Concept explainers

Exercise 1-48 Income Statement

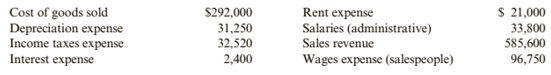

The following information is available for Wright Auto Supply at December 31, 2019.

Required:

1. Prepare a single-step income statement for the year ended December 31, 2019.

2. Prepare a multiple-step income statement for the year ended December 31, 2,019.

3. CONCEPTUAL CONNECTION Comment on the differences between the single-step and the multiple-step income statements.

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-1:

To Prepare:

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019.

Answer to Problem 48E

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses | $ 509,720 | |

| Net Income | $ 75,880 | |

Explanation of Solution

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues (A) | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses (B) | $ 509,720 | |

| Net Income (A-B) | $ 75,880 | |

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-2:

To Prepare:

The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019.

Answer to Problem 48E

The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

Explanation of Solution

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-3:

To Indicate:

The difference between the multi step and single step Income Statements.

Answer to Problem 48E

The difference between the multi step and single step Income Statements is explained as follows:

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Explanation of Solution

The difference between the multi step and single step Income Statements is explained as follows:

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues (A) | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses (B) | $ 509,720 | |

| Net Income (A-B) | $ 75,880 | |

Want to see more full solutions like this?

Chapter 1 Solutions

Cornerstones of Financial Accounting

- Problem 1-60A Income Statement and Balance Sheet The following information for Rogers Enterprises is available at December 31, 2019 and includes all of Rogers financial statement amounts except retained earnings: Required: Prepare a single-step income statement and a c1assified balance sheet for the year ending December 31, 2019, for Rogers.arrow_forwardBrief Exercise 3-33 Preparing an Income Statement The adjusted trial balance of Pelton Company at December 31, 2019, includes the following accounts: Wages Expense, $22,400; Service Revenue. Rent Expense, $3,200; Dividends, $4,000; Retained Earnings, $12,200; and Prepaid Rent, $1,000. Required: Prepare a single-step income Statement for Pelton for 2019.arrow_forwardCase 1-74 Comparative Analysis: Under Armour, lnc., versus Columbia Sportswear Refer to the 10-K reports of Under Armour, Inc., and Columbia Sportswear that are available for download from the companion website at CengageBrain.com Required: Answer the following questions: With regard to the income statement: What amounts did Under Armour report as revenues, expenses, and net income for the year ended December 3 l, 2016? What amounts did Columbia report as revenues, expenses, and net income for the fiscal year ended December 31, 2016? Compare any trends that you detect with regard to revenues expenses. and net income.arrow_forward

- Problem 1-61A Retained Earnings Statement Dittman Expositions has the following data available: Required: Prepare retained earnings statements for 2019 and 2020.arrow_forwardCornerstone Exercise 3-25 Preparing a Retained Earnings Statement Refer to the information for Sparrow Company on the previous page. Required: Prepare a retained earnings statement for Sparrow for 2019.arrow_forwardExercise 3-57 Preparing a Retained Earnings Statement Refer to the unadjusted trial balance for Oxmoor Corporation in Exercise 3-56. Required: Prepare a retained earnings statement for Oxmoor for the year ended December 31, 2019.arrow_forward

- Cornerstone Exercise 3-26 Preparing a Balance Sheet Refer to the information for Sparrow Company on the previous page. Required: prepare a classified balance sheet for Sparrow at December 31, 2019.arrow_forwardMultiple-step income statement On March 31, 20Y5, the balances of the accounts appearing in the ledger of Lange Daughters Inc. are as follows: a. Prepare a multiple-step income Statement for the year ended March 31, 20Y5. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forwardExercise 1-35 Accounting Concepts OBJECTIVE 06° A list of accounting concepts and related definitions is presented below. Concept Definition 1. Revenue a. Owners claim on the resources of a company 2, Expense b. The difference between revenues and expenses 3. Net income (1055) c. Increase in assets from the sale of goods or services 4, Dividend d. Economic resumes of a company 5. Asset e. Cost of assets consumed in the operation of a business 6, Liability f. Creditors' claims on the resources of a company 7. Stock holders, equity g. Distribution of earnings to stockholders Required: Match each of the concepts with its corresponding definitionarrow_forward

- Exercise 3-58 Preparing a Balance Sheet Refer to the unadjusted trial balance for Oxmoor Corporation in Exercise 3-56. Required: Prepare a classified balance sheet for Oxmoor at December 3 l , 2019.arrow_forwardBrief Exercise 3-36 Preparing and Analyzing Closing Entries At December 31, 2019, the ledger of Aulani Company includes the following accounts, all having normal balances: Sales Revenue, cost of Goods sold, $31,000; Retained $20,000; Interest Expense, $3,200; Dividends, $5,000, Wages Expense $5,000, and Interest Payable, $2,100. Required: Prepare the closing entries for Aulani at December 31, 2019. How does the closing process affect Aulanis retained earnings?arrow_forwardAdjustment for Customer Refunds and Returns Assume the following data for Alpine Technologies for the year ending July 31. 20Y2. Illustrate the effects of the adjustments for customer refunds and returns on the accounts and financial statements of Alpine Technologies for the year ended July 31. 20Y2.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,