EBK ENGINEERING ECONOMY

17th Edition

ISBN: 9780134838229

Author: Sullivan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 13P

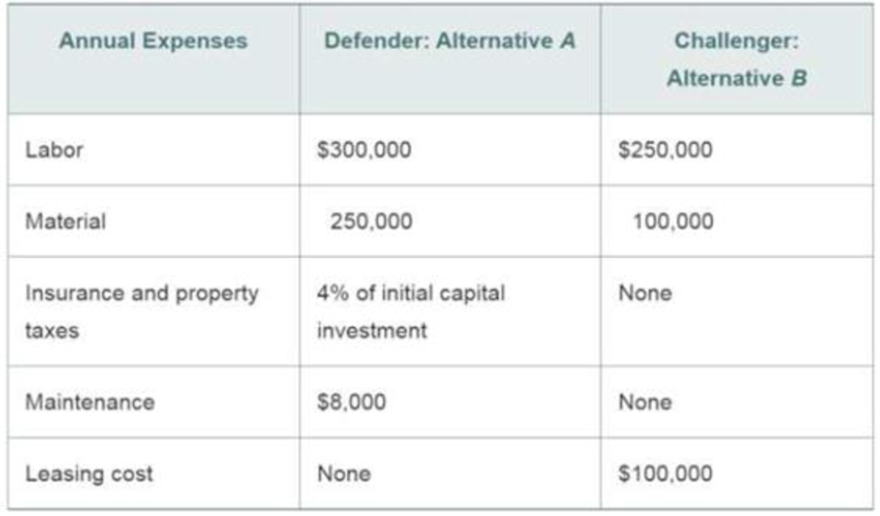

Use the PW method to select the better of the following alternatives:

Assume that the defender was installed five years ago. The MARR is 10% per year.

Definition of alternatives:

A: Retain an already owned machine (defender) in service for eight more years.

B: Sell the defender and lease a new one (challenger) for eight years.

Alternative A (additional information):

Cost of defender five years ago = $500,000

BV now = $111,550

Estimated MV eight years from now = $50,000

Present MV = $150,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A remotely situated fuel cell has an installed cost of $2,000 and will reduceexisting surveillance expenses by $350 per year for eight years. The border security agency’s MARR is 10% per year. Solve, a. What is the minimum salvage (market) value after eight years that makes the fuel cell worth purchasing? b. What is the fuel cell’s IRR if the salvage value is negligible?

Give typing answer with explanation and conclusion

A piece of equipment has a first cost of $175,000, a maximum useful life of 7 years, and a market (salvage) value described by the relation S = 120,000 – 11,000k, where k is the number of years since it was purchased. The salvage value cannot go below zero. The AOC series is estimated using AOC = 60,000 + 14,000k. The interest rate is 12% per year. Determine the economic service life and the respective AW.

The AW at the Economic Service Life, (in $)

Two numerically controlled drill presses are being considered by the production department of Zunni's Manufacturing; one must be

selected. Comparison data is shown in the table below. MARR is 10%/year.

Drill Press T Drill Press M

Initial Investment

Estimated Life

Estimated Salvage Value

Annual Operating Cost

Annual Maintenance Cost

Click here to access the TVM Factor Table Calculator

$20,000

10 years

$5,000

$12,000

$2,000

$30,000

10 years

$7,000

$6,000

$4,000

Chapter 9 Solutions

EBK ENGINEERING ECONOMY

Ch. 9 - Prob. 1PCh. 9 - Prob. 2PCh. 9 - Prob. 3PCh. 9 - Prob. 4PCh. 9 - Prob. 5PCh. 9 - Prob. 6PCh. 9 - Prob. 7PCh. 9 - A city water and waste-water department has a...Ch. 9 - Prob. 9PCh. 9 - Prob. 10P

Ch. 9 - Prob. 11PCh. 9 - Prob. 12PCh. 9 - Use the PW method to select the better of the...Ch. 9 - Prob. 14PCh. 9 - Prob. 15PCh. 9 - Prob. 16PCh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Prob. 21PCh. 9 - Prob. 22PCh. 9 - Prob. 23PCh. 9 - Prob. 24PCh. 9 - Prob. 25PCh. 9 - Prob. 26PCh. 9 - Prob. 27SECh. 9 - Prob. 28SECh. 9 - Prob. 29CSCh. 9 - Prob. 30CSCh. 9 - Prob. 31CSCh. 9 - Prob. 32FECh. 9 - Prob. 33FECh. 9 - Prob. 34FECh. 9 - Prob. 35FECh. 9 - Prob. 36FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In a replacement analysis problem, the following information is available Initial cost : 12.000 YTL Annual maintenance cost: None in the first three years 2.000 YTL at the end of the 4th year 2.000 YTL at the end of the 5th year 2,500 YTL per year after the 5th year will increase smoothly (at the end of the 6th year, 4.500 YTL 7.000 YTL at the end of the 7th year, etc. The scrap value in any given year is zero. Take the discount rate of 10% and ignore income taxes. Calculate the most economical life for this candidate equipment. A) 6 B) 2 C) 5 D) 8 E) 4arrow_forwardAnew forklift truck will require an investment of $30,000 and is expected to have end-of-year market values and annual expenses as shown in the Table below. If MARR is 10% per year, find the Economic Service Life of the truck. End of year 1 2 3 4 5 Market Value at end of year $22,500 $16,875 $12,750 $9,750 $7,125 Annual Expenses during year $3,000 $4,500 $7,000 $10,000 $13,000arrow_forwardA manufacturer has been ordered to stop discharging acidic waste into the city sewer. Your analysis shows that the company should choose one of the following systems: System Installed Cost H J $25,000 Your Answer: $35,000 Annual O&M Cost $1,000 in the first year, but grows by 10% each year $500 in the first year, but grows each year by $100 Salvage Value $2,000 $5,000 If the life span of each project is 20 years and interest is assumed to be Y%, which system should be purchased? 4arrow_forward

- Two 150 horsepower motors are being considered for the company's expansion, as presented in the table below (1 hp = 0.746 kw, Php10 per Kw-hour): Purchase price Useful life Market value Annual operational cost Annual maintenance cost Efficiency MARR Motor A Php 200,000 10 years None 15,000 10,000 80% 10% per year Motor B Php 250,000 10 years 2,500 30,000 5,000 90% How many hours of operations can the company chose either motor A or motor B (the breakeven hours for both motors)? If the motor is to operate for less than and greater than the break-even hours for both motors, which motor should be chosen? Input answers in the succeeding questions.arrow_forwardThe plant manager at a company would like to perform an analysis for a new $250,000 machine. She estimates benefits of $20,000 in the first year, and benefits are increasing by 10% per year. 1) What is the payback period for the machine? 2)Suppose that the machine life is 15 years and machine has a salvage value of 20% of the initial cost at the end of its useful life. If the MARR of the company is 11 % per year, is this investment acceptable? Why?arrow_forward5. The physical life is always greater than all the other "life" factors under replacement analysis. 6. If breakeven analysis is conducted with PW analysis for different MEAS, it doesn't guarantee that the fastest alternative to reach its breakeven point has also the highest equivalent worth.arrow_forward

- An agricultural land requires a 20PK motor to pump water from a water sources. The number of operating hours (motor hours) each year depends on height rainfall, so the hours of operation are variable. The motor is used in the long term 4 years time. There are 2 alternatives proposed for the procurement of these motors:Alternative A:The cost of buying an automatic electric motorbike is Rp. 1,400 million with a final value of Rp. 200 million With a lifespan of 4 years. Operational costs of Rp. 840k per hour, and maintenance fee of Rp. 120 million per year. Alternative B :The cost of purchasing a gasoline motorbike is Rp. 550 million with a final value of zero. With age used for 4 years.Operational costs consist of:• Gasoline costs Rp. 420k per hour• Maintenance fee of Rp. 150k per hour• Operator fee Rp. 800k per hourQuestion :Determine in how many hours each year the two motors must operate, in order to cost the two alternatives are equal. Use MARR 10% per year. When used during 1,000…arrow_forwardThe AW values for retaining a presently owned machine for additional years are shown in the table. Note that the values represent the AW amount for each of the n years that the asset is kept, i.e., if it is kept 5 more years, the annual worth is $−95,000 for each of the 5 years. Assume that future costs remain as estimated for the replacement study and that used machines like the one presently owned will always be available. (a) What is the ESL and associated AW of the defender at a MARR of 12% per year? (b) A challenger with an ESL of 7 years and an AWC = $-90,000 per year has been identified. Which AW will be less for the respective ESL periods? Retention Period, Years AW Value, $ per Year 1 -89,000 2 -95,000 3 -86,000 4 -85,000 5 -95,000 a) The ESL of the defender is ____year(s) with the lowest AW of $_____. b) The (Click to select defender challenger) has the lower AW at $______for n equal to ____ .arrow_forwardAn engineer calculated the AW values shown for retaining a presently owned machine additional years. A challenger has an ESL of 4 years with AW = $-60,000 per year. Assuming all future costs remain the same, when should the company replace the defender? The MARR is 12% per year. Assume used machines like the one presently owned will always be available. AW of Defender, 24 -77,000 -63,000 Years Retained 1 12 -58,000 -64,000 -70,000 13 4 a) at year 5 b) at vear 2 always be available. AW of Defender, 2$ |-77,000 -63,000 -58,000 -64,000 -70,000 Years Retained 3 4 15 O a) at year 5 b) at year 2 c) at year 1 d) at year 4 e) at year 3arrow_forward

- NEV, Inc. wants to evaluate two new methods that will improve their productivity. Both alternatives have 22 years of service life and NEV uses MARR of 13%. Alternative A has a first cost of $3,315,000 Maintenance cost will start end of year three due to an incentive in the contract with the manufacture that will give free maintenance in the first 2 years. The maintenance cost at end of year three is $42,000 and will increase by $2,700 starting end of year four and continue to increase with the same value thereafter till the end of its service life. A three-times major repair will occur. The first one is at end of year 8 that will cost $56,000, the second one is at end of year 13 and will cost $32,000 and the third and last major repair is $27,500 at end of year 19. The expected revenues from this alternative are $572,000 per year starting end of year 1 and this option will have a salvage value of $840,000 at the end of its service life. Alternative B has a first cost of $2,570,000 and…arrow_forwardAE Criterion - Single Project* *Blank & Tarquin (2005). Engineering Economy, 7th edition. Example 6.3. The owner of a pizza shop plans to purchase and install five portable in-car systems to increase delivery speed and accuracy. Each system costs $4600, has a 5-year useful life, and may be salvaged for an estimated $300. Total operating cost for all systems is $1000 for the first year, increasing by $100 per year thereafter. The owner estimates increased net income of $6000 per year for all five systems. Is this project financially viable at an MARR of 10%?arrow_forwardMr. Garcia sold his machine for P20,000 after using it for 6 years. He bought a new machine worth 75,000 with an expected life of 12 years and a salvage value of 2,000. The operating cost is P5,500 per year. The old machine which he bought for P50,000 when new will be useful for 10 years and a junk value of 1,000 but because of appropriate maintenance, it will be useful for another 5 years, no salvage value, with an annual operating cost of twice the new one. If money is worth 12%, was the engineer justified in selling the old machine? Use the ROR method. Show complete solution. Thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Difference between Renewable and Nonrenewable Resources; Author: MooMooMath and Science;https://www.youtube.com/watch?v=PLBK1ux5b7U;License: Standard Youtube License