College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 4E

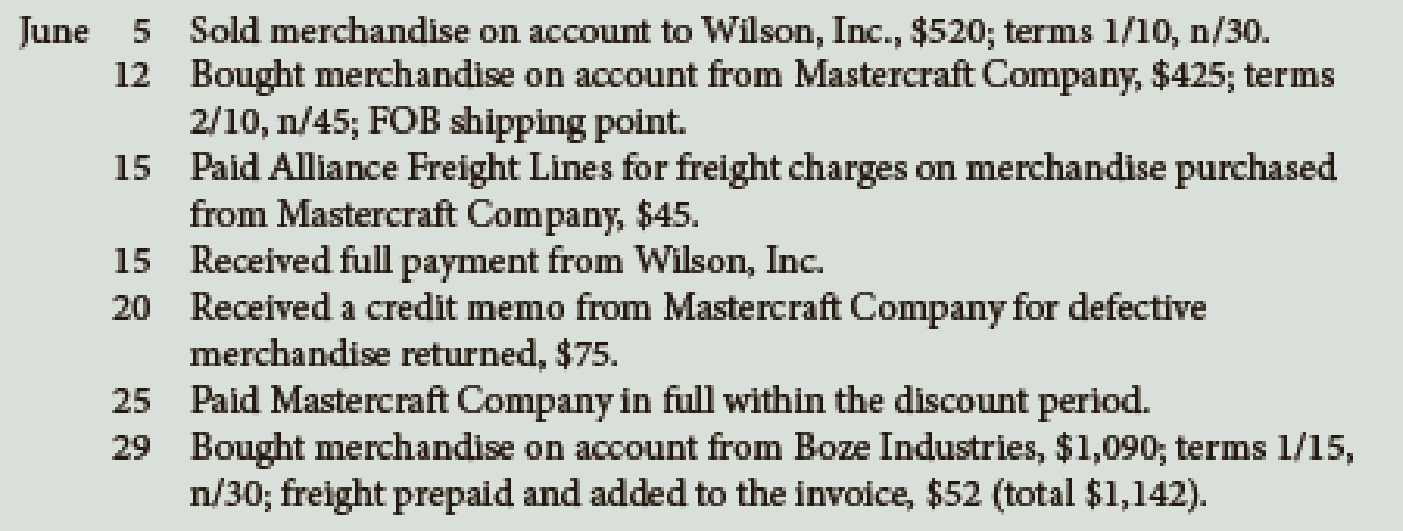

Record the following transactions in general journal form using the periodic inventory system:

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 10 Solutions

College Accounting (Book Only): A Career Approach

Ch. 10 - What do credit terms of 2/10, n/30 mean? 210 days...Ch. 10 - What is the entry to record the cash received on a...Ch. 10 - Prob. 3QYCh. 10 - Which of the following is not an advantage of the...Ch. 10 - Prob. 5QYCh. 10 - What is the normal balance for each of the...Ch. 10 - What does an X under the total of a special...Ch. 10 - Prob. 3DQCh. 10 - In a cash receipts journal, both the Accounts...Ch. 10 - If a cash payments journal is supposed to save...

Ch. 10 - Describe the posting procedure for a cash payments...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - For the following purchases of merchandise,...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Describe the transactions recorded in the...Ch. 10 - Record the following transactions in general...Ch. 10 - Prob. 5ECh. 10 - Record general journal entries to correct the...Ch. 10 - Label the blanks in the column heads as either...Ch. 10 - Prob. 8ECh. 10 - Prob. 9ECh. 10 - Indicate the journal in which each of the...Ch. 10 - The following transactions were completed by...Ch. 10 - Preston Company sells candy wholesale, primarily...Ch. 10 - MacDonald Bookshop had the following transactions...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by...Ch. 10 - The following transactions were completed by Yang...Ch. 10 - C. R. McIntyre Company sells candy wholesale,...Ch. 10 - Prob. 3PBCh. 10 - The following transactions were completed by Yang...Ch. 10 - The following transactions were completed by...Ch. 10 - Prob. 1ACh. 10 - You are the manager of the Accounts Receivable...Ch. 10 - Prob. 3ACh. 10 - Suppose we collected cash from a charge customer...Ch. 10 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

For each of the following transactions, state which special journal (Sales Journal, Cash Receipts Journal, Cash...

Principles of Accounting Volume 1

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Plantwide and Departmental Overhead Allocation; Activity-Based Costing; Segmented Income Statements Koontz Comp...

Introduction To Managerial Accounting

1. For Frank’s Funky Sounds, straight-line depreciation on the trucks is a

Learning Objective 1

a. variable cos...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare journal entries to record the following transactions, assuming periodic inventory updating and first-in, first-out (FIFO) cost allocation.arrow_forwardRules of debit and credit for periodic inventory accounts Complete the following table by indicating for A through G whether the proper answer is debit or credit:arrow_forwardUnder the periodic inventory system, the ending inventory is entered by debiting Merchandise Inventory and crediting Income Summary.arrow_forward

- Using the partial work sheet provided below, prepare the adjusting entries for merchandise inventory.arrow_forwardWhat is a perpetual inventory accounting system? What journal entries are involved?arrow_forwardWhich type or types of inventory timing system (periodic or perpetual) requires the user to record two journal entries every time a sale is made. A. periodic B. perpetual C. both periodic and perpetual D. neither periodic nor perpetualarrow_forward

- DETERMINING THE BEGINNING AND ENDING INVENTORY FROM A PARTIAL WORK SHEET: PERIODIC INVENTORY SYSTEM From the following partial work sheet, indicate the dollar amount of beginning and ending merchandise inventory:arrow_forwardWhich of the following describes features of a perpetual inventory system? A. Technology is normally used to record inventory changes. B. Merchandise bought is recorded as purchases. C. An adjusting journal entry is required at year end, to match physical counts to the asset account. D. Inventory is updated at the end of the period.arrow_forwardRefer to RE6-5. Assume Longmire uses a perpetual inventory system. Prepare the related journal entries for Longmire Sons.arrow_forward

- Costume Warehouse sells costumes and accessories. Review the following transactions and prepare the journal entry or entries if Costume Warehouse uses: A. the perpetual inventory system B. the periodic inventory systemarrow_forwardWhy is it necessary to adjust the Merchandise Inventory account under a periodic inventory system?arrow_forwardPrepare journal entries to record the following transactions, assuming perpetual inventory updating and first-in, first-out (FIFO) cost allocation. Assume no beginning inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY