PRIN.OF CORPORATE FINANCE >BI<

12th Edition

ISBN: 9781260431230

Author: BREALEY

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 12PS

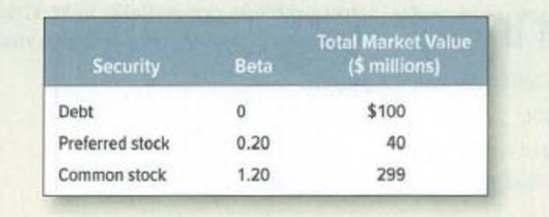

Company cost of capital Nero Violins has the following capital structure:

- a. What is the firm’s asset beta? (Hint: What is the beta of a portfolio of all the firm’s securities?)

- b. Assume that the

CAPM is correct. What discount rate should Nero set for investments that expand the scale of its operations without changing its asset beta? Assume a risk-free interest rate of 5% and a market risk premium of 6%. Ignore taxes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

If a firm cannot invest retained earnings to earn a rate of returngreater than or equal to the required rate of return on retained earnings, it should return those funds to its stockholders.

The cost of equity using the CAPM approach

The current risk-free rate of return (rRFrRF) is 4.67% while the market risk premium is 5.75%. The Burris Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Burris’s cost of equity is .

The cost of equity using the bond yield plus risk premium approach

The Taylor Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Taylor’s bonds yield 11.52%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Taylor’s cost of internal equity is:

18.84%

15.07%

14.32%

18.08%

The…

The cost of retained earnings

True or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders.

True

False

The cost of equity using the CAPM approach

The current risk-free rate of return (rRF

) is 4.23% while the market risk premium is 6.17%. The D’Amico Company has a beta of 1.56. Using the capital asset pricing model (CAPM) approach, D’Amico’s cost of equity is .

The cost of equity using the bond yield plus risk premium approach

The Kennedy Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Kennedy’s bonds yield 10.28%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 5.89. Based on the bond-yield-plus-risk-premium approach, Kennedy’s cost of internal equity is:…

The cost of raising capital through retained earnings is the cost of raising capital through issuing new common stock.

The cost of equity using the CAPM approach

The current risk-free rate of return (rRFrRF) is 4.67% while the market risk premium is 5.75%. The Jefferson Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Jefferson’s cost of equity is .

The cost of equity using the bond yield plus risk premium approach

The Jackson Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Jackson’s bonds yield 11.52%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Jackson’s cost of internal equity is:

18.84%

18.08%

15.07%

14.32%

Chapter 9 Solutions

PRIN.OF CORPORATE FINANCE >BI<

Ch. 9 - (VAR.P and STDEV.P) Choose two well-known stocks...Ch. 9 - (AVERAGE, VAR.P and STDEV.P) Now calculate the...Ch. 9 - (SLOPE) Download the Standard Poors index for the...Ch. 9 - Company cost of capital Suppose a firm uses its...Ch. 9 - Prob. 2PSCh. 9 - Definitions Define the following terms: a. Cost of...Ch. 9 - Asset betas EZCUBE Corp. is 50% financed with...Ch. 9 - Prob. 6PSCh. 9 - Fudge factors John Barleycorn estimates his firms...Ch. 9 - Asset betas Which of these projects is likely to...

Ch. 9 - True/false True or false? a. The company cost of...Ch. 9 - Certainty equivalents A project has a forecasted...Ch. 9 - Company cost of capital The total market value of...Ch. 9 - Company cost of capital Nero Violins has the...Ch. 9 - Measuring risk The following table shows estimates...Ch. 9 - Company cost of capital You are given the...Ch. 9 - Measuring risk Look again at Table 9.1. This time...Ch. 9 - Prob. 16PSCh. 9 - WACC Binomial Tree Farms financing includes 5...Ch. 9 - Prob. 18PSCh. 9 - Prob. 19PSCh. 9 - Prob. 20PSCh. 9 - Certainty equivalents A project has the following...Ch. 9 - Prob. 22PSCh. 9 - Beta of costs Suppose that you are valuing a...Ch. 9 - Fudge factors An oil company executive is...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.arrow_forwardCOST OF CAPITAL Coleman Technologies is considering a major expansion program that has been proposed by the companys information technology group. Before proceeding with the expansion, the company must estimate its cost of capital. Suppose you are an assistant to Jerry Lehman, the financial vice president. Your first task is to estimate Colemans cost of capital Lehman has provided you with the following data, which he believes may be relevant to your task. The firms tax rate is 25%. The current price of Colemans 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity, is 1.153.72. Coleman does not use short-term, interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firms 10%, 100.00 par value, quarterly dividend, perpetual preferred stock is 111.10. Colemans common stock is currently selling for 50.00 per share. Its last dividend (D0) was 4.19, and dividends are expected to grow at a constant annual rate of 5% in the foreseeable future. Colemans beta is 1.2, the yield on T-bonds is 7%, and the market risk premium is estimated to be 6%. For the bond-yield-plus-risk-premium approach, the firm uses a risk premium of 4%. Colemans target capital structure is 30% debt, 10% preferred stock, and 60% common equity. To structure the task somewhat, Lehman has asked you to answer the following questions: a. 1. What sources of capital should be included when you estimate Colemans WACC? 2. Should the component costs be figured on a before-tax or an a after-tax basis? 3. Should the costs be historical (embedded) costs or new (marginal) costs? b. What is the market interest rate on Colemans debt and its component cost of debt? c. 1. What is the firms cost of preferred stock? 2. Colemans preferred stock is riskier to investors than its debt, yet the preferreds yield to investors is lower than the yield to maturity on the debt Does this suggest that you have made a mistake? (Hint: Think about taxes) d. 1. Why is there a cost associated with retained earnings? 2. What is Colemans estimated cost of common equity using the CAPM approach? e. What is the estimated cost of common equity using the DCF approach? f. What is the bond-yield-plus-risk-premium estimate for Colemans cost of common equity? g. What is your final estimate for rs? h. Explain in words why new common stock has a higher cost than retained earnings. i. 1. What are two approaches that can be used to adjust for flotation costs? 2. Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost? j. What is Colemans overall, or weighted average, cost of capital (WACC)? Ignore flotation costs. k. What factors influence Colemans composite WACC? l. Should the company use the composite WACC as the hurdle rate for each of its projects? Explain.arrow_forwardPremium for Financial Risk Ethier Enterprise has an unlevered beta of 1.0. Ethier is Financed with 50% debt and has a levered beta of 1.6. If the risk-free rate is 5.5% and the market risk premium is 6%, how much is the additional premium that Ethier’s shareholders require to be compensated for financial risk?arrow_forward

- d) Calculate the firm’s weighted average cost of capital (WACC) e) XYZAB Limited has a Research and Development division operating independently to produce cutting-edge products. This division has its own target capital structure of 30% debt and 70% equity as well as a beta of 1.5 and cost of debt of 14%. Given a market risk premium of 8%, a risk-free rate of 6%, what WACC should the division use to discount its cashflows?arrow_forwardTrue or False: It is free for a company to raise money through retained earnings, because retained earnings represent money that is left over after dividends are paid out to shareholders. False True The cost of equity using the CAPM approach The current risk-free rate of return (rRFrRF) is 4.23% while the market risk premium is 6.63%. The Allen Company has a beta of 0.78. Using the capital asset pricing model (CAPM) approach, Allen’s cost of equity is (9.40%, 8.46, 11.28, 9.87) . The cost of equity using the bond yield plus risk premium approach The Hoover Company is closely held and, therefore, cannot generate reliable inputs with which to use the CAPM method for estimating a company’s cost of internal equity. Hoover’s bonds yield 10.28%, and the firm’s analysts estimate that the firm’s risk premium on its stock over its bonds is 3.55%. Based on the bond-yield-plus-risk-premium approach, Hoover’s cost of internal equity is: 13.83%…arrow_forwardYou have the following information on a company on which to base your calculations and discussion: Cost of equity capital (rE) = 18.55% Cost of debt (rD) = 7.85% Expected market premium (rM –rF) = 8.35% Risk-free rate (rF) = 5.95% Inflation = 0% Corporate tax rate (TC) = 35% Current long-term and target debt-equity ratio (D:E) = 2:5 a. What are the equity beta (bE) and debt beta (bD) of the firm described above?[Hint: Assume that the above costs of capital have been generated by an appropriate equilibrium model.] b. What is the weighted-average cost of capital (WACC) for this firm at the current debt-equity ratio? c. What would the company’s cost of equity capital become if you unlevered the capital structure (i.e. reduced gearing until there is no debt)arrow_forward

- A firm's stock has a beta of 1.75, Treasury bills yield 3.8%, and the market portfolio offers an expected return of 9.5%. In addition to equity, the firm finances 26% of its assets with debt that has a yield to maturity of 7.4%. The firm is in the 28% marginal tax bracket. (b) Calculate the cost of equity. (c) In your own words, briefly explain the capital asset pricing model (CAPM) you used for answering part (b).arrow_forwardWhat is the principal message of the Capital Asset Pricing Model (CAPM)? What are its assumptions? What is Beta? Is high beta good or bad for a company? Which type of company will have a higher Beta: a fast food chain or a luxury cruise-ship company? Why? Brimbank company shares has an expected return of 15%. The share’s Beta is 1.2, the risk-free rate is 3% and the market risk premium is 6%. Based on this information do you think the share is overvalued or undervalued? Why? A [particular share sells for $30. The shares’ Beta is 1.25, the risk-free rate is 4%, and the expected return on the market portfolio is 10%. If you predict that the share’s market price next year will be $33 (and no dividend), should you buy the share or not? Why?arrow_forwardIf a firm cannot invest retained earnings to earn a rate of return______________ (Pick either A- greater than or equal to or B- Less than) the required rate of return on retained earnings, it should return those funds to its stockholders. The current risk-free rate of return is 4.60% and the current market risk premium is 6.10%. Green Caterpillar Garden Supplies Inc. has a beta of 1.56. Using the Capital Asset Pricing Model (CAPM) approach, Green Caterpillar’s cost of equity is_____________% Cute Camel Woodcraft Company is closely held and, as a result, cannot generate reliable inputs for the CAPM approach. Cute Camel’s bonds yield 10.20%, and the firm’s analysts estimate that the firm’s risk premium on its stock relative to its bonds is 3.50%. Using the bond-yield-plus-risk-premium approach, the firm’s cost of equity is___________% The stock of Cold Goose Metal Works Inc. is currently selling for $25.67, and the firm expects its dividend to be $2.35…arrow_forward

- Nero Violins has the following capital structure: Security Beta Total Market Value ($ millions) Debt 0 $ 102 Preferred stock 0.22 42 Common stock 1.22 301 What is the firm's asset beta? (Hint: What is the beta of a portfolio of all the firm's securities?) Note: Do not round intermediate calculations. Round your answer to 3 decimal places. Assume that the CAPM is correct. What discount rate should Nero set for investments that expand the scale of its operations without changing its asset beta? Assume a risk-free interest rate of 7% and a market risk premium of 8%. Ignore taxes. Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardDiamond Drillers is planning to use retained earnings to finance anticipated capital expenditures. The beta coefficient for this stock is 1.20. The risk-free rate of return interest is 9% and the market risk is estimated at 13%. If a new issue of common stock were used in this model, the flotation costs would be 7%. By using the capital asset pricing model, what is the cost of using retained earnings to finance the capital expenditure?arrow_forwardExpress Steel Corporation wishes to calculate its cost of common stock equity, by using the capital asset pricing model (CAPM). The firm’s investment advisors and its own analysts indicate that the risk-free rate equals 9,1%; the firm’s beta equals 0,75; and the market return equals 16%. Please estimate the cost of common stock equity by using CAPM.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY