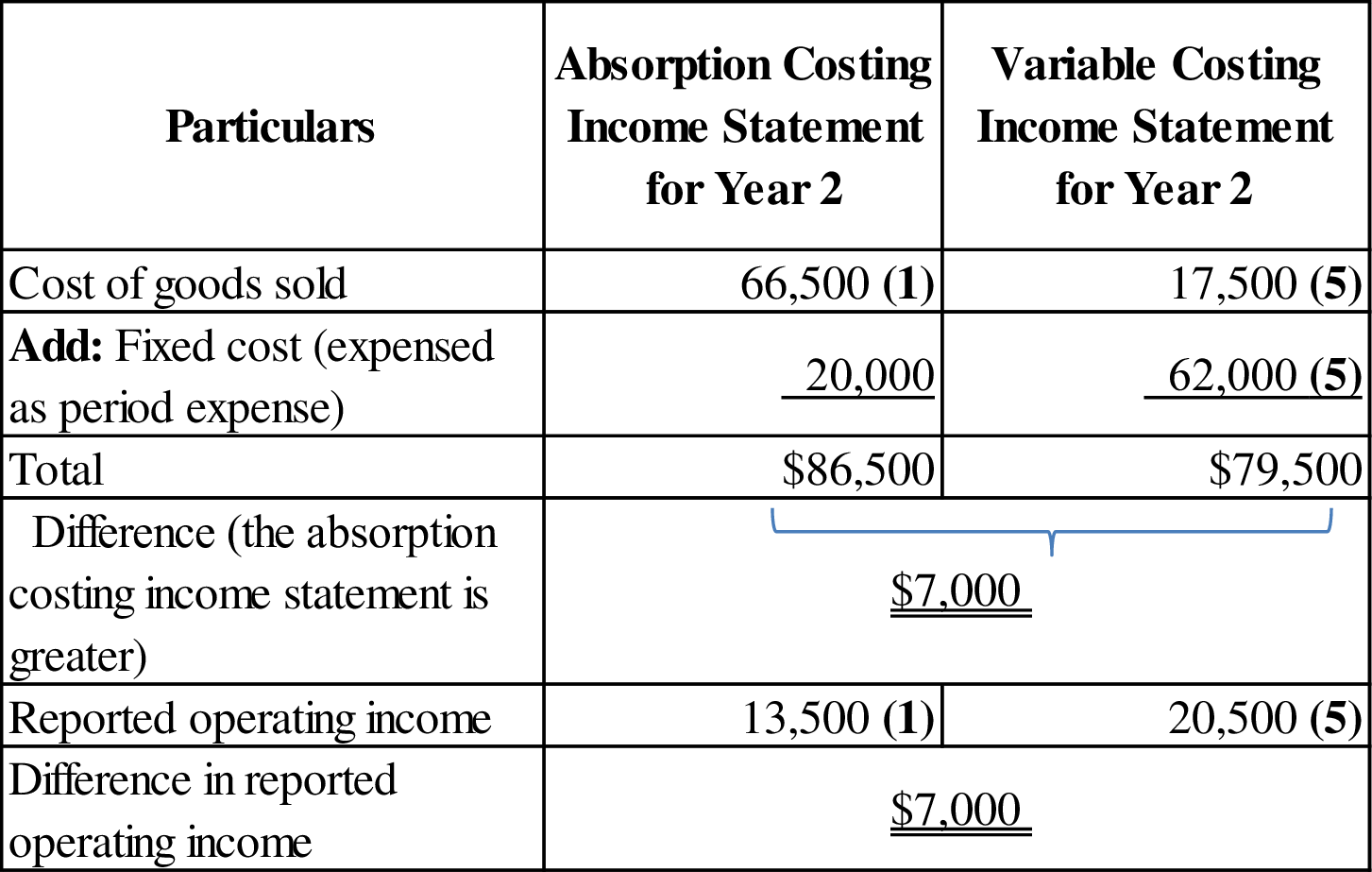

Reconcile the reported operating income of company L for each year under absorption and variable costing, by comparing the cost of goods sold and fixed cost on each income statement.

Explanation of Solution

Absorption Costing: “Absorption costing is a method that allocates “direct labor, direct materials, fixed manufacturing overhead and variable manufacturing overhead” to products and it is required by GAAP for the purpose of external reporting”.

Variable Costing: Managers frequently use variable costing for internal purposes for taking decision making. The cost of goods manufactured includes direct materials, direct labor, and variable factory overhead. Fixed factory overhead treated as period (fixed) expense.

Reconcile the reported operating income of company L for each year under absorption and variable costing as follows:

For year 1:

Figure (1)

For year 2:

Figure (2)

Working note (1):

Prepare an operating income statement of Company L for both years under absorption costing method as follows:

| Operating income statement under absorption costing method | ||

| Particulars | Year 1 | Year 2 |

| Sales revenue (2) (C) | $ 125,000 | $ 125,000 |

| Less: Cost of goods sold: | ||

| Beginning finished-goods inventory (4) | $ 0 | $10,500 |

| Cost of goods manufactured (3) | 63,000 | 56,000 |

| Cost of goods available for sale | $63,000 | $66,500 |

| Ending finished-goods inventory (4) | 10,500 | $ 0 |

| Cost of goods sold (D) | $52,500 | $66,500 |

| Gross margin | $72,500 | $58,500 |

| Less: Selling and administrative expenses | $ 45,000 | $ 45,000 |

| Operating income | $27,500 | $13,500 |

Table (1)

Working note (2):

Calculate the value of sales revenue for both years.

| Particulars | Production units (A) | Year 1 |

Year 2 |

| Sales revenue | 2,500 units | $125,000 | $125,000 |

Table (2)

Working note (3):

Calculate the cost of goods manufactured for both years.

Year 1:

Year 2:

Working note (4):

Calculate the cost of ending inventory for year 1:

Note: The ending inventory for year 1 is considered as the beginning inventory for year 2.

Working note (5):

Prepare an operating income statement of Company L for both years under variable costing method as follows:

| Particulars | Year 1 | Year 2 |

| Sales revenue (E) (1) | $ 125,000 | $ 125,000 |

| Less: Cost of goods sold: | ||

| Beginning finished-goods inventory | $ 0 | $3,500 |

| Cost of goods manufactured | 21,000 | 14,000 |

| Cost of goods available for sale | $21,000 | $17,500 |

| Ending finished-goods inventory (6) | $3,500 | $0 |

| Cost of goods sold | $17,500 | $17,500 |

| Add: Variable selling and administrative costs | $25,000 | $25,000 |

| Total variable costs (F) | $42,500 | $42,500 |

| Contribution margin | $82,500 | $82,500 |

| Less: Fixed costs: | ||

| Manufacturing | $42,000 | $42,000 |

| Selling and administrative | $20,000 | $20,000 |

| Total fixed costs | $62,000 | $62,000 |

| Operating income | $20,500 | $20,500 |

Table (3)

Working note (6):

Calculate the cost of ending inventory for year 1:

Note: The ending inventory for year 1 is considered as the beginning inventory for year 2.

Under the fixed cost for year 1 only the selling and administrative cost are consider.

2.

Ascertain the total operating income of company L for both years under absorption costing and under variable costing.

Explanation of Solution

Ascertain the total operating income of company L for both years under absorption costing and under variable costing as follows:

Total operating income under absorption costing:

Total operating income under variable costing:

3.

Ascertain the total sales revenue of company L both years under absorption costing and under variable costing.

Explanation of Solution

Ascertain the total sales revenue of company L both years under absorption costing and under variable costing as follows:

Total sales revenue under absorption costing:

Total sales revenue under variable costing:

4.

Ascertain the total of all costs expensed on the operating income statements of company L for both years under absorption costing and under variable costing.

Explanation of Solution

Total of all costs expensed under absorption costing:

Total of all costs expensed under variable costing:

5.

Deduct the total costs expensed from the total sales revenue of company L for both years (a) under absorption costing and (b) under variable costing.

Explanation of Solution

a. Deduct the total costs expensed from the total sales revenue of company L for both years under absorption costing as follows:

b. Deduct the total costs expensed from the total sales revenue of company L for both years under variable costing as follows:

6.

Evaluate the results of the above calculation.

Explanation of Solution

- In this case, the company has sold same number of (2,500) units for both years, at a price of $50. Therefore, the total sales revenue is same for both years under absorption and variable costing and sales revenue has nothing to do with the costing method used.

- The total costs expensed ($209,000) for both years are also same under variable and absorption costing. Because the company has sold the same number of units for both years.

- The combined operating income of Company L for the two-year period is $41,000 under both absorption and variable costing. Because the total sales revenue and the total expenses of the company are same under both costing methods over the two-year.

- The analysis in requirement (1) indicates that the operating income of company L is distributed differently for both years under absorption and variable costing. Therefore, the operating income under the two costing methods is not the same within each year. Under absorption costing, the operating income is higher by $7,000 for year 1 and for year 2 it is lower by $7,000. Because the expenses under absorption costing are $7,000 lower in year 1 and $7,000 greater in year 2. However, it reported the same operating income across the two-year combined period under both costing methods.

- Therefore, the difference between absorption and variable costing is caused by the timing with which expenses are recognized. For instance: Under absorption costing, the fixed manufacturing overhead is not expensed until year 2. Whereas, under variable costing all of the fixed manufacturing overhead is expensed in year 1 as a period cost.

Want to see more full solutions like this?

Chapter 8 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- Summarized data for Backdraft Co. for its first year of operations are as follows: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forwardSummarized data for Walrus Co. for its first year of operations are: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forwardTo determine the effect of different levels of production on the company’s income, move to cell B7 (Actual production). Change the number in B7 to the different production levels given in the table below. The first level, 100,000, is the current level. What happens to the operating income on both statements as production levels change? Enter the operating incomes in the following table. Does the level of production affect income under either costing method? Explain your findings.arrow_forward

- When the number of units in ending inventory increases through the year, which of the following is true? A. Net income is the same for variable and absorption costing. B. Net income is higher for variable costing than for absorption costing. C. Net income is higher for absorption costing than for variable costing. D. There is no relationship between net Income and the costing method.arrow_forwardVariable-Costing Income Statement Refer to the data for Osterman Company on the previous page. Required: 1. Calculate the cost of goods sold under variable costing. 2. Prepare an income statement using variable costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forwardAbsorption-Costing Income Statement Refer to the data for Osterman Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-23 and 3-24: During the most recent year, Osterman Company had the following data:arrow_forward

- Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardThe following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the year ended December 31: Assume that 8,500 million of cost of goods sold and 4,000 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: Also, assume that 30% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Caterpillar Inc. Round numbers to nearest million. b. Explain the difference between the amount of operating income reported under the absorption costing and variable costing concepts. Round numbers to nearest million.arrow_forwardWhen prices are falling (deflation), which costing method would produce the highest gross margin for the following? Choose first-in, first-out (FIFO); last-in, first-out (LIFO); or weighted average, assuming that B62 Company had the following transactions for the month. Calculate the gross margin for each of the following cost allocation methods, assuming B62 sold just one unit of these goods for $400. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

- Inventory Valuation under Variable Costing Refer to the data for Judson Company above. Required: 1. How many units are in ending inventory? 2. Using variable costing, calculate the per-unit product cost. 3. What is the value of ending inventory under variable costing? Use the following information for Brief Exercises 3-21 and 3-22: During the most recent year, Judson Company had the following data associated with the product it makes:arrow_forwardRipley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardOn October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning