SURVEY OF ACCOUNTING 360DAY CONNECT CAR

5th Edition

ISBN: 9781260591811

Author: Edmonds

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 1E

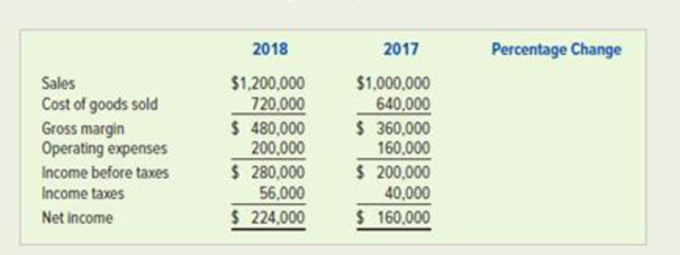

Exercise 9-1 Horizontal analysis

Winthrop Corporation reported the following operating results for two consecutive years:

Required

- a. Compute the percentage changes in Winthrop Corporation’s income statement components between the two years. Round percentages to one decimal point.

- b. Comment on apparent trends revealed by the percentage changes computed in Requirement a.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Problem 16-09 a-b Ivanhoe Corporation is preparing the comparative financial statements to be included in the annual report to stockholders. Ivanhoe employs a fiscal year ending May 31. Income from operations before income taxes for Ivanhoe was $1,319,000 and $621,000, respectively, for fiscal years ended May 31, 2021 and 2020. Ivanhoe experienced a loss from discontinued operations of $416,000 on March 3, 2021. A 20% combined income tax rate pertains to any and all of Ivanhoe Corporation’s profits, gains, and losses. Ivanhoe’s capital structure consists of preferred stock and common stock. The company has not issued any convertible securities or warrants and there are no outstanding stock options. Ivanhoe issued 37,300 shares of $100 par value, 6% cumulative preferred stock in 2017. All of this stock is outstanding, and no preferred dividends are in arrears. There were 1,071,600 shares of $1 par common stock outstanding on June 1, 2019. On September 1, 2019, Ivanhoe sold an additional…

a) Prepare a projected income statement for the year

to 31 October Year 8.

b) Calculate for Year 7 and Year 8

i) Earnings per Share

ii) Degree of operating gearing

iii) Degree of financial gearing

iv) Degree of combined gearing

c) Briefly evaluate the information produced in a & b

d) Calculate the sales revenue required in Year 8 to

maintain existing earnings per share

Vertical analysis

Two income statements for Cornea Company follow:

Cornea Company

Income Statements

For the Years Ended December 31

20Y9

20Y8

Fees earned

$1,570,000

$1,300,000

Expenses

(832,100)

(780,000)

Net income

$737,900

$520,000

Required:

a. Prepare a vertical analysis of Cornea Company’s income statements. If required, round your percentage to the nearest whole number.

Cornea Company

Income Statements

For the Years Ended December 31

20Y9

20Y8

Amount

Percent

Amount

Percent

Fees earned

$1,570,000

%

$1,300,000

%

Expenses

(832,100)

%

(780,000)

%

Operating income

$737,900

%

$520,000

%

b. Does the vertical analysis indicate a favorable or an unfavorable trend?

Chapter 9 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

Ch. 9 - 1. Why are ratios and trends used in financial...Ch. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - 4. What is the significance of inventory turnover,...Ch. 9 - 5. What is the difference between the current...Ch. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - 9. What are some limitations of the earnings per...Ch. 9 - Prob. 10Q

Ch. 9 - Prob. 11QCh. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Prob. 14QCh. 9 - Exercise 9-1 Horizontal analysis Winthrop...Ch. 9 - Prob. 2ECh. 9 - Prob. 3ECh. 9 - Prob. 4ECh. 9 - Prob. 5ECh. 9 - Prob. 6ECh. 9 - Prob. 7ECh. 9 - Prob. 8ECh. 9 - Comprehensive analysis The December 31, 2019,...Ch. 9 - Prob. 10ECh. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Ratio analysis Compute the specified ratios using...Ch. 9 - Prob. 14ECh. 9 - LO 13-2, 13-3, 13-4, 13-5 Exercise 13-15A...Ch. 9 - Prob. 16PCh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Problem 9-21 Ratio analysis Selected data for...Ch. 9 - Prob. 22PCh. 9 - Problem 9-23 Ratio analysis The following...Ch. 9 - Prob. 24PCh. 9 - Prob. 1ATCCh. 9 - Prob. 3ATCCh. 9 - ATC 9-5 Ethical Dilemma Making the ratios look...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vertical analysis The condensed income statements through income from operations for Dell Inc. and Apple Inc. for recent fiscal years follow (numbers in millions of dollars): Prepare comparative common-sized statements, rounding percents to one decimal place. Interpret the analyses.arrow_forwardSales transactions Using transactions listed in P4-2, indicate the effects of each transaction on the liquidity metric working capital and profitability metric gross profit percent. Indicate the gross profit percent for each sale (rounding to one decimal place) in parentheses next to the effect of the sale on the company’s ability to attain an overall gross profit percent of 30%.arrow_forwardApple Inc.: Segment revenue analysis Segment disclosure by Apple Inc. provides sales information for its major product lines for three recent years as follows (in millions): A. Which product had the greatest percentage of Year 3 sales? Which product had the least percentage of Year 3 sales? (Round to nearest whole percent.) B. Which product grew the most in sales, in percentage terms, using Year 1 as the base year? (Round to nearest whole percent.)arrow_forward

- RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem 24-8B. REQUIRED Calculate the following ratios and amounts for 20-1 and 20-2 (round all calculations to two decimal places). (a) Return on assets (Total assets on January 1, 20-1, were 111,325.) (b) Return on common stockholders equity (Total common stockholders equity on January 1, 20-1, was 82,008.) (c) Earnings per share of common stock (The average numbers of shares outstanding were 6,300 shares in 20-1 and 6,900 in 20-2.) (d) Book value per share of common stock (e) Quick ratio (f) Current ratio (g) Working capital (h) Receivables turnover and average collection period (Net receivables on January 1, 20-1, were 28,995.) (i) Merchandise inventory turnover and average number of days to sell inventory (Merchandise inventory on January 1, 20-1, was 32,425.) (j) Debt-to-equity ratio (k) Asset turnover (Assets on January 1, 20-1, were 111,325.) (l) Times interest earned ratio (m) Profit margin ratio (n) Assets-to-equity ratio (o) Price-earnings ratio (The market price of the common stock was 120.00 and 110.00 on December 31, 20-2 and 20-1, respectively.)arrow_forward(b)Prepare a vertical analysis of the income statement data for Oriole Corporation for both years. (Round percentages to 1 decimal place, e.g. 12.1%.) ORIOLE CORPORATIONCondensed Income Statementschoose the accounting period For the Years Ended December 31For the Month Ended December 31December 31 2022 2021 $ Percent $ Percent Net sales $632,300 enter percentages rounded to 1 decimal place % $544,800 enter percentages rounded to 1 decimal place % Cost of goods sold 456,600 enter percentages rounded to 1 decimal place % 415,500 enter percentages rounded to 1 decimal place % Gross Profit 175,700 enter percentages rounded to 1 decimal place % 129,300 enter percentages rounded to 1 decimal place % Operating expenses 74,100 enter percentages rounded to 1 decimal place % 44,500 enter percentages rounded to 1 decimal…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License