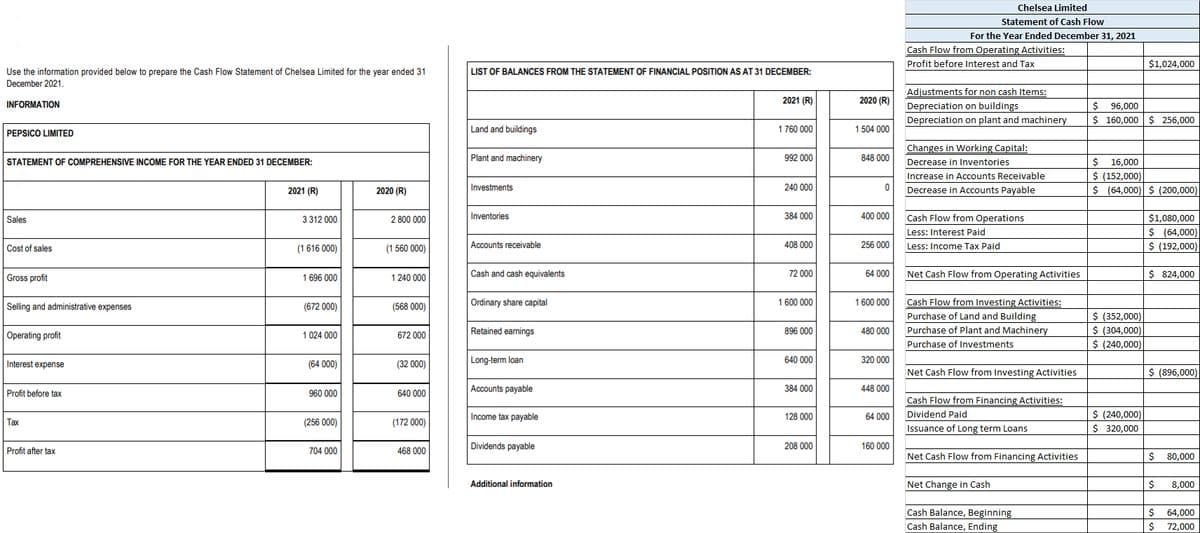

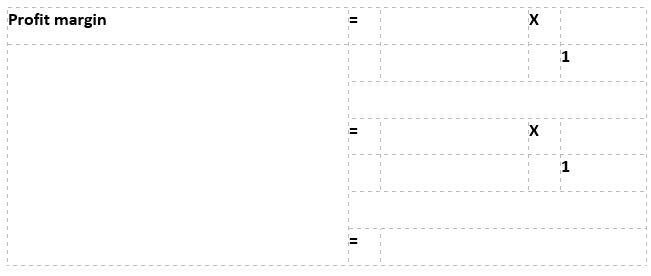

Use the information provided (first picture) to calculate the profit margin ratios for 2021 and put your answer in the template provided (second picture)

Use the information provided (first picture) to calculate the profit margin ratios for 2021 and put your answer in the template provided (second picture)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 55PSA

Related questions

Question

Practice Pack

Use the information provided (first picture) to calculate the profit margin ratios for 2021 and put your answer in the template provided (second picture)

Transcribed Image Text:Chelsea Limited

Statement of Cash Flow

For the Year Ended December 31, 2021

Cash Flow from Operating Activities:

Profit before Interest and Tax

$1,024,000

Use the information provided below to prepare the Cash Flow Statement of Chelsea Limited for the year ended 31

LIST OF BALANCES FROM THE STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER:

December 2021.

Adjustments for non cash Items:

2021 (R)

2020 (R)

INFORMATION

Depreciation on buildings

2$

96,000

Depreciation on plant and machinery

$ 160,000 $ 256,000

Land and buildings

1 760 000

1 504 000

PEPSICO LIMITED

Changes in Working Capital:

Plant and machinery

992 000

848 000

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER:

Decrease in Inventories

16,000

$ (152,000)

$ (64,000) $ (200,000)

Increase in Accounts Receivable

2021 (R)

2020 (R)

Investments

240 000

Decrease in Accounts Payable

Sales

3 312 000

2 800 000

Inventories

384 000

400 000

Cash Flow from Operations

$1,080,000

$ (64,000)

$ (192,000)

Less: Interest Paid

Cost

sales

(1616 000)

(1 560 000)

Accounts receivable

408 000

256 000

Less: Income Tax Paid

Gross profit

1 696 000

1 240 000

Cash and cash equivalents

72 000

64 000

Net Cash Flow from Operating Activities

$ 824,000

Cash Flow from Investing Activities:

Purchase of Land and Building

Selling and administrative expenses

(672 000)

(568 000)

Ordinary share capital

1 600 000

1 600 000

$ (352,000)

$ (304,000)

$ (240,000)

Operating profit

Retained earnings

896 000

480 000

Purchase of Plant and Machinery

1 024 000

672 000

Purchase of Investments

Interest expense

(64 000)

(32 000)

Long-term loan

640 000

320 000

Net Cash Flow from Investing Activities

$ (896,000)

Profit before tax

960 000

640 000

Accounts payable

384 000

448 000

Cash Flow from Financing Activities:

Income tax payable

128 000

64 000

Dividend Paid

$ (240,000)

Tax

(256 000)

(172 000)

Issuance of Long term Loans

$ 320,000

Profit after tax

704 000

468 000

Dividends payable

208 000

160 000

Net Cash Flow from Financing Activities

80,000

Additional information

Net Change in Cash

8,000

Cash Balance, Beginning

Cash Balance, Ending

64,000

2$

72,000

Transcribed Image Text:Profit margin

1

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning