Cost Data for Managerial Purposes—Finding Unknowns

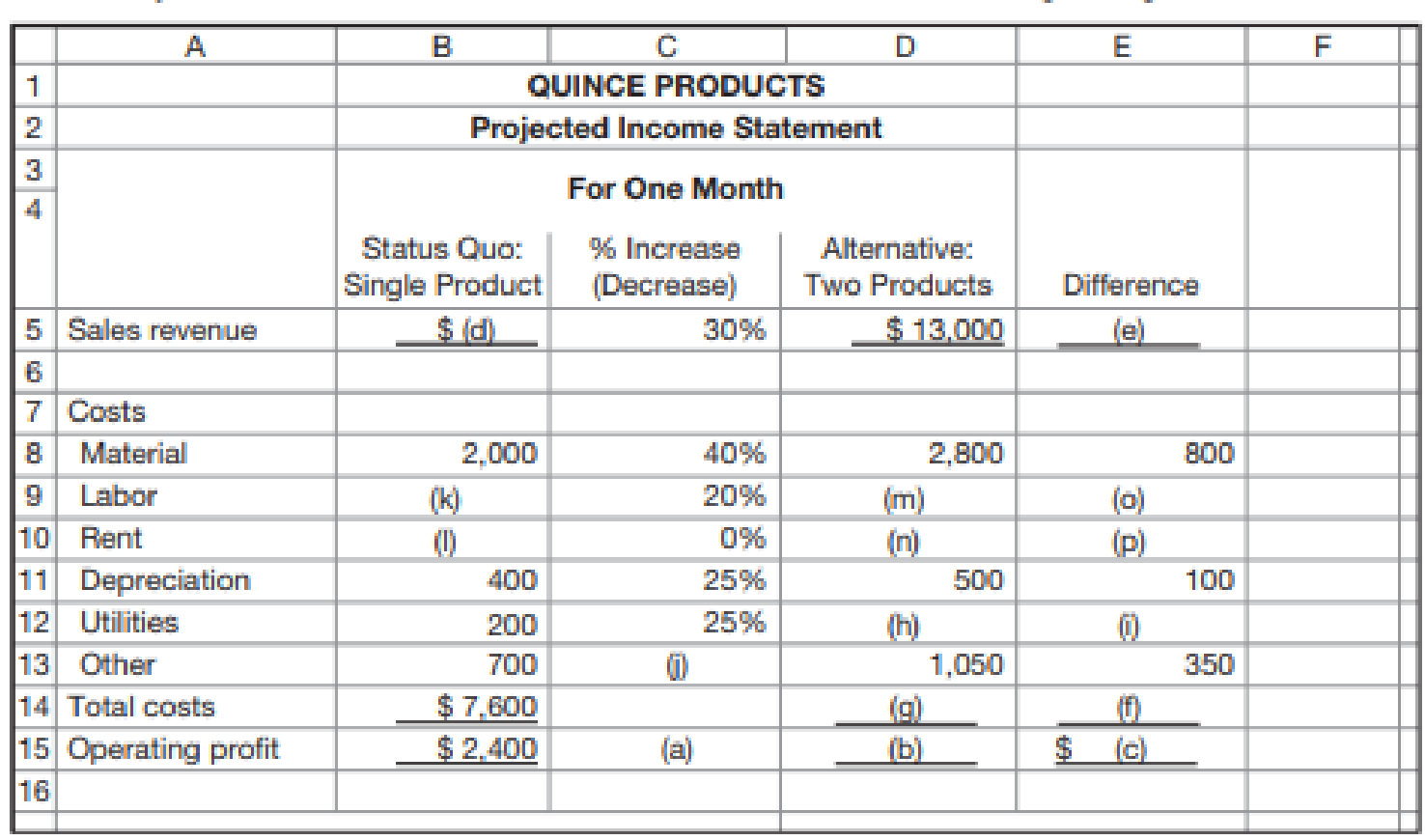

Quince Products is a small company in southern California that makes jams and preserves. Recently, a sales rep from one of the company’s suppliers suggested that Quince could increase its profitability by 50 percent if it introduced a second line of products, packaged fruit. She offered to do the analysis and show the company her assumptions.

When Quince’s management opened the spreadsheet sent by the sales rep, they noticed that there were several blank cells. In the meantime, the sales rep had taken a job with a competitor and told the managers at Quince that she could no longer advise them. Although they were not sure they should rely on the analysis, they asked you to see if you could reconstruct the sales rep’s analysis. They had been considering this new business already and wanted to see if their analysis was close to that of an outside observer. The incomplete spreadsheet follows.

Required

Fill in the blank cells.

Fill in the blank cells of the projected income statement.

Explanation of Solution

Projected income statement: The projected income statement represents the future financial position of the entity. The projected income statement is prepared with an objective of showing the financial results for a future period of time.

Fill in the blank cells of the projected income statement:

| Company Q | ||||

| Projected Income Statement | ||||

| For One Month | ||||

| Status Quo: | % Increase | Alternative | ||

| Single Product | Decrease | Two Products | Difference | |

| Sales revenue | $ 10,000 (d) | 30% | $ 13,000 | $ 3,000 (e) |

| Costs | ||||

| Material | $ 2,000 | 40% | $ 2,800 | $ 800 |

| Labor | $ 2,500 (k) | 20% | $ 3,000 (m) | $ 500 (o) |

| Rent | $ 1,800 (l) | 0% | $ 1,800 (n) |

|

| Depreciation | $ 400 | 25% | $ 500 | $ 100 |

| Utilities | $ 200 | 25% | $ 250 (h) | $ 50 (i) |

| Other | $ 700 | 50% (j) | $ 1,050 | $ 350 |

| Total costs | $ 7,600 | $ 9,400 (g) | $ 1,800 (f) | |

| Operating profit | $ 2,400 (a) | $ 3,600 (b) | $ 1,200 (c) | |

Working note 1:

Compute value of (a):

It is given that the profit has increased by 50%, (a) represent the % increase or decrease in profit.

Working note 2:

Compute value of (b):

Working note 3:

Compute value of (c):

Working note 4:

Compute value of (d):

Working note 5:

Compute value of (e):

Working note 5:

Compute value of (f):

Working note 6:

Compute value of (g):

Working note 6:

Compute value of (h):

Working note 7:

Compute value of (i):

Working note 8:

Compute value of (j):

Working note 8:

Compute value of (k):

Labor plus rent (single product):

Labor plus rent (two products):

Increase in labor:

Thus,

Working note 8:

Compute value of (l):

Working note 8:

Compute value of (m):

Working note 9:

Compute value of (n):

Working note 10:

Compute value of (o):

Working note 11:

Compute value of (p):

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Suspicious Acquisition of Data, Ethical Issues Bill Lewis, manager of the Thomas Electronics Division, called a meeting with his controller, Brindon Peterson, and his marketing manager, Patty Fritz. The following is a transcript of the conversation that took place during the meeting: Bill: Brindon, the variable costing system that you developed has proved to be a big plus for our division. Our success in winning bids has increased, and as a result our revenues have increased by 25%. However, if we intend to meet this years profit targets, we are going to need something extraam I right, Patty? Patty: Absolutely. While we have been able to win more bids, we still are losing too many, particularly to our major competitor, Kilborn Electronics. If we knew more about their bidding strategy, we could be more successful at competing with them. Brindon: Would knowing their variable costs help? Patty: Certainly. It would give me their minimum price. With that knowledge, Im sure that we could find a way to beat them on several jobs, particularly on those jobs where we are at least as efficient. It would also help us to identify where we are not cost competitive. With this information, we might be able to find ways to increase our efficiency. Brindon: Well, I have good news. Ive been talking with Carl Penobscot, Kilborns assistant controller. Carl doesnt feel appreciated by Kilborn and wants to make a change. He could easily fit into our team here. Plus, Carl has been preparing for a job switch by quietly copying Kilborns accounting files and records. Hes already given me some data that reveal bids that Kilborn made on several jobs. If we can come to a satisfactory agreement with Carl, hell bring the rest of the information with him. Well easily be able to figure out Kilborns prospective bids and find ways to beat them. Besides, I could use another accountant on my staff. Bill, would you authorize my immediate hiring of Carl with a favorable compensation package? Bill: I know that you need more staff, Brindon, but is this the right thing to do? It sounds like Carl is stealing those files, and surely Kilborn considers this information confidential. I have real ethical and legal concerns about this. Why dont we meet with Laurie, our attorney, and determine any legal problems? Required: 1. Is Carls behavior ethical? What would Kilborn think? 2. Is Bill correct in supposing that there are ethical and/or legal problems involved with the hiring of Carl? (Reread the section on corporate codes of conduct in Chapter 1.) What would you do if you were Bill? Explain.arrow_forwardDifferential Costing As pointed out earlier in Heres the Real Kicker, Kicker changed banks a couple of years ago because the loan officer at its bank moved out of state. Kicker saw that as an opportunity to take bids for its banking business and to fine-tune the banking services it was using. This problem uses that situation as the underlying scenario but uses three banks: FirstBank, Community Bank, and RegionalOne Bank. A set of representative data was presented to each bank for the purpose of preparing a bid. The data are as follows: Checking accounts needed: 6 Checks per month: 2,000 Foreign debits/credits on checking accounts per month: 200 Deposits per month: 300 Returned checks: 25 per month Credit card charges per month: 4,000 Wire transfers per month: 100, of which 60 are to foreign bank accounts Monthly credit needs (line of credit availability and cost): 100,000 average monthly usage These are overall totals for the six accounts during a month. Internet banking services? Knowledgeable loan officer? Responsiveness of bank? FirstBank Bid: Checking accounts: 5 monthly maintenance fee per account 0.10 foreign debit/credit 0.50 earned for each deposit 3 per returned check Credit card fees: 0.50 per item Wire transfers: 15 to domestic bank accounts, 50 to foreign bank accounts Line of credit: Yes, this amount is available, interest charged at prime plus 2%, subject to a 6% minimum interest rate Internet banking services? Yes, full online banking available: 15 one-time setup fee for each account 20 monthly fee for software module The loan officer assigned to the potential Kicker account had 10 years of experience with medium to large business banking and showed an understanding of the audio industry. Community Bank Bid: Checking accounts: No fees for the accounts, and no credits earned on deposits 2.00 per returned check Credit card fees: 0.50 per item, 7 per batch processed. Only manual processing was available, and Kicker estimated 20 batches per month Wire transfers: 30 per wire transfer Line of credit: Yes, this amount is available: interest charged at prime plus 2% subject to a 7% minimum interest rate Internet banking services? Not currently, but within the next 6 months The loan officer assigned to the potential Kicker account had 4 years of experience with medium to large business banking, none of which pertained to the audio industry. RegionalOne Bank Bid: Checking accounts: 5 monthly maintenance fee per account to be waived for Kicker 0.20 foreign debit/credit 0.30 earned for each deposit 3.80 per returned check Credit card fees: 0.50 per item Wire transfers: 10 to domestic bank accounts, 55 to foreign bank accounts Line of credit: Yes, this amount is available: interest charged at prime plus 2% subject to a 6.5% minimum interest rate Internet banking services? Yes, full online banking available: one-time setup fee for each account waived for Kicker 20 monthly fee for software module The loan officer assigned to the potential Kicker account had 2 years of experience with large business banking. Another branch of the bank had expertise in the audio industry and would be willing to help as needed. This bank was the first one to submit a bid. Required: 1. Calculate the predicted monthly cost of banking with each bank. Round answers to the nearest dollar. 2. CONCEPTUAL CONNECTION Suppose Kicker felt that full online Internet banking was critical. How would that affect your analysis from Requirement 1? How would you incorporate the subjective factors (e.g., experience, access to expertise)?arrow_forwardJolene Askew, manager of Feagan Company, has committed her company to a strategically sound cost reduction program. Emphasizing life-cycle cost management is a major part of this effort. Jolene is convinced that production costs can be reduced by paying more attention to the relationships between design and manufacturing. Design engineers need to know what causes manufacturing costs. She instructed her controller to develop a manufacturing cost formula for a newly proposed product. Marketing had already projected sales of 25,000 units for the new product. (The life cycle was estimated to be 18 months. The company expected to have 50 percent of the market and priced its product to achieve this goal.) The projected selling price was 20 per unit. The following cost formula was developed: Y=200,000+10X1 where X1=Machinehours(Theproductisexpectedtouseonemachinehourforeveryunitproduced.) Upon seeing the cost formula, Jolene quickly calculated the projected gross profit to be 50,000. This produced a gross profit of 2 per unit, well below the targeted gross profit of 4 per unit. Jolene then sent a memo to the Engineering Department, instructing them to search for a new design that would lower the costs of production by at least 50,000 so that the target profit could be met. Within two days, the Engineering Department proposed a new design that would reduce unit-variable cost from 10 per machine hour to 8 per machine hour (Design Z). The chief engineer, upon reviewing the design, questioned the validity of the controllers cost formula. He suggested a more careful assessment of the proposed designs effect on activities other than machining. Based on this suggestion, the following revised cost formula was developed. This cost formula reflected the cost relationships of the most recent design (Design Z). Y=140,000+8X1+5,000X2+2,000X3 where X1=MachinehoursX2=NumberofbatchesX3=Numberofengineeringchangeorders Based on scheduling and inventory considerations, the product would be produced in batches of 1,000; thus, 25 batches would be needed over the products life cycle. Furthermore, based on past experience, the product would likely generate about 20 engineering change orders. This new insight into the linkage of the product with its underlying activities led to a different design (Design W). This second design also lowered the unit-level cost by 2 per unit but decreased the number of design support requirements from 20 orders to 10 orders. Attention was also given to the setup activity, and the design engineer assigned to the product created a design that reduced setup time and lowered variable setup costs from 5,000 to 3,000 per setup. Furthermore, Design W also creates excess activity capacity for the setup activity, and resource spending for setup activity capacity can be decreased by 40,000, reducing the fixed cost component in the equation by this amount. Design W was recommended and accepted. As prototypes of the design were tested, an additional benefit emerged. Based on test results, the post-purchase costs dropped from an estimated 0.70 per unit sold to 0.40 per unit sold. Using this information, the Marketing Department revised the projected market share upward from 50 percent to 60 percent (with no price decrease). Required: 1. Calculate the expected gross profit per unit for Design Z using the controllers original cost formula. According to this outcome, does Design Z reach the targeted unit profit? Repeat, using the engineers revised cost formula. Explain why Design Z failed to meet the targeted profit. What does this say about the use of unit-based costing for life-cycle cost management? 2. Calculate the expected profit per unit using Design W. Comment on the value of activity information for life-cycle cost management. 3. The benefit of the post-purchase cost reduction of Design W was discovered in testing. What direct benefit did it create for Feagan Company (in dollars)? Reducing post-purchase costs was not a specific design objective. Should it have been? Are there any other design objectives that should have been considered?arrow_forward

- Cost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forwardThe Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forwardEvaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.arrow_forward

- Cost Behavior, High-Low Method, Pricing Decision Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firms founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believes that an inexpensive accounting services clinic could provide basic accounting services for small businesses located in the barrio. He wants to price the services at cost. Since the clinic is brand new, it has no experience to go on. Carlos decided to operate the clinic for 2 months before determining how much to charge per hour on an ongoing basis. As a temporary measure, the clinic adopted an hourly charge of 25, half the amount charged by Fonseca, Ruiz, and Dunn for professional services. The accounting services clinic opened on January 1. During January, the clinic had 120 hours of professional service. During February, the activity was 150 hours. Costs for these two levels of activity usage are as follows: Required: 1. Classify each cost as fixed, variable, or mixed, using hours of professional service as the activity driver. 2. Use the high-low method to separate the mixed costs into their fixed and variable components. (Note: Round variable rates to two decimal places and fixed amounts to the nearest dollar.) 3. Luz Mondragon, the chief paraprofessional of the clinic, has estimated that the clinic will average 140 professional hours per month. If the clinic is to be operated as a nonprofit organization, how much will it need to charge per professional hour ? How much of this charge is variable? How much is fixed? (Note: Round answers to two decimal places.) 4. CONCEPTUAL CONNECTION Suppose the accounting center averages 170 professional hours per month. How much would need to be charged per hour for the center to cover its costs ? Explain why the per-hour charge decreased as the activity output increased. (Note: Round answers to two decimal places.)arrow_forwardAnalyze Horsepower Hookup, Inc. Horsepower Hookup, Inc., is a large automobile company that specializes in the production of high-powered trucks. The company is determining cost allocations for purposes of performance evaluation. A portion of company bonuses depends on divisions achieving cost management goals. This necessitates highly accurate support department cost allocation. Management has also stated that it has the means to implement as complex a method as necessary. The general manager over the Mid-Size D wants to get a good idea of what factors are driving the costs of the support departments in order to make accurate cost allocations, so finding accurate support department cost drivers is important. Support department costs include Janitorial (163,100) and Security (285,400). The Janitorial costs vary depending on the number of vehicles produced, increasing with larger production volumes. Security costs are fixed based on the size of the lot, and do not change with respect to how many vehicles are in the lot or warehouse. Joint costs involved in producing the trucks before the split-off point where the various makes, models, and colors are produced are 946,000 for the period. All makes, models, and colors sell at relatively similar margins, but the sports models and metallic colors are normally more difficult to produce during the joint production process. a. Which support department cost allocation method (direct, sequential, or reciprocal services) should be used to allocate support department cost? b. What driver would be best for allocating Janitorial costs? c. What driver would be best for allocating Security costs? d. If Janitorial costs were to be allocated based on square footage, and Security costs based on asset value, what percentage of each support departments costs would be allocated to each production department using the sequential method (allocating Security costs first) given the following: e. Should Janitorial and Security costs be considered when evaluating the performance of cost management employees? f. What joint cost allocation method should be used for performance evaluation purposes?arrow_forwardRizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forward

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardAldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forwardAnalyze Milkrageous, Inc. Milkrageous, Inc., a large, private dairy products company, is determining cost allocations for performance evaluation purposes. Company bonuses are based on cost containment, so accurate costing numbers are imperative. The general managers (GMs) over the cheese and yogurt divisions are being evaluated. Support department costs include Janitorial ($150,700) and Maintenance ($300,200). The Janitorial costs remain relatively fixed from quarter to quarter. Maintenance costs, however, vary with respect to the number of service calls made each quarter. The joint cost of processing milk before the split-off point for yogurt and cheese is $755,000 for the quarter. Yogurt sells at higher margins than cheese (at split-off as well as after further processing), but is equally difficult to produce as cheese. a. Identify the method of support department cost allocation that matches the given situation. a. Direct method. b. Reciprocal services method. c. Sequence method. d.…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,