"I know headquarters wants us to add that new product line.” said Dell Havasi, manager of Billings Company's Office Products Division. "But I want to see the numbers before I make any move. Our division's return on investment (ROI) has led the company for three years, and I don't want any letdown".

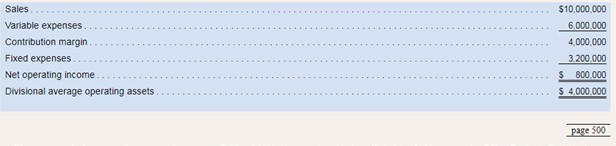

Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROLs. Operating results for the company's Office Products Division for this year are given below:

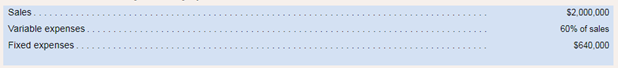

The company had an overall return on investment [ROI) of 15% this year [considering all divisions). Next year the Office Products Division has an opportunity to add a new product line that would require an additional investment that would increase average operating assets by $1,000,000. The cost and revenue characteristics of the new product line per year would be: Required:

Required:

1. Compute the Office Products Division's ROI for this year.

7. Compute the Office Products Division's ROI for the new product line by itself.

3. Compute the Office Products Division's ROI for next year assuming that it performs the same as this year and adds the new product line.

4. If you were in Dell Havasi's position, would you accept or reject the new product line? Explain.

5. Why do you suppose headquarters is anxious for the Office Products Division to add the new product line?

6. Suppose that the company's minimum required

a. Compute the Office Products Division's residual income for this year.

b. Compute the Office Products Division's residual income for the new product line by itself.

c. Compute the Office Products Division's residual income for next year assuming that it performs the same as this year and adds the new product line.

d. Using the residual income approach, if you were in Dell Havasi's position, would you accept or reject the new product line? Explain.

1)

Return on Investment, Margin and Turnover:

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year

Answer to Problem 18P

Solution:

The Return on Investment for the year is 3.2%

Explanation of Solution

- Given:

Sales = $10,000,000

Variable Expense = $6,000,000

Fixed Expenses=$3,200,000

Cost of capital = 15%

Average Operating Assets = $4,000,000

Calculations:

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover.

2)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the product line

Answer to Problem 18P

Solution:

The Return on Investment for the product line is 4%

Explanation of Solution

- Given: Sales = $2,000,000

Variable Expense = $1,200,000

Fixed Expenses=$640,000

Cost of capital = 15%

Average Operating Assets = $1,000,000

- Formulae used:

Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover.

3)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Return on Investment for the year with new product.

Answer to Problem 18P

Solution:

The Return on Investment for the year is 3.33%

Explanation of Solution

- Given: Sales = $12,000,000 [$10,000,000 + $2,000,000]

Variable Expense = $7,200,000 [ $6,000,000 + $1,200,000]

Fixed Expenses=$3,840,000 [$3,200,000 + $640,000]

Cost of capital = 15%

Average Operating Assets = $5,000,000 [$4,000,000 + $1,000,000]

- Formulae used:

- Calculations:

- Margin is the percentage of Profit earned by an entity in a given reporting period. Profit is calculated as Revenues less Cost of Goods Sold and Indirect Expenses.

- Margin is Profit expressed in terms of Sales as a percentage.

- Turnover is the capital turnover ratio. This is calculated by dividing the sales by the average operating assets for the year.

- Return on Investment is calculated as Margin divided by Turnover.

- Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Hence it can be seen that the Return on Investment is calculated as Margin divided by Turnover.

4)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Whether to accept to reject the new product line.

Answer to Problem 18P

Solution:

The new product line must be accepted.

Explanation of Solution

- The return on investment of the company before the introduction of the product line is 3.2%.

- The return on investment of the new product is 4%

- Combined return on investment of the company after the introduction of the product is 3.33%

- The return on investment of the new product is greater than the return on investment of the company

- After introduction of the new product, sales, revenues and operating assets of the company all increase and consequently so does the return on investment.

- Hence since the return on investment is increasing, the new product may be accepted.

Hence the new product line may be accepted as the return on investment of the product is positive and the return on investment of the company increases after the new product line is accepted.

5)

Return on Investment, Margin and Turnover

Return on Investment is calculated as Margin divided by Turnover. Here Margin refers to the Sales Margin and Turnover refers to the Capital Turnover Ratio.

Return on Investment calculations are important from a business standpoint as they help in evaluation of new investment proposals, make or buy decisions, capital expenditure projects and whether to invest in a particular company or not.

Why the company is eager to add the new product line.

Answer to Problem 18P

Solution:

The company is eager to add the new product line since the roi of the company increases, after introduction of the new product line.

Explanation of Solution

- The return on investment of the company before the introduction of the product line is 3.2%.

- The return on investment of the new product is 4%

- Combined return on investment of the company after the introduction of the product is 3.33%

- The return on investment of the new product is greater than the return on investment of the company

- After introduction of the new product, sales, revenues and operating assets of the company all increase and consequently so does the return on investment

- Return on investment as an investment measure seeks to accept any investment proposal that generates positive returns.

- In the given instance, the return on investment of the new product line results in a boost in the return on investment of the company and hence the eagerness of the company to add the new product line is justified.

Hence it can be seen that the new product line is profitable and hence the company is eager to add the same to its operations.

6)

a)

Residual Income

In investment accounting, residual income is the income over the minimum expected rate of return or cost of capital. Hence residual income is calculated as Net Operating Income for the year less the cost of capital.

Net Operating Income is the net operating income for the year and Cost of capital is Minimum rate of return expected from average operating assets for the year.

Residual Income for the year

Answer to Problem 18P

Solution:

Residual Income is $320000.

Explanation of Solution

- Given: Sales = $10,000,000

Variable Expense = $6,000,000

Fixed Expenses=$3,200,000

Cost of capital = 12%

Average Operating Assets = $4,000,000

Formulae used:

- Calculations:

- In any organization, the capital invested carries a cost. This cost can be in the form of dividends on shareholder capital.

- To evaluate the investment proposal, the residual income approach is used. Under this approach, the Residual income is calculated as Net Operating Income for the year less the Cost of capital for the year.

- Cost of capital is calculated as Average Operating Assets x Minimum rate of return expected and is expressed as an amount in value.

- Net Operating Income for the year is calculated as Revenues for the year less Cost of goods sold and indirect expenses such as administrative expenses, selling and distribution expenses etc.

- Residual Income is therefore the remainder of the Net Operating Income for the year after deducting the Cost of Equity capital.

Hence the residual income is calculated for the previous year.

6)

b)

Residual Income

In investment accounting, residual income is the income over the minimum expected rate of return or cost of capital. Hence residual income is calculated as Net Operating Income for the year less the cost of capital.

Net Operating Income is the net operating income for the year and Cost of capital is Minimum rate of return expected from average operating assets for the year.

Residual Income for the product line

Answer to Problem 18P

Solution:

Residual Income is $40,000.

Explanation of Solution

- Given: Sales = $2,000,000

Variable Expense = $1,200,000

Fixed Expenses=$640,000

Cost of capital = 12%

Average Operating Assets = $1,000,000

Formulae used:

- Calculations:

- In any organization, the capital invested carries a cost. This cost can be in the form of dividends on shareholder capital.

- To evaluate the investment proposal, the residual income approach is used. Under this approach, the Residual income is calculated as Net Operating Income for the year less the Cost of capital for the year.

- Cost of capital is calculated as Average Operating Assets x Minimum rate of return expected and is expressed as an amount in value.

- Net Operating Income for the year is calculated as Revenues for the year less Cost of goods sold and indirect expenses such as administrative expenses, selling and distribution expenses etc.

- Residual Income is therefore the remainder of the Net Operating Income for the year after deducting the Cost of Equity capital.

Hence the residual income is calculated for the product line.

6)

c)

Residual Income

In investment accounting, residual income is the income over the minimum expected rate of return or cost of capital. Hence residual income is calculated as Net Operating Income for the year less the cost of capital.

Net Operating Income is the net operating income for the year and Cost of capital is Minimum rate of return expected from average operating assets for the year.

Residual Income for the company after introduction of the product line

Answer to Problem 18P

Solution:

Residual Income is $360,000.

Explanation of Solution

- Given: Sales = $12,000,000 [$10,000,000 + $2,000,000]

Variable Expense = $7,200,000 [ $6,000,000 + $1,200,000]

Fixed Expenses=$3,840,000 [$3,200,000 + $640,000]

Cost of capital = 12%

Average Operating Assets = $5,000,000 [$4,000,000 + $1,000,000

Formulae used:

- In any organization, the capital invested carries a cost. This cost can be in the form of dividends on shareholder capital.

- To evaluate the investment proposal, the residual income approach is used. Under this approach, the Residual income is calculated as Net Operating Income for the year less the Cost of capital for the year.

- Cost of capital is calculated as Average Operating Assets x Minimum rate of return expected and is expressed as an amount in value.

- Net Operating Income for the year is calculated as Revenues for the year less Cost of goods sold and indirect expenses such as administrative expenses, selling and distribution expenses etc.

- Residual Income is therefore the remainder of the Net Operating Income for the year after deducting the Cost of Equity capital.

Hence the residual income is calculated for the previous year for the combined product lines of the company.

6)

d)

Residual Income as a tool for performance measurement.

In investment accounting, residual income is the income over the minimum expected rate of return or cost of capital. Hence residual income is calculated as Net Operating Income for the year less the cost of capital.

Net Operating Income is the net operating income for the year and Cost of capital is Minimum rate of return expected from average operating assets for the year.

Whether to accept or reject the product line based on residual income

Answer to Problem 18P

Solution:

The product line must be accepted as the residual income is positive.

Explanation of Solution

- In any organization, the capital invested carries a cost. This cost can be in the form of dividends on shareholder capital.

- To evaluate the investment proposal, the residual income approach is used. Under this approach, the Residual income is calculated as Net Operating Income for the year less the Cost of capital for the year.

- Cost of capital is calculated as Average Operating Assets x Minimum rate of return expected and is expressed as an amount in value.

- Net Operating Income for the year is calculated as Revenues for the year less Cost of goods sold and indirect expenses such as administrative expenses, selling and distribution expenses etc.

- Residual Income is therefore the remainder of the Net Operating Income for the year after deducting the Cost of Equity capital.

- In the given instance, the residual income of the new product line as well as the combined product lines of the entity after introduction of the new product line are positive.

- This means that the revenue from new product line exceeds the minimum return required from operating assets.

- Hence since the new product line is profitable, based on the residual income earned, the new product line must be accepted.

Hence the usage of residual income approach to evaluate investment opportunities can be seen.

Want to see more full solutions like this?

Chapter 10 Solutions

Introduction To Managerial Accounting

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardSuspicious Acquisition of Data, Ethical Issues Bill Lewis, manager of the Thomas Electronics Division, called a meeting with his controller, Brindon Peterson, and his marketing manager, Patty Fritz. The following is a transcript of the conversation that took place during the meeting: Bill: Brindon, the variable costing system that you developed has proved to be a big plus for our division. Our success in winning bids has increased, and as a result our revenues have increased by 25%. However, if we intend to meet this years profit targets, we are going to need something extraam I right, Patty? Patty: Absolutely. While we have been able to win more bids, we still are losing too many, particularly to our major competitor, Kilborn Electronics. If we knew more about their bidding strategy, we could be more successful at competing with them. Brindon: Would knowing their variable costs help? Patty: Certainly. It would give me their minimum price. With that knowledge, Im sure that we could find a way to beat them on several jobs, particularly on those jobs where we are at least as efficient. It would also help us to identify where we are not cost competitive. With this information, we might be able to find ways to increase our efficiency. Brindon: Well, I have good news. Ive been talking with Carl Penobscot, Kilborns assistant controller. Carl doesnt feel appreciated by Kilborn and wants to make a change. He could easily fit into our team here. Plus, Carl has been preparing for a job switch by quietly copying Kilborns accounting files and records. Hes already given me some data that reveal bids that Kilborn made on several jobs. If we can come to a satisfactory agreement with Carl, hell bring the rest of the information with him. Well easily be able to figure out Kilborns prospective bids and find ways to beat them. Besides, I could use another accountant on my staff. Bill, would you authorize my immediate hiring of Carl with a favorable compensation package? Bill: I know that you need more staff, Brindon, but is this the right thing to do? It sounds like Carl is stealing those files, and surely Kilborn considers this information confidential. I have real ethical and legal concerns about this. Why dont we meet with Laurie, our attorney, and determine any legal problems? Required: 1. Is Carls behavior ethical? What would Kilborn think? 2. Is Bill correct in supposing that there are ethical and/or legal problems involved with the hiring of Carl? (Reread the section on corporate codes of conduct in Chapter 1.) What would you do if you were Bill? Explain.arrow_forwardJarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forward

- Keep or Drop a Division Jan Shumard, president and general manager of Danbury Company, was concerned about the future of one of the companys largest divisions. The divisions most recent quarterly income statement follows: Jan is giving serious consideration to shutting down the division because this is the ninth consecutive quarter that it has shown a loss. To help him in his decision, the following additional information has been gathered: The division produces one product at a selling price of 100 to outside parties. The division sells 50% of its output to another division within the company for 83 per unit (full manufacturing cost plus 25%). The internal price is set by company policy. If the division is shut down, the user division will buy the part externally for 100 per unit. The fixed overhead assigned per unit is 20. There is no alternative use for the facilities if shut down. The facilities and equipment will be sold and the proceeds invested to produce an annuity of 100,000 per year. Of the fixed selling and administrative expenses, 30% represent allocated expenses from corporate headquarters. Variable selling expenses are 5 per unit sold for units sold externally. These expenses are avoided for internal sales. No variable administrative expenses are incurred. Required: 1. Prepare an income statement that more accurately reflects the divisions profit performance. 2. Should the president shut down the division? What will be the effect on the companys profits if the division is closed?arrow_forwardSegmented Income Statement, Management Decision Making FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows: Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTimes vice president of marketing. Required: 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by 1,000 (250 for the scented line and 750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information? 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines? 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forward

- Aldovar Company produces a variety of chemicals. One division makes reagents for laboratories. The divisions projected income statement for the coming year is: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. (Note: Round answer to the nearest unit.) Calculate the contribution margin ratio and use it to calculate the break-even sales revenue. (Note: Round contribution margin ratio to four decimal places, and round the break-even sales revenue to the nearest dollar.) 2. The divisional manager has decided to increase the advertising budget by 250,000. This will increase sales revenues by 1 million. By how much will operating income increase or decrease as a result of this action? 3. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000. Without preparing a new income statement, by how much are profits underestimated? 4. Compute the margin of safety based on the original income statement. 5. Compute the degree of operating leverage based on the original income statement. If sales revenues are 8% greater than expected, what is the percentage increase in operating income? (Note: Round operating leverage to two decimal places.)arrow_forwardDantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward

- “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make a decision. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated using ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,440,000 Variable expenses 14,094,600 Contribution margin 8,345,400 Fixed expenses 6,130,000 Net operating income $ 2,215,400 Divisional average operating assets $ 4,480,000 The company had an overall return on investment (ROI) of 18.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product requiring $2,430,600 of…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,505,000 Variable expenses 14,105,500 Contribution margin 8,399,500 Fixed expenses 6,145,000 Net operating income $ 2,254,500 Divisional average operating assets $ 4,687,500 The company had an overall return on investment (ROI) of 17.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product line that…arrow_forward“I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings Company’s Office Products Division. “But I want to see the numbers before I make any move. Our division’s return on investment (ROI) has led the company for three years, and I don’t want any letdown.” Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to the divisional managers who have the highest ROIs. Operating results for the company’s Office Products Division for this year are given below: Sales $ 22,505,000 Variable expenses 14,105,500 Contribution margin 8,399,500 Fixed expenses 6,145,000 Net operating income $ 2,254,500 Divisional average operating assets $ 4,687,500 The company had an overall return on investment (ROI) of 17.00% this year (considering all divisions). Next year the Office Products Division has an opportunity to add a new product line that…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning