Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 19E

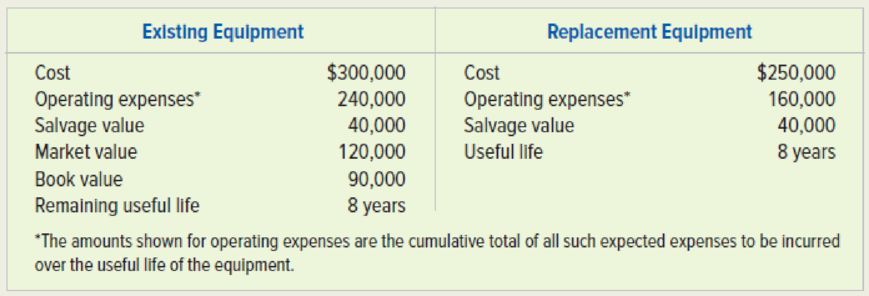

Exercise 6-19A Asset replacement decision

Mead Company is considering the replacement of some of its manufacturing equipment. Information regarding the existing equipment and the potential replacement equipment follows:

Required

Based on this information, recommend whether to replace the equipment. Support your recommendation with appropriate computations.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

EXERCISE 11–1 Indicate whether the items below are to be capitalized as an intangible asset or expensed. Which account(s) would each item be recorded to?

Salaries of research staff

Costs to test prototypes

Borrowing costs for development of a qualifying intangible asset

Executive salaries for time spent on development of an intangible asset

Costs to launch a new product

Purchase cost of a patent from a third party

Product research costs

Costs internally incurred to create goodwill

Legal costs to successfully defend a patent

Purchase price of new software

Training costs for new software

Direct costs of special programming needed when purchasing new software

Costs incurred in forming a corporation for purposes of commercializing a new product

Operating losses incurred in the start-up of a business to manufacture a patented produce

The purchase cost of a franchise

The cost of developing a patent

The cost of purchasing a patent from an inventor

Legal costs incurred in securing a patent…

49

List of Statements

1. The job ticket is used to allocate each labor hour of work to specific WIP accounts.

2. Because fixed assets are requested and employed by end-users asset acquisitions should be formal and explicitly authorized.

Which of the statement(s) above is(are) invalid?

O Both statements are valid

Statement 2

O Both statements are invalid

O Statement 1

answer only

23. Which of the following costs is relevant to a make-or-buy decision of a particular part of a product?

a.The direct labor costs used to manufacture the part

b.The depreciation on the plant used to manufacture the part

c.The fixed annual rent paid for the office building

d.The salary of the sales manager who sells the product

Chapter 13 Solutions

Survey Of Accounting

Ch. 13 - Prob. 1QCh. 13 - Prob. 2QCh. 13 - Prob. 3QCh. 13 - Prob. 4QCh. 13 - Prob. 5QCh. 13 - Prob. 6QCh. 13 - Prob. 7QCh. 13 - Prob. 8QCh. 13 - Prob. 9QCh. 13 - Prob. 10Q

Ch. 13 - Prob. 11QCh. 13 - Prob. 12QCh. 13 - Prob. 13QCh. 13 - Prob. 14QCh. 13 - Prob. 15QCh. 13 - Prob. 16QCh. 13 - Prob. 17QCh. 13 - Prob. 18QCh. 13 - Prob. 19QCh. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - Prob. 3ECh. 13 - Prob. 4ECh. 13 - Exercise 6-5AOpportunity costs Norman Dowd owns...Ch. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - Prob. 8ECh. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - Exercise 6-11AEstablishing price for an...Ch. 13 - Exercise 6-12AOutsourcing decision with...Ch. 13 - Exercise 6-13AOutsourcing decision affected by...Ch. 13 - Prob. 14ECh. 13 - Exercise 6-15ASegment elimination decision Dudley...Ch. 13 - Prob. 16ECh. 13 - Exercise 6-17AAsset replacementopportunity cost...Ch. 13 - Prob. 18ECh. 13 - Exercise 6-19A Asset replacement decision Mead...Ch. 13 - Exercise 6-20A Asset replacement decision Kahn...Ch. 13 - Exercise 6-21A Annual versus cumulative data for...Ch. 13 - Problem 6-23A Context-sensitive relevance Required...Ch. 13 - Problem 6-24A Context-sensitive relevance...Ch. 13 - Problem 6-25A Effect of order quantity on special...Ch. 13 - Problem 6-26A Effects of the level of production...Ch. 13 - Problem 6-28A Eliminating a segment Western Boot...Ch. 13 - Effect of activity level and opportunity cost on...Ch. 13 - Problem 6-30A Comprehensive problem including...Ch. 13 - Prob. 29PCh. 13 - ATC 6-1 Business Application Case Analyzing...Ch. 13 - ATC 6-2 Group Assignment Relevance and cost...Ch. 13 - Prob. 3ATCCh. 13 - Prob. 4ATCCh. 13 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 17 The cost of a new building that is currently under construction, not for sale but for a company's own use, is reported on the balance sheet: Multiple Choice as an asset called Work in Process. after construction is complete. as an asset called Construction in Progress. as a liability until construction is complete.arrow_forward______21. The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use. ____ 22. An estimate of the amount which an asset can be sold at the end of its useful life is called residual value. ____ 23. Federal unemployment taxes are paid by the employer and the employee. ____ 24. When minor errors occur in the estimates used in the determination of depreciation, the amounts recorded for depreciation expense in the past should be corrected. ____ 25. Residual value is not relevant when calculating the annual depreciation expense using the double declining-balance method (do not consider the calculation for the final year). True and False questionsarrow_forwardChapter 8 Why are the costs of plant/long term assets recovered through depreciation vs. expensed out during the period purchased? Choose one of the following depreciation methods to discuss: straight line, units of production, declining balance. Share how depreciation using this method is calculated and provide an example of when this would be the most ideal method for application.arrow_forward

- Q3) (Classification Issues—intangibles) Presented below and on the next page is a list of that could be included in the intangible assets section of the statement of financial position. Investment in a subsidiary company. Timberland, Cost of engineering activity required 10 advance the design of product to the manufacturing stage. Cost of searching for applications of new research findings. Costs incurred in the formation of a corporation. Training costs incurred in start-up of new operation. Purchase cost of a franchise. Goodwill generated internally Cost of testing in search for product alternatives. Goodwill acquired in the purchase of a business. Cost of developing a patent (before achieving economic viability). Cost of purchasing a patent from an inventor. Legal costs incurred in securing a patent. Unrecovered costs of a successful legal suit to protect the patent, Cost of conceptual formulation of possible product alternatives. Cost of purchasing a copyright. Development costs…arrow_forwardQuestion 9: AICPA.083734FAR-SIM Many years after constructing a plant asset, management spent a significant sum on the asset. Which of the following types of expenditures should be capitalized in this instance: (1) an expenditure for routine maintenance that increases the useful life compared with deferring the maintenance, (2) an expenditure that increases the useful life of the asset compared with the original estimate assuming normal maintenance at the required intervals, (3) an expenditure that increases the utility of the asset. (1) (2) (3) Yes Yes Yes No Yes Yes No No Yes No Yes Noarrow_forwardQuestion 36: Match each depreciation function with its best description. SLN SYD DDB Results in the same depreciation expense each period Bases depreciation on the number of years in the asset's useful life Accelerated depreciation method that doesn't consider salvage value in the initial calculationsarrow_forward

- Exercise 22-10 Listed below are various types of accounting changes and errors.For each change or error, indicate how it would be accounted for using the following code: 1. Change in a plant asset’s salvage value. select a type of accounting approach 2. Change due to overstatement of inventory. select a type of accounting approach 3. Change from sum-of-the-years’-digits to straight-line method of depreciation. select a type of accounting approach 4. Change from presenting unconsolidated to consolidated financial statements. select a type of accounting approach 5. Change from LIFO to FIFO inventory method. select a type of accounting approach 6. Change in the rate used to compute warranty costs. select a type of accounting approach 7. Change from an unacceptable accounting principle to an acceptable accounting principle. select a type of accounting approach 8. Change in a patent’s…arrow_forward6. Evaluate the following statements: S1. When buildings and improvements are constructed in connection with the removal of natural resources and their usefulness is limited to the duration of the project, the depreciation should be recognized on an output basis similar to the one used for the natural resource itself. S2. The acquisition cost of wasting assets includes the purchase price and developmental costs, such as drilling costs, sinking mine shafts, and constructing roads. a. True, True b. False, True c. True, False d. False, Falsearrow_forwardanswer in 10 minutes What is the criterion a company uses to decide whether to include an expenditure in the cost of property, plant,and equipment rather than expensing it? Give an example of the types of expenditures that are included in the cost of property, plant and equipment as a result of the application of this criterionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY