College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 4E

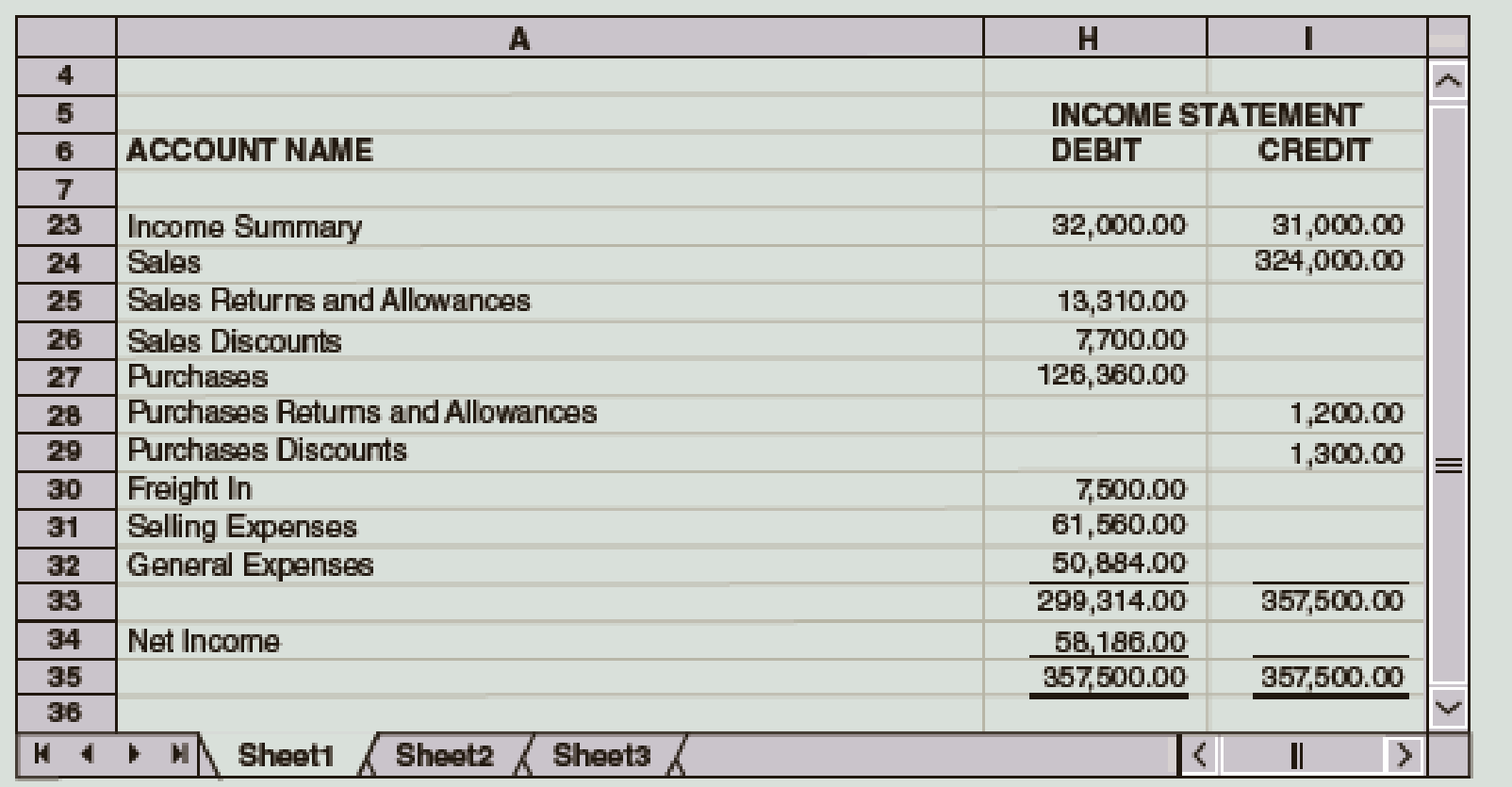

The Income Statement columns of the August 31 (year-end) work sheet for Ralley Company are shown here. From the information given, prepare an income statement for the company. To save time and space, the expenses have been grouped together into two categories.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can I please get help with this question including an explaination of how to categorize??

A review of the accounting records of Baird Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP.

Salary of the company president—$75,000.

Salary of the vice president of manufacturing—$50,000.

Salary of the chief financial officer—$42,000.

Salary of the vice president of marketing—$40,000.

Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$147,000.

Wages of production workers—$703,500.

Salaries of administrative personnel—$60,000.

Salaries of engineers and other personnel responsible for maintaining production equipment—$133,500.

Commissions paid to sales staff—$146,000.

Required

What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense?

Assuming that Baird made 5,000…

What is the total cost of compensation expense for the first week of January year 1 for Webber packing company?

The following expenses were incurred by a merchandising business during the year. In which expense section of the income statement should each be reported: (a) selling,(b) administrative, or (c) other?1. Advertising expense2. Depreciation expense on store equipment3. Insurance expense on office equipment4. Interest expense on notes payable5. Rent expense on office building6. Salaries of office personnel7. Salary of sales manager8. Sales supplies used

Chapter 12 Solutions

College Accounting (Book Only): A Career Approach

Ch. 12 - What is the term used for the profit on a sale...Ch. 12 - Which of the following is not an example of a...Ch. 12 - Prob. 3QYCh. 12 - What is the third entry of the closing procedure...Ch. 12 - What general journal entry is used to undo a...Ch. 12 - Prob. 1DQCh. 12 - What is the difference between the cost of goods...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQ

Ch. 12 - Explain the calculation of net sales and net...Ch. 12 - Prob. 7DQCh. 12 - What are the rules for recognizing whether an...Ch. 12 - Prob. 9DQCh. 12 - Calculate the missing items in the following:Ch. 12 - Using the following information, prepare the Cost...Ch. 12 - Prob. 3ECh. 12 - The Income Statement columns of the August 31...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - From the following T accounts, journalize the...Ch. 12 - From the following information, journalize the...Ch. 12 - A partial work sheet for The Fan Shop is presented...Ch. 12 - Prob. 2PACh. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - A partial work sheet for McKnight Music Store is...Ch. 12 - Here is the partial work sheet for Meyer Mountain...Ch. 12 - The following partial work sheet covers the...Ch. 12 - The following accounts appear in the ledger of...Ch. 12 - Costco is the largest chain of membership...Ch. 12 - A music store sells new instruments. The store...Ch. 12 - You are an owner/bookkeeper in a country whose...Ch. 12 - Prob. 4ACh. 12 - Prob. 5ACh. 12 - Prob. 1CP

Additional Business Textbook Solutions

Find more solutions based on key concepts

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

18. What is the calculation for return on assets (ROA)? Explain what ROA measures.

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Using the information from Problem 1-2B and the inventory information for the Best Bikes below, complete the re...

Managerial Accounting

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FINANCIAL STATEMENTS The Income Statement and Balance Sheet columns of Wen Companys work sheet are shown on the next page. Additional information needed to prepare the financial statements is as follows: REQUIRED 1. Prepare an income statement and a schedule of cost of goods manufactured for the year ended December 31, 20--. 2. Prepare a statement of retained earnings for the year ended December 31, 20--. 3. Prepare a balance sheet as of December 31, 20--.arrow_forwardFINANCIAL STATEMENTS The Income Statement and Balance Sheet columns of Braiden Companys work sheet are shown on the next page. Additional information needed to prepare the financial statements is as follows: REQUIRED 1. Prepare an income statement and a schedule of cost of goods manufactured for the year ended December 31, 20--. 2. Prepare a statement of retained earnings for the year ended December 31, 20-- 3. Prepare a balance sheet as of December 31, 20--.arrow_forwardThe following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forward

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardExplain Adjustments, Financial Statements, and Year-End Accounting for a Manufacturing Businessarrow_forwardAll of the following is a period cost EXCEPT: a. Salary of an accountant. b. Cost of a training session attended by the company's controller. c. Insurance on a company administration building. d. Monthly depreciation of assembly line equipment.arrow_forward

- Prepare an income statement through gross profit for vennman company for the month ended March 31.arrow_forwardThe financial analysis of a manufacturing company for the previous year yielded the following details: (see picture) The weeks of supply for the company are Answer weeks. (Enter your response rounded to two decimal places.)arrow_forwardCertain items descriptions and amounts are missing from the monthly income statement of chili Manufacturing Company. Fill in the missing information on the income statement. Select the heading, the complete the statement.arrow_forward

- Suppose a company paid $15,000 for supplies during the year and you determine that there were $2,000 and $3,000 in supplies at the beginning and end of the year, respectively. What was supplies expense for the year?arrow_forwardAt year end,Elliott counted the office supplies on hand,which amounted to $1500.The firm had $900 of supplies on hand at the start of the year, and had purchased $600 of supplies during the year.What was the total office supplies expense for the year?arrow_forwardMason, Durant, and Westbrook (MDW) is a tax services firm. The firm is located in Oklahoma City and employs 15 professionals and eight staff. The firm does tax work for small businesses and well-to-do individuals. The following data are provided for the last fiscal year. (The Mason, Durant, and Westbrook fiscal year runs from July 1 through June 30.) Required: 1. Prepare a statement of cost of services sold. 2. Refer to the statement prepared in Requirement 1. What is the dominant cost? Will this always be true of service organizations? If not, provide an example of an exception. 3. Assuming that the average fee for processing a return is 850, prepare an income statement for Mason, Durant, and Westbrook. 4. Discuss three differences between services and tangible products. Calculate the average cost of preparing a tax return for last year. How do the differences between services and tangible products affect the ability of MDW to use the last years average cost of preparing a tax return in budgeting the cost of tax return services to be offered next year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY