Concept explainers

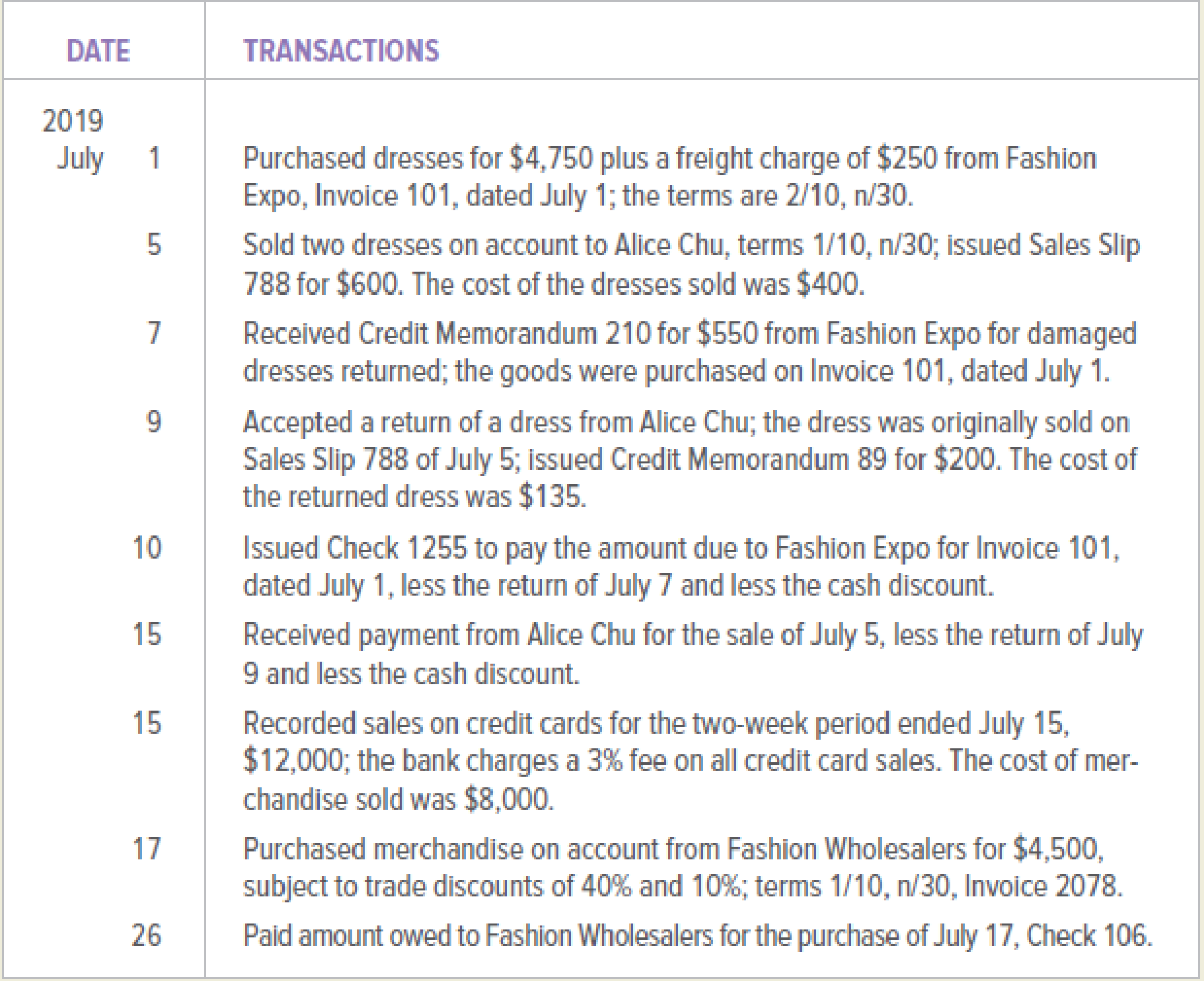

The following transactions took place at Fine Fashions Outlet during July 2019. Fine Fashions Outlet uses a perpetual inventory system. Record the transactions in a general journal. Use 8 as the page number for the general journal.

Analyze: What percentage of the total amount due to Fashion Expo on July 1 is due to the freight charge?

Post the transactions in the general journal using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System:

The perpetual inventory systems are used for the management of the inventory which provides the latest information about inventory records. The transactions are recorded in inventory ledger correspondingly with each inventory purchase, inventory sale and inventory returns under the perpetual inventory system. The general ledger merchandise inventory account is also updated by the system.

The transactions are posted to general journal as follows:

Merchandise purchased on credit including freight charges:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 1, 2019 | Merchandise inventory | 5,000 | ||

| Accounts payable/Company FE | 5,000 | |||

| (to record the merchandise purchased on credit with 2/10, n/30 terms) | ||||

Table (1)

- • The merchandise inventory account is debited. This is because the merchandise inventory can be identified as asset account and the account balance is increasing. The freight charges are included within merchandise inventory account. No separate account is prepared for the freight charges under perpetual inventory system.

- • Accounts payable is liability and the account balance is increasing. Therefore, it is credited.

Recording of the merchandise sold:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 5, 2019 | Accounts Receivable/ Company AC | 600 | ||

| Sales | 600 | |||

| (to record the merchandise sold on credit on terms 1/10,n/30) | ||||

Table (2)

- • The accounts receivables account is an asset account and the account balance is increasing. Therefore, the accounts receivables account is debited.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated from selling merchandise.

Recording of the cost of merchandise sold:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 5, 2019 | Cost of goods sold | 400 | ||

| Merchandise inventory | 400 | |||

| (to record the cost of merchandise sold) | ||||

Table (3)

- • The cost of goods sold account is an expense account and the account balance is increasing. Therefore, the cost of goods sold account is debited.

- • The merchandise inventory account is credited. This is because merchandise inventory account is an asset account and the account balance is decreasing.

Record the receiving of credit memorandum and merchandise returned:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 7, 2019 | Accounts payable/Company FE | 550 | ||

| Merchandise inventory | 550 | |||

| (to record the merchandise returned and receiving credit memorandum) | ||||

Table (4)

- • Since, the accounts payable is liability and the account balance is decreasing. Therefore, it is debited.

- • The merchandise inventory is an asset account and the account balance is decreasing. Therefore, its balance is credited.

Recording the returned merchandise sold and the credit memorandum:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 9, 2019 | Sales returns and allowances | 200 | ||

| Accounts Receivable/ Company AC | 200 | |||

| (to record the merchandise returned plus sales tax) | ||||

Table (5)

- • The sales returns and allowances account is identified as contra revenue account with debit normal balance and increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts payable account is credited.

Recording the cost of returned merchandise sold:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 9, 2019 | Merchandise inventory | 135 | ||

| Cost of goods sold | 135 | |||

| (to record the cost of returned merchandise sold) | ||||

Table (6)

- • The merchandise inventory account is debited. This is because it is an asset account and the account balance is increasing.

- • The cost of goods sold is an expense account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made with purchase discount:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 10, 2019 | Accounts payable/Company FE | 4,650 | ||

| Merchandise inventory | 84 | |||

| Cash | 4,566 | |||

| (to record the payment made and taking purchase discount ) | ||||

Table (7)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited. The amount in accounts payable accounts is calculated after subtracting the purchase returns amount.

- • The purchase discount is received of the payment made and there is reduction is merchandise purchases cost. Therefore, merchandise inventory account is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment received from the accounts receivable:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 15, 2019 | Sales discount | 4 | ||

| Cash | 396 | |||

| Accounts Receivable/Company AC | 400 | |||

| (to record the payment received from the account receivable) |

Table (8)

- • The sales discount account is identified as contra revenue account and it has debit normal balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 15, 2019 | Credit card expense | 360 | ||

| Cash | 11,640 | |||

| Sales | 12,000 | |||

| (to record the merchandise sold on credit on terms 1/10,n/30) | ||||

Table (9)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The accounts receivables account is an asset account and the account balance is increasing. Therefore, the accounts receivables account is debited.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated from selling merchandise.

Recording of the cost of merchandise sold:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 15, 2019 | Cost of goods sold | 8,000 | ||

| Merchandise inventory | 8,000 | |||

| (to record the cost of merchandise sold) | ||||

Table (10)

- • The cost of goods sold account is an expense account and the account balance is increasing. Therefore, the cost of goods sold account is debited.

- • The merchandise inventory account is credited. This is because merchandise inventory account is an asset account and the account balance is decreasing.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 17, 2019 | Merchandise inventory | 2,430 | ||

| Accounts payable/Company FW | 2,430 | |||

| (to record the inventory purchased on account with terms 1/10,n/30) | ||||

Table (11)

- • The merchandise inventory account is debited. This is because it is an asset account and the account balance is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the payment made with purchase discount:

| GENERAL JOURNAL | Page 8 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| July 26, 2019 | Accounts payable/Company FW | 2,430 | ||

| Merchandise inventory | 24.3 | |||

| Cash | 2,405.7 | |||

| (to record the payment made and taking purchase discount ) | ||||

Table (12)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited. The amount in accounts payable accounts is calculated after subtracting the purchase returns amount.

- • The purchase discount is received of the payment made and there is reduction is merchandise purchases cost. Therefore, merchandise inventory account is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

The percentage of freight charges in the total due amount can be calculated as follows:

Substitute 250 for freight charges and 5000 for total due amount in the above formula.

The amount $250 as freight charges can be identified as five percent of total amount $5,000 due to the company FE.

Working Note:

Calculating purchase discount:

Under the perpetual inventory system, the purchase discount is represented by the merchandise inventory account. The purchased discount is calculated on the merchandise purchases cost excluding purchase returns and the freight charges. The purchase discount is given as two percent of the merchandise purchase.

The amount of purchase discount would be $84.

Calculations for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the payments as per 1/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $4.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as three percent for all credit card sales.

The expense would amount to be $360.

Calculations for the purchases amount:

The seller provides the trade discount of forty percent and the ten percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be the invoice price.

The purchases amount that would be calculated is $2,430.

Calculating purchase discount:

Under the perpetual inventory system, the purchase discount is represented by the merchandise inventory account. The purchased discount is calculated on the merchandise purchases cost excluding trade discount. The purchase discount is given as one percent of the merchandise purchase.

The amount of purchase discount would be $24.3.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING-ACCESS

- On December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forwardOn June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forward

- Beginning inventory, purchases, and sales for Item Widget are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on March 25 and (b) the inventory on March 31.arrow_forwardBeginning inventory, purchases, and sales for Item Gidget are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on September 27 and (b) the inventory on September 30.arrow_forwardPalisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forward

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December.arrow_forwardThe following data were extracted from the accounting records of Harkins Company for the year ended April 30, 2019: a. Prepare the cost of merchandise sold section of the income statement for the year ended April 30, 2019, using the periodic inventory system. b. Determine the gross profit to be reported on the income statement for the year ended April 30, 2019. c. Would gross profit be different if the perpetual inventory system was used instead of the periodic inventory system?arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forward

- Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardPappas Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardUnder the periodic inventory system, what account is debited when an estimate is made for the cost of merchandise inventory sold this year, but expected to be returned next year? (a) Estimated Returns Inventory (b) Sales Returns and Allowances (c) Merchandise Inventory (d) Customer Refunds Payablearrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,