Concept explainers

Johnson Electrical produces industrial ventilation fans. The company plans to manufacture 72,000 fans evenly over the next quarter at the following costs: direct material, $1,440,000; direct labor, $360,000; variable production overhead, $450,000; and fixed production overhead, $900,000. The $900,000 amount includes $72,000 of straight-line

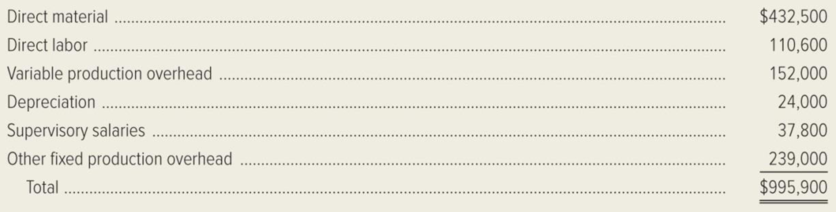

Shortly after the conclusion of the quarter’s first month, Johnson reported the following costs:

Dave Kellerman and his crews turned out 20,000 fans during the month—a remarkable feat given that the firm’s manufacturing plant was closed for several days because of storm damage and flooding. Kellerman was especially pleased with the fact that overall financial performance for the period was favorable when compared with the budget. His pleasure, however, was very short-lived, as Johnson’s general manager issued a stern warning that performance must improve, and improve quickly, if Kellerman had any hopes of keeping his job.

Required:

- 1. Explain the difference between a static budget and a flexible budget.

- 2. Which of the two budgets would be more useful when planning the company’s cash needs over a range of activity?

- 3. Prepare a performance report that compares static budget and actual costs for the period just ended (i.e., the report that Kellerman likely used when assessing his performance).

- 4. Prepare a performance report that compares flexible budget and actual costs for the period just ended (i.e., the report that the general manager likely used when assessing Kellerman’s performance).

- 5. Which of the two reports is preferred? Should Kellerman be praised for outstanding performance or is the general manager’s warning appropriate? Explain, citing any apparent problems for the firm.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Balcom Enterprises is planning to introduce a new product that will sell for $110 a unit. Manufacturing cost estimates for 27,000 units for the first year of production are: • Direct materials $1,269,000. • Direct labor $528,000 (based on $16 per hour x 33,000 hours). Although overhead has not be estimated for the new product, monthly data for Balcom's total production for the last two years has been analyzed using simple linear regression. The analysis results are as follows: Dependent variable Independent variable Intercept Coefficient on independent variable Coefficient of correlation R² Multiple Choice Based on this information, what is the total overhead cost for an estimated activity level of 43,000 direct labor-hours? $392,000 $144,000 $804,000 Factory overhead costs Direct labor hours. $134,000 $ $258.000 6.00 0.953 0.842arrow_forwardSimplex Company has the following estimated costs for next year: Direct materials $15,000 Direct labor $55,000 Sales commissions $75,000 Salary of production supervisor $35,000 Indirect materials $5,000 Advertising expense $11,000 Rent of factory equipment $16,000 Simplex estimates that 10,000 direct labor and 16,000 machine-hours will be worked during the year. If overhead in applied on the basis of machine hours, the overhead rate per hour will be:arrow_forwardBalcom Enterprises is planning to introduce a new product that will sell for $120 a unit. Manufacturing cost estimates for 28,000 units for the first year of production are: Direct materials $1,372,000. Direct labor $1,008,000 (based on $18 per hour × 56,000 hours). Although overhead has not be estimated for the new product, monthly data for Balcom's total production for the last two years has been analyzed using simple linear regression. The analysis results are as follows: Dependent variable Factory overhead costs Independent variable Direct labor hours Intercept $ 136,000 Coefficient on independent variable $ 5.00 Coefficient of correlation 0.959 R2 0.846 Based on this information, how much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)? Multiple Choice $72 $92 $95 $77arrow_forward

- The Maria Company estimated its factory overhead of the next period at P160,000. It is estimated that 40,000 units will be produced at a materials cost of P200,000. Production will require 40,000 man-hours at an estimated wage cost of P80,000. The machines will run about 25,000 hours. How much is the Machine Depreciation Cost Driver rate?arrow_forwardSanta Fe Company, a farm-equipment manufacturer, currently produces 20,000 units of gas filters for use in its lawnmower production annually. The following costs are reported according to the previous year's production: It is anticipated that gas-filter production will last five years. If the company continues to produce the product in-house, annual direct-material costs will increase at a rate of 5%. (For example, the annual direct-material costs during the first production year will be $63,000.) In addition, direct-labor costs will increase at a rate of 6% per year, and variable-overhead costs will increase at a rate of 3% while fixed-overhead costs will remain at the current level over the next five years. Tompkins Company has offered to sell Santa Fe Company 20,000 units of gas filters for $25 per unit. If Santa Fe accepts the offer, some of the facilities currently used to manufacture the gas filters could be rented to a third party at an annual rate of $35,000. In addition,…arrow_forwardWary Corp. Is capable of turning out fifteen (15) completed units every 30 seconds. The plant normally operates five days a week on a two eight-hour shift. Each year, the factory is closed twelve (12) working days for holidays. Machinery is idle 750 hours for cleaning, oiling and maintenance. Normal sales averages 110,000 units a year over a five-year period. The expected sales volume for the year is 112,500 units. The fixed cost of operating the plant amounted to P385,000 per year. a. Compute the Idle capacity cost under normal capacity if the plant operated at 3,400 hours. b. Compute the fixed unit costs under Practical capacityarrow_forward

- The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Units to be produced Each unit requires 0.25 direct labor-hours and direct laborers are paid $14.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $95,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $35,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 11,500 10,500 12,500 13,500 Complete this question by entering your answers in the tabs below. Req 1…arrow_forwardThe management of Red Star Company estimates that 60,000 machine-hours will be required to support the production planned for the year. It also estimates $300,000 of total fixed manufacturing overhead cost for the coming year and $5 of variable manufacturing overhead cost per machine-hour. What is the predetermined overhead rate?arrow_forwarda product cell for wallace company has budgeted conversion costs of $420,000 for the year. the cell is planned to be available 2,100 hours for production. each unit requires $12.50 of materials cost. the cell started and completed 700 units. the cell process time for the product is 15 minutes per unit. what is the cost(s) to be debited to finished goods for the period?arrow_forward

- Bellfont Company produces door stoppers. August production costs are below: Door Stoppers produced 70,000 Direct material (variable) $20,000 Direct labor (variable) 40,000 Supplies (variable) 20,000 Supervision (fixed) 29,600 Depreciation (fixed) 23,200 Other (fixed) 5,900 In september, Bellfont expects to produce 100,000 door stoppers. Assuming no structural changes, what is Bellfont's production cost per door stoppers for September? Round to two decimal places.arrow_forwardMidas Industries manufactures 20,000 components per year. The manufacturing cost of components was determined as follows: Direct materials 100,000 ,Direct labor 160,000, Variable manufacturing overhead 60,000, Fixed manufacturing overhead 80,000. An outside supplier has offered to sell the component for 17. If it purchases the component from the outside supplier, the manufacturing facilities would be unused and could be rented out for 10,000. If Midas purchases the component from the supplier instead of manufacturing it, the effect on income would be: A. 70,000 increase. B.50,000 decrease. C.10,000 decrease. D.30,000 increase.arrow_forwardKARATE Corp. is capable of turning out 15 completed units every 30 seconds. The plant normally operates five days a week on a two eight-hour shift. Each year, the factory is closed 12 working days for holidays. Machinery is idle 750 hours for cleaning, oiling and maintenance. Normal sales averages 110,000 units a year over a five-year period. The expected sales volume for the year is 112,500 units. The fixed cost of operating the plant amounted to P385,000 per year. 1. Compute the Fixed Unit Costs under Practical Capacity? 2. Compute the idle Capacity Cost under normal capacity if the plant operated at 3,400 hours? SHOW SOLUTIONS IN A GOOD ACCOUNTING FORM!arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning