PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 3AP

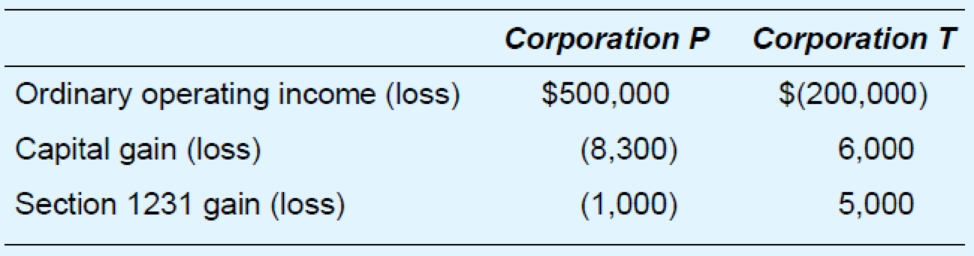

Corporation P owns 93 percent of the outstanding stock of Corporation T. This year, the corporation’s records provide the following information.

- a. Compute each corporation’s taxable income if each files a separate tax return.

- b. Compute consolidated taxable income if Corporation P and Corporation T file a consolidated tax return.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the amount of taxable income and separately stated items in each of the cases below. Assuming the corporation is a

Subchapter S corporation. Ignore any carryforward items.

Required:

a. Corporate financial statement: net income of $52,750 including tax expense of $15,300, charitable contributions of $3,000, and

depreciation expense of $37,450. Depreciation expense for tax purposes is $46,480.

b. Corporate financial statement: net income of $140,200 including tax expense of $68,450, charitable contributions of $28,000,

depreciation expense of $103,750, and meals expenses of $31,300. Depreciation expense for tax purposes is $145,900.

c. Corporate financial statement: net income of $227,350 including tax expense of $111,540, charitable contributions of $16,000,

municipal bond interest of $19,390, meals expenses of $41,900, capital gains of $6,150, and depreciation expense of $143,050.

Depreciation expense for tax purposes is $131,750, and the corporation has a $7,105 charitable…

Determine taxable income in each of the following instances. Assume that the corporation is a C corporation and that book income is

before any income tax expense.

Required:

a. Book income of $52,000 including capital gains of $1,500, a charitable contribution of $1,100, and meals expenses of $4,000.

b. Book income of $94,000 including capital losses of $2,500, a charitable contribution of $13,000, and meals expenses of $1,100.

c. Book income of $77,000 including municipal bond interest of $1,050, a charitable contribution of $4,100, and dividends of $1,200

from a 10% owned domestic corporation. The corporation also has an $6,100 charitable contribution carryover.

d. Book income of $131,000 including municipal bond interest of $1,250, a charitable contribution of $3,550, and dividends of $5,600

from a 70% owned domestic corporation. The corporation has a capital loss carryover of $4,550 and a capital gain of $1,100 in the

current year.

Amount

a. Taxable income

b. Taxable income

c.…

For each of the following transactions, indicate wheth-er a special adjustment must be made in computing R Corporation’s current E&P. Answer assuming that E&P has already been adjusted for current taxable income.

During the year, the corporation paid estimated Federal income taxes of $25,000 and estimated state income taxes of $10,000.

The corporation received $5,000 of interest income from its investment in tax-exempt bonds.

The corporation received a $10,000 dividend from General Motors Corporation.

The corporation purchased machinery for $9,000 and expensed the entire amount in accordance with Code § 179.

The corporation reported a § 1245 gain of $20,000. f. The corporation had a capital loss carryover of $7,000 from the previous year. This year the corporation had capital gains before consideration of the loss of $10,000.

Chapter 11 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Cramer Corporation, a calendar year, accrual basis...Ch. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Camden Corporation, a calendar year accrual basis...Ch. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - In 2018, NB Inc.s federal taxable income was...Ch. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nicole and Mohammad (married taxpayers filing jointly) are equal owners in an S corporation. The company reported sales revenue of $350,000 and expenses of $210,000. The corporation also earned $15,000 in taxable interest and dividend income and had $9,000 investment interest expense. Required: How are these amounts reported for tax purposes in the following schedules? Amount Schedule A Schedule B Schedule Earrow_forwardFielding Sporting Goods Corporation (FSGC) is a calendar-year corporation. What is the Book to Tax Reconciliation's Adjustments, and Taxable Income? 1) FSGC owns 40 percent of the outstanding Magnolia Corp. (MC) stock. Magnolia Corp. reported $1,000,000 of income for the year. FSGC accounted for its investment in MC under the equity method and it recorded its pro rata share of MC's earnings for the year. MC also distributed a $150,000 dividend to FSGC. Description Вook Income Adjustments Adjustments (Debit) (Credit) Тахable Income Income From Investment in 400,000 Corporate Stock Dividends Received Deductionarrow_forwardIncome Tax Rates-Corporations Taxable Income Over- $ 0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 But not Over- $ 50,000 75,000 100,000 335,000 10,000,000 15,000,000 18,333,333 The Tax Is: $ 15% 7,500 + 25% 13,750 + 34% 22,250 + 39% 113,900 + 34% 3,400,000+ 35% 5,150,000+ 38% 35% $ Of the Amount Over- 0 50,000 75,000 100,000 335,000 10,000,000 15,000,000 0arrow_forward

- During the year, CDE Corporation earned enough profits to pay dividends to its shareholders. CDE is a C corporation. What are the tax consequences of this distribution? (a) The corporation will increase their earnings and profits by the amount distributed. (b) The corporation will reduce its taxable income by the amount distributed to the shareholders. (c) The corporation will pay a flat tax of 21% on the amount distributed. The shareholders also include their dividends received in taxable income. (d) There are no direct tax consequences for either the corporation or the shareholders.arrow_forwardPatriot Corporation reports the following results for the current year: View the current year results. Read the requirements. Requirement a. What are Patriot's taxable income and income tax liability for the current year? Begin by computing Patriot's taxable income. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Gross income Minus: Taxable income Requirements a. What are Patriot's taxable income and income tax liability for the current year? b. How would your answers to Part a change if Patriot's short-term capital loss is $12,000 instead of $2,000? Print Done - X Current Year Results Gross profits on sales Long-term capital gain Long-term capital loss Short-term capital gain Short-term capital loss Operating expenses Print $ 159,000 7,000 8,000 9,000 2,000 70,000 Done Xarrow_forwardThe entity reports the following transactions for the 2022 tax year. The trustee accumulates all accounting income for the year. Operating income from a business Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds Trustee fees, deductible portion Net rental losses, passive activity $785,000 47,100 6,280,000 (23,550) (157,000) Click here to access tax table for this problem. Carryout the tax computations to two decimal places and round the final tax liability to the nearest dollar. Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $ The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $ The Federal income tax liability for the Valerio Trust is $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License