College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 1E

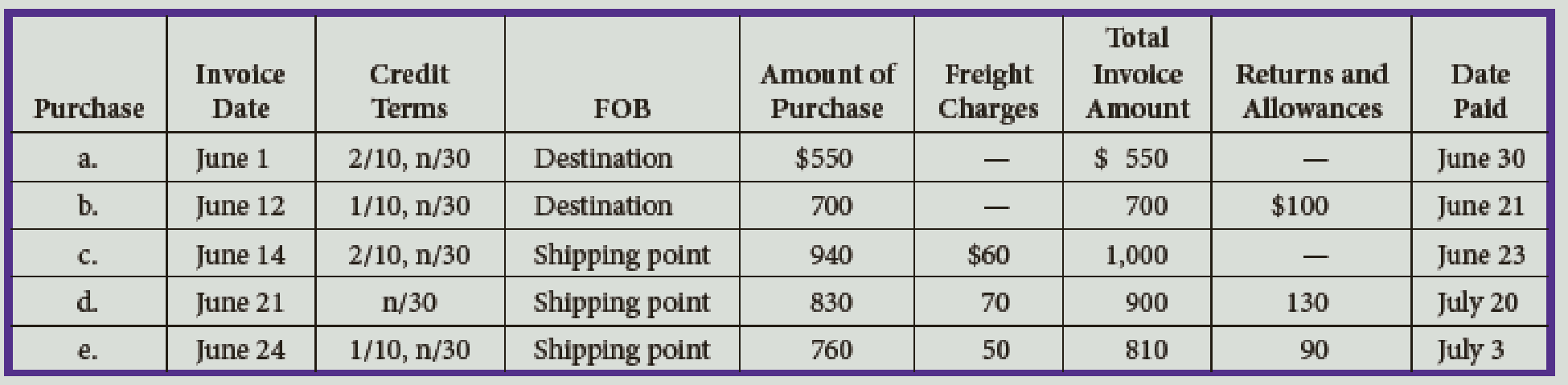

For the following purchases of merchandise, determine the amount of cash to be paid.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

Ch. 10 - What do credit terms of 2/10, n/30 mean? 210 days...Ch. 10 - What is the entry to record the cash received on a...Ch. 10 - Prob. 3QYCh. 10 - Which of the following is not an advantage of the...Ch. 10 - Prob. 5QYCh. 10 - What is the normal balance for each of the...Ch. 10 - What does an X under the total of a special...Ch. 10 - Prob. 3DQCh. 10 - In a cash receipts journal, both the Accounts...Ch. 10 - If a cash payments journal is supposed to save...

Ch. 10 - Describe the posting procedure for a cash payments...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - For the following purchases of merchandise,...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Record the following transactions in general...Ch. 10 - Prob. 5ECh. 10 - Record general journal entries to correct the...Ch. 10 - Label the blanks in the column heads as either...Ch. 10 - Prob. 8ECh. 10 - Prob. 9ECh. 10 - Indicate the journal in which each of the...Ch. 10 - The following transactions were completed by...Ch. 10 - Preston Company sells candy wholesale, primarily...Ch. 10 - MacDonald Bookshop had the following transactions...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by Yang...Ch. 10 - C. R. McIntyre Company sells candy wholesale,...Ch. 10 - Prob. 3PBCh. 10 - The following transactions were completed by Yang...Ch. 10 - The following transactions were completed by...Ch. 10 - Prob. 1ACh. 10 - You are the manager of the Accounts Receivable...Ch. 10 - Prob. 3ACh. 10 - Suppose we collected cash from a charge customer...Ch. 10 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (4th Edition)

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Calculating certain information using the direct method (Learning Objective 4) 20-25 min. Trudeaus Marine, Inc....

Financial Accounting, Student Value Edition (5th Edition)

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following accounts are used when recording a purchase? A. cash, merchandise inventory B. accounts payable, merchandise inventory C. A or B D. cash, accounts payablearrow_forwardName two situations where cash would be remitted to a customer from a retailer after purchase.arrow_forwardWe record purchases of inventory for cash in which journal(s)?arrow_forward

- The journal that should be used to record the return of merchandise for credit is the (a) purchases journal. (b) cash payments journal. (c) general journal. (d) accounts payable journal.arrow_forwardName two situations where cash would be remitted to a retailer from a manufacturer after purchase.arrow_forwardWhich of the following accounts are used when recording a purchase using a periodic inventory system? A. cash, purchases B. accounts payable, sales C. accounts payable, accounts receivable D. cash, merchandise inventoryarrow_forward

- Which of the following accounts are used when recording the sales entry of a sale on credit? A. merchandise inventory, cash B. accounts receivable, merchandise inventory C. accounts receivable, sales D. sales, cost of goods soldarrow_forwardCan a sales journal be used to record sales on account and a cash sale? Why or why not?arrow_forwardFor each of the following accounts, identify whether the normal balance is a debit or a credit. Also specify whether the account is a contra account. a. Sales Returns and Allowances b. Merchandise Inventory c. Sales d. d Freight In e. Purchases Returns and Allowances f. Sales Tax Payable g. Purchasesarrow_forward

- Which two accounts are used to recognize shipping charges for a buyer, assuming the buyer purchases with cash and the terms are FOB Shipping Point? A. delivery expense, cash B. merchandise inventory, cash C. merchandise inventory, accounts payable D. The buyer does not record anything for shipping since it is FOB Shipping Point.arrow_forwardIf a customer pays with a credit card and the service has been provided, which of the following accounts will be used to record the sales entry for this transaction? A. Cost of Goods Sold, Merchandise Inventory, Sales Revenue B. Sales Revenue, Credit Card Expense, Accounts Receivable C. Accounts Receivable, Merchandise Inventory, Credit Card Expense D. Cost of Goods Sold, Credit Card Expense, Sales Revenuearrow_forwardPurchases on account of merchandise for resale would be recorded in the _______________. a. Sales journal b. Purchases journal c. Cash receipts journal d. Cash payments journal e. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License