Concept explainers

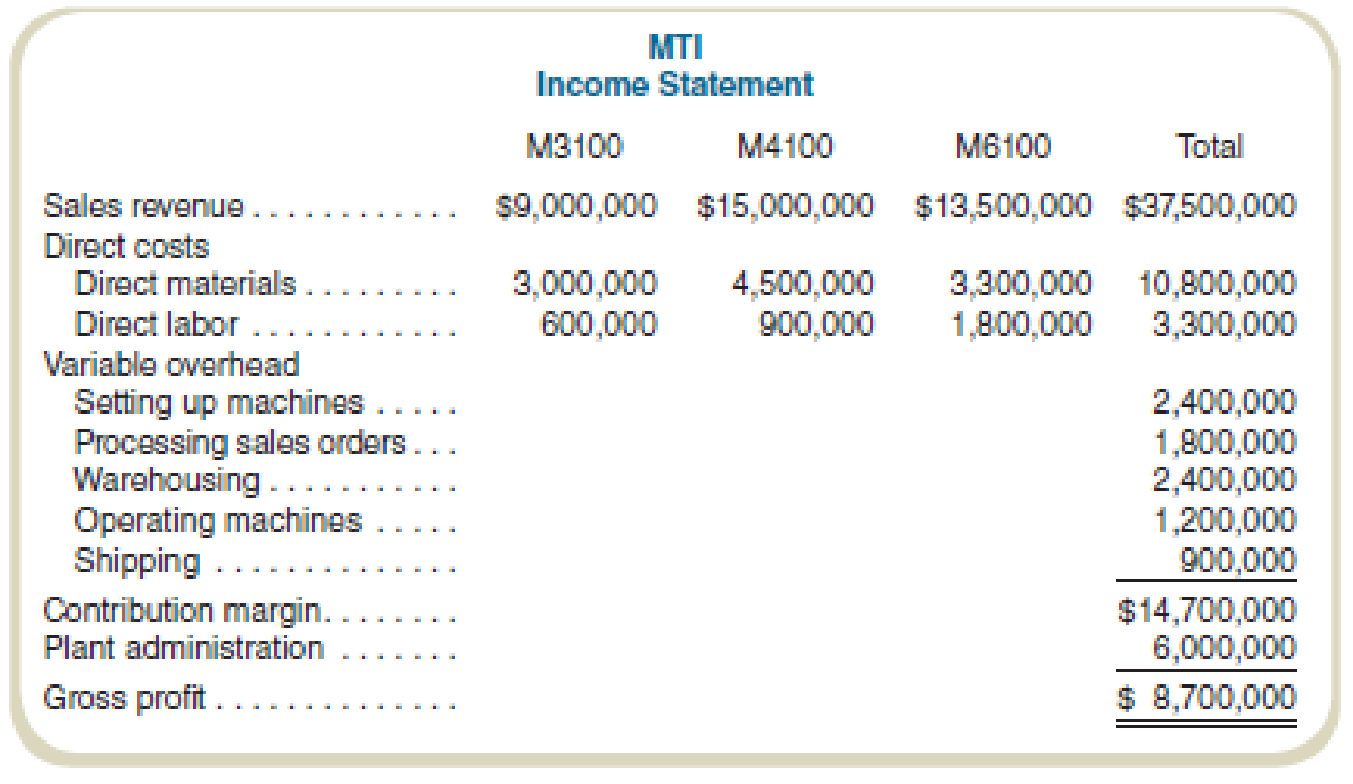

MTI makes three types of lawn tractors: M3100, M4100, and M6100. In the past, it allocated overhead to products using machine-hours. Last year, the company produced 10,000 units of M3100, 17,500 units of M4100, and 10,000 units of M6100 and had the following revenues and costs:

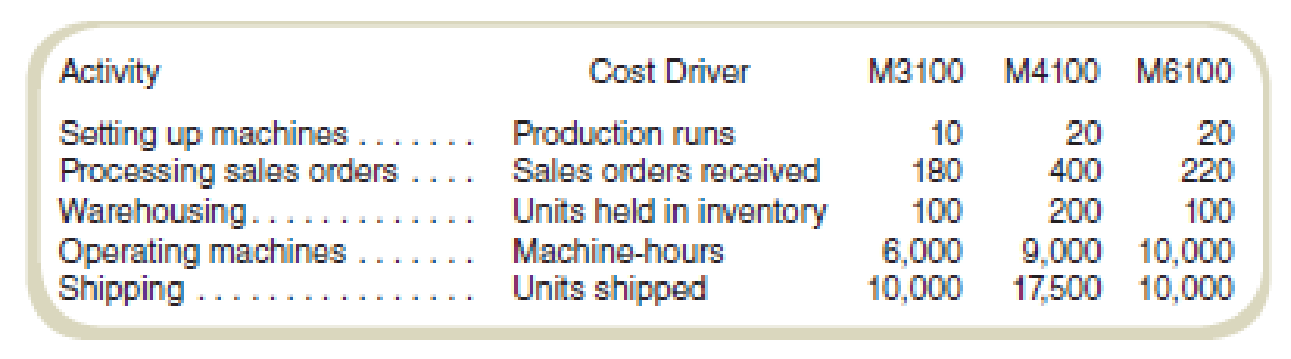

MTI’s controller has heard about activity-based costing and puts together an employee team to recommend cost allocation bases. The employee team recommends the following:

The employee team recommends that plant administration costs not be allocated to products.

Required

- a. Using machine-hours to allocate overhead, complete the income statement for MTI. Do not allocate plant administrative costs to products.

- b. Complete the income statement using the activity-based costing method suggested by the employee team.

- c. Write a brief report indicating how activity-based costing might result in better decisions by MTI.

- d. After hearing the recommendations, the president expresses concern about failing to allocate plant administrative costs. If plant administrative costs were to be allocated to products, how would you allocate them?

a.

Complete the income statement in accordance with the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Complete the income statement:

| Particulars | M3100 | M4100 | M6100 | Total |

| Sales revenue | $9,000,000 | $15,000,000 | $13,500,000 | $37,500,000 |

| Add: Direct costs: | ||||

| Direct material | $3,000,000 | $4,500,000 | $3,300,000 | $10,800,000 |

| Direct labor | $600,000 | $900,000 | $1,800,000 | $3,300,000 |

|

Variable overhead | $2,088,000 | $3,132,000 | $3,480,000 | $8,700,000 |

| Contribution margin | $3,312,000 | $6,468,000 | $4,920,000 | $14,700,000 |

| Less: Plant admin | $6,000,000 | |||

| Gross profit | $8,700,000 |

Table: (1)

Working note 1:

Compute the machine hour rate:

b.

Complete the income statement in accordance with the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Compute the cost driver rates:

| Particulars | Cost | Activity volume | Unit rate | |

| Setting up machines | $2,400,000 | 50 Production runs | $48,000 | |

| Processing sales orders | $1,800,000 | 800 Sales orders | $2,250 | |

| Warehousing | $2,400,000 | 400 Units | $6,000 | |

| Operating machines | $1,200,000 | 25,000 Machine-hours | $48 | |

| Shipping | $900,000 | 37,500 Units shipped | $24 |

Table: (2)

Complete the income statement using the activity-based costing system:

| Particulars | M3100 | M4100 | M6100 | Total |

| Sales revenue | $9,000,000 | $15,000,000 | $13,500,000 | $37,500,000 |

| Direct costs: | ||||

| Direct material | $3,000,000 | $4,500,000 | $3,300,000 | $10,800,000 |

| Direct labor | $600,000 | $900,000 | $1,800,000 | $3,300,000 |

| Variable overhead: | ||||

|

Setting up machines | $480,000 | $960,000 | $960,000 | $2,400,000 |

|

Processing orders | $405,000 | $900,000 | $495,000 | $1,800,000 |

|

Warehousing | $600,000 | $1,200,000 | $600,000 | $2,400,000 |

|

Operating machines | $288,000 | $432,000 | $480,000 | $1,200,000 |

|

Shipping | $240,000 | $420,000 | $240,000 | $900,000 |

| Contribution margin | $3,387,000 | $5,688,000 | $5,625,000 | $14,700,000 |

| Less: Plant admin | $6,000,000 | |||

| Gross profit | $8,700,000 |

Table: (3)

c.

Write a brief report according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

The relevance of the activity-based costing system according to the information given in the question:

The computed income statement by the machine-hour method and activity-based costing method are equal. Thus, the choice of method will not have any impact on the choice of the method used for the determination of profit and cost.

But, choosing the activity-based method of computation provides a better assessment of the costing structure. The allocation of cost on the basis of cost drivers helps management taking informed decision.

d.

Determine the cost allocation according to the information given in the question.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

The relevance of plant administration cost with respect to the information given in the question:

The allocation of the cost should be in a manner that can establish a relationship between benefits and the plant administration cost. The more information related to the plant administration cost would help establish the correlation better for the identification of the parts of the plant administration cost.

Want to see more full solutions like this?

Chapter 9 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardFirenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forward

- Mott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Motts two products are weed eaters and lawn edgers. The unit prime costs under the old system are as follows: Under the old manufacturing system, the company operated three service centers and two production departments. Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Under the old system, the overhead costs of the service departments were allocated directly to the producing departments and then to the products passing through them. (Both products passed through each producing department.) The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system, the Machining Department used 80,000 machine hours, and the Assembly Department used 20,000 direct labor hours. Each weed eater required 1.0 machine hour in Machining and 0.25 direct labor hour in Assembly. Each lawn edger required 2.0 machine hours in Machining and 0.5 hour in Assembly. Bases for allocation of the service costs are as follows: Upon implementing JIT, a manufacturing cell for each product was created to replace the departmental structure. Each cell occupied 40,000 square feet. Maintenance and materials handling were both decentralized to the cell level. Essentially, cell workers were trained to operate the machines in each cell, assemble the components, maintain the machines, and move the partially completed units from one point to the next within the cell. During the first year of the JIT system, the company produced and sold 20,000 weed eaters and 30,000 lawn edgers. This output was identical to that for the last year of operations under the old system. The following costs have been assigned to the manufacturing cells: Required: 1. Compute the unit cost for each product under the old manufacturing system. 2. Compute the unit cost for each product under the JIT system. 3. Which of the unit costs is more accurate? Explain. Include in your explanation a discussion of how the computational approaches differ. 4. Calculate the decrease in overhead costs under JIT, and provide some possible reasons that explain the decrease.arrow_forwardStacks manufactures two different levels of hockey sticks: the Standard and the Slap Shot. The total overhead of $600,000 has traditionally been allocated by direct labor hours, with 400,000 hours for the Standard and 200.000 hours for the Slap Shot. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $450.000 of overhead, with 30,000 hours used on the Standard product and 15,000 hours used on the Slap Shot product. It was also estimated that the inspection cost pool would have $150,000 of overhead, with 25,000 hours for the Standard and 5,000 hours for the Slap Shot. What is the overhead rate per product, under traditional and under ABC costing?arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forward

- Young Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardBig Mikes, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controllers department, believes that overhead activities and costs should be classified into groups that have the same driver. He has decided that unloading incoming goods, counting goods, and inspecting goods can be grouped together as a more general receiving activity, since these three activities are all driven by the number of receiving orders. The 10 months of data shown below have been gathered for the receiving activity. Required: 1. Prepare a scattergraph, plotting the receiving costs against the number of purchase orders. Use the vertical axis for costs and the horizontal axis for orders. 2. Select two points that make the best fit, and compute a cost formula for receiving costs. 3. Using the high-low method, prepare a cost formula for the receiving activity. 4. Using the method of least squares, prepare a cost formula for the receiving activity. What is the coefficient of determination?arrow_forward

- Salley is developing material and labor standards for her company. She finds that it costs $0.55 per pound of material per widget. Each widget requires 6 pounds of material per widget. Salley is also working with the operations manager to determine what the standard labor cost is for a widget. Upon observation, Salley notes that it takes 3 hours in the assembly department and 1 hour in the finishing department to complete one widget. All employees are paid $10.50 per hour. A. What is the standard materials cost per unit for a widget? 8. What is the standard labor cost per unit for a widget?arrow_forwardLansing. Inc., provided the following data for its two producing departments: Machine hours are used to assign the overhead of the Molding Department, and direct labor hours are used to assign the overhead of the Polishing Department. There are 30,000 units of Form A produced and sold and 50,000 of Form B. Required: 1. Calculate the overhead rates for each department. 2. Using departmental rates, assign overhead to live two products and calculate the overhead cost per unit. How does this compare with the plantwide rate unit cost, using direct labor hours? 3. What if the machine hours in Molding were 1,200 for Form A and 3,800 for Form B and the direct labor hours used in Polishing were 5,000 and 15,000, respectively? Calculate the overhead cost per unit for each product using departmental rates, and compare with the plantwide rate unit costs calculated in Requirement 2. What can you conclude from this outcome?arrow_forwardThe chief executive officer of Acadia, Inc. attended a conference in which one of the sessions was devoted to variable costing. The CEO was impressed by the presentation and has asked that the following data of Acadia, Inc. be used to prepare comparative statements using variable costing and the companys absorption costing. The data follow: The factory produced 80,000 units during the period, and 70,000 units were sold for 700,000. 1. Prepare an income statement using variable costing. 2. Prepare an income statement using absorption costing. (Round unit costs to three decimal places.)arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College