MANAGERIAL ACCOUNTING FUND. W/CONNECT

5th Edition

ISBN: 9781259688713

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 2PSA

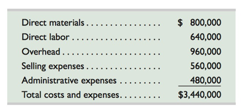

Calla Company produces skateboards that sell for $50 per unit. The company currently has the capacity to produce 90,000 skateboards per year, but is selling 80,000 skateboards per year. Annual costs for 80,000 skateboards follow.

A new retail store has offered to buy 10,000 of its skateboards for $45 per unit. The store is in a different market from Calla’s regular customers and would not affect regular sales. A study of its costs in anticipation of this additional business reveals the following:

- Direct materials and direct labor arc 100% variable.

- Thirty percent of overhead is fixed at any production level from 80,000 units to 90,000 units the remaining 70% of annual overhead costs are variable with respect to volume.

- Selling expenses are 60% variable with respect to number of units sold, and the other 40% of selling expenses are fixed.

- There will be an additional $2 per unit selling expense for this order.

- Administrative expenses would increase by a $1,000 fixed amount.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Scrooge McDuck Safe Limited is considering buying the hinges it uses in the

manufacture of vaults from an outside vendor. Currently, Scrooge McDuck Safe

Limited makes the hinges in its own manufacturing facility. Scrooge McDuck

Safe Limited can buy the hinges for $1.50 each. The company uses 900,000

hinges each year. Fixed cost for Scrooge McDuck Safe Limited would not

change if the company stopped making the hinges. Information about Scrooge

McDuck Safe Limited's cost to manufacture the 900,000 casters follows:

Per Unit

$.50

.10

Total

Direct material

$450,000

90,000

360,000

225.000

$1,125,000

Direct labor

Variable overhead

Fixed overhead

Total

.40

25

$1.25

Required:

A. Prepare a relevant cost schedule that indicates whether Scrooge McDuck

Safe Limited should buy the hinges or continue to make them.

B. If Scrooge purchased the hinges, management has approached you that a

dial producer wishes to rent the vacant space for $150,000 to produce

their dials. Does this change your decision??…

Steele Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racingbikes with limited sales. Steele produces and sells only 10,000 bikes each year. Due to the low volume of activity, Steele is unable to obtainthe economies of scale that larger producers achieve. For example, Steele could buy the handlebars for $31 each; they cost $34 each tomake. The following is a detailed breakdown of current production costs.

Item

Unit Cost

Total

Unit Level Costs

Materials

$16

160,000

Labor

12

120,000

Overhead

2

20,000

Allocated Facility Level Cost

4

40,000

Total

$34

340,000

After seeing these figures, Steele’s president remarked that it would be foolish for the company to continue to produce the handlebars at $34each when it can buy them for $31 each.RequiredCalculate the total relevant cost. Do you agree with the president’s conclusion?

Per Unit

Total

Total Relevant Cost

A manufacturing firm is making auto parts. The machine operators do the packaging and fill the shipping boxes. Each box should contain 60 parts, but the operators

fill the boxes by eye, so the average parts per box is 63. Each auto part costs $1. The company realizes that they are wasting parts by overfilling the boxes and decides

to automate the packaging which reduces the average parts per box to 60.

The equipment would cost $65,000 and SL depreciation with 7-year depreciable life and $10,000 salvage value would be used. Cost of maintaining the equipment is

$8,000 annually. The firm manufactures 800K auto parts each year. The combined federal and state incremental tax rate is 30%. Assume a 7-year analysis period and

MARR of 10%.

1. What is the after-tax present worth?

2. What is the after-tax payback period? (No-return payback period)

Chapter 10 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

Ch. 10 - Prob. 1MCQCh. 10 - Prob. 2MCQCh. 10 - Prob. 3MCQCh. 10 - Prob. 4MCQCh. 10 - Prob. 5MCQCh. 10 - Prob. 1DQCh. 10 - Is nonfinancial information ever useful in...Ch. 10 - What is a relevant cost? Identify the two types of...Ch. 10 - Prob. 4DQCh. 10 - Prob. 5DQ

Ch. 10 - Prob. 6DQCh. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQCh. 10 - Prob. 1QSCh. 10 - Prob. 2QSCh. 10 - Prob. 3QSCh. 10 - Prob. 4QSCh. 10 - Prob. 5QSCh. 10 - Prob. 6QSCh. 10 - Prob. 7QSCh. 10 - Prob. 8QSCh. 10 - Signal mistakenly produced 1,000 defective cell...Ch. 10 - Prob. 10QSCh. 10 - Prob. 11QSCh. 10 - Prob. 12QSCh. 10 - Prob. 13QSCh. 10 - Prob. 14QSCh. 10 - Rory Company has a machine with a book value of...Ch. 10 - Fill in each of the blanks below with the correct...Ch. 10 - Prob. 2ECh. 10 - Goshford Company produces a single product and has...Ch. 10 - Prob. 4ECh. 10 - Prob. 5ECh. 10 - Prob. 6ECh. 10 - Prob. 7ECh. 10 - Prob. 8ECh. 10 - Prob. 9ECh. 10 - Suresh Co. expects its five departments to yield...Ch. 10 - Exercise 23-11 Sales mix A1 Childress Company...Ch. 10 - Prob. 12ECh. 10 - Prob. 13ECh. 10 - Prob. 1PSACh. 10 - Calla Company produces skateboards that sell for...Ch. 10 - Prob. 3PSACh. 10 - Prob. 4PSACh. 10 - Prob. 5PSACh. 10 - Elegant Decor Companys management is trying to...Ch. 10 - Prob. 1PSBCh. 10 - Prob. 2PSBCh. 10 - Prob. 3PSBCh. 10 - Prob. 4PSBCh. 10 - Prob. 5PSBCh. 10 - Esme Companys management is trying to decide...Ch. 10 - Prob. 10SPCh. 10 - Apple currently chooses to buy (mainly from...Ch. 10 - Prob. 3BTNCh. 10 - Assume that you work for Greebles Department...Ch. 10 - Prob. 5BTNCh. 10 - Prob. 6BTNCh. 10 - Prob. 7BTNCh. 10 - Prob. 8BTNCh. 10 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?arrow_forwardBienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

- Reubens Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided, If Reuben accepts the offer, what will the effect on profit be?arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forwardShelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?arrow_forward

- Garrison Boutique, a small novelty store, just spent $4,000 on a new software program that will help in organizing its inventory. Due to the steep learning curve required to use the new software, Garrison must decide between hiring two part-time college students or one full-time employee. Each college student would work 20 hours per week, and would earn $1 S per hour. The full-time employee would work 40 hours per week and would earn $15 per hour plus the equivalent of $2 per hour in benefits. Employees are given two polo shirts to wear as their uniform. The polo-shirts cost Garrison $10 each. What are the relevant costs, relevant revenues, sunk costs, and opportunity costs for Garrison?arrow_forwardJoe Mama's Bakery is looking to outsource its products after poor reviews about one of its products. It sells typical bakery items and is looking to outsource its cookie production. It currently costs Joe Mama's Bakery $2 in ingredients per dozen cookies and each baker can produce five dozen per hour. Bakers are paid $10 per hour. Electric Avenue Baking is offering to sell Joe Mama's Bakery a dozen cookies for $3.50. Should Joe Mama's Bakery outsource? All overhead will remain the same, regardless of the decision made. No, the cost of making the cookies in house is equal to the cost of outsourcing. No, the cost of making the cookies in house is more than outsourcing. Yes, the cost of making the cookies in house is more than outsourcing. Yes, the cost of making the cookies in house is less than outsourcing. No, the cost of making the cookies in house is less than outsourcing.arrow_forwardVernon Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Vernon produces and sells only 6,900 bikes each year. Due to the low volume of activity, Vernon is unable to obtain the economies of scale that larger producers achieve. For example, Vernon could buy the handlebars for $33 each; they cost $36 each to make. The following is a detailed breakdown of current production costs. Item Unit Cost Total Unit-level costs $103,500 82,800 13,800 48,300 Materials $15 Labor 12 Overhead Allocated facility-level costs 2 Total $36 $248,400 After seeing these figures, Vernon's president remarked that it would be foolish for the company to continue to produce the handlebars at $36 each when it can buy them for $33 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Per Unit Total Total relevant cost Do you agree with the president's conclusion?arrow_forward

- Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His estimates of monthly costs for the proposed location are as follows: Fixed costs: Occupancy costs Salaries Other Variable costs (including cost of paint) $6 per gallon Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold. Required: a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store. c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of operating income that would be earned per month at each of these sales volumes. a. Contribution margin ratio a. Break-even sales volume in dollars a. Break-even sales volume in…arrow_forwardMallory’s Video Supply has changed its focus tremendously and as a result has dropped the selling price of DVD players from $45 to $38. Some units in the work-in-process inventory have costs of $30 per unit associated with them, but Mallory can only sell these units in their current state for $22 each. Otherwise, it will cost Mallory $11 per unit to rework these units so that they can be sold for $38 each. How much is the financial impact if the units are processed further? a. $5 per unit profit b. $3 per unit loss c. $16 per unit profit d. $12 per unit lossarrow_forwardThe Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Calculate the net benefit or cost to The Knot if it adopts JIT production at the Spartanburg plant.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License