PRINCIPLES OF TAXATION F/BUS...(LL)

23rd Edition

ISBN: 9781260433197

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 22AP

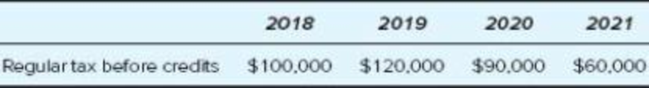

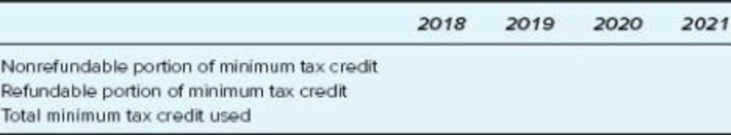

Callen Inc. has accumulated minimum tax credits of $1.3 million from tax years prior to 2018. The following are Callen’s regular tax before credits for 2018 through 2021.

Complete the following table to calculate Callen’s allowable minimum tax credit each year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Callen Inc. had accumulated minimum tax credits of $1.37 million from tax years prior to 2018. For 2018, its regular tax before credits was $135,000. For 2019, its regular tax before credits was $155,000. If Callen does not elect the quickie refund options provided by the CARES Act with respect to 2018 minimum tax credits, determine the total amount of minimum tax credit it would claim in 2018 and 2019?

Hallick, Incorporated has a fiscal year ending June 30. Taxable income was $7,100,000 for its year ended

June 30, 2018, and it projects similar taxable income for its 2023 fiscal year. Use 2017 tax rate schedule if

needed.

Required:

a. Compute Hallick's regular tax liability for its June 30, 2018, tax year.

b. Compute Hallick's projected regular tax liability for its June 30, 2023, tax year.

Answer is complete but not entirely correct.

a. Regular tax liability

b. Projected regular tax liability

$ 2,414,000

$ 1,491,000€

J-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2018. The only difference between accounting and taxable income is estimated product warranty costs for sales this year. Warrantypayments are expected to be in equal amounts over the next three years. Recent tax legislation will change thetax rate from the current 40% to 30% in 2020. Determine the amounts necessary to record J-Matt’s income taxesfor 2018 and prepare the appropriate journal entry.

Chapter 11 Solutions

PRINCIPLES OF TAXATION F/BUS...(LL)

Ch. 11 - Prob. 1QPDCh. 11 - Prob. 2QPDCh. 11 - Prob. 3QPDCh. 11 - Prob. 4QPDCh. 11 - Prob. 5QPDCh. 11 - Libretto Corporation owns a national chain of...Ch. 11 - Prob. 7QPDCh. 11 - Prob. 8QPDCh. 11 - Prob. 9QPDCh. 11 - In your own words, explain the conclusion that...

Ch. 11 - Prob. 1APCh. 11 - Prob. 2APCh. 11 - Corporation P owns 93 percent of the outstanding...Ch. 11 - This year, Napa Corporation received the following...Ch. 11 - This year, GHJ Inc. received the following...Ch. 11 - In its first year, Camco Inc. generated a 92,000...Ch. 11 - Prob. 7APCh. 11 - Prob. 8APCh. 11 - Cranberry Corporation has 3,240,000 of current...Ch. 11 - Hallick Inc. has a fiscal year ending June 30....Ch. 11 - Landover Corporation is looking for a larger...Ch. 11 - Cramer Corporation, a calendar year, accrual basis...Ch. 11 - Prob. 13APCh. 11 - Prob. 14APCh. 11 - Prob. 15APCh. 11 - Prob. 16APCh. 11 - In each of the following cases, compute the...Ch. 11 - Prob. 18APCh. 11 - Prob. 19APCh. 11 - Jackson Corporation has accumulated minimum tax...Ch. 11 - Camden Corporation, a calendar year accrual basis...Ch. 11 - Callen Inc. has accumulated minimum tax credits of...Ch. 11 - Prob. 23APCh. 11 - Prob. 24APCh. 11 - In 2018, NB Inc.s federal taxable income was...Ch. 11 - James, who is in the 35 percent marginal tax...Ch. 11 - Leona, whose marginal tax rate on ordinary income...Ch. 11 - Prob. 28APCh. 11 - Prob. 29APCh. 11 - Prob. 30APCh. 11 - Prob. 1IRPCh. 11 - Prob. 2IRPCh. 11 - Prob. 3IRPCh. 11 - Prob. 4IRPCh. 11 - Prob. 5IRPCh. 11 - Prob. 6IRPCh. 11 - Prob. 7IRPCh. 11 - Prob. 8IRPCh. 11 - Prob. 1RPCh. 11 - Prob. 2RPCh. 11 - Prob. 3RPCh. 11 - This year, Prewer Inc. received a 160,000 dividend...Ch. 11 - Prob. 1TPCCh. 11 - Prob. 2TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jackson Corporation has accumulated minimum tax credits of $475,000 from tax years prior to 2019. Required: If 2019 regular tax before credits is $210,000 and Jackson qualifies for general business credits of $13,000, calculate its allowable minimum tax credit for 2019.arrow_forwardJenkins Corporation had $675,000 of taxable income for 2018 and $575,000 for 2019. What is the minimum amount that it must submit for each estimated quarterly tax payment to avoid any penalty for underpayment?arrow_forwardJ-Matt, Inc., had pretax accounting income of $319,000 and taxable income of $352,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $33,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022–2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from the current 25% to 20% in 2023. Determine the amounts necessary to record J-Matt’s income taxes for 2021 and prepare the appropriate journal entry.arrow_forward

- Wise Company began operations at the beginning of 2021. The following information pertains to this company. 1. Pretax financial income for 2021 is $100,000. 2. The tax rate enacted for 2021 and future years is 20%. 3. Differences between the 2021 income statement and tax return are listed below: a. Warranty expense accrued for financial reporting purposes amounts to $7,000. Warranty deductions per the tax return amount to $2,000. b. Gross profit on construction contracts using the percentage-of-completion method per books amounts to $92,000. Gross profit on construction contracts for tax purposes amounts to $67,000. c. Depreciation of property, plant, and equipment for financial reporting purposes amounts to $60,000. Depreciation of these assets amounts to $80,000 for the tax return. d. A $3,500 fine paid for violation of pollution laws was deducted in computing pretax financial income. e. Interest revenue recognized on an investment in tax-exempt municipal…arrow_forwardIn each of the following cases, compute the corporation’s regular tax: Use 2017 tax rate schedule if needed. Required: Silva Corporation has $170,000 taxable income for its tax year ended December 31, 2017. Goyal Corporation has $170,000 taxable income for its tax year ended December 31, 2018. Carver Corporation has $170,000 taxable income for its tax year ended October 31, 2018. Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. corporations' regular tax a. b. c.arrow_forwardUse the information in Table 1-3. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17%, calculate the amount of tax liability for 2018 for all taxpayers. How does this amount differ from the actual liability? Graded on the following: Calculates tax liability for yearly taxpayers indicating how amounts differ from the actual liability.arrow_forward

- CSX Corporation reported the following in its tax footnote to its 2019 financial statements. Use this information to answer the requirements. $ millions Net income Interest expense, net 737 639 546 Average total assets 37,493 36,234 35,577 Compute (a) return on assets and (b) the adjusted return on assets for each of the three years. Assume a statutory tax rate of 37% for 2017 and 22% for 2018 and 2019. a. Compute return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute ROA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROA for each year. Year Numerator Net income 2019 2018 2017 $3,331 $3,309 $5,471 2017 $ 2018 $ 2019 $ 2017 $ 2018 S 2019 $ Denominator + Average total assets ÷ 35,577 5,471 $ 3,309 $ 3,331 $ ÷ b. Compute adjusted return on assets (ROA) for 2017, 2018, and 2019 Note: 1. Select the appropriate numerator and denominator used to compute adjusted ROA from the…arrow_forwardBezos Company’s income tax return shows income taxes payable for 2020 of $75,000 (that is, $75,000 is owed for 2020). For financial reporting, the firm reports deferred tax assets of $67,900 at the beginning of 2020 and $63,600 at the end of 2020. It reports deferred tax liabilities of $53,600 at the beginning of 2020 and $59,400 at the end of 2020. Compute the amount of income tax expense for 2020.arrow_forwardJ-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2016. The only difference between accounting and taxable income is estimated product warranty costs for sales this year. Warranty payments are expected to be in equal amounts over the next three years. Recent tax legislation will change the tax rate from the current 40% to 30% in 2018. Determine the amounts necessary to record J-Matt’s income taxes for 2016 and prepare the appropriate journal entry.arrow_forward

- Bonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardAs the accountant for Monroe Trucking Company, you are preparing the company’s annual return, Form 940 andSchedule A. Use the following information to complete Form 940 and Schedule A on pages 5-52 to 5-54.The net FUTA tax liability for each quarter of 2019 was as follows: 1st, $97.00; 2nd, $87.00; 3rd, $69.70; and 4th,$59.50.Since the net FUTA tax liability did not exceed $500, the company was not required to make its first deposit ofFUTA taxes until January 31, 2020. Assume that the electronic payment was made on time.a. One of the employees performs all of his duties in another state—Louisiana.b. Total payments made to employees during calendar year 2019:Texas..........................$53,450Louisiana ...................22,150Total ..........................$75,600c. Employer contributions into employees’ 401(k) retirement plan: $1,250.d. Payments made to employees in excess of $7,000: $22,150.e. Form is to be signed by Vernon Scott, Vice President, and dated 1/31/20.f. Phone…arrow_forwardJohnson Ltd. Paid $64,000 in taxes for 2017, and will use this amount to estimate the quarterly instalment payments due to CRA for 2018. Johnson Ltd. has a December 31 t year end. Prepare the journal entries to record: a) the March 31, 2018 instalment amount payable, b) the instalment payment on April 15, 2018, and c) the December 31, 2018 final tax payable amount if the total yearly taxes owing was actually $59,000. (no entry for the actual payment, just the recognition of the payable amount).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License