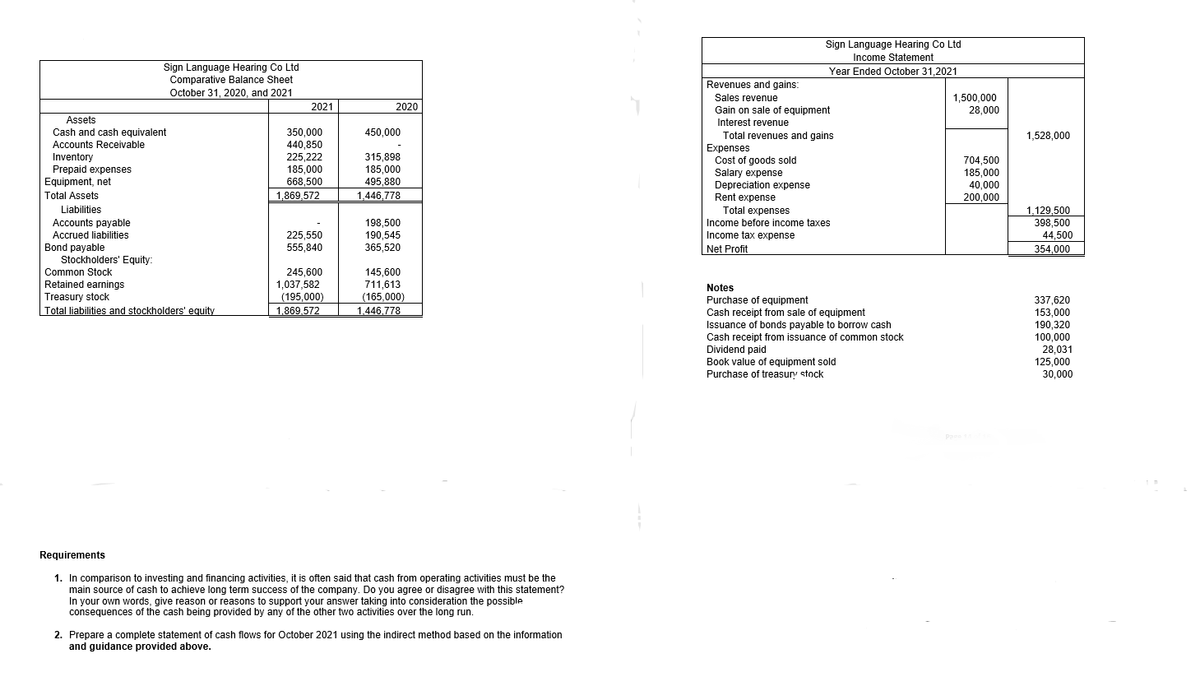

Sign Language Hearing Co Ltd Income Statement Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 Year Ended October 31,2021 Revenues and gains: 1,500,000 28,000 Sales revenue 2021 2020 Gain on sale of equipment Interest revenue Assets Cash and cash equivalent Accounts Receivable 350,000 440,850 225,222 185,000 668,500 1,869,572 450,000 1,528,000 Total revenues and gains Expenses Cost of goods sold Salary expense Depreciation expense Rent expense Total expenses Income before income taxes Inventory Prepaid expenses Equipment, net 315,898 185,000 495,880 704,500 185,000 40,000 200,000 Total Assets 1,446,778 Liabilities Accounts payable 198,500 190,545 365,520 1,129,500 398,500 44,500 354,000 Accrued liabilities 225,550 555,840 Income tax expense Bond payable Stockholders' Equity: Net Profit Common Stock Retained earnings Treasury stock Total liabilities and stockholders' equity 245,600 1,037,582 145,600 711,613 (165,000) 1.446.778 Notes (195,000) 1.869.572 Purchase of equipment Cash receipt from sale of equipment Issuance of bonds payable to borrow cash Cash receipt from issuance of common stock Dividend paid Book value of equipment sold Purchase of treasury stock 337,620 153,000 190,320 100,000 28,031 125,000 30,000 Requirements 1. In comparison to investing and financing activities, it is often said that cash from operating activities must be the main source of cash to achieve long term success of the company. Do you agree or disagree with this statement? In your own words, give reason or reasons to support your answer taking into consideration the possible consequences of the cash being provided by any of the other two activities over the long run. 2. Prepare a complete statement of cash flows for October 2021 using the indirect method based on the information and guidance provided above.

Sign Language Hearing Co Ltd Income Statement Sign Language Hearing Co Ltd Comparative Balance Sheet October 31, 2020, and 2021 Year Ended October 31,2021 Revenues and gains: 1,500,000 28,000 Sales revenue 2021 2020 Gain on sale of equipment Interest revenue Assets Cash and cash equivalent Accounts Receivable 350,000 440,850 225,222 185,000 668,500 1,869,572 450,000 1,528,000 Total revenues and gains Expenses Cost of goods sold Salary expense Depreciation expense Rent expense Total expenses Income before income taxes Inventory Prepaid expenses Equipment, net 315,898 185,000 495,880 704,500 185,000 40,000 200,000 Total Assets 1,446,778 Liabilities Accounts payable 198,500 190,545 365,520 1,129,500 398,500 44,500 354,000 Accrued liabilities 225,550 555,840 Income tax expense Bond payable Stockholders' Equity: Net Profit Common Stock Retained earnings Treasury stock Total liabilities and stockholders' equity 245,600 1,037,582 145,600 711,613 (165,000) 1.446.778 Notes (195,000) 1.869.572 Purchase of equipment Cash receipt from sale of equipment Issuance of bonds payable to borrow cash Cash receipt from issuance of common stock Dividend paid Book value of equipment sold Purchase of treasury stock 337,620 153,000 190,320 100,000 28,031 125,000 30,000 Requirements 1. In comparison to investing and financing activities, it is often said that cash from operating activities must be the main source of cash to achieve long term success of the company. Do you agree or disagree with this statement? In your own words, give reason or reasons to support your answer taking into consideration the possible consequences of the cash being provided by any of the other two activities over the long run. 2. Prepare a complete statement of cash flows for October 2021 using the indirect method based on the information and guidance provided above.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 2AP

Related questions

Question

Kindly also include a section to the Comparative

Transcribed Image Text:Sign Language Hearing Co Ltd

Income Statement

Sign Language Hearing Co Ltd

Comparative Balance Sheet

October 31, 2020, and 2021

Year Ended October 31,2021

Revenues and gains:

Sales revenue

1,500,000

28,000

2021

2020

Gain on sale of equipment

Interest revenue

Total revenues and gains

Expenses

Cost of goods sold

Salary expense

Depreciation expense

Rent expense

Total expenses

Assets

Cash and cash equivalent

Accounts Receivable

450,000

350,000

440,850

225,222

185,000

1,528,000

315,898

185,000

495,880

Inventory

704,500

185,000

40,000

200,000

Prepaid expenses

Equipment, net

668,500

1,869,572

Total Assets

1,446,778

Liabilities

Accounts payable

Accrued liabilities

Bond payable

Stockholders' Equity:

198,500

190,545

365,520

1,129,500

398,500

44,500

354,000

Income before income taxes

Income tax expense

225,550

555,840

Net Profit

Common Stock

245.600

Retained earnings

Treasury stock

1,037,582

(195,000)

| 1,869,572

145,600

711,613

(165,000)

Notes

Purchase of equipment

Cash receipt from sale of equipment

Issuance of bonds payable to borrow cash

Cash receipt from issuance of common stock

Dividend paid

Book value of equipment sold

337,620

153,000

Total liabilities and stockholders' equity

1,446,778

190.320

100,000

28,031

125,000

30,000

Purchase of treasury stock

Pa

Requirements

1. In comparison to investing and financing activities, it is often said that cash from operating activities must be the

main source of cash to achieve long term success of the company. Do you agree or disagree with this statement?

In your own words, give reason or reasons to support your answer taking into consideration the possible

consequences of the cash being provided by any of the other two activities over the long run.

2. Prepare a complete statement of cash flows for October 2021 using the indirect method based on the information

and guidance provided above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning