PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 21PS

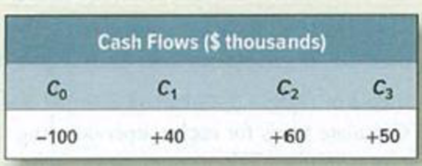

Certainty equivalents A project has the following

The estimated project beta is 1.5. The market return rm is 16%, and the risk-free rate rf is 7%.

- a. Estimate the

opportunity cost of capital and the project’s PV (using the same rate to discount each cash flow). - b. What are the certainty-equivalent cash, flows in each year?

- c. What is the ratio of the certainty-equivalent cash flow to the expected cash flow in each year?

- d. Explain why this ratio declines.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A project has the following forecasted cash flows: Cash Flows ($ thousands) C0 C1 C2 C3 −180 +120 +140 +130 The estimated beta is 1.56. The market return is 16%, and the risk-free rate is 4%. a. Estimate the cost of capital for the project and the project’s PV. b. What are the certainty equivalent cash flows in each year? c. What is the ratio of the certainty-equivalent cash flow to the expected cash flow in each year?

The data related to a project with an investment amount of 10.000.000 TL is as follows, and the risk-free discount rate is 10%.

YEAR1

YEAR2

Possibility

Cash Flows

Possibility

Cash Flows

%20

3.000.000

%25

5.000.000

%60

7.000.000

%50

8.000.000

%20

8.000.000

%25

9.000.000

Calculate the expected Net Present Value of the project and the Standard Deviation of its Net Present Value based on these data.

A project with an initial cost of GH¢ 500,000 has the following forecasted cash inflows:

Year

Cashflows (GH¢)

1

150,000

2

200,000

3

250,000

4

300,000

5

320,000

The estimated project beta is 1.2. The market return is 19%, and the risk-free rate is 10%.

Required:

1. Compute the opportunity cost of capital and the project’s Present Value (

2. Indicate the annual Certainty Equivalent cash flow to the expected cashflow in each case?

3. What is the ratio of Certainty Equivalent cashflow to the expected cashflow in each case?

4. What is the meaning of this ratio? and Why does this ratio declines?

Chapter 9 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Company cost of capital Suppose a firm uses its...Ch. 9 - Prob. 2PSCh. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 6PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Asset betas Which of these projects is likely to...

Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - Measuring risk The following table shows estimates...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Measuring risk Look again at Table 9.1. This time...Ch. 9 - Prob. 16PSCh. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 18PSCh. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 22PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Scenario Analysis Shao Industries is considering a proposed project for its capital budget. The company estimates the projects NPV is 12 million. This estimate assumes that the economy and market conditions will be average over the next few years. The companys CFO, however, forecasts there is only a 50% chance that the economy will be average. Recognizing this uncertainty, she has also performed the following scenario analysis: What are the projects expected NPV, standard deviation, and coefficient of variation?arrow_forwardA project has a forecasted cash flow of $121 in year 1 and $132 in year 2. The interest rate is 8%, the estimated risk premium on the market is 10.25%, and the project has a beta of 0.61. If you use a constant risk-adjusted discount rate, answer the following: What is the PV of the project? What is the certainty-equivalent cash flow in year 1 and year 2? What is the ratio of the certainty-equivalent cash flows to the expected cash?arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 7 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: -$6,800 $ 1,010 $2,210 $1,410 $1,410 $1,210 $ 1,010 Use the IRR decision rule to evaluate this project. IRR %?arrow_forward

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$7,100 $1,000 $2,200 $1,400 $1,400 $1,200 $1,000 Use the IRR decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.) Should it be accepted or rejected?multiple choice accepted rejectedarrow_forwardA project has an expected risky cash flow of RM 200, in year 1. The risk-free rate is 6%, the market rate of return is 16%, and the project’s beta is 1.5. Calculate the certainty equivalent cash flow for year 1.arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 7 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$5,000 $1,270 $2,470 $1,670 $1,670 $1,470 $1,270 Use the PI decision rule to evaluate this project. (Do not round intermediate calculations and round your final answer to 2 decimal places.) PI: _____.__arrow_forward

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 9 percent, and that the maximum allowable payback and discounted payback statistics for the project are 2.0 and 3.0 years, respectively. Time: 0 1 2 3 4 5 6 Cash flow: −$7,100 $1,100 $2,300 $1,500 $1,500 $1,300 $1,100 Use the NPV decision rule to evaluate this project. (Negative amount should be indicated by a minus sign. Do not round intermediatearrow_forwardA project has a forecasted cash flow of $121 in year 1 and $132 in year 2. The interest rate is 8%, the estimated risk premium on the market is 10.25%, and the project has a beta of 0.61. If you use a constant risk-adjusted discount rate, answer the following:a. What is the PV of the project? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What is the certainty-equivalent cash flow in year 1 and year 2? (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. What is the ratio of the certainty-equivalent cash flows to the expected cash flows in years 1 and 2? (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown as follows, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected? Time 0 1 2 3 4 5 6 Cash Flow –$ 5,000 $ 1,200 $ 1,400 $ 1,600 $ 1,600 $ 1,100 $ 2,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License