Concept explainers

Ratio analysis

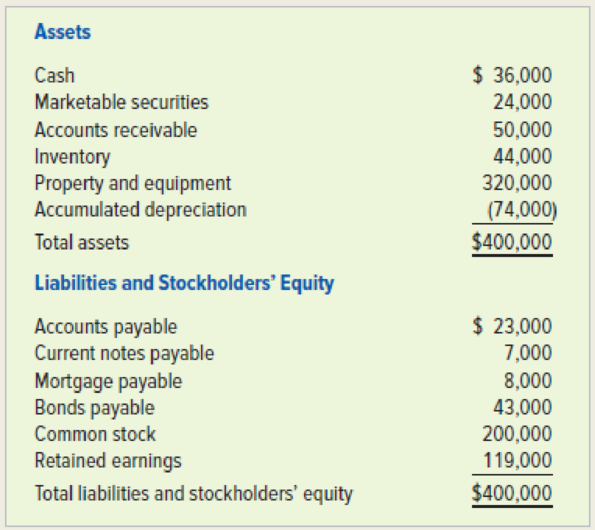

Compute the specified ratios using Duluth Company’s

The average number of common stock shares outstanding during 2018 was 880 shares. Net income for

the year was $40,000.

Required

Compute each of the following and round computations to two decimal points:

a.

b. Earnings per share.

c. Quick (acid-test) ratio.

d. Return on investment.

e. Return on equity.

f. Debt to equity ratio.

a.

Compute the current ratio for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Current ratio: Current ratio is one of the liquidity ratios, which measures the capacity of the company to meet its short-term obligations using its current assets. Current ratio is calculated by using the formula:

Determine the current ratio of Company D:

Working Note:

Determine the current assets.

Determine the current liabilities.

Thus, the current ratio of Company D is 5.13:1.

b.

Compute the earnings per share for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Earnings per Share: Earnings per share help to measure the profitability of a company. Earnings per share are the amount of profit that is allocated to each share of outstanding stock.

Determine the earnings per share of Company D:

Thus, the earnings per share of Company D is $45.45 per share.

c.

Compute the quick (acid-test) ratio for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Quick ratio: It is a ratio used to determine a company’s ability to pay back its current liabilities by liquid assets that are current assets except inventory and prepaid expenses. Quick ratio is calculated as follows:

Determine the quick ratio of Company D:

Determine the quick assets.

Thus, the quick ratio of Company D is 3.67:1.

d.

Compute the return on investment for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Return on investments (assets): Return on investments (assets) is the financial ratio which determines the amount of net income earned by the business with the use of total assets owned by it. It indicates the magnitude of the company’s earnings with relative to its total assets. Return on investment is calculated as follows:

Determine the return on investment ratio of Company D:

Note: As there is no information given regarding Average total assets, the Total asset is assumed as Average total asset.

Thus, the return on investment of Company D is 10.00%.

e.

Compute the return on equity for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Return on equity: It is one of the profitability ratios. Return on average equity ratio is used to determine the relationship between the net income available for the common stockholders’ and the average common stock. Return on average equity is calculated as follows:

Determine the return on equity ratio of Company D:

Working Note:

Determine the amount of average total stockholders’ equity.

Note: As there is no information given regarding Average total stockholders’ equity, the Total stockholders’ equity is assumed as Average total stockholders’ equity.

Thus, the return on equity of Company D is 12.54%.

f.

Compute the debt to equity ratio for Company D for 2018 from the data given in balance sheet.

Explanation of Solution

Debt–to-equity ratio: The debt-to-equity ratio indicates that the company’s debt as a proportion of its stockholders’ equity. The debt-to-equity ratio is calculated using the formula:

Determine the debt-to-equity ratio of Company D:

Working Note:

Determine the amount of total stockholders’ equity.

Determine the amount of total liabilities.

Thus, the debt-to-equity ratio of Company D is 25.39%.

Want to see more full solutions like this?

Chapter 9 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

- Ratio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardRatio of liabilities to stockholders equity and times interest earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: The income before income tax expense was 480,000 and 420,000 for the current and previous years, respectively. A. Determine the ratio of liabilities to stockholders equity at the end of each year. Round to one decimal place. B. Determine the times interest earned ratio for both years. Round to one decimal place. C. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?arrow_forward

- RATIO ANALYSIS OF COMPARATIVE FINANCIAL STATEMENTS Refer to the financial statements in Problem 24-8A. REQUIRED Calculate the following ratios and amounts for 20-1 and 20-2 (round all calculations to two decimal places): (a) Return on assets (Total assets on January 1, 20-1, were 175,750.) (b) Return on common stockholders equity (Total common stockholders equity on January 1, 20-1, was 106,944.) (c) Earnings per share of common stock (The average numbers of shares outstanding were 8,400 shares in 20-1 and 9,200 in 20-2.) (d) Book value per share of common stock (e) Quick ratio (f) Current ratio (g) Working capital (h) Receivables turnover (Net receivables on January 1, 20-1, were 39,800.) (i) Merchandise inventory turnover (Merchandise inventory on January 1,20-1, was 48,970.) (j) Debt-to-equity ratio (k) Asset turnover (Assets on January 1, 20-1, were 175,750.) (l) Times interest earned ratio (m) Profit margin ratio (n) Assets-to-equity ratio (o) Price-earnings ratio (The market price of the common stock was 100.00 and 85.00 on December 31, 20-2 and 20-1, respectively.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forward

- Ernst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub