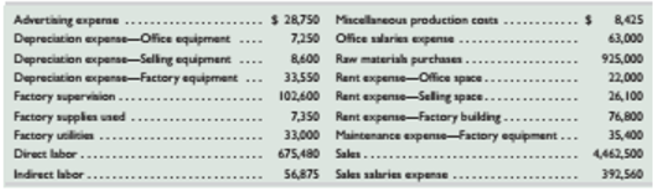

The following calendar year-end information is taken from the December 31, 2015, adjust

Required

- Identity and classify each of the costs above as either a product or period cost.

- Classify each of the product costs as either direct materials, direct labor, or factory

overhead. - Classify each of the period costs as either selling or general and administrative expenses.

Concept introduction:

Product cost:

The costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Rents on factory building, factory maintenance, and depreciation on factory equipment are some of its examples.

Period cost:

These costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administrative activities. Depreciation on office equipment, advertising expense and office manager salaries are some of its examples.

Requirement 1:

Identification and Classification of costs of Leone Company as either product or period.

Answer to Problem 2PSA

Classification of costs of Leone Company (Amount in $):

| Particulars | Product cost | Period cost |

| Advertising expense | 28, 750 | |

| Depreciation expense- Office equipment | 7, 250 | |

| Depreciation expense- Selling equipment | 8, 600 | |

| Depreciation expense- Factory equipment | 33, 550 | |

| Factory supervision | 1, 02, 600 | |

| Factory supplies used | 7, 350 | |

| Factory utilities | 33, 000 | |

| Direct labor | 6, 75, 480 | |

| Indirect labor | 56, 875 | |

| Miscellaneous production costs | 8, 425 | |

| Office salaries expense | 63, 000 | |

| Raw materials purchases | 9, 25, 000 | |

| Rent expense- Office space | 22, 000 | |

| Rent expense- Selling space | 26, 100 | |

| Rent expense- Factory building | 76, 800 | |

| Maintenance expense- Factory equipment | 35, 400 | |

| Sales salaries expense | 3, 92, 560 |

Explanation of Solution

The costs of Leone Company can be classified into product or period based on their nature as explained below:

Product costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Therefore, following costs would be classified as Product:

- Depreciation expense- Factory equipment: as it relates to manufacturing overheads

- Factory supervision: as it relates to manufacturing overheads

- Factory supplies used: as it relates to manufacturing overheads

- Factory utilities: as it relates to manufacturing overheads

- Direct labor: as it is cost of direct labor

- Indirect labor: as it relates to manufacturing overheads

- Miscellaneous production costs: as it relates to manufacturing overheads

- Raw material purchases: as it relates to direct materials

- Rent expense- Factory building: as it relates to manufacturing overheads

- Maintenance expense- Factory equipment: as it relates to manufacturing overheads

Period costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administrative activities. Following would be classified as Period costs:

- Advertising expense: : as it relates to selling activity

- Depreciation expense- Office equipment: as it relates to general and administrative activity

- Depreciation expense- Selling equipment: as it relates to selling activity

- Office salaries expense: as it relates to general and administrative activity

- Rent expense- Office space: as it relates to general and administrative activity

- Rent expense- Selling space: as it relates to selling activity

- Sales salaries expense: as it relates to selling activity

Therefore, identification and classification of costs of Leone Company, as asked in the given problem is shown below:

Classification of costs of Leone Company (Amount in $):

| Particulars | Product cost | Period cost |

| Advertising expense | 28, 750 | |

| Depreciation expense- Office equipment | 7, 250 | |

| Depreciation expense- Selling equipment | 8, 600 | |

| Depreciation expense- Factory equipment | 33, 550 | |

| Factory supervision | 1, 02, 600 | |

| Factory supplies used | 7, 350 | |

| Factory utilities | 33, 000 | |

| Direct labor | 6, 75, 480 | |

| Indirect labor | 56, 875 | |

| Miscellaneous production costs | 8, 425 | |

| Office salaries expense | 63, 000 | |

| Raw materials purchases | 9, 25, 000 | |

| Rent expense- Office space | 22, 000 | |

| Rent expense- Selling space | 26, 100 | |

| Rent expense- Factory building | 76, 800 | |

| Maintenance expense- Factory equipment | 35, 400 | |

| Sales salaries expense | 3, 92, 560 |

Concept introduction:

Product cost:

The costs are incurred when the product is acquired or produced and are considered in the inventory valuation. It includes costs of direct materials, direct labor and manufacturing overheads. Rents on factory building, factory maintenance, depreciation on factory equipment are some of its examples.

Direct materials:

These are the cost of materials used for production of the product. The cost of all the materials integral to finished product and having a physical presence that is readily traced to that finished product is included in direct materials.

Direct labor:

These consist of wages paid to labor who have physically and directly work on the goods being produced other than administrative and selling activities.

Factory overheads:

All other costs remaining other than direct materials and direct labor relating to factory comes under Factory overheads.

Requirement 2:

Identification and Classification of product costs of Leone Company as direct materials, direct labor and factory overheads.

Answer to Problem 2PSA

Classification of product costs of Leone Company (Amount in $):

| Particulars | Direct materials | Direct labor | Factory overheads |

| Depreciation expense- Factory equipment | 33, 550 | ||

| Factory supervision | 1, 02, 600 | ||

| Factory supplies used | 7, 350 | ||

| Factory utilities | 33, 000 | ||

| Direct labor | 6, 75, 480 | ||

| Indirect labor | 56, 875 | ||

| Miscellaneous production costs | 8, 425 | ||

| Raw materials purchases | 9, 25, 000 | ||

| Rent expense- Factory building | 76, 800 | ||

| Maintenance expense- Factory equipment | 35, 400 |

Explanation of Solution

The product costs of Leone Company can be classified into direct materials, direct labor and factory overheads based on their nature as explained below:

Direct materials are the cost of materials used for production of the product. Therefore, costs of Raw material purchases would be classified under direct materials.

Direct labor includes wages paid to labor who have physically and directly work on the goods being produced other than administrative and selling activities. Only cost of direct labor would be covered under direct labor.

All other costs remaining other than direct materials and direct labor relating to factory comes under Factory overheads. Therefore, following costs would factory overheads:

- Depreciation expense- Factory equipment

- Factory supervision

- Factory supplies used

- Factory utilities

- Indirect labor

- Miscellaneous production costs

- Rent expense- Factory building

- Maintenance expense- Factory equipment

Therefore, identification and classification of product costs of Leone Company, as asked in the given problem is shown below:

Classification of product costs of Leone Company (Amount in $):

| Particulars | Direct materials | Direct labor | Factory overheads |

| Depreciation expense- Factory equipment | 33, 550 | ||

| Factory supervision | 1, 02, 600 | ||

| Factory supplies used | 7, 350 | ||

| Factory utilities | 33, 000 | ||

| Direct labor | 6, 75, 480 | ||

| Indirect labor | 56, 875 | ||

| Miscellaneous production costs | 8, 425 | ||

| Raw materials purchases | 9, 25, 000 | ||

| Rent expense- Factory building | 76, 800 | ||

| Maintenance expense- Factory equipment | 35, 400 |

Concept introduction:

Period cost:

These costs are associated with the passage of time, i.e. when the business has no production or inventory purchasing activities, this cost would still be incurred. Mostly, these costs are associated with selling or general and administration activities. Depreciation on office equipment, advertising expense and office manager salaries are some of its examples.

Selling expenses:

These are the expenses incurred for making sales. These include direct and indirect cost associated with selling a product.

General and administrative expenses:

These are basically the overheads of the company. These are the costs a company incurs to keep its business operational.

Requirement 3:

Identification and Classification of period costs of Leone Company as selling and general or administration expenses.

Answer to Problem 2PSA

Classification of period costs of Leone Company (Amount in $):

| Particulars | Selling expenses | General or administration expenses |

| Advertising expense | 28, 750 | |

| Depreciation expense- Office equipment | 7, 250 | |

| Depreciation expense- Selling equipment | 8, 600 | |

| Office salaries expense | 63, 000 | |

| Rent expense- Office space | 22, 000 | |

| Rent expense- Selling space | 26, 100 | |

| Sales salaries expense | 3, 92, 560 |

Explanation of Solution

The period costs of Leone Company can be classified into product or period based on their nature as explained below:

Period costs are associated with the passage of time and are associated with selling and general or administration activities.

Selling expenses are incurred for making sales and include direct and indirect cost associated with selling a product. Following would be covered under selling expenses:

- Advertising expense:

- Depreciation expense- Selling equipment

- Rent expense- Selling space

- Sales salaries expense

General or administrative expenses are the overheads a company incurs to keep its business operational. Following are classified under them:

- Depreciation expense- Office equipment

- Office salaries expense

- Rent expense- Office space

Therefore, identification and classification of period costs of Leone Company, as asked in the given problem is shown below:

Classification of period costs of Leone Company (Amount in $):

| Particulars | Selling expenses | General or administration expenses |

| Advertising expense | 28, 750 | |

| Depreciation expense- Office equipment | 7, 250 | |

| Depreciation expense- Selling equipment | 8, 600 | |

| Office salaries expense | 63, 000 | |

| Rent expense- Office space | 22, 000 | |

| Rent expense- Selling space | 26, 100 | |

| Sales salaries expense | 3, 92, 560 |

Want to see more full solutions like this?

Chapter 1 Solutions

MANAGERIAL ACCOUNTING ACCT 2302 >IC<

- The following data are taken from the general ledger and other records of Coral Park Production Co. on January 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardThe following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardThe following information is available for the first year of operations of Creston Inc., a manufacturer of fabricating equipment: Determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

- The adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardStatement of cost of goods manufactured for a manufacturing company Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows: a. Prepare a cost of goods manufactured statement for March. b. Determine the cost of goods sold for March.arrow_forwardSeveral items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December: Instructions 1. For both companies, determine the amounts of the missing items (a) through (f), identifying them by letter. 2. Prepare Yakima Companys statement of cost of goods manufactured for December. 3. Prepare Yakima Companys income statement for December.arrow_forward

- During March, the following costs were charged to the manufacturing department: $14886 for materials; $14,656 for labor; and $13,820 for manufacturing overhead. The records show that 30,680 units were completed and transferred, while 2,400 remained in ending inventory. There were 33,080 equivalent units of material and 31,640 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory?arrow_forwardThe following data were taken from the general ledger and other data of McDonough Manufacturing on July 31: Compute the cost of goods sold for the month of July.arrow_forwardDaytona Beverages Inc. uses the FIFO cost method and adds all materials, labor, and factory overhead evenly to production. A record of the factory operations for October follows: Required: Prepare a cost of production summary for the month.arrow_forward

- Statement of cost of goods manufactured; income statement; balance sheet The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 33,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of November. 2. Prepare an income statement for the month of November. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of November 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThis information was collected for the first year of manufacturing for Appliance Apps: Prepare an income statement under variable costing, and prepare a reconciliation to the income under the absorption method.arrow_forwardNelson Fabrication Inc. had a remaining credit balance of $20,000 in its under- and overapplied factory overhead account at year-end. The balance was deemed to be large and, therefore, should be closed to Work in Process, Finished Goods, and Cost of Goods Sold. The year-end balances of these accounts, before adjustment, showed the following: Determine the prorated amount of the overapplied factory overhead that is chargeable to each of the accounts. Prepare the journal entry to close the credit balance in Under-and Overapplied Factory Overhead.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT