Concept explainers

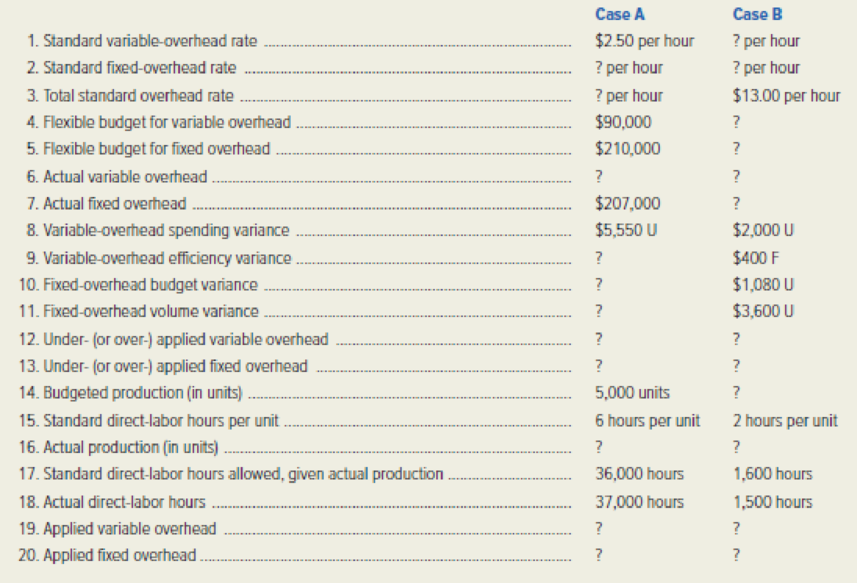

For each of the following independent Cases A and B, fill in the missing information. The company budgets and applies production

Calculate the missing amount for each of the given independent case A and B.

Explanation of Solution

Flexible Budget: A flexible budget is a budget that is prepared for different levels of the output. In other words, it is a budget that adjusts according to the changes in the volume of the activity. The main purpose of preparing flexible budget is to determine the differences among standard and actual result.

Calculate the missing amount for each of the given independent case A and B as follows:

| Particulars | Case A | Case B |

| 1. Standard variable overhead rate | $2.50 per hour |

$4.00 per hour (13) |

| 2. Standard fixed overhead rate |

$7.00 per hour (2) |

$9.00 per hour (14) |

| 3. Total standard overhead rate |

$9.50 per hour (3) | $13.00 per hour |

| 4. Flexible budget for variable overhead | $ 90,000 |

$ 6,400 (15) |

| 5. Flexible budget for fixed overhead | $ 210,000 |

$ 18,000 (16) |

| 6. Actual variable overhead |

$ 98,050 (4) |

$ 8,000 (17) |

| 7. Actual fixed overhead | $ 207,000 |

$ 19,080 (18) |

| 8. Variable overhead spending variance | $5,550 U | $2,000 U |

| 9. Variable overhead efficiency variance |

$2,500 U (5) | $400 F |

| 10. Fixed overhead budget variance |

$3,000 F (6) | $1,080 U |

| 11. Fixed overhead volume variance |

-$42,000 (7) | $3,600 U |

| 12. Under (over) applied variable overhead | $8,050 Under applied (8) | $1,600 Under applied (19) |

| 13. Under (over) applied fixed overhead | $45,000 over applied (9) | $4,680 under applied (21) |

| 14. Budgeted production (in units) | 5,000 units | 1,000 units (22) |

| 15. Standard direct labor hours per unit | 6 hours per unit | 2 hours per unit |

| 16. Actual production (in units) | 6,000 units (10) | 800 units (23) |

| 17. Standard direct labor hours allowed for actual production | 36,000 hours | 1,600 hours |

| 18. Actual direct labor hours | 37,000 hours | 1,500 hours |

| 19. Applied variable overhead | $ 90,000 (11) | $ 6,400 (24) |

| 20. Applied fixed overhead | $ 252,000 (12) | $ 14,400 (25) |

Table (1)

Working note (1):

Calculate the budgeted direct labor hours for Case A.

Working note (2):

Calculate the standard fixed overhead rate for Case A.

Working note (3):

Calculate the total standard overhead rate for Case A.

Working note (4):

Calculate the actual variable overhead for Case A.

Working note (5):

Calculate the variable overhead efficiency variance for Case A.

Working note (6):

Calculate the fixed overhead budget variance for Case A.

Working note (7):

Calculate the fixed overhead volume variance for Case A.

Working note (8):

Calculate the under applied variable overhead for Case A.

Working note (9):

Calculate the over applied fixed overhead for Case A.

Working note (10):

Calculate the actual production for Case A.

Working note (11):

Calculate the applied variable overhead for Case A.

Working note (12):

Calculate the applied fixed overhead for Case A.

Working note (13):

Calculate the variable overhead efficiency variance for Case B.

Working note (14):

Calculate the standard fixed overhead rate for Case B.

Working note (15):

Calculate the flexible budget for variable overhead for Case B.

Working note (16):

Calculate the flexible budget for fixed overhead for Case B.

Working note (17):

Calculate the actual variable overhead for Case B.

Working note (18):

Calculate the actual fixed overhead for Case B.

Working note (19):

Calculate the under applied variable overhead for Case B.

Working note (20):

Calculate the under applied fixed overhead for Case B.

Working note (21):

Calculate the budgeted direct labor hours for Case B:

Working note (22):

Calculate the budgeted production for Case B:

Working note (23):

Calculate the actual production for Case B:

Working note (24):

Calculate the applied variable overhead for Case B:

Working note (25):

Calculate the applied fixed overhead for Case B:

Want to see more full solutions like this?

Chapter 11 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- The fixed factory overhead variance is caused by the difference between which of the following? A. actual and standard allocation base B. actual and budgeted Units C. actual fixed overhead and applied fixed overhead D. actual and standard overhead ratesarrow_forwardAcme Inc. has the following information available: A. Compute the material price and quantity, and the labor rate and efficiency variances. B. Describe the possible causes for this combination of favorable and unfavorable variances.arrow_forwardComputing labor variances Fill in the missing figures for each of the following independent cases: (Round all rates to the nearest cent and all totals to the nearest dollar.)arrow_forward

- If variances are recorded in the accounts at the time the manufacturing costs are incurred, what does a debit balance in Direct Materials Price Variance represent?arrow_forwardPerformance Report for Variable Variances Potter Company provided the following information: Required: Prepare a performance report that shows the variances for each variable overhead item (inspection and power).arrow_forwardKamen Manufacturing Co. estimates the following labor and overhead costs for the period: Required: Use the four-variance method for overhead analysis. Calculate the variances for direct labor and overhead. Prove that the overhead variances equal over- or underapplied factory overhead for the period.arrow_forward

- The variable overhead rate variance is caused by the sum between which of the following? A. actual and standard allocation base B. actual and standard overhead rates C. actual and budgeted units D. actual units and actual overhead ratesarrow_forwardRecompute the variances from the second Acme Inc. exercise using $0.0725 as the standard cost of the material and $14 as the standard labor cost per hour. How has your explanation of the variances changed?arrow_forward(Appendix) Calculating factory overhead: three variances Using the data given in E8-17, calculate the following overhead variances: a. Spending variance. b. Production-volume variance. c. Efficiency variance. d. Was the factory overhead under- or overapplied? By what amount? In all problems involving variances, use F and U to indicate favorable and unfavorable variances, respectively.arrow_forward

- (Appendix 10A) Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported on the balance sheet at the end of the year. e. All of these.arrow_forwardRibcos labor cost information for making its only product for March is as follows: A. What is the direct labor rate variance? B. What is the direct labor time variance? C. What is the total direct labor variance?arrow_forwardWarner Company has the following data for the past year: Warner uses the overhead control account to accumulate both actual and applied overhead. Required: 1. Calculate the overhead variance for the year and close it to cost of goods sold. 2. Assume the variance calculated is material. After prorating, close the variances to the appropriate accounts and provide the final ending balances of these accounts. 3. What if the variance is of the opposite sign calculated in Requirement 1? Provide the appropriate adjusting journal entries for Requirements 1 and 2.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning