MANAGERIAL ACCTG W/MYLAB FDOC

5th Edition

ISBN: 9780136471868

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.20AE

Compute and interpret the expanded

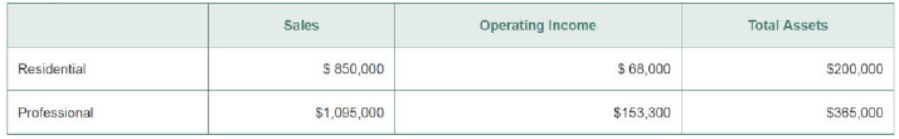

Rogers, a national manufacturer of lawn-mowing and snow-blowing equipment, segments its business according to customer type: Professional and Residential. Assume the following divisional information was available for the past year (in thousands of dollars):

Assume that management has a 25% target

Requirements

Round all of your answers to four decimal places.

- 1. Calculate each division’s ROI.

- 2. Calculate each division’s sales margin. Interpret your results.

- 3. Calculate each division’s capital turnover. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude?

- 5. Calculate each division’s residual income (RI). Interpret your results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using ROI and RI to evaluate investment centers

Zims, a national manufacturer of lawn-mowing and snow-blowing equipment, segments its business according to customer type: professional and residential. The following divisional information was available for the past year:

Management has 21 26% target rate of return for each division.

Requirements

Calculate each division’s ROI. Round all of your answers to four decimal places.

Calculate each division’s profit margin ratio. Interpret your results.

Calculate each division’s asset turnover ratio. Interpret your results.

Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude.

Please step by step process.

Professor von Nordenflycht presents Dean Kayande with two new proposals for offering a graduate certificate program. Both programs will cost $60,000, for classroom and instructor time. Both programs are projected to have two possible revenue outcomes. Program 1, which focuses on accounting, is projected to have a 50% chance of generating $150,000 in revenue and a 50% chance of generating $100,000 in revenue. Project 2, which focuses on cryptocurrencies, is predicted to have a 62.5% chance of generating $200,000 in revenue or, otherwise, generating no revenue!

a. What is the expected value of each program?

b. What is the variance of each program?

A professional division at a business school provides several development programs that have been tailored to the specific training needs of both the public and private sectors. The program director is planning to offer a one-full-day course in risk management to be sold at $2,250 plus orientation fee (5%) per participant. The division incurs a cost of $45,000 for promotion, classroom space, staff and instructor’s salary, as well as a cost of $240 per participant for refreshments, lunch, course material, a gift package, and a framed certificate of completion. How many participants need to register in the course for it to be worthwhile to offer it? Round to two decimal places.

Group of answer choices

21.20

26.86

36.72

Chapter 10 Solutions

MANAGERIAL ACCTG W/MYLAB FDOC

Ch. 10 - (Learning Objective 1) Companies often...Ch. 10 - (Learning Objective 1) Which of the following is...Ch. 10 - (Learning Objective 1) In terms of responsibility...Ch. 10 - (Learning Objective 2) Which of the following is...Ch. 10 - (Learning Objective 2) A segment margin is the...Ch. 10 - Prob. 6QCCh. 10 - Prob. 7QCCh. 10 - Prob. 8QCCh. 10 - Prob. 9QCCh. 10 - Prob. 10QC

Ch. 10 - Identify and understand responsibility centers...Ch. 10 - Identify types of responsibility centers (Learning...Ch. 10 - Identify centralized and decentralized...Ch. 10 - Prob. 10.4SECh. 10 - Prob. 10.5SECh. 10 - Prob. 10.6SECh. 10 - Calculate ROI (Learning Objective 3) Refer to Epic...Ch. 10 - Prob. 10.8SECh. 10 - Prob. 10.9SECh. 10 - Prob. 10.10SECh. 10 - Prob. 10.11SECh. 10 - Interpret a performance report (Learning Objective...Ch. 10 - Prob. 10.13SECh. 10 - Classify KPIs by balanced scorecard perspective...Ch. 10 - Use vocabulary terms (Learning Objectives 1, 2, 3,...Ch. 10 - Prob. 10.16SECh. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prepare a segment margin performance report...Ch. 10 - Compute and interpret the expanded ROI equation...Ch. 10 - Prob. 10.21AECh. 10 - Prob. 10.22AECh. 10 - Comparison of ROI and residual income (Learning...Ch. 10 - Prob. 10.24AECh. 10 - Comprehensive flexible budget problem (Learning...Ch. 10 - Prepare a flexible budget performance report...Ch. 10 - Work backward to find missing values (Learning...Ch. 10 - Construct a balanced scorecard (Learning Objective...Ch. 10 - Sustainability and the balanced scorecard...Ch. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prob. 10.32BECh. 10 - Prob. 10.33BECh. 10 - Prob. 10.34BECh. 10 - Prob. 10.35BECh. 10 - Prob. 10.36BECh. 10 - Prob. 10.37BECh. 10 - Prob. 10.38BECh. 10 - Prob. 10.39BECh. 10 - Prob. 10.40BECh. 10 - Prob. 10.41BECh. 10 - Sustainability and the balanced scorecard...Ch. 10 - Prepare a budget with different volumes for...Ch. 10 - Prepare and interpret a performance report...Ch. 10 - Prob. 10.45APCh. 10 - Prob. 10.46APCh. 10 - Prob. 10.47APCh. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.49BPCh. 10 - Prob. 10.50BPCh. 10 - Evaluate divisional performance (Learning...Ch. 10 - Prob. 10.52BPCh. 10 - Determine transfer price at a manufacturer under...Ch. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.55SC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.You are required to submit this assignment to LopesWrite. Please refer to the directions in the Student Success Center.Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm was founded 5 years ago to provide educational software for the rapidly expanding primary and secondary school markets. Although EduSoft has done well, the firm's founder believes an industry shakeout is imminent. To survive, EduSoft must grab market share now, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price to follow suit, Mr. Duncan does not think it would be wise to issue new common stock at this time. On the other hand, interest rates are currently high by historical standards, and the firm's B rating means that interest payments on a new debt issue would be prohibitive.…arrow_forwardGipps Business College (GBC) has two degree programs, undergraduate (UG) and graduate (GRAD) and three service departments, information technology (IT), Event Planning (EP), and Career Services (CS). The CFO of GBC is conducting a profitability analysis of the two programs and wants to include the appropriate costs of the service departments in the costs of the two degree programs. As a part of the analysis, the CFO has collected the following usage patterns of the ser vice departments over the last two years. Using Departments Suppying Department IT EP CS UG GRAD IT 0 10% 20% 40% 30% EP 0 0 25% 25% 50% CS 0 0 0 60% 40% Direct Costs $ 70,000.00 $ 90,000.00 $ 100,000.00 To be determined Required:- a.) The CFO is unsure what the best way to allocate the cost is and has asked you for the allocations to the UG and GRAD programs using: The direct method; The step method starting with IT, followed by EP,…arrow_forwardCorporation is preparing its balanced scorecard for the past quarter. The balanced scorecard contains four perspectives: financial, customer, internal business process, and learning and growth. asap need help thanks ss attachedarrow_forward

- Profit Planning and Control This case is a manufacturer and could make specialty bikes, ski or outdoor equipment, computers, food like chocolates, saltwater taffy, cookies, or donuts, etc. Create the balance sheet, income statement, and statement of the cash flow from the following information. Use the following information for the learning experiences Sales volume units = 11,000 Sales price/unit = $100 Variable manufacturing costs/unit = $60 Fixed manufacturing costs = $210,000 Fixed sales & administration costs = $190,000 Business income tax rate = 25% Current assets = $250,000 (Cash $50,000, Accounts Receivables $100,000, Inventory $100,000) Fixed assets = $750,000 Current liabilities = $200,000 (Accounts Payable $100,000, Short Term Debt $100,000) Long Term Debt = $300,000 Owners' Equity = $500,000arrow_forwardBordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is paid 25 per hour. Required: 1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total production of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, cumulative total time in hours, and the time for the last unit. Show results by row for each of units one through eight. (Round answers to two significant digits.)arrow_forwardMerkley Company, a manufacturer of machine parts, implemented lean manufacturing at the end of 20X1. Three value streams were established: one for new product development and two order fulfillment value streams. One of the value streams set a goal to increase its ROS to 45% of sales by the end of the year. During the year, the value stream made significant improvements in several areas. The Box Scorecard below was prepared, with performance measures for the beginning of the year, midyear, and end of year. Although the members of the value stream were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 45%. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first 6 months? The second 6 months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected.arrow_forward

- Each of the following scenarios requires the use of accounting information to carry out one or more of the following managerial activities: (1) planning, (2) control and evaluation, (3) continuous improvement, or (4) decision making. a. MANAGER: At the last board meeting, we established an objective of earning an after-tax profit equal to 20 percent of sales. I need to know the revenue that we need to earn in order to meet this objective, given that we have 250,000 to spend on the promotional campaign. Once I have estimated sales in units, we then need to outline a promotional campaign that conforms to our budget and that will take us where we want to be. However, to compute the targeted sales revenue, I need to know the unit sales price, the unit variable cost, and the associated fixed production and support costs. I also need to know the tax rate. b. MANAGER: We have problems with our procurement process. Our accounts payable department is spending 80 percent of its time resolving discrepancies between the purchase order, receiving order, and suppliers invoice. Incorrect part numbers on the purchase orders, incorrect quantities ordered, and wrong parts sent (or the incorrect quantity) are just a few examples of sources of discrepancies. A complete redesign of the process has been suggested, which will allow us to eliminate virtually all of the errors and, at the same time, significantly reduce the number of clerks needed in purchasing, receiving, and accounts payable. This redesign promises to significantly reduce costs, decrease lead time, and increase customer satisfaction. c. MANAGER: This overhead cost report indicates that we have spent significantly more on inspection, purchasing, and production than was budgeted. An investigation has revealed that the source of the problem is faulty components from suppliers. A supplier evaluation has revealed that by selecting five suppliers with the best quality records (out of 15 currently used), the number of defective components will be dramatically reduced, thus producing significant overhead savings by reducing the demand for inspections, reordering, and rework. d. MANAGER: A large local firm has approached me and has offered to sell us one of the components used in our small enginesa component that we are currently producing internally. I need to know costs that we would avoid if this component is purchased so that I can assess the economic merits of this offer. e. MANAGER: Currently, our deluxe lawn mower is losing money. We need to increase profits. I would like to know how much our profits would be if we reduce our variable costs by 50 per mower while maintaining our current sales volume. Also, marketing claims that if we increase advertising expenditures by 1,000,000 and cut prices by 15 percent, we can increase the number of mowers sold by 25 percent. I would like to know which approach offers the most profit, or if a combination of the approaches may be best. f. MANAGER: We are implementing a major quality improvement program. We will be increasing the investment in prevention and detection activities with the expectation of driving down both internal and external failure costs. I expect to see trend reports for all categories of quality costs. I want to see if improving quality really does reduce costs and improve profitability. g. MANAGER: Our engineering design department has proposed a new design for our product. The new design promises to reduce post-purchase costs and, as a consequence, increase market share. I need to know the cost of producing this new design because it uses some new components and requires some different manufacturing processes. I would then like to have a projected income statement based on the new market share and new production costs. The planned selling price will be the same, or maybe even 10 percent lower. Projections based on the two price scenarios would be needed. h. MANAGER: My engineers have said that by redesigning our two main production processes, we can reduce move time by 90 percent and wait time by 85 percent. This would decrease cycle time and virtually eliminate the need to carry finished goods inventories. On-time deliveries would also increase dramatically. This would produce cost savings of nearly 20,000,000 per year. Market share and revenues would also increase. Required: 1. Describe each of the four managerial responsibilities. 2. Identify the managerial activity or activities applicable for each scenario, and indicate the role of accounting information in the activity.arrow_forwardUsing ROI and RI to evaluate investment centers Wolf Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through home improvement stores), Automotive (sales to auto manufacturers), International, and Administration. The following is selected divisional information for its two largest divisions: Paint Stores and Consumer. Management has specified a 21% target rate of return. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate each division’s RI. Interpret your results, and offer a recommendation for any division with negative RI. Describe some of the factors that management considers when…arrow_forwardDuncan’s Pizzas is a chain of pizza stores. Pizzas are made fresh in-store, and then delivered to customers by a fleet of drivers. The senior management team has identified the strategic priorities for the business as on-time delivery and product quality.Required:a) For each of the strategic priorities, suggest three performance measures. b) If the company is successful in achieving challenging targets for these performance measures, will it also necessarily achieve high profitability? Explain your answer. (maximum 400 words)arrow_forward

- Using ROI and RI to evaluate investment centers XTreme Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and inline skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-snow Sports. The following divisional information is available for the past year: XTreme’s management has specified a 13% target rate of return. Calculate each division’s profit margin ratio. Interpret your results.arrow_forwardUsing ROI and RI to evaluate investment centers Tiger Paints is a national paint manufacturer and retailer. The company is segmented into five divisions: Paint Stores (branded retail locations), Consumer (paint sold through home improvement stores), Automotive (sales to auto manufacturers), International, and Administration. The following is selected divisional information for its two largest divisions: Paint Stores and Consumer: Management has specified a 19% target rate of return. Requirements Calculate each division’s ROI. Round all of your answers to four decimal places. Calculate each division’s profit margin ratio. Interpret your results. Calculate each division’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate each division’s RI. Interpret your results, and offer a recommendation for any division with negative RI. Describe some of the factors that management considers when…arrow_forwardPerformance Aid, Inc. has two divisions: Test Preparation and Language Arts. Results (in millions) for the past three years are partially displayed here: Q.Complete the table by filling in the blanks.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Why do we need accounting?; Author: EconClips;https://www.youtube.com/watch?v=weCXE2wIl90;License: Standard Youtube License