Cost Behavior, High-Low Method, Pricing Decision

Fonseca, Ruiz, and Dunn is a large, local accounting firm located in a southwestern city. Carlos Ruiz, one of the firm’s founders, appreciates the success his firm has enjoyed and wants to give something back to his community. He believes that an inexpensive accounting services clinic could provide basic accounting services for small businesses located in the barrio. He wants to price the services at cost.

Since the clinic is brand new, it has no experience to go on. Carlos decided to operate the clinic for 2 months before determining how much to charge per hour on an ongoing basis. As a temporary measure, the clinic adopted an hourly charge of $25, half the amount charged by Fonseca, Ruiz, and Dunn for professional services.

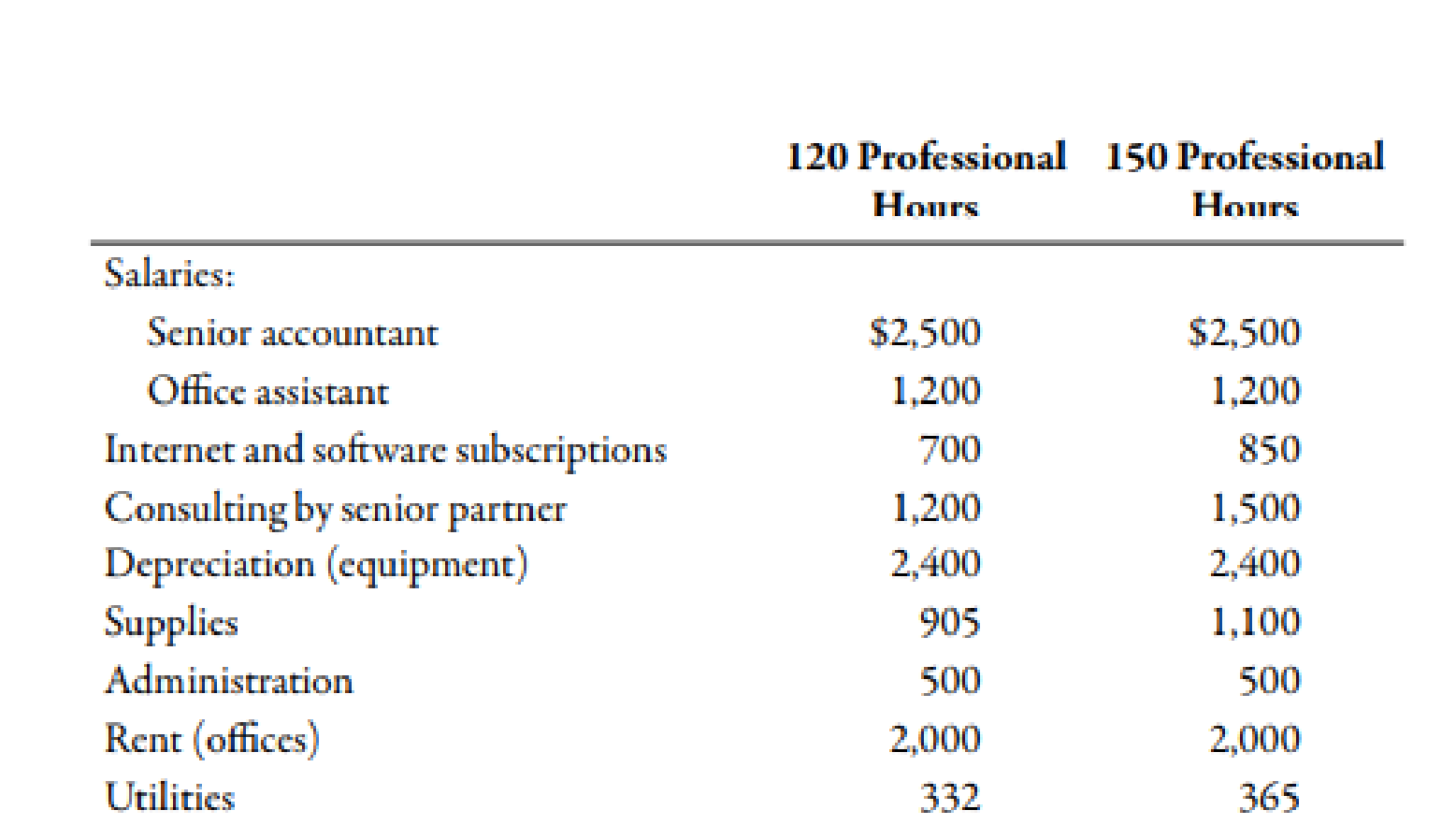

The accounting services clinic opened on January 1. During January, the clinic had 120 hours of professional service. During February, the activity was 150 hours. Costs for these two levels of activity usage are as follows:

Required:

- 1. Classify each cost as fixed, variable, or mixed, using hours of professional service as the activity driver.

- 2. Use the high-low method to separate the mixed costs into their fixed and variable components. (Note: Round variable rates to two decimal places and fixed amounts to the nearest dollar.)

- 3. Luz Mondragon, the chief paraprofessional of the clinic, has estimated that the clinic will average 140 professional hours per month. If the clinic is to be operated as a nonprofit organization, how much will it need to charge per professional hour ? How much of this charge is variable? How much is fixed? (Note: Round answers to two decimal places.)

- 4. CONCEPTUAL CONNECTION Suppose the accounting center averages 170 professional hours per month. How much would need to be charged per hour for the center to cover its costs ? Explain why the per-hour charge decreased as the activity output increased. (Note: Round answers to two decimal places.)

1.

Categorize the activities into fixed cost, variable cost or mixed cost.

Explanation of Solution

Cost:

Cost can be defined as the cash and cash equivalent which is incurred against the products or its related services which will benefit the organization in the future. There are two types of costs that are fixed and variable costs. Combination of fixed and variable is referred to as mixed cost.

| Serial Number | Activities | Categorize |

| 1 | Senior accountant | Fixed cost |

| 2 | Office assistant | Fixed cost |

| 3 | Internet and software subscriptions | Mixed cost |

| 4 | Consulting by senior partner | Variable cost |

| 5 | Depreciation | Fixed cost |

| 6 | Supplies | Mixed cost |

| 7 | Administration | Fixed cost |

| 8 | Rent | Fixed cost |

| 9 | Utilities | Mixed cost |

Table (1)

2.

Divide the mixed costs into fixed and variable components with the help of high-low method.

Explanation of Solution

High Low Method:

The method in which, high and low points of data are used to classify the mixed cost into fixed and variable cost known as high low method. This is one among the three costs of separation methods.

Use the following formula to calculate the value of variable rate of internet and software subscriptions:

Substitute $850 for high receiving cost, $700 for low receiving cost, 150 for high professional hours and 120 for low professional hours in the above formula.

Therefore, variable rate is $5.00 per hour.

Use the following formula to calculate the fixed cost for a month of internet and software subscriptions:

Substitute $850 for high receiving cost, $5.00 for variable rate and 150 for high professional hours in the above formula.

Therefore, fixed cost for a month is $100.

Use the following formula to calculate the value of variable rate of supplies:

Substitute $1,100 for high receiving cost, $905 for low receiving cost, 150 for high professional hours and 120 for low professional hours in the above formula.

Therefore, variable rate is $6.5 per hour.

Use the following formula to calculate the fixed cost for a month of supplies:

Substitute $1,100 for high receiving cost, $6.50 for variable rate and 150 for high professional hours in the above formula.

Therefore, fixed cost for a month is $125.

Use the following formula to calculate the value of variable rate of utilities:

Substitute $365 for high receiving cost, $332 for low receiving cost, 150 for high professional hours and 120 for low professional hours in the above formula.

Therefore, variable rate is $1.10 per hour.

Use the following formula to calculate the fixed cost for a month of utilities:

Substitute $365 for high receiving cost, $1.10 for variable rate and 150 for high professional hours in the above formula.

Therefore, fixed cost for a month is $200.

3.

Calculate the value of total cost and charge per hour. Also, calculate the fixed cost and variable cost.

Explanation of Solution

Use the following formula to calculate the value of fixed cost per hour:

Substitute $9,025 for total cost and 140 for professional hours in the above formula.

Therefore, the value of fixed cost per hour is $64.46.

Use the following formula to calculate the value of variable cost per hour:

Substitute $5 for variable rate of internet subscriptions, $10 for consulting by senior partner, $6.50 for supplies and 1.10 for utilities in the above formula.

Therefore, the value of variable cost per hour is $22.60.

Use the following formula to calculate the value of total clinic cost:

Substitute $9,025 for fixed cost and $22.60 for variable rate and 140 for professional hours in the above formula.

Therefore, the value of total clinic cost is $12,189.

Use the following formula to calculate the value of charge per hour:

Substitute $12,189 for total clinic cost, 140 for professional hours and $22.60 for variable rate in the above formula.

Therefore, the value of charge per hour is $87.06.

Working Note:

Total Cost is calculated by adding the values of all the activities that is $9,025

4.

Calculate the value of charge per hour when the number of professional hours is 170 hours.

Explanation of Solution

Use the following formula to calculate the value of charge per hour:

Substitute $9,025 for fixed cost, 170 for professional hours and $22.60 for variable rate in the above formula.

Therefore, the value of charge per hour is $75.69.

The charge per hour decreases because fixed cost is divided by the large amount of professional hours.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Cost Information and Ethical Behavior, Service Organization Jean Erickson, manager and owner of an advertising company in Charlotte, North Carolina, arranged a meeting with Leroy Gee, the chief accountant of a large, local competitor. The two are lifelong friends. They grew up together in a small town and attended the same university. Leroy is a competent, successful accountant but is having some personal financial difficulties after some of his investments turned sour, leaving him with a 15,000 personal loan to pay offjust when his oldest son is starting college. Jean, on the other hand, is struggling to establish a successful advertising business. She had recently acquired the rights to open a branch office of a large regional advertising firm headquartered in Atlanta, Georgia. During her first 2 years, she was able to build a small, profitable practice. However, the chance to gain a significant foothold in Charlotte hinged on the success of winning a bid to represent the state of North Carolina in a major campaign to attract new industry and tourism. The meeting she had scheduled with Leroy concerned the bid she planned to submit. Jean: Leroy, Im at a critical point in my business venture. If I can win the bid for the states advertising dollars, Ill be set. Winning the bid will bring 600,000 to 700,000 of revenues into the firm. On top of that, I estimate that the publicity will bring another 200,000 to 300,000 of new business. Leroy: I understand. My boss is anxious to win that business as well. It would mean a huge increase in profits for my firm. Its a competitive business, though. As new as you are, I doubt that youll have much chance of winning. Jean: Youre forgetting two very important considerations. First, I have the backing of all the resources and talent of a regional firm. Second, I have some political connections. Last year, I was hired to run the publicity side of the governors campaign. He was impressed with my work and would like me to have this business. I am confident that the proposals I submit will be very competitive. My only concern is to submit a bid that beats your firm. If I come in with a lower bid and good proposals, the governor can see to it that I get the work. Leroy: Sounds promising. If you do win, however, there will be a lot of upset people. After all, they are going to claim that the business should have been given to local advertisers, not to some out-of-state firm. Given the size of your office, youll have to get support from Atlanta. You could take a lot of heat. Jean: True. But I am the owner of the branch office. That fact alone should blunt most of the criticism. Who can argue that Im not a local? Listen, with your help, I think I can win this bid. Furthermore, if I do win it, you can reap some direct benefits. With that kind of business, I can afford to hire an accountant, and Ill make it worthwhile for you to transfer jobs. I can offer you an up-front bonus of 15,000. On top of that, Ill increase your annual salary by 20%. That should solve most of your financial difficulties. After all, we have been friends since day oneand what are friends for? Leroy: Jean, my wife would be ecstatic if I were able to improve our financial position as quickly as this opportunity affords. I certainly hope that you win the bid. What kind of help can I provide? Jean: Simple. To win, all I have to do is beat the bid of your firm. Before I submit my bid, I would like you to review it. With the financial skills you have, it should be easy for you to spot any excessive costs that I may have included. Or perhaps I included the wrong kind of costs. By cutting excessive costs and eliminating costs that may not be directly related to the project, my bid should be competitive enough to meet or beat your firms bid. Required: 1. What would you do if you were Leroy? Fully explain the reasons for your choice. What do you suppose the code of conduct for Leroys company would say about this situation? 2. What is the likely outcome if Leroy agrees to review the bid? Is there much risk to him personally if he reviews the bid? Should the degree of risk have any bearing on his decision?arrow_forwardDifferential Costing As pointed out earlier in Heres the Real Kicker, Kicker changed banks a couple of years ago because the loan officer at its bank moved out of state. Kicker saw that as an opportunity to take bids for its banking business and to fine-tune the banking services it was using. This problem uses that situation as the underlying scenario but uses three banks: FirstBank, Community Bank, and RegionalOne Bank. A set of representative data was presented to each bank for the purpose of preparing a bid. The data are as follows: Checking accounts needed: 6 Checks per month: 2,000 Foreign debits/credits on checking accounts per month: 200 Deposits per month: 300 Returned checks: 25 per month Credit card charges per month: 4,000 Wire transfers per month: 100, of which 60 are to foreign bank accounts Monthly credit needs (line of credit availability and cost): 100,000 average monthly usage These are overall totals for the six accounts during a month. Internet banking services? Knowledgeable loan officer? Responsiveness of bank? FirstBank Bid: Checking accounts: 5 monthly maintenance fee per account 0.10 foreign debit/credit 0.50 earned for each deposit 3 per returned check Credit card fees: 0.50 per item Wire transfers: 15 to domestic bank accounts, 50 to foreign bank accounts Line of credit: Yes, this amount is available, interest charged at prime plus 2%, subject to a 6% minimum interest rate Internet banking services? Yes, full online banking available: 15 one-time setup fee for each account 20 monthly fee for software module The loan officer assigned to the potential Kicker account had 10 years of experience with medium to large business banking and showed an understanding of the audio industry. Community Bank Bid: Checking accounts: No fees for the accounts, and no credits earned on deposits 2.00 per returned check Credit card fees: 0.50 per item, 7 per batch processed. Only manual processing was available, and Kicker estimated 20 batches per month Wire transfers: 30 per wire transfer Line of credit: Yes, this amount is available: interest charged at prime plus 2% subject to a 7% minimum interest rate Internet banking services? Not currently, but within the next 6 months The loan officer assigned to the potential Kicker account had 4 years of experience with medium to large business banking, none of which pertained to the audio industry. RegionalOne Bank Bid: Checking accounts: 5 monthly maintenance fee per account to be waived for Kicker 0.20 foreign debit/credit 0.30 earned for each deposit 3.80 per returned check Credit card fees: 0.50 per item Wire transfers: 10 to domestic bank accounts, 55 to foreign bank accounts Line of credit: Yes, this amount is available: interest charged at prime plus 2% subject to a 6.5% minimum interest rate Internet banking services? Yes, full online banking available: one-time setup fee for each account waived for Kicker 20 monthly fee for software module The loan officer assigned to the potential Kicker account had 2 years of experience with large business banking. Another branch of the bank had expertise in the audio industry and would be willing to help as needed. This bank was the first one to submit a bid. Required: 1. Calculate the predicted monthly cost of banking with each bank. Round answers to the nearest dollar. 2. CONCEPTUAL CONNECTION Suppose Kicker felt that full online Internet banking was critical. How would that affect your analysis from Requirement 1? How would you incorporate the subjective factors (e.g., experience, access to expertise)?arrow_forwardFlexible budgeting, performance measurement, and ethics Montevideo Manufacturing, Inc. produces a single type of small motor. The bookkeeper who does not have an in-depth understanding of accounting principles prepared the following performance report with the help of the production manager. In a conversation with the sales manager, the production manager was overheard saying, You sales guys really messed up our May performance, and it is only because production did such a great job controlling costs that we arent in even worse shape. Required: 1. Do you agree with the production manager that the manufacturing area did a good job of controlling costs? 2. Prepare a flexible budget for Montevideo Manufacturings expenses at the following activity levels: 45,000 units, 50,000 units, and 55,000 units. 3. Prepare a revised performance report, using the most appropriate flexible budget from (2) above. 4. Now what is your response to the production managers claim? 5. Assume that you have just been hired as the new accountant. You observe that the production manager is about to receive a large bonus based on the favorable materials, labor, and factory overhead variances indicated in the flexible budget prepared by the bookkeeper. Using the IMA Statement of Ethical Professional Practice as your guide, what standards, if any, apply to your responsibilities in this matter?arrow_forward

- 2 Uma has heard about cost-volume-profit analysis and wants to know how it applies to her business. The cost accountant at the soda factory is constantly rambling about break-even and margin of safety. Uma wants comprehensive analysis and recommendations on how her business can be run as effectively as possible.arrow_forwardEthics and pricing. Instyle Interior Designs has been requested to prepare a bid to decorate four model homes for a new development. Winning the bid would be a big boost for sales representative Jim Doogan, who works entirely on commission. Sara Groom, the cost accountant for Instyle, prepares the bid based on the following cost information: Based on the company policy of pricing at 120% of full cost, Groom gives Doogan a figure of $165,600 to submit for the job. Doogan is very concerned. He tells Groom that at that price, Instyle has no chance of winning the job. He confides in her that he spent $600 of company funds to take the developer to a basketball playoff game where the developer disclosed that a bid of $156,000 would win the job. He hadn’t planned to tell Groom because he was confident that the bid she developed would be below that amount. Doogan reasons that the $600 he spent will be wasted if Instyle doesn’t capitalize on this valuable information. In any case, the company…arrow_forwardSEARCH ASK CHAT MATH SOLVER Question A local coffee shop has two major product lines—drinks and pastries. If the manager allocates common costs on any objective basis discussed in this chapter, the drinks are profitable, but the pastries are not. The manager is concerned that the supervisor at corporate headquarters will drop the pastries. The manager is concerned because a relative, who is struggling to make a go of a new business, supplies pastries to the coffee shop. The manager, therefore, decides to allocate all common costs to the drinks because “Drinks can afford to absorb these costs until we get the pastries line on its feet.” After assigning all common costs to drinks, both the drinks and pastries product lines appear to be marginally profitable. Consequently, corporate headquarters decides to continue the pastries line. Required How would you recommend the manager allocate the common costs between drinks and pastries? You are the assistant…arrow_forward

- You work for Alphabet Holdings Plc as a junior management accountant. The board of directors are considering ways to improve the suboptimal performance of an investment in a manufacturing company called DEF products Ltd. As you can see from the table below the directors are considering closing products Bozon and Carbon in an effort to improve overall profitability. You spot that marginal costing would show the results differently and may affect the directors’ decision. Requirements for Question 2 Use your knowledge of management accounting and marginal costing to calculate the contribution of each product Use your findings from part (a) and appropriate academic references to explain whether the company should stop making product Bozon Use your findings from part (a) and appropriate academic references to explain whether the company should stop making product Carbon Discuss how and why marginal costing calculates contribution to pay overheads and why this is…arrow_forwardLife-Cycle Costing Kate Stephens, the COO of BioDerm, has asked her cost management team for a product-line profitability analysis for her firm’s two products, Xderm and Yderm. The two skin care products require a large amount of research and development and advertising. After receiving the following statement from BioDerm’s accountants, Kate concludes that Xderm is the more profitable product and that perhaps cost-cutting measures should be applied to Yderm: 1.Suppose that 75% of the R&D and selling expenses are traceable to Xderm. Using this assumption, compute the life-cycle income for each product and the return on sales for each product. See attachment. Please explain. Thanks!arrow_forwardLife-Cycle Costing Kate Stephens, the COO of BioDerm, has asked her cost management team for a product-line profitability analysis for her firm’s two products, Xderm and Yderm. The two skin care products require a large amount of research and development and advertising. After receiving the following statement from BioDerm’s accountants, Kate concludes that Xderm is the more profitable product and that perhaps cost-cutting measures should be applied to Yderm: Required Explain why Kate may be wrong in her assessment of the relative performance of the two products. Suppose that 75% of the R&D and selling expenses are traceable to Xderm. Using this assumption, compute the life-cycle income for each product and the return on sales for each product. Consider your answers to requirements 1 and 2 with the following additional information: R&D and selling expenses are substantially higher for Xderm because it is a new product. Kate has strongly supported development of the new…arrow_forward

- Frank Corporation evaluates its managers based on return on investment (ROI). Hazel B and Sarah D, managers of the electronics and housewares departments respectively, have recently suffered from declining profits in their departments. Over lunch, they discuss the problem, and how they could improve performance. Most of the discussion centers around ways to increase sales. Near the end of the lunch period, however, Sarah remarks that there are two components to consider, and that they have considered only one. She wonders whether there is some way to reduce investment, and by decreasing the denominator of the ROI fraction, to improve the final result. Back at work, Hazel continues to mull over Sarah's remarks. She decides to pursue the matter further, and before the end of the quarter she has sold quite a bit of older equipment and replaced it with equipment obtained with a short-term lease. Her performance, measured by ROI, is markedly improved, although sales continue to be…arrow_forwardREQUIREMENT: Ethical behaviour for managers and management accountants Question Asma is a junior management accountant at Flower Cloth Ltd. Asma is given the task of compiling a cost-benefit analysis report on whether the company should purchase an expensive new machine from Radi Ltd, where her brother is the new sales manager. Asma did not tell anyone in Flower Cloth about her brother’s new job. In preparing her report, Asma overstates the qualitative benefits and understates the costs associated with this new machine to help her brother make his first sales as the new sales manager. Required: Discuss why and how Asma has deviated from the standards of ethical conduct.arrow_forwardEthics and a Cost-Volume-Profit Application Danna Lumus, the marketing manager for a division that produces a variety of paper products, is considering the divisional manager's request for a sales forecast for a new line of paper napkins. The divisional manager has been gathering data so that he can choose between two different production processes. The first processwould have a variable cost of $10 per case produced and total fixed cost of $100,000. The second process would have a variable cost of $6 per case and total fixed cost of $200,000. The selling pricewould be $30 per case. Danna had just completed a marketing analysis that projects annual sales of 30,000 cases. Danna is reluctant to report the 30,000 forecast to the divisional manager. She knows that the first process would be labor intensive, whereas the second would be largely automated with little labor and no requirement for an additional production supervisor. If the first process is chosen, Jerry Johnson, a good friend,…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning