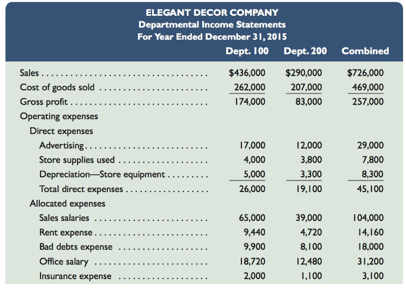

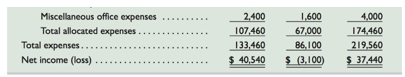

Elegant Decor Company’s management is trying to decide whether to eliminate Department 200, which has produced losses or low profits for several years. The company’s 2015 departmental income statements show the following.

In analyzing whether to eliminate Department 200, management considers the following:

a. The company has one office worker who earns $600 per week, or $31,200 per year, and four sales- clerks who each earn $500 per week, or $26,000 per year for each salesclerk.

b. The full salaries of two salesclerks are charged to Department 100. The full salary of one salesclerk is charged to Department 200. The salary of the fourth clerk, who works half-time in both departments, is divided evenly between the two departments.

c. Eliminating Department 200 would avoid the sales salaries and the office salary currently allocated to it. However, management prefers another plan. Two salesclerks have indicated that they will be quitting soon. Management believes that their work can be done by the other two clerks if the one office worker works in sales half-time. Eliminating Department 200 will allow this shift of duties. If this change is implemented, half the office worker’s salary would be reported as sales salaries and half would be reported as office salary.

d. The store building is rented under a long-term lease that cannot be changed. Therefore. Department

100 will use the space and equipment currently used by Department 200.

e. Closing Department 200 will eliminate its expenses for advertising,

Required

1. Prepare a three column report that lists items and amounts for (a) the company’s total expenses (including cost of goods sold)—in column 1. (b) the expenses that would be eliminated by closing (a) Department 200—in column 2, and (c) the expenses that will continue—in column 3.

2. Prepare a

Analysis Component

3. Reconcile the company’s combined net income with the forecasted net income assuming that

Department 200 is eliminated (list both items and amounts). Analyze the reconciliation and explain why you think the department should or should not be eliminated.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- Artisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forwardManuel Inc. produces textiles in many different forms. After recording lower than anticipated profits last year, Manuel has decided to shut down one of its divisions that is not performing well. The accounting manager has compiled the following data on the two divisions being considered for closing and has asked you to evaluate the short-term and long-term effects on profits of closing each division. Which division should be closed if Manuel is most concerned with increasing long-run profits? Winter Outerwear High-End Suits Net revenues $ 1,200,000 $ 5,200,000 Variable costs 660,000 2,160,000 Contribution margin 540,000 3,040,000 Controllable fixed costs 0 2,020,000 Controllable margin 540,000 1,020,000 Noncontrollable fixed costs 770,000 1,540,000 Contribution by division $ (230,000 ) $ (520,000 ) multiple choice Winter Outerwear High-End Suits Closing either would have the same…arrow_forwardJack Jones, the materials manager at Precision Enterprises, is beginning to look for ways to reduce inventories. A recent accounting statement shows that the inventory investment for raw materials is $4,076, 100, for work-in-process is $6,888,000, and for finished goods is $2,994,000. This year's cost of goods sold will be about $30,108,000. Assume that there are 52 business weeks per year. a. Express total inventory as weeks of supply. The weeks of supply is weeks. (Enter your response rounded to one decimal place.) 27 **arrow_forward

- Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS discontinues frozen foods. The operating results from the most recent period are: Order processing Receiving Shelf-stocking Customer support Sales Cost of goods sold SFS estimates that store support expenses, in total, are approximately 20% of revenues. The controller says that not every sales dollar requires or uses the same amount of store support activities. A preliminary analysis reveals store support activities for these three product lines are: Frozen Foods $ 120,000 185,000 Activity (cost driver) Order processing (number of purchase orders) Receiving (number of deliveries) Shelf-stocking (number of hours per delivery) Customer support (total units sold) The controller estimates activity-cost rates for each activity as follows: $ 88 per purchase order 110 per delivery per hour per item…arrow_forwardJack Jones, the materials manager at Precision Enterprises, is beginning to look for ways to reduce inventories. A recent accounting statement shows that the inventory investment for raw materials is $3,672,800, for work-in-process is $6,978,000, and for finished goods is $2,675,000. This year's cost of goods sold will be about $24,700,000. Assume that there are 52 business weeks per year. a. Express total inventory as weeks of supply. The weeks of supply is 28.05 weeks. (Enter your response rounded to one decimal place.) b. Express total inventory as inventory turns. The inventory turnover is turns per year. (Enter your response rounded to one decimal place.)arrow_forwardPhoenix Press produces consumer magazines. Thehouse and home division, which sells home-improvement and home-decorating magazines, has seen a 20%reduction in operating income over the past 9 months, primarily due to an economic recession and a depressedconsumer housing market. The division’s controller, Sophie Gellar, has felt pressure from the CFO toimprove her division’s operating results by the end of the year. Gellar is considering the following options forimproving the division’s performance by year-end: a. Cancelling two of the division’s least profitable magazines, resulting in the layoff of 25 employees.b. Selling the new printing equipment that was purchased in January and replacing it with discardedequipment from one of the company’s other divisions. The previously discarded equipment no longermeets current safety standards.c. Recognizing unearned subscription revenue (cash received in advance for magazines that will bedelivered in the future) as revenue when cash is received…arrow_forward

- Phoenix Press produces consumer magazines. Thehouse and home division, which sells home-improvement and home-decorating magazines, has seen a 20%reduction in operating income over the past 9 months, primarily due to an economic recession and a depressedconsumer housing market. The division’s controller, Sophie Gellar, has felt pressure from the CFO toimprove her division’s operating results by the end of the year. Gellar is considering the following options forimproving the division’s performance by year-end:a. Cancelling two of the division’s least profitable magazines, resulting in the layoff of 25 employees.b. Selling the new printing equipment that was purchased in January and replacing it with discardedequipment from one of the company’s other divisions. The previously discarded equipment no longermeets current safety standards.c. Recognizing unearned subscription revenue (cash received in advance for magazines that will bedelivered in the future) as revenue when cash is received…arrow_forwardBovine Company, a wholesale distributor of DVDs, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement below:Sales $1,500,000 Variable expenses 588,000 Contribution margin 912,000 Fixed expenses 945,000 Net operating loss $ (33,000)In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following data:Geographic Market South Central North Sales $400,000 $600,000 $500,000 Variable expenses as a percentage of sales 52% 30% 40% Traceable fixed expenses $240,000 $330,000 $200,000Required: i. Prepare a contribution format income statement segmented by geographic market, as desired by the president. ii. The company’s sales manager believes that sales in the Central geographic market could be increased by 15% if monthly advertising were increased by $25,000. Would you recommend the increased advertising? Show…arrow_forwardEsme Company’s management is trying to decide whether to eliminate Department Z, which has produced low profits or losses for several years. The company’s departmental income statements show the following.arrow_forward

- Bovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales $ 2,070,000 Variable expenses 895,880 Contribution margin 1,174,120 Fixed expenses 1,319,000 Operating loss $ (144,880 ) In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Geographic Market South Central North Sales $ 607,000 $ 806,000 $ 657,000 Variable expenses as a percentage of sales 50 % 36 % 46 % Traceable fixed expenses $ 320,000 $ 480,000 $ 307,000 Required:1. Prepare a contribution format income statement segmented by geographic market, as requested by the president. 2-a. The company’s sales manager believes that sales in the Central…arrow_forwardWingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales $ 1,610,000 Variable expenses 659,000 Contribution margin 951,000 Fixed expenses 1,046,000 Net operating income (loss) $ (95,000) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following information: Division East Central West Sales $ 430,000 $ 610,000 $ 570,000 Variable expenses as a percentage of sales 52 % 34 % 40 % Traceable fixed expenses $ 288,000 $ 321,000 $ 193,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $29,000 based on the belief that it would…arrow_forwardHorizon Corporation manufactures personal computers. The company began operations in 2012 and reported profits for the years 2012 through 2019. Due primarily to increased competition and price slashing in the industry, 2020’s income statement reported a loss of $20 million. Just before the end of the 2021 fiscal year, a memo from the company’s chief financial officer (CFO) to Jim Fielding, the company controller, included the following comments:If we don’t do something about the large amount of unsold computers already manufactured, our auditors will require us to record a write-down. The resulting loss for 2021 will cause a violation of our debt covenants and force the company into bankruptcy. I suggest that you ship half of our inventory to J.B. Sales, Inc., in Oklahoma City. I know the company’s president, and he will accept the inventory and acknowledge the shipment as a purchase. We can record the sale in 2021 which will boost our loss to a profit. Then J.B. Sales will simply…arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College