Solve the following ratios from year 2018-2020. Show complete solutions/computations. -OPERATING MARGIN -BASIC EARNINGS POWER -PRICE EARNINGS RATIO

Solve the following ratios from year 2018-2020. Show complete solutions/computations. -OPERATING MARGIN -BASIC EARNINGS POWER -PRICE EARNINGS RATIO

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

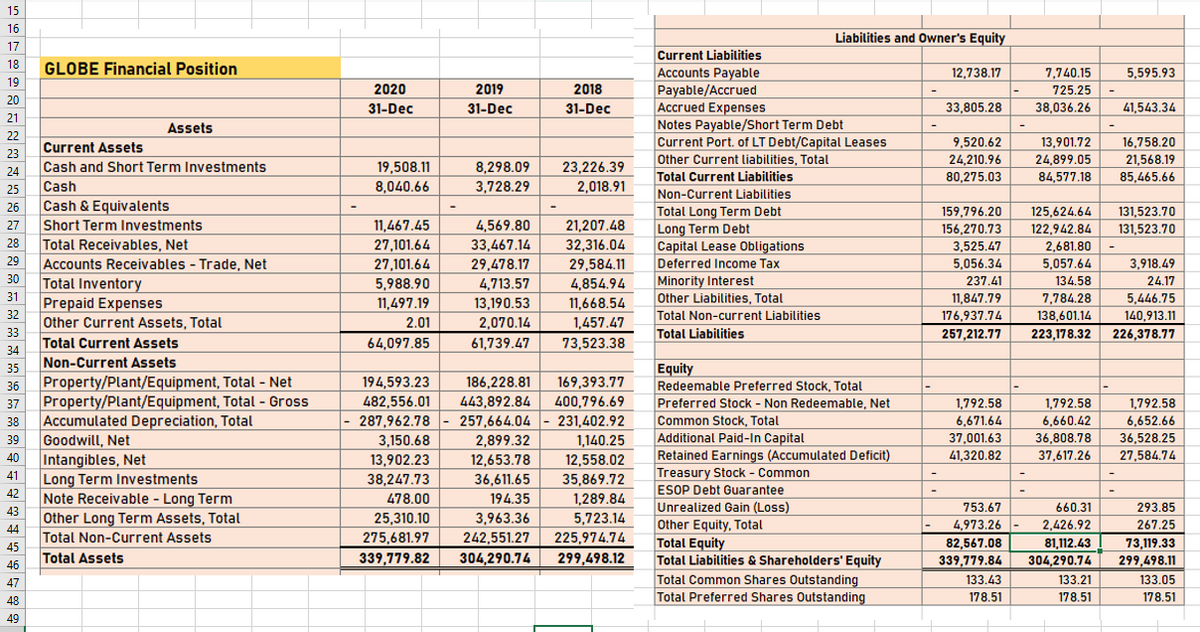

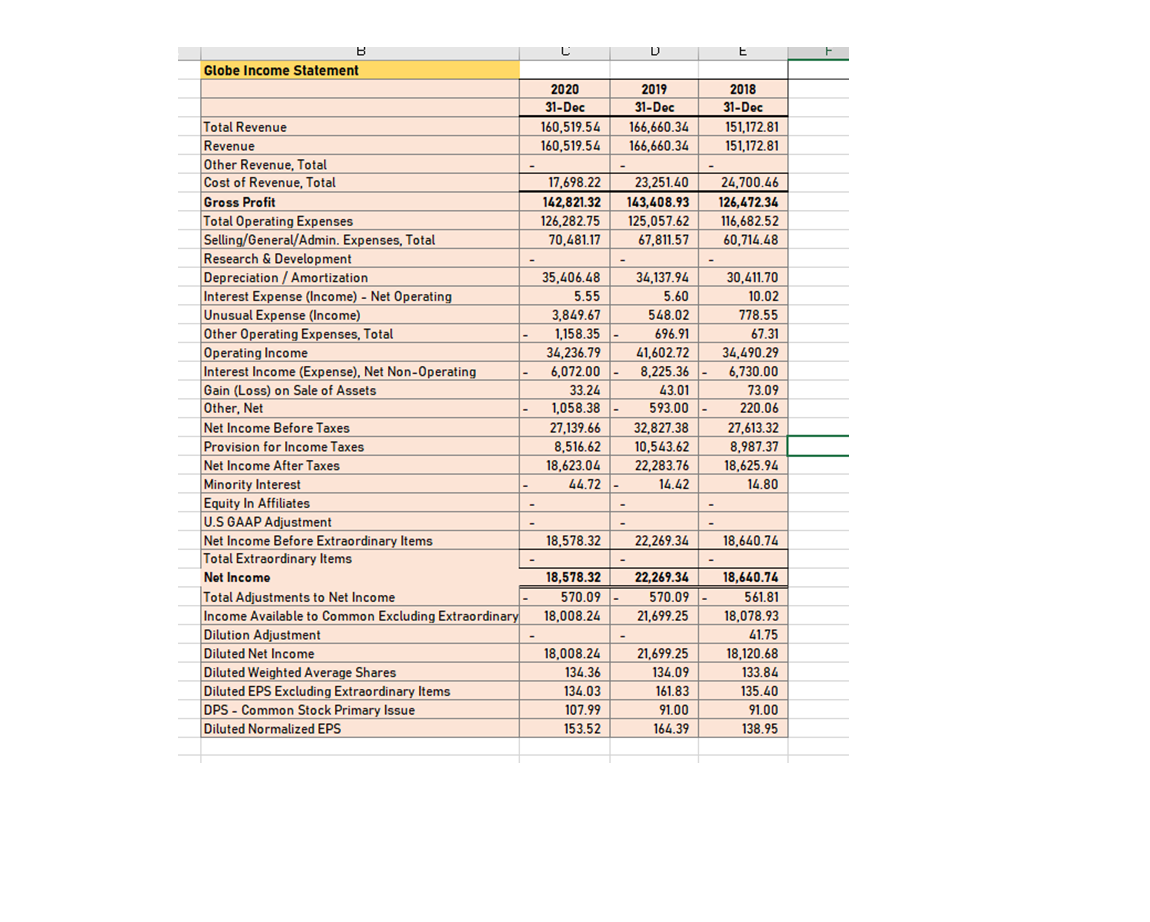

1. Solve the following ratios from year 2018-2020. Show complete solutions/computations.

-OPERATING MARGIN

-BASIC EARNINGS POWER

-PRICE EARNINGS RATIO

Transcribed Image Text:15

16

Liabilities and Owner's Equity

17

Current Liabilities

Accounts Payable

Payable/Accrued

Accrued Expenses

18

GLOBE Financial Position

12,738.17

7,740.15

5,595.93

19

2020

2019

2018

725.25

20

31-Dec

31-Dec

31-Dec

33,805.28

38,036.26

41,543.34

21

Notes Payable/Short Term Debt

Current Port. of LT Debt/Capital Leases

Assets

22

9,520.62

13,901.72

16,758.20

Current Assets

23

Other Current liabilities, Total

24,210.96

24,899.05

21,568.19

Cash and Short Term Investments

19,508.11

8,298.09

23,226.39

24

Total Current Liabilities

80,275.03

84,577,18

85,465.66

Cash

8,040.66

3,728.29

2,018.91

25

Non-Current Liabilities

26

Cash & Equivalents

Total Long Term Debt

159,796.20

125,624.64

131,523.70

Short Term Investments

11,467.45

27,101.64

27

4,569.80

21,207.48

Long Term Debt

Capital Lease Obligations

Deferred Income Tax

156,270.73

122,942.84

131,523.70

Total Receivables, Net

Accounts Receivables - Trade, Net

28

33,467,14

32,316.04

2,681.80

5,057.64

3,525.47

29

27,101.64

5.056.34

29,478.17

4,713.57

29,584.11

3,918.49

30

134.58

Total Inventory

31

Prepaid Expenses

32

Other Current Assets, Total

33

Total Current Assets

34

Minority Interest

Other Liabilities, Total

5,988.90

4,854.94

237.41

24.17

11,497.19

13,190.53

11,668.54

11,847.79

7,784.28

5,446,75

Total Non-current Liabilities

176,937.74

138,601,14

140,913.11

2.01

2,070.14

1,457.47

Total Liabilities

257,212.77

223,178.32

226,378.77

64,097.85

61,739.47

73,523.38

Non-Current Assets

Equity

Redeemable Preferred Stock, Total

35

Property/Plant/Equipment, Total - Net

194,593.23

186,228.81

443,892.84

169,393.77

36

Property/Plant/Equipment, Total - Gross

Accumulated Depreciation, Total

Goodwill, Net

Intangibles, Net

37

482,556.01

400,796.69

Preferred Stock - Non Redeemable, Net

1,792.58

1,792.58

1,792.58

6,660.42

36,808.78

287,962.78

257.664.04

231,402.92

6,652.66

Common Stock, Total

Additional Paid-In Capital

Retained Earnings (Accumulated Deficit)

Treasury Stock - Common

38

6,671.64

39

3,150.68

2,899.32

1,140.25

37,001.63

36,528.25

40

13,902.23

12,653.78

12,558.02

41,320.82

37,617.26

27,584.74

Long Term Investments

42

Note Receivable - Long Term

43

41

38,247.73

36,611.65

35,869.72

ESOP Debt Guarantee

194.35

3,963.36

478.00

1,289.84

Unrealized Gain (Loss)

Other Equity, Total

Total Equity

Total Liabilities & Shareholders' Equity

753.67

660.31

293.85

5,723.14

Other Long Term Assets, Total

44

Total Non-Current Assets

45

Total Assets

25,310.10

4,973.26 -

2,426.92

267.25

242,551.27

304,290.74

275,681.97

225,974.74

82,567.08

81,112.43

73,119.33

339,779.82

299,498.12

339,779.84

304,290.74

299,498.11

46

47

Total Common Shares Outstanding

133.43

133.21

133.05

48

Total Preferred Shares Outstanding

178.51

178.51

178.51

49

Transcribed Image Text:Globe Income Statement

2020

2019

2018

31-Doc

31-Doc

31-Dec

Total Revenue

Revenue

160,519.54

166,660.34

151,172.81

160,519.54

166,660.34

151,172.81

Other Revenue, Total

Cost of Revenue, Total

17,698.22

23,251.40

24,700,46

Gross Profit

142,821.32

143,408.93

126,472.34

Total Operating Expenses

Selling/General/Admin. Expenses, Total

Research & Development

Depreciation / Amortization

Interest Expense (Income) - Net Operating

Unusual Expense (Income)

Other Operating Expenses, Total

Operating Income

Interest Income (Expense), Net Non-Operating

126,282.75

125,057.62

116,682.52

70,481.17

67,811.57

60,714.48

35,406.48

34,137.94

30,411.70

5.55

5.60

10.02

3.849.67

548.02

778.55

1,158.35

696.91

67.31

41,602.72

34,490.29

34,236.79

6,072.00

8.225.36

6,730.00

Gain (Loss) on Sale of Assets

Other, Net

Net Income Before Taxes

43.01

593.00

33.24

73.09

1,058.38

220.06

27,139.66

8,516.62

18,623.04

32.827,38

27,613.32

Provision for Income Taxes

10,543.62

8,987.37

Net Income After Taxes

Minority Interest

Equity In Affiliates

U.S GAAP Adjustment

Net Income Before Extraordinary Items

Total Extraordinary Items

22.283.76

18,625.94

44.72

14.42

14.80

18,578.32

22,269.34

18,640.74

22,269.34

570.09

Net Income

18,578.32

18,640.74

570.09

Total Adjustments to Net Income

Income Available to Common Excluding Extraordinary

Dilution Adjustment

Diluted Net Income

561.81

18,008.24

21,699.25

18,078.93

41,75

18,008.24

21,699.25

18,120.68

Diluted Weighted Average Shares

Diluted EPS Excluding Extraordinary Items

DPS - Common Stock Primary Issue

134.36

134.09

133.84

134.03

161.83

135.40

107.99

91.00

91.00

Diluted Normalized EPS

153,52

164.39

138,95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education