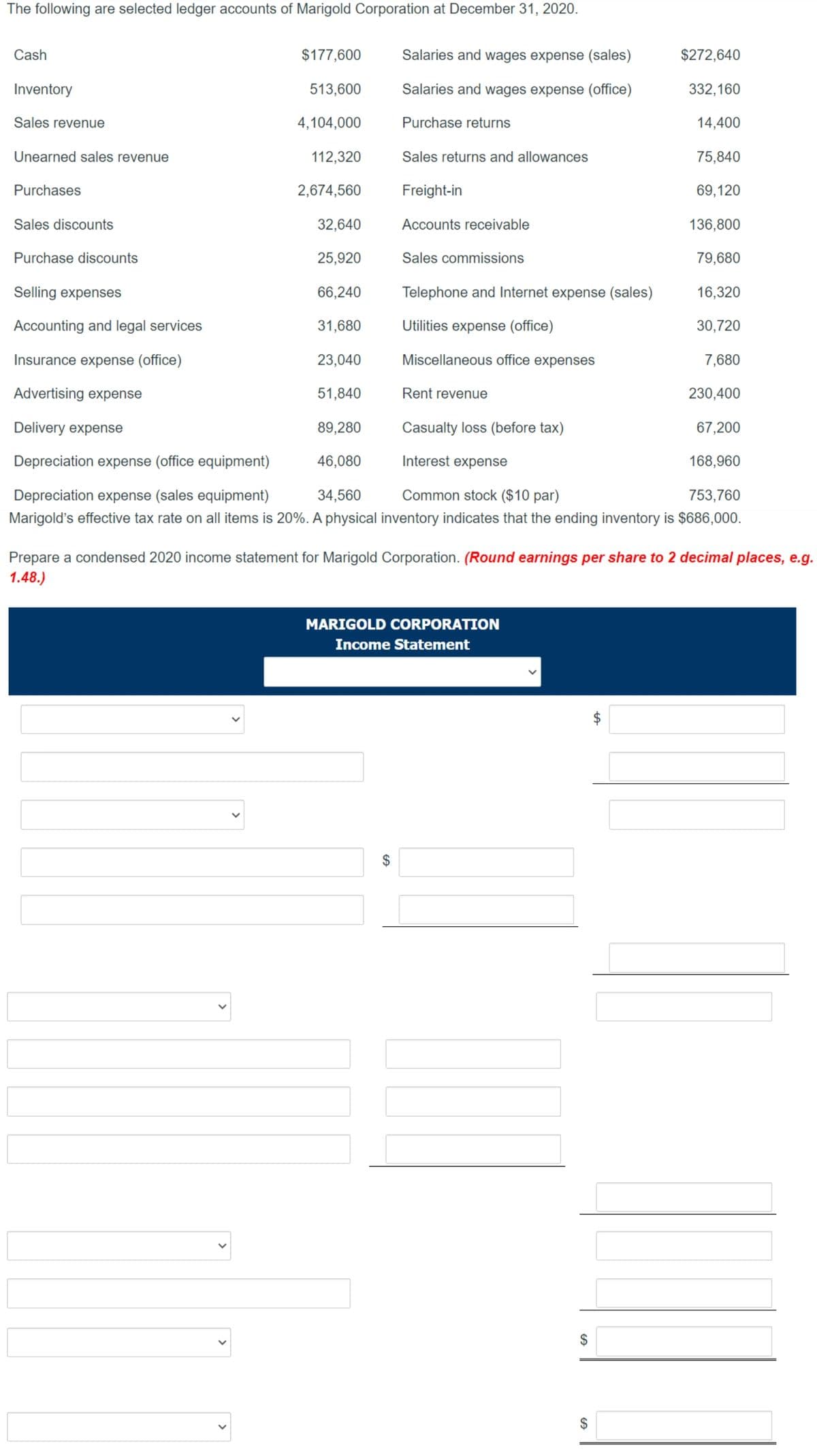

Prepare a condensed 2020 income statement for Marigold Corporation. (Round earnings per share to 2 decimal places, e.g. 1.48.)

Prepare a condensed 2020 income statement for Marigold Corporation. (Round earnings per share to 2 decimal places, e.g. 1.48.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

Transcribed Image Text:The following are selected ledger accounts of Marigold Corporation at December 31, 2020.

Cash

$177,600

Salaries and wages expense (sales)

$272,640

Inventory

513,600

Salaries and wages expense (office)

332,160

Sales revenue

4,104,000

Purchase returns

14,400

Unearned sales revenue

112,320

Sales returns and allowances

75,840

Purchases

2,674,560

Freight-in

69,120

Sales discounts

32,640

Accounts receivable

136,800

Purchase discounts

25,920

Sales commissions

79,680

Selling expenses

66,240

Telephone and Internet expense (sales)

16,320

Accounting and legal services

31,680

Utilities expense (office)

30,720

Insurance expense (office)

23,040

Miscellaneous office expenses

7,680

Advertising expense

51,840

Rent revenue

230,400

Delivery expense

89,280

Casualty loss (before tax)

67,200

Depreciation expense (office equipment)

46,080

Interest expense

168,960

Depreciation expense (sales equipment)

34,560

Common stock ($10 par)

753,760

Marigold's effective tax rate on all items is 20%. A physical inventory indicates that the ending inventory is $686,000.

Prepare a condensed 2020 income statement for Marigold Corporation. (Round earnings per share to 2 decimal places, e.g.

1.48.)

MARIGOLD CORPORATION

Income Statement

2$

$

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College