PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 5AP

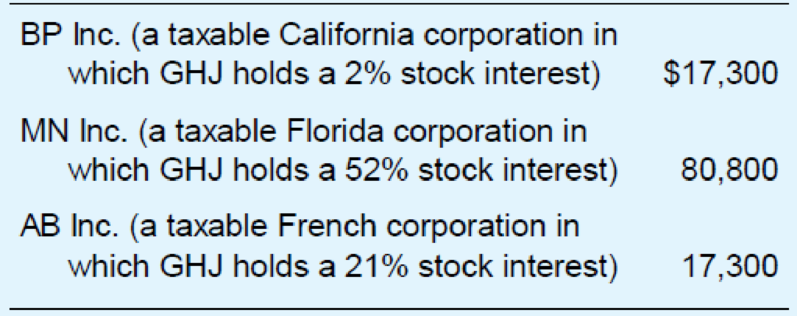

This year, GHJ Inc. received the following dividends.

Compute GHJ’s dividends-received deduction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

3. During the year, Chinawish Co. distributed property

dividends in the form of inventories. The carrying amount on

the date of declaration was P2,000,000 and the fair values,

which approximated the net realizable values, were P1,600,000

on the date of declaration and P2,200,000 on the date of

distribution.

Requirement: Provide the journal entries on the dates of declaration

and distribution.

Determine the amount of the dividends received deduction in each of the following instances. In all cases, the net income figure includes the full dividend. Use Dividends deduction table.

Dividend of $11,500 from a 45% owned corporation; taxable income before DRD of $54,500.

Dividend of $19,900 from a 15% owned corporation; taxable income before DRD of $78,000.

Dividend of $13,000 from a 60% owned corporation; taxable income before DRD of $7,000.

Dividend of $3,500 from a 10% owned corporation; taxable income before DRD of $2,760.

a.

Dividend received deduction

b.

Dividend received deduction

c.

Dividend received deduction

d.

Dividend received deduction

Determine the amount of the dividends received deduction in each of the followinginstances. In all cases, the net income figure includes the full dividend.a. Dividend of $10,000 from a 45% owned corporation; taxable income before DRDof $50.000.b. Dividend of $19.000 from a 15% owned corporation;taxable income before DRD of$75.000.c. Dividend of $22,000 from a 60% owned corporation; taxable income before DRD ofSI1.000.d. Dividend of $8.000 from a 10% owned corporation; taxable income before DRD of$7.000.

Chapter 11 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Cramer Corporation, a calendar year, accrual basis...Ch. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Camden Corporation, a calendar year accrual basis...Ch. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - In 2018, NB Inc.s federal taxable income was...Ch. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to RE5-1. Prepare a single-step income statement for Brandt Corporation for the current year.arrow_forwardTaxable income Champ received a $27,600 distribution from NeatCo, a U.S. C corporation. NeatCo’s earnings and profits for the year totaled $16,560. How much dividend income does Champ recognize?arrow_forwardHw.67. Determine the amount of the dividends received deduction in each of the following instances. In all cases, the net income figure includes the full dividend. Use Dividends deduction table. Required: Dividend of $14,000 from a 45% owned corporation; taxable income before DRD of $62,000. Dividend of $21,400 from a 15% owned corporation; taxable income before DRD of $83,000. Dividend of $15,500 from a 60% owned corporation; taxable income before DRD of $8,500. Dividend of $4,750 from a 10% owned corporation; taxable income before DRD of $3,910.arrow_forward

- DER Company has the following in the current year: Capital gains of $8,500 Capital losses of $18,500 Business income of S7,500 Property income of $5,500 Which of the following will be included in Net Income for Tax Purposes for DER Company? ..... Choose the correct answer. O A. capital losses of $4,250 O B. capital gains of $10,000 OC. capital losses of $8,500 O D. capital losses of $0arrow_forwardWhipporwill, Incorporated's, net income for the most recent year was $9,551. The tax rate was 23 percent. The firm paid $4,695 in total interest expense and deducted $5,162 in depreciation expense. a. What was the company's taxable income for the year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What was the company's EBIT for the year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What was the company's cash coverage ratio for the year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardChamp received a $13,200 distribution from NeatCo, a U.S. C corporation. NeatCo's earnings and profits for the year totaled $7,920. How much dividend income does Champ recognize?arrow_forward

- During the current year, Stern Company had pretax accounting income of $42 million. Stern's only temporary difference for the year was rent received for the following year in the amount of $16 million. Stern's taxable income for the year would be: Multiple Choice $58 million $26 million. $42 million. $47 million.arrow_forwardCrane Company reported net income of $470000 for the year ended 12/31/21. Included in the computation of net income were: depreciation expense, $59000; amortization of a patent, $31000; income from an investment in common stock of Blossom Company, accounted for under the equity method, $47000; and amortization of a bond discount, $11000. Crane also paid an $79000 dividend during the year. The net cash provided by operating activities would be reported at $335000. $445000. $414000. $524000.arrow_forwardJock (LTD) is a manufacturer of Stationery. The Following information is given regarding Jock Ltd for 2021 and 2022 Income tax Expense for 2021 is R9 565 and for 2022 is R8 575 The Income tax for 2021 according to the final assessment for SARS is R9 800.00 Total Dividends declared for 2021 is R5 000. The dividends tax rate is 15% Prepare the journal entries for the year ended 31 December 2021 and 2022 (Include journal narrations)arrow_forward

- FGH Corporation had the following in 2021: Sales P 3.4M; Cost of sales P 1.2M; Admin expense P 0.3M; Selling expenses P .5M; other taxable income from operations P .1M. 1. What is deductible expense if the company uses OSD? 2. Using the problem above, what is the income tax payable?arrow_forwardThe "other income" section of A Company's Statement of Comprehensive Income contains P5,000 in interest income, P15,000 equity in B Co. earnings, and P25,000 gain on sale of available-for-sale securities. Assuming the sale of the securities increased the current portion of income tax expense by P10,000, determine the amount of A's reclassification adjustment to other comprehensive income.arrow_forwardNaaman received a Form 1099-DIV reporting ordinary dividends of $3,500 and qualified dividends of $1,200. Calculate the amount of dividends that will be taxed at the ordinary income rates. $2,300 O $1,200 O $4,700 O $3,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License