VIRTUAL GAMING SYSTEMS [Income Statement for the year ending December 31, 2021 Net sales 2,991,000 Cost of goods sold 1,941,000 Gross profit 1,050,000 Expenses: Operating expenses 849,000 Depreciation expense 22,500 Loss on sale of land 7,100 Interest expense 10,500 Income tax expense 39,000 Total expenses 928,100 Net income 121,900 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2021 2020 Current assets: Cash 177,000 135,000 Accounts receivable 72,000 51,000 Inventory 96,000 126,000 Prepaid rent 11,100 4,920 Long-term assets: Investment in bonds 96,000 0 Land 201,000 231,000 Equipment 261,000 201,000 Less: Accum Deprec (55,500) (33,000) Total assets 858,600 715,920 Liabilities and Stockholders' Equity Current liabilities: Accounts payable 57,000 72,000 Interest payable 4,200 2,100 Income tax payable 10,500 13,100 Long-term liabilities: Notes payable 276,000 216,000 Stockholders' equity: Common stock 291,000 291,000 Retained earnings 219,900 121,720 Total liabilities &stockholders’ equity 858,600 715,920 Question 6: Assuming that all sales were on account, calculate the following risk ratios for 2021 using the data in the tables above. (Use 365 days a year & round answers to 1 decimal place) 6a: Receivables turnover ratio 6b: Average Collection Period 6c: Inventory Turnover Ratio 6d: Average Days in Inventory: 6e: Current Ratio: 6f: Acid-test ratio: 6g: Debt to Equity Ratio:

VIRTUAL GAMING SYSTEMS [Income Statement for the year ending December 31, 2021 Net sales 2,991,000 Cost of goods sold 1,941,000 Gross profit 1,050,000 Expenses: Operating expenses 849,000 Depreciation expense 22,500 Loss on sale of land 7,100 Interest expense 10,500 Income tax expense 39,000 Total expenses 928,100 Net income 121,900 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2021 2020 Current assets: Cash 177,000 135,000 Accounts receivable 72,000 51,000 Inventory 96,000 126,000 Prepaid rent 11,100 4,920 Long-term assets: Investment in bonds 96,000 0 Land 201,000 231,000 Equipment 261,000 201,000 Less: Accum Deprec (55,500) (33,000) Total assets 858,600 715,920 Liabilities and Stockholders' Equity Current liabilities: Accounts payable 57,000 72,000 Interest payable 4,200 2,100 Income tax payable 10,500 13,100 Long-term liabilities: Notes payable 276,000 216,000 Stockholders' equity: Common stock 291,000 291,000 Retained earnings 219,900 121,720 Total liabilities &stockholders’ equity 858,600 715,920 Question 6: Assuming that all sales were on account, calculate the following risk ratios for 2021 using the data in the tables above. (Use 365 days a year & round answers to 1 decimal place) 6a: Receivables turnover ratio 6b: Average Collection Period 6c: Inventory Turnover Ratio 6d: Average Days in Inventory: 6e: Current Ratio: 6f: Acid-test ratio: 6g: Debt to Equity Ratio:

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 19BEA

Related questions

Question

Question 4: [Please see attached screenshot and answer all questions]

Question 5: [Please see screenshot and answer all questions]

| VIRTUAL GAMING SYSTEMS [Income Statement for the year ending December 31, 2021 | ||

| Net sales | 2,991,000 | |

| Cost of goods sold | 1,941,000 | |

| Gross profit | 1,050,000 | |

| Expenses: | ||

| Operating expenses | 849,000 | |

| 22,500 | ||

| Loss on sale of land | 7,100 | |

| Interest expense | 10,500 | |

| Income tax expense | 39,000 | |

| Total expenses | 928,100 | |

| Net income | 121,900 |

| VIRTUAL GAMING SYSTEMS Balance Sheets December 31 |

||

| 2021 | 2020 | |

| Current assets: | ||

| Cash | 177,000 | 135,000 |

| 72,000 | 51,000 | |

| Inventory | 96,000 | 126,000 |

| Prepaid rent | 11,100 | 4,920 |

| Long-term assets: | ||

| Investment in bonds | 96,000 | 0 |

| Land | 201,000 | 231,000 |

| Equipment | 261,000 | 201,000 |

| Less: Accum Deprec | (55,500) | (33,000) |

| Total assets | 858,600 | 715,920 |

| Liabilities and |

||

| Current liabilities: | ||

| Accounts payable | 57,000 | 72,000 |

| Interest payable | 4,200 | 2,100 |

| Income tax payable | 10,500 | 13,100 |

| Long-term liabilities: | ||

| Notes payable | 276,000 | 216,000 |

| Stockholders' equity: | ||

| Common stock | 291,000 | 291,000 |

| 219,900 | 121,720 | |

| Total liabilities &stockholders’ equity | 858,600 | 715,920 |

Question 6: Assuming that all sales were on account, calculate the following risk ratios for 2021 using the data in the tables above. (Use 365 days a year & round answers to 1 decimal place)

6a: Receivables turnover ratio

6b: Average Collection Period

6c: Inventory Turnover Ratio

6d: Average Days in Inventory:

6e:

6f: Acid-test ratio:

6g: Debt to Equity Ratio:

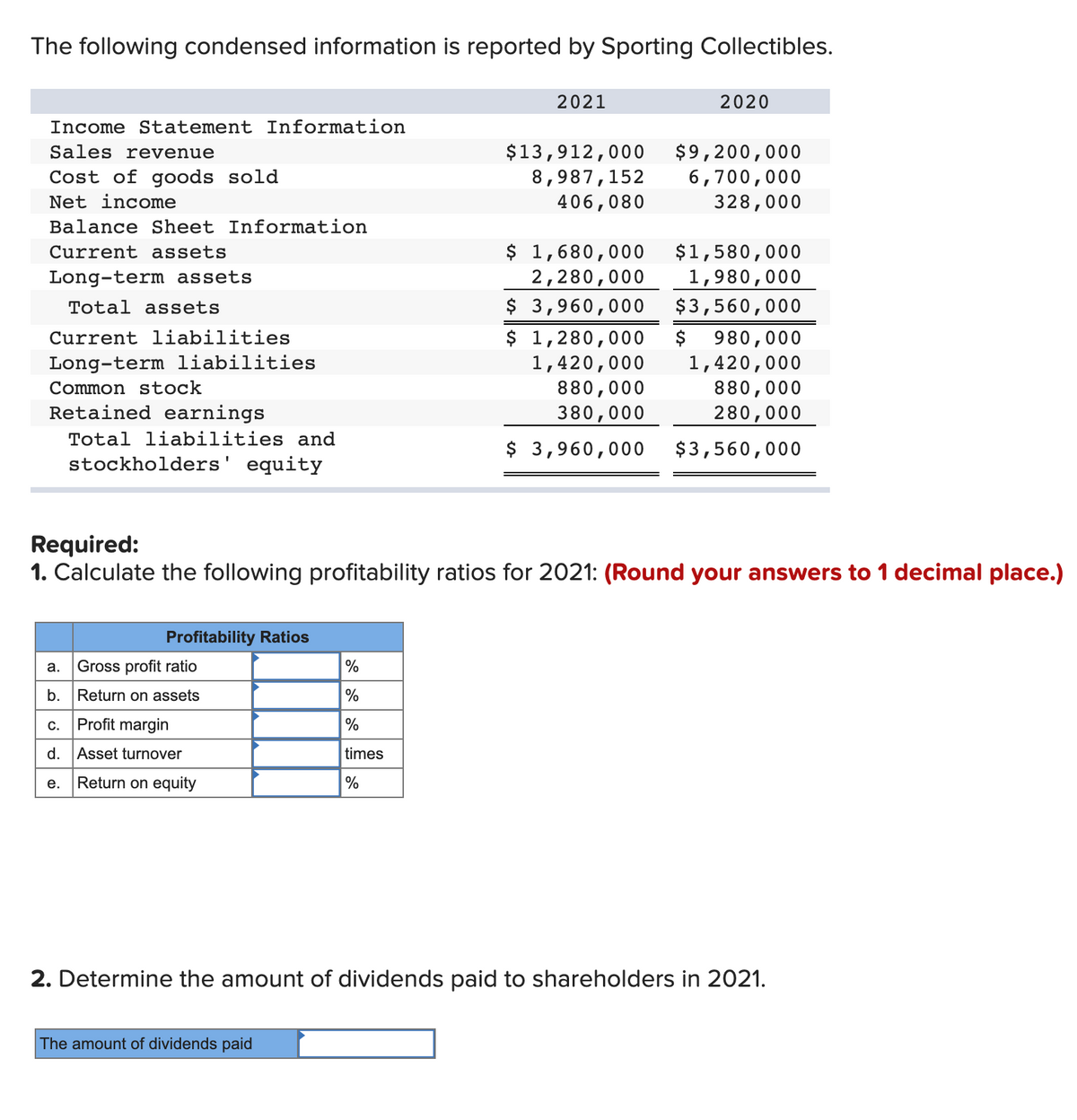

Transcribed Image Text:The following condensed information is reported by Sporting Collectibles.

2021

2020

Income Statement Information

Sales revenue

Cost of goods sold

Net income

$13,912,000

8,987,152

406,080

$9,200,000

6,700,000

328,000

Balance Sheet Information

$ 1,680,000

2,280,000

$ 3,960,000

Current assets

$1,580,000

Long-term assets

1,980,000

Total assets

$3,560,000

$ 1,280,000

1,420,000

880,000

Current liabilities

$

980,000

1,420,000

880,000

280,000

Long-term liabilities

Common stock

Retained earnings

380,000

Total liabilities and

$ 3,960,000

$3,560,000

stockholders' equity

Required:

1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.)

Profitability Ratios

а.

Gross profit ratio

%

b.

Return on assets

%

Profit margin

%

C.

d. Asset turnover

times

Return on equity

%

е.

2. Determine the amount of dividends paid to shareholders in 2021.

The amount of dividends paid

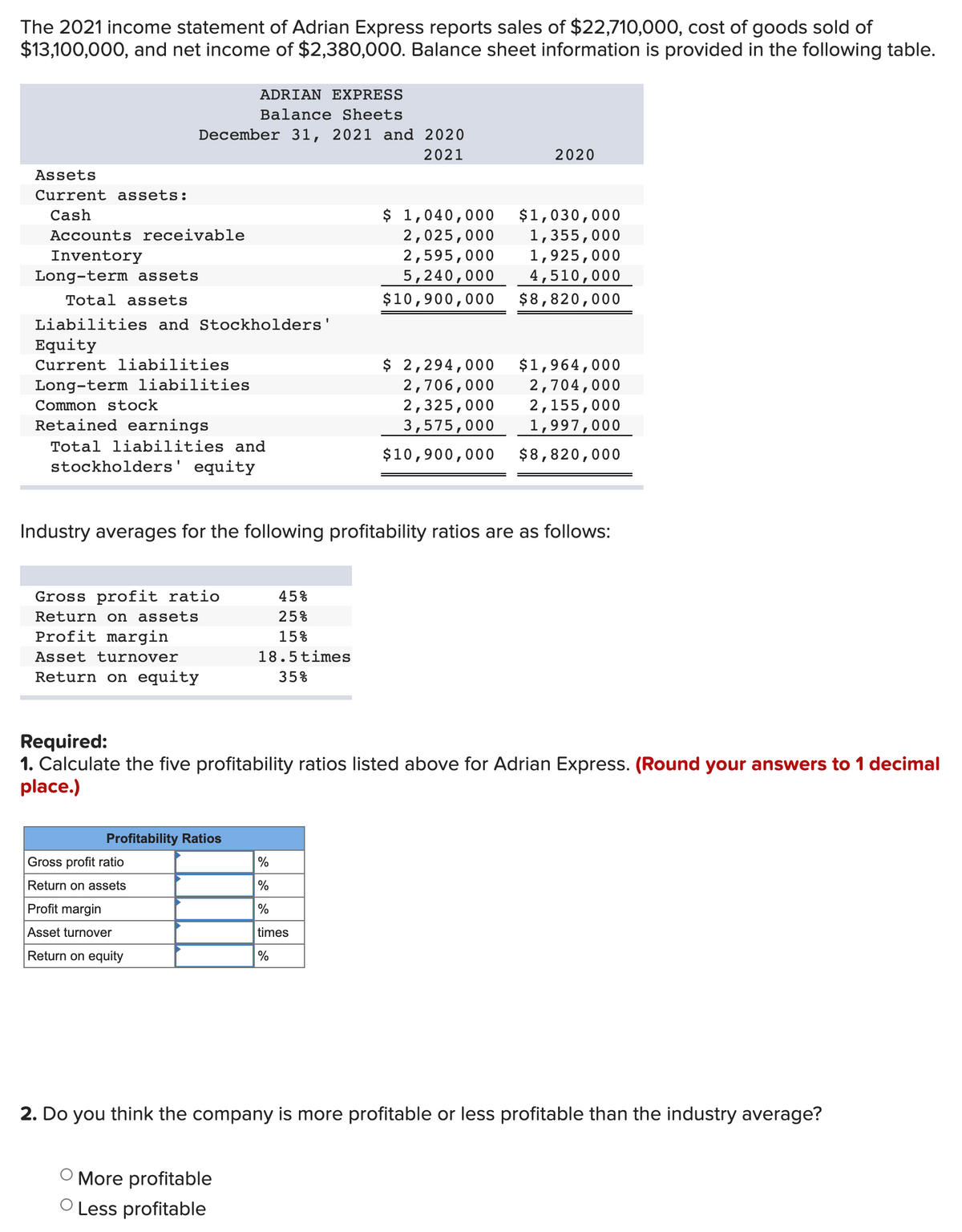

Transcribed Image Text:The 2021 income statement of Adrian Express reports sales of $22,710,000, cost of goods sold of

$13,100,000, and net income of $2,380,00O. Balance sheet information is provided in the following table.

ADRIAΝ ΕXPRES S

Balance Sheets

December 31, 2021 and 2020

2021

2020

Assets

Current assets:

$ 1,040,000

2,025,000

2,595,000

$1,030,000

1,355,000

1,925,000

Cash

Accounts receivable

Inventory

5,240,000

$10,900,000

4,510,000

$8,820,000

Long-term assets

Total assets

Liabilities and Stockholders'

Equity

$ 2,294,000

2,706,000

2,325,000

$1,964,000

2,704,000

2,155,000

1,997,000

Current liabilities

Long-term liabilities

Common stock

Retained earnings

3,575,000

Total liabilities and

$10,900,000

$8,820,000

stockholders' equity

Industry averages for the following profitability ratios are as follows:

Gross profit ratio

45%

Return on assets

25%

Profit margin

15%

Asset turnover

18.5times

Return on equity

35%

Required:

1. Calculate the five profitability ratios listed above for Adrian Express. (Round your answers to 1 decimal

place.)

Profitability Ratios

Gross profit ratio

%

Return on assets

%

Profit margin

%

Asset turnover

times

Return on equity

%

2. Do you think the company is more profitable or less profitable than the industry average?

More profitable

O Less profitable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning