Concept explainers

Selection of a Denominator:

Morton Company's budgeted variable manufacturing overhead is S4.50 per direct labor-hour and its budgeted fixed manufacturing overhead is S270.000 per year.

The company manufactures a single product whose standard direct labor-hours per unit is 2 hours. The standard direct labor wage rate is $15 per hour. The standards also allow 4 feet of raw material per unit at a standard cost of $8.75 per foot.

Although normal activity is 30.000 direct labor-hours each year, the company expects to operate at a 40.000-hour level of activity this year.

Required:

1. Assume that the company chooses 30.000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements.

2. Assume that the company chooses 40.000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements.

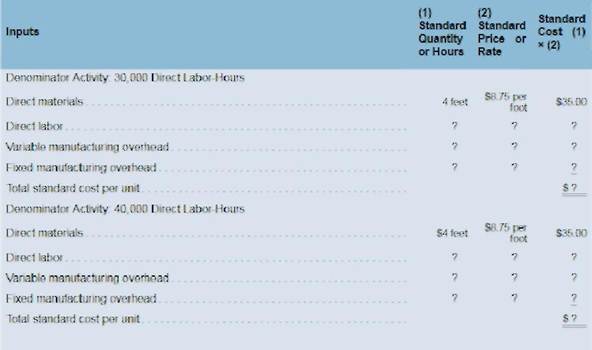

3. Complete two standard cost cards as outlined below.

4. Assume that the company actually produces 18.000 units and works 38.000 direct labor-hours during the year. Actual

Do the following:

a. Compute the standard direct labor-hours allowed for this year's production.

b. Complete the Manufacturing Overhead T-account below. Assume that the company uses 30.000 direct labor-hours (normal activity) as the denominator activity in computing predetermined overhead rates, as you have done in (1) above.

c. Determine the cause of the underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

5. Looking at the variances you have computed, what appears to be the major disadvantage of using normal activity ratherthan expected actual activity as a denominator in computing the predetermined overhead rate? What advantages can you see to offset this disadvantage?

1

Predetermined overhead rate

It is a rate that is used by a company to allocate its manufacturing overhead cost to all the products. A predetermined overhead rate consists of a fixed portion and a variable portion.

To calculate: Predetermined overhead rate for 30,000 direct labor hours, fixed and variable portion of predetermined overhead rate.

Answer to Problem 12P

Predetermined overhead rate is calculated as $13.5 per hour. Variable portion in the rate is $4.5 per hour and fixed portion is $9 per hour.

Explanation of Solution

A predetermined overhead rate can be calculated by the sum of variable manufacturing overhead rate and fixed manufacturing overhead rate. So, it can be written as:

Here, variable overhead rate is given as $4.5for each hour and fixed manufacturing overhead rate will be calculated as:

So, the predetermined overhead rate will be:

Therefore, predetermined overhead rate is $13.5 per hour. Fixed portion of the predetermined overhead rate is $9 and variable portion is $4.5.

2

Predetermined overhead rate

It is a rate that is used by a company to allocate its total manufacturing overhead cost to all the products. A predetermined overhead rate consists of a fixed portion and a variable portion.

To calculate: Predetermined overhead rate for 40,000 direct labor hours, fixed and variable portion of predetermined overhead rate.

Answer to Problem 12P

Predetermined overhead rate is calculated as $11.25 per hour. Variable portion in the rate is $4.5 per hour and fixed portion is $6.75 per hour.

Explanation of Solution

A predetermined overhead rate is the sum of variable manufacturing overhead rate and fixed manufacturing overhead rate. So, it can be written as:

Here, variable overhead rate is given as $4.5 for each hour and fixed manufacturing overhead rate will be calculated as:

So, the predetermined overhead rate will be:

Therefore, predetermined overhead rate is $11.25 per hour. Fixed portion of the predetermined overhead rate is $6.75 and variable portion is $4.5.

3

Standard cost card

A standard cost card helps in the calculationof the total standard cost of one unit by showing necessary information about standard rate, price, quantity and hours.

To prepare: Standard cost cards for 30,000 and 40,000 direct labor hours.

Answer to Problem 12P

Total standard cost of one unit for 30,000 hours is $92 and for 40,000 hours is $87.5.

Explanation of Solution

For 30,000 labor hours, standard cost card will be prepared as follows:

| Particulars | Standard quantity or hours | Standard price or rate | Standard cost |

| Direct material | 3 feet | $8.75 per foot | $35 |

| Direct labor | 2 hours | $15 per hour | $30 |

| Variable manufacturing overhead | 2 hours | $4.5 per hour | $9 |

| Fixed manufacturing overhead | 2 hours | $9 per hour | $18 |

| Total standard cost | $92 |

Therefore, total standard cost of one unit while using 30,000 hours is $54.

For 40,000 labor hours, standard cost card will be prepared as follows:

| Particulars | Standard quantity or hours | Standard price or rate | Standard cost |

| Direct material | 3 feet | $8.75 per foot | $35 |

| Direct labor | 2 hours | $15 per hour | $30 |

| Variable manufacturing overhead | 2 hours | $4.5 per hour | $9 |

| Fixed manufacturing overhead | 2 hours | $6.75 per hour | $13.5 |

| Total standard cost | $87.5 |

Therefore, total standard cost of one unit while using 40,000 hours is $87.5.

4

Standard hours

Standard hours represent number of hours that should be used by labors in the production process. These hours are compared with actual hours used and variance is computed.

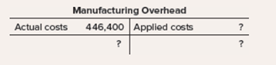

Manufacturing overheads account

This account shows actual amount of variable manufacturing overhead, actual fixed manufacturing overheads, applied variable and fixed manufacturing overheads and helps in the calculation of over or under applied overheads.

To calculate: Number of standard labor hours allowed, over applied overheads in manufacturing overheads account, variances related to variable overheads and fixed overheads.

Answer to Problem 12P

Allowed Standard direct labor hours are 36,000 and overapplied overheads in manufacturing overheads account are $39,600.

Variable overhead rate variance is $3,800 (U), variable overhead efficiency variance is 9,000 (U), fixed overhead budget variance is $1,600 (U) and fixed overhead volume variance is $54,000 (U).

Explanation of Solution

Part 4a

Allowed standard labor hours are calculated by the following formula:

Here, actual number of units produced are 18,000 and standard hours allowed for one unit are 2. So, total standard hours will be calculated as:

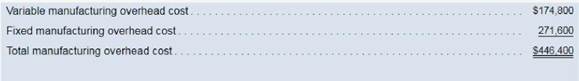

Part 4b

Manufacturing overhead account will be prepared as follows:

Manufacturing overhead account

| Particulars | Amount ($) | Particulars | Amount ($) |

| Actual Variable manufacturing overheads incurred | 174,800 | Variable overhead applied ($4.5*18,000*2) | 162,000 |

| Fixed manufacturing overheads incurred | 271,600 | Fixed overhead applied ($9*18,000*2) | 324,000 |

| Overheadsoverapplied (balance) | 39,600 | ||

| 486,000 | 486,000 |

Overapplied overheads are $39,600.

Part 4c

Formula to calculate variable overhead rate variance is,

Here, standard rate is $4.5 (given), actual hours are 38,000 and actual rate is $4.6 (174,800/38,000). So, the variance will be:

Formula to calculate variable overhead efficiency variance is,

Here, standard rate is $4.5, actual hours are 38,000 and standard hours are 36,000 (2 hours * 18,000 units). So, the variance will be,

Formula to calculate fixed overhead budget variance is,

Here, budgeted overheads are $270,000 and actual fixed overheads are $271,600. So, the variance will be:

Formula to calculate fixed overhead volume variance is,

Here, budgeted fixed overheads are $270,000 and fixed overheads applied to WIP are $324,000 (18,000 units *2 hours* $9). So, the variance will be:

Variable overhead rate variance is $3,800 unfavorable, variable overhead efficiency variance is $9,000 unfavorable, fixed overhead budget variance is $1,600 unfavorable and fixed overhead efficiency variance is $54,000 unfavorable.

5

Predetermined overhead rate

It is a rate that a company calculates using the estimated cost and estimated hours. It helps in the process of allocation of cost.

To explain: Disadvantages of using normal activity as denominator activity in the calculation of predetermined overhead rate rather than estimated activities and one advantage that can cover those advantages.

Explanation of Solution

Predetermined overhead rate is computed using the estimated or expected data and not the actual data. This rate is known as predetermined rate because it uses budgeted activities rather than the normal or actual activities.

In this question, company has used 30,000 hours and 40,000 hours as the denominator activities rather than the estimated data and all the variances related to variable overheads and fixed overheads (computed in sub parts 4) are unfavorable.

So, disadvantages of using normal activities rather than estimated activities may include, 1. Accurate standard rate, price or rates for the calculation of several variances cannot be calculated, 2. Using normal activities in mist cases make all the variances related to manufacturing overhead negative or unfavorable, 3 As wrong standard rates or hours are used in the calculation of variances, correct amount of variances may not be calculated.

Only estimated data should be used for the calculation of predetermined overhead rate. An advantage that can cover the above disadvantages is that it saves the company from the calculation of standard rate or standard hours.

Want to see more full solutions like this?

Chapter 9 Solutions

INTRO. TO MANAG. ACCT.W/CONNECT>LLF<>IC

- Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardMoleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.arrow_forward

- Jillian Manufacturing Inc. manufactures a single product and uses a standard cost system. The factory overhead is applied on the basis of direct labor hours. A condensed version of the company’s flexible budget follows: The product requires 3 lb of materials at a standard cost of $5 per pound and 2 hours of direct labor at a standard cost of $10 per hour. For the current year, the company planned to operate at the level of 6,250 direct labor hours and to produce 3,125 units of product. Actual production and costs for the year follow: Required: For the current year, compute the factory overhead rate that will be used for production. Show the variable and fixed components that make up the total predetermined rate to be used. Prepare a standard cost card for the product. Show the individual elements of the overhead rate as well as the total rate. Compute (a) standard hours allowed for production and (b) under- or overapplied factory overhead for the year. Determine the reason for any under- or overapplied factory overhead for the year by computing all variances, using each of the following methods: Two-variance method Three-variance method (appendix) Four-variance method (appendix)arrow_forwardShinto Corp. uses a standard cost system and manufactures one product. The variable costs per product follow: Budgeted fixed overhead costs for the month are $4,000, and Shinto expected to manufacture 2,000 units. Actual production, however, was only 1,800 units. Materials prices were 10% over standard, and labor rates were 5% over standard. Of the factory overhead expense, only 80% was used, and fixed overhead was $100 over budget. The actual variable overhead cost was $4,800. In materials usage, 8% more parts were used than were allowed for actual production by the standard, and 6% more labor hours were used than were allowed. Required: Calculate the materials and labor variances. Calculate the variances for overhead by the four-variance method. (Hint: First compute the fixed and variable overhead rates per hour.)arrow_forwardGeorgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forward

- Calculating amount of factory overhead applied to work in process The overhead application rate for a company is 2.50 per unit, made up of 1.00 for fixed overhead and 1.50 for variable overhead. Normal capacity is 10,000 units. In one month, there was an unfavorable flexible budget variance of 200. Actual overhead for the month was 27,000. What was the amount of the budgeted overhead for the actual level of production?arrow_forwardA company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forwardA company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forward

- Variable Cost Ratio, Contribution Margin Ratio Chillmax Company plans to sell 3,500 pairs of shoes at 60 each in the coming year. Unit variable cost is 21 (includes direct materials, direct labor, variable factory overhead, and variable selling expense). Fixed factory overhead is 30,000 and fixed selling and administrative expense is 48,000. Required: 1. Calculate the variable cost ratio. 2. Calculate the contribution margin ratio. 3. Prepare a contribution margin income statement based on the budgeted figures for next year. In a column next to the income statement, show the percentages based on sales for sales, total variable cost, and total contribution margin.arrow_forwardAt the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardRefer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,