PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 13PS

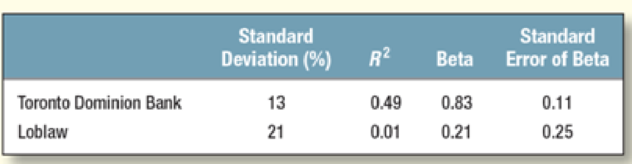

Measuring risk The following table shows estimates of the risk of two well-known Canadian stocks:

- a. What proportion of each stock’s risk was market risk, and what proportion was specific risk?

- b. What is the variance of Toronto Dominion? What is the specific variance?

- c. What is the confidence interval on Loblaw’s beta? (See page 227 for a definition of “confidence interval.”)

- d. If the

CAPM is correct, what is the expected return on Toronto Dominion? Assume a risk-free interest rate of 5% and an expected market return of 12%. - e. Suppose that next year the market provides a zero return. Knowing this, what return would you expect from Toronto Dominion?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following table shows estimates of the risk of two well-known Canadian stocks:

Standard

Standard

Deviation (%)

R2

Beta

Error of Beta

Sun Life Financial

25.7

0.19

0.95

0.16

Loblaw

30.5

0.01

0.21

0.27

What proportion of each stock’s risk was market risk, and what proportion was specific risk?

What is the variance of the returns for Sun Life Financial stock? What is the specific variance?

What is the confidence interval on Loblaw's beta?

If the CAPM is correct, what is the expected return on Sun Life? Assume a risk-free interest rate of 4% and an expected market return of 13%.

Suppose that next year, the market provides a 18% return. Knowing this, what return would you expect from Sun Life?

The following table shows estimates of the risk of two well-known Canadian stocks:

Standard Deviation (%)

R2raise to the power of 2

Beta

Standard Error of Beta

Sun Life Financial

25.7

0.19

0.93

0.12

Suncor Energy

26.5

0.02

0.70

0.27

What proportion of each stock’s risk was market risk, and what proportion was specific risk?

What is the variance of the returns for Sun Life Financial stock? What is the specific variance?

What is the confidence interval on Suncor’s beta?

If the CAPM is correct, what is the expected return on Sun Life? Assume a risk-free interest rate of 4% and an expected market return of 14%.

Suppose that next year, the market provides a 14% return. Knowing this, what return would you expect from Sun Life?

When working with the CAPM, which of the following factors can be determined with the most precision?

a. The most appropriate risk-free rate, rRF.

b. The market risk premium (RPM).

c. The beta coefficient, bi, of a relatively safe stock.

d. The expected rate of return on the market, rM.

e. The beta coefficient of "the market," which is the same as the beta of an average stock.

Chapter 9 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Company cost of capital Suppose a firm uses its...Ch. 9 - Prob. 2PSCh. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 6PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Asset betas Which of these projects is likely to...

Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - Measuring risk The following table shows estimates...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Measuring risk Look again at Table 9.1. This time...Ch. 9 - Prob. 16PSCh. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 18PSCh. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 22PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the correlation coefficient between Blandy and the market. Use this and the previously calculated (or given) standard deviations of Blandy and the market to estimate Blandy’s beta. Does Blandy contribute more or less risk to a well-diversified portfolio than does the average stock? Use the SML to estimate Blandy’s required return.arrow_forwardWhat is a characteristic line? How is this line used to estimate a stocks beta coefficient? Write out and explain the formula that relates total risk, market risk, and diversifiable risk.arrow_forwardThe standard deviation of stock returns for Stock A is 40%. The standard deviation of the market return is 20%. If the correlation between Stock A and the market is 0.70, then what is Stock A’s beta?arrow_forward

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?arrow_forwardMarket equity beta measures the covariability of a firms returns with all shares traded on the market (in excess of the risk-free interest rate). We refer to the degree of covariability as systematic risk. The market prices securities so that the expected returns should compensate the investor for the systematic risk of a particular stock. Stocks carrying a market equity beta of 1.20 should generate a higher return than stocks carrying a market equity beta of 0.90. Nonsystematic risk is any source of risk that does not affect the covariability of a firms returns with the market. Some writers refer to nonsystematic risk as firm-specific risk. Why is the characterization of nonsystematic risk as firm-specific risk a misnomer?arrow_forwardSuppose the index model for stocks A and B is estimated with the following results: rA = 2% + 0.8RM + eA, rB = 2% + 1.2RM + eB, σM = 20%, and RM = rM − rf . The regression R2 of stocks A and B is 0.40 and 0.30, respectively. Answer the following questions. Total: (a) What is the variance of each stock? (b) What is the firm-specific risk of each stock? (c) What is the covariance between the two stocks?arrow_forward

- (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return0.20 10% 0.15 -4% 0.60 16% 0.35 7%0.20 21% 0.35 13% 0.15 20% a) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, what is the expected rate of return for stock A? What is the standard deviation? b. Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, what is the expected rate of return for stock B? What is the standard deviation? c. Based on the risk (as measured by the standard deviation) and return of each stock, which…arrow_forwardSuppose the index model for stocks A and B is estimated with the following results:rA = 2% + 0.8RM + eA, rB = 2% + 1.2RM + eB , σM = 20%, and RM = rM − rf . The regressionR2 of stocks A and B is 0.40 and 0.30, respectively.(a) What is the variance of each stock? (b) What is the firm-specific risk of each stock? (c) What is the covariance between the two stocks?arrow_forwardWhen working with the CAPM, which of the following factors can be determined with the most precision? a. The beta coefficient of "the market," which is the same as the beta of an average stock. b. The beta coefficient, bi, of a relatively safe stock. c. The market risk premium (RPM). d. The most appropriate risk-free rate, rRF. e. The expected rate of return on the market, rM.arrow_forward

- From the following information, calculate covariance between stocks A and B and expected return and risk of a portfolio in which A and B are equally weighted.Which stock would be best recommend if investment in individual stock is to be made? Justify the answer using numerical calculations. Stock A Stock B Expected return 24% 35% Standard deviation 12% 18% Coefficient of correlation 0.65arrow_forwardThe market and Stock A have the following probability distributions: Probability Return on market Return on Stock A 0.2 18% 16% 0.3 12% 14% 0.5 10% 11% Calculate the expected rates of return for the market and Stock A. Calculate the coefficient of variation for the market and Stock A (Standard deviation for market is 3.0265% and standard deviation for Stock A is 2.0224%).arrow_forwardAhmed observed the following data of two stocks as shown in the below table. Which stock do you advise Ahmed to select according to the required rate of return? And explain why? Stock A Stock B Market Standard Deviation Return 30% 30% 22% Correlation Coefficient between A & M -30% Correlation Coefficient between B & M 30% Expected Market Return 11% Risk-Free rate of return 5%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY