Concept explainers

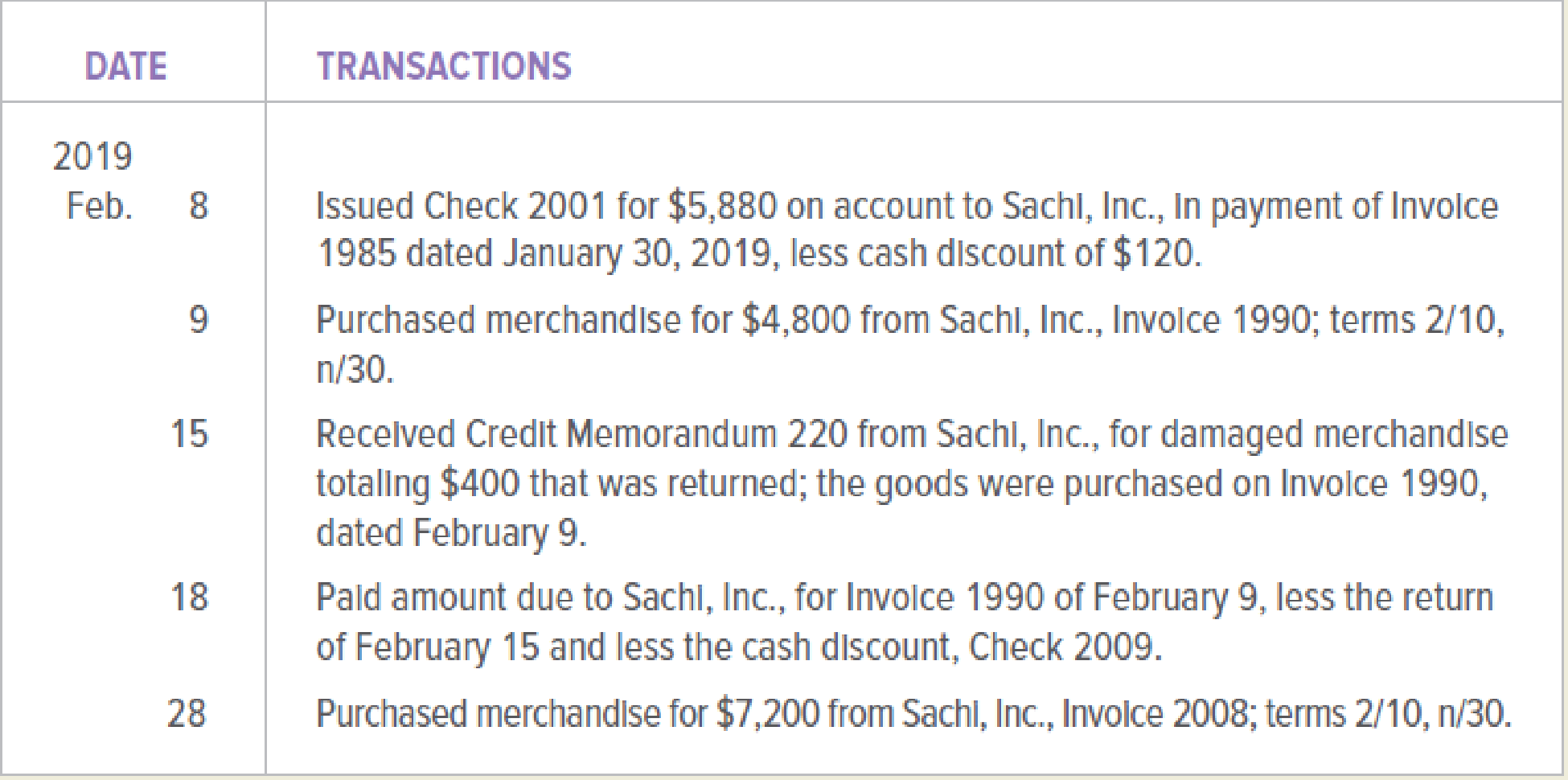

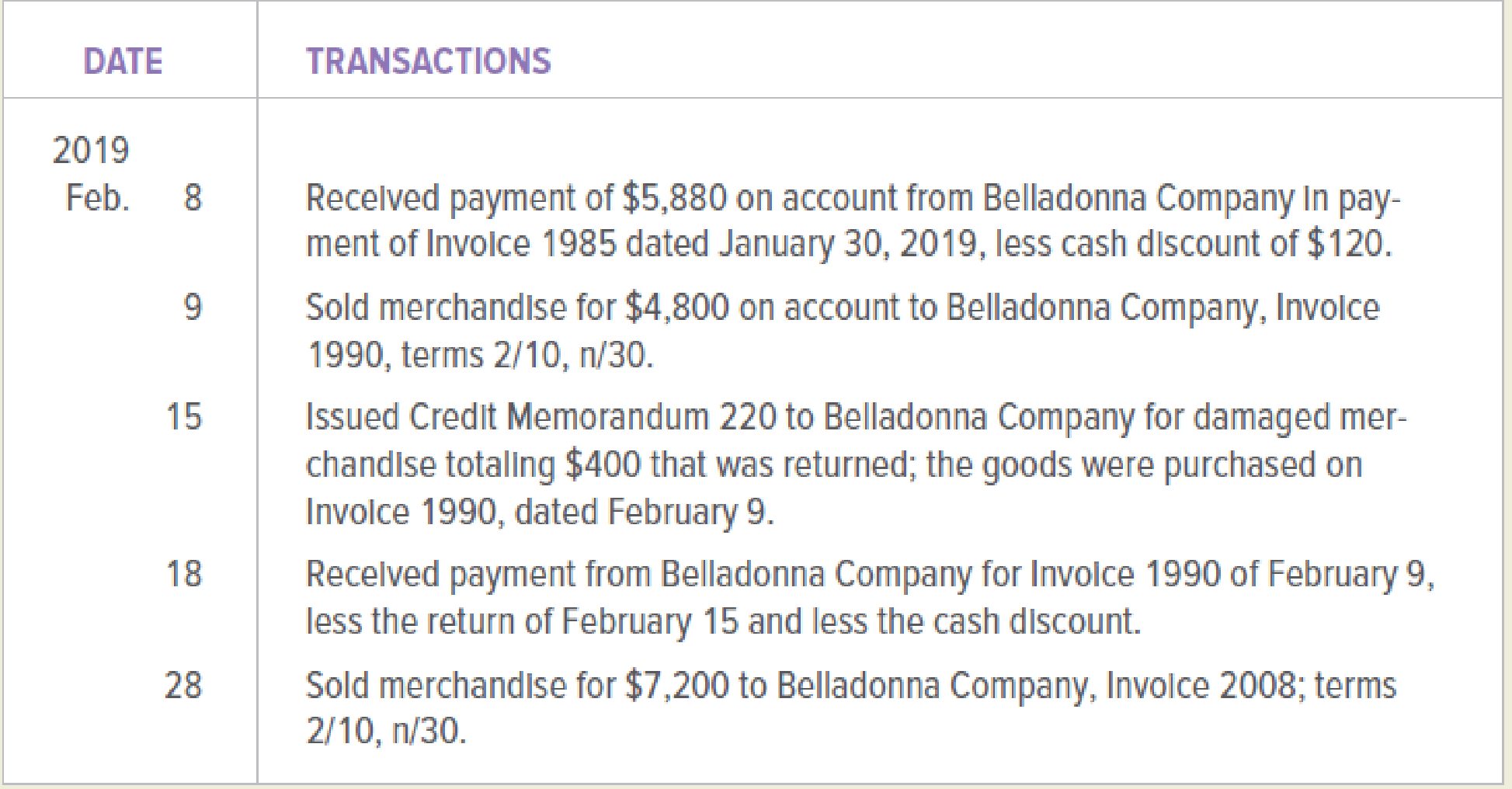

Belladonna Company (buyer) and Sachi, Inc. (seller), engaged in the following transactions during February 2019:

Belladonna Company

Sachi, Inc.

INSTRUCTIONS

- 1. Open the accounts payable ledger account and

accounts receivable ledger account indicated below for both Belladonna Company and Sachi, Inc. Enter the balances as of February 1, 2019. - 2. Journalize the transactions above in a general journal for both Belladonna Company and Sachi, Inc. Begin the journals for both companies with page 12.

- 3.

Post the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for Belladonna Company. - 4. Post the transactions to the appropriate accounts in the general ledger and the accounts receivable subsidiary ledger for Sachi, Inc.

GENERAL LEDGER ACCOUNTS—BELLADONNA COMPANY

201 Accounts Payable, $6,000 Cr.

ACCOUNTS PAYABLE LEDGER ACCOUNT—BELLADONNA COMPANY

Sachi, Inc., $6,000

GENERAL LEDGER ACCOUNTS—SACHI, INC.

111 Accounts Receivable, $6,000 Dr.

ACCOUNTS RECEIVABLE LEDGER ACCOUNT—SACHI, INC.

Belladonna Company, $6,000

Analyze: What is the balance of the accounts payable for Sachi, Inc., in the Belladonna Company accounts payable subsidiary ledger? What is the balance of the accounts receivable for Belladonna Company in the Sachi, Inc., accounts receivable subsidiary ledger?

1.

Create the accounts payable ledger account and accounts receivable ledger account of company B and company SI indicating the balances on given date.

Explanation of Solution

Ledgers:

Ledgers are T accounts to which journal entries are posted. Ledgers are used to ascertain transactions of a particular account and its closing balance for the period. The day-to-day transactions of the business are recorded in their respective ledgers.

The accounts payable ledger account of company B is as follows:

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| February 1,2019 | Balance | 6,000 | ||

Table (1)

The accounts receivable ledger account of company SI is as follows:

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| February 1,2019 | Balance | 6,000 | ||

Table (2)

2.

Record the entries into the general journal of the company B and the company SI.

Explanation of Solution

The recording of entries in the general journal for company B is as follows:

Recording the payment made:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 8, 2019 | Accounts payable/Company SI | 6,000 | ||

| Purchases discounts | 120 | |||

| Cash | 5,880 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (3)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 9, 2019 | Purchases | 4,800 | ||

| Accounts payable/Company SI | 4,800 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (4)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Accounts payable is liability and the balance of accounts payable is increasing. Therefore, it is credited.

Recording the purchases returned and credit memorandum received:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 15, 2019 | Accounts payable/Company SI | 400 | ||

| Purchases returns and allowances | 400 | |||

| (to record the inventory returned and credit memorandum received) | ||||

Table (5)

- • The accounts payable account is a liability account. The accounts payable account has the normal credit balance and it is decreasing. Therefore, it is debited.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 18, 2019 | Accounts payable/Company SI | 4,400 | ||

| Purchases discounts | 88 | |||

| Cash | 4,312 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (6)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 28, 2019 | Purchases | 7,200 | ||

| Accounts payable/Company SI | 7,200 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (7)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Since, the accounts payable is liability and the account balance is increasing. Therefore, it is credited.

The recording of entries in the general journal for company SI is as follows:

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 8, 2019 | Sales Discount | 120 | ||

| Cash | 5,880 | |||

| Accounts Receivable/Company B | 6,000 | |||

| (to record the payment received and discount provided) | ||||

Table (8)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 9, 2019 | Accounts Receivable/ Company B | 4,800 | ||

| Sales | 4,800 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (9)

- • The accounts receivable is debited. This is because the accounts receivables account is an asset account and the account balance is increasing.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated.

Recording the returned merchandise sold and the credit memorandum:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 15, 2019 | Sales returns and allowances | 400 | ||

| Accounts Receivable/ Company B | 400 | |||

| (to record the merchandise returned and issued credit memorandum) | ||||

Table (10)

- • The sales returns and allowances account is identified as contra revenue account with normal debit balance and it is increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts receivable account is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 18, 2019 | Sales Discount | 88 | ||

| Cash | 4,312 | |||

| Accounts Receivable/Company B | 4,400 | |||

| (to record the timely payment received from the account receivable) | ||||

Table (11)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold and sales tax payable:

| GENERAL JOURNAL | Page 12 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| February 28, 2019 | Accounts Receivable/ Company B | 7,200 | ||

| Sales | 7,200 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (12)

- • The accounts receivables account is debited. This is because the accounts receivables account is an asset account and the account balance is increasing.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated.

Working Note:

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company SI was agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $88.

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 2/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $88.

3.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company B.

Explanation of Solution

The posting of general journal in the appropriate accounts in the general ledger and the accounts payable subsidiary ledger is as follows:

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 5,880 | (5,880) | ||

| February 18, 2019 | 4,312 | (10,192) | ||

Table (13)

| Accounts Payable/Company SI | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (14)

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (15)

| Purchases | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 28, 2019 | 7,200 | 12,000 | ||

Table (16)

| Purchases Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 15, 2019 | 400 | 400 | ||

Table (17)

| Purchases Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 120 | 120 | ||

| February 18, 2019 | 88 | 208 | ||

Table (18)

4.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company SI.

Explanation of Solution

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 5,880 | 5,880 | ||

| February 18, 2019 | 4,312 | 10,192 | ||

Table (19)

| Accounts Receivable/Company B | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (20)

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | 6,000 | ||

| February 8, 2019 | 6,000 | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 15, 2019 | 400 | 4,400 | ||

| February 18, 2019 | 4,400 | - | ||

| February 28, 2019 | 7,200 | 7,200 | ||

Table (21)

| Sales | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 9, 2019 | 4,800 | 4,800 | ||

| February 28, 2019 | 7,200 | 12,000 | ||

Table (22)

| Sales Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 15, 2019 | 400 | 400 | ||

Table (23)

| Sales Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| Feburary 1,2019 | Balance | - | ||

| February 8, 2019 | 120 | 120 | ||

| February 18, 2019 | 88 | 208 | ||

Table (24)

The balance of accounts payable account for company SI in company B’s subsidiary ledger is $7,200 credit balance. The balance of accounts receivable account for company B in company SL’s subsidiary ledger is $7,200 debit balance.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING-ACCESS

- Refer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forwardOn March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forwardBalance Sheet The following is an alphabetical list or Lloyds Hudson Dealership Inc.s December 31, 2019, balance sheet accounts and amounts: Required: 1. Prepare a properly classified balance sheet for Lloyds Hudson Dealership as of December 31, 2019. List the additional parenthetical or note disclosures (if any) that should be made for each item. 2. Next Level Compute the current ratio. What does it indicate about Lloyds Hudson Dealership?arrow_forward

- The balance in Ashwood Companys accounts payable account at December 31, 2019, was 1,200,000 before any necessary year-end adjustment relating to the following: Goods were in transit from a vendor to Ashwood on December 31, 2019. The invoice cost was 85,000, and the goods were shipped FOB shipping point on December 29, 2019. The goods were received on January 2, 2020. Goods shipped FOB shipping point on December 20, 2019, from a vendor to Ashwood were lost in transit. The invoice cost was 40,000. On January 5, 2020, Ashwood filed a 40,000 claim against the common carrier. Goods shipped FOB destination on December 22, 2019, from a vendor to Ashwood were received on January 6, 2020. The invoice cost was 20,000, What amount should Ashwood report as accounts payable on its December 31,2019, balance sheet? a. 1,260,000 b. 1,285,000 c. 1,325,000 d. 1,345,000arrow_forwardAnalyzing Accounts Receivable Upham Companys June 30, 2019, balance sheet included the following information: Required: 1. Prepare the journal entries necessary for Upham to record the preceding transactions. 2. Prepare an analysis and schedule that shows the amounts of the accounts receivable, allowance for doubtful accounts, notes receivable, and notes receivable dishonored accounts that will be disclosed on Uphams June 30, 2020, balance sheet.arrow_forwardComprehensive Selected transactions of Shadrach Computer Corporation during November and December of 2019 are as follows: Required: Prepare journal entries to record the preceding transactions of Shadrach Computer Corporation for 2019. Include year-end accruals. Round all calculations to the nearest dollar.arrow_forward

- Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forwardOn January 1, 2020, the records of ABC Company showed a debit balance of P650,000 in its Accounts Receivable account. The following summary transactions that occurred during 2020 were also shown under the said account: Debits:Charge sales, P6,300,000Shareholders’ subscriptions, P200,000Deposit on contract, P120,000Claims against common carrier for shipping damages, P100,000IOUs from employees, P10,000Cash advances to affiliates, P150,000Advances to a supplier, P30,000Credits:Collections from customers, P5,300,000Write-off, P35,000Merchandise returns, P45,000Allowances to customers for shipping damages, P25,000Collections on carrier claims, P40,000Collections on subscriptions, P50,000Required:a. Determine the correct amount of accounts receivable.b. Compute the amount to be presented as “trade and other receivables” under current assets.arrow_forwardRosalie Couses the gross method to record sales made on credit. On June 10, 2019, it made sales of £100,000 with terms 2/10, n/30 to Finley Farms, Inc. On June 19, 2019, Rosalie received payment for 1/2 the amount due from Finley Farms. Rosalie’s fiscal year end is on June 30, 2019. What amount will be reported in the statement of financial position for the accounts receivable due from Finley Farms, Inc.?arrow_forward

- Lavender Company started its business on April 1, 2019. Using the following accounts, prepare the journal entries below in the General Journal. PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the transactions. Cash Petty Cash Accounts Receivable Office Supplies Computer Equipment Accounts Payable Unearned Services Income Services Income Lavender, Capital Dividends Maintenance Expense Miscellaneous Expense Rent Expense Wages Expense Cash Short and Over The following are the transactions that happened during the month of April. PLEASE NOTE: You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345). The owner invested $7,500 from their personal account to the business account DR CR Paid rent $600 with check #101. DR CR Initiated a petty cash fund $250 check #102. DR CR…arrow_forwardOn September 18, 2019, Afton Company purchased $4,125 of supplies on account. In Afton Company’s chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. Required: A. Journalize the September 18, 2019, transaction on page 87 of Afton Company’s two-column journal. B. Prepare a four-column account for Supplies. Enter a debit balance of $2,050 as of September 1, 2019. Enter “Balance” in the Item column and place a check mark (√) in the Posting Reference column. C. Prepare a four-column account for Accounts Payable. Enter a credit balance of $18,440 as of September 1, 2019. Enter “Balance” in the Item column and place a check mark (√) in the Posting Reference column. D. Post the September 18, 2019, transaction to the accounts. E. Do the rules of debit and credit apply to all companies?arrow_forwardThe Beep-Beep Alarm Company provides security services in Bloomington, IL. At the year end 2019, afteradjusting entries have been made, the following list of account balances is prepared.Service Revenue $ 612,900Salaries Expense $ 148,250Rent Expense $ 27,600Utilities Expense $ 48,800Supplies Expense $ 51,900Income Tax Expense $ 30,800Retained Earnings $ 305,550Dividends $ 6,0001. Prepare the closing journal entry to close the revenue account on December 31st. Date Account Debit Credit2. Prepare the closing journal entry to close the expense account on December 31st. Date Account Debit Credit3. Income Summary is an account used to indicate consideration of all revenues and expenses as one value for a closing entry.Prepare the closing journal entry on December 31st to close Income Summary if the company used this as a single account ratherthan individually closing revenues and expenses. Hint: this means the company did not individually complete #1 and #2 but theoutcome should be the…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning