ATC 6-1 Business Application Case Analyzing inventory reductions at Supervalu

Real-world companies often reduce the complexity of their operations in an attempt to increase profits. In late 2014 and early 2015 McDonald’s Corporation announced a series of restructuring efforts it planned to undertake to improve profitability. One of these was to reduce the number of items offered for sale in its restaurants. In October 2014, General Motors announced plans to reduce the number of vehicle production platforms on which it builds cars from 26 to four by 2025. In 2010, Supervalu, Inc., one of the largest grocery store companies in the United States, announced it was planning to reduce the number of different items it carries in its inventory by as much as 25 percent. Supervalu is one of the largest grocery store companies in the United States.

Most of the planned reduction in inventory items at Supervalu was going to be accomplished by reducing the number of different package sizes rather than by reducing entire product brands. The new approach was intended to allow the company to get better prices from its vendors and to put more emphasis on its own store brands.

Required

- a. Identify some costs savings these companies might realize by reducing the number of items they sell or use in production. Be as specific as possible, and use your imagination.

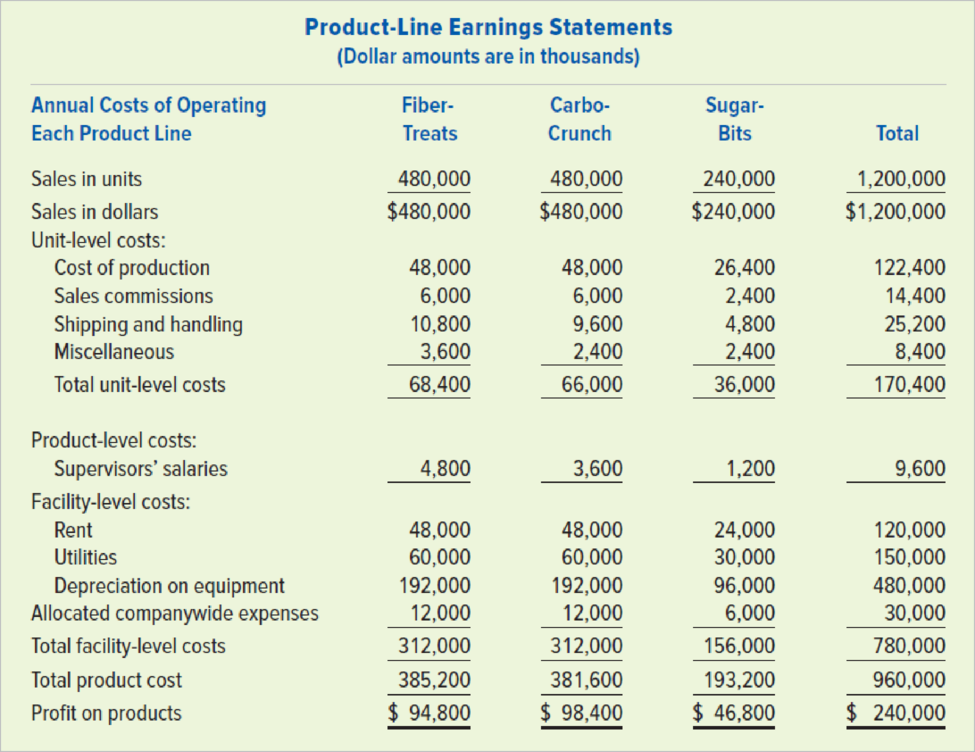

- b. Consider the additional information presented below, which is hypothetical. All dollar amounts are in thousands, unit amounts are not. Assume that Supervalu decides to eliminate one product line, Sugar-Bits, for one of its segments that currently produces three products. As a result, the following are expected to occur:

- (1) The number of units sold for the segment is expected to drop by only 40,000 because of the elimination of Sugar-Bits, since most customers are expected to purchase a Fiber-Treats or Carbo-Crunch product instead. The shift of sales from Sugar-Bits to Fiber-Treats and Carbo-Crunch is expected to be evenly split. In other words, the sales of Fiber-Treats and Carbo-Crunch will each increase by 100,000 units.

- (2) Rent is paid for the entire production facility, and the space used by Sugar-Bits cannot be sublet.

- (3) Utilities costs are expected to be reduced by $24,000.

- (4) All of the supervisors for Sugar-Bits were all terminated. No new supervisors will be hired for Fiber-Treats or Carbo-Crunch.

- (5) The equipment being used to produce Sugar-Bits is also used to produce the other two products. However, the company believes that as a result of eliminating Sugar-Bits it can dispose of equipment that has a remaining useful life of 5 years, and a projected salvage value of $20,000. Its current market value is $35,000.

- (6) Facility-level costs will continue to be allocated between the product lines based on the number of units produced.

Prepare revised product-line earnings statements based on the elimination of Sugar-Bits. (Hint: It will be necessary to calculate some per-unit data to accomplish this.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Survey Of Accounting

- Exercise 6-14 (Algo) Calculate inventory using lower of cost and net realizable value (LO6-6) [The following information applies to the questions displayed below.] A company like Golf USA that sells golf-related inventory typically will have inventory items such as golf clothing and golf equipment. As technology advances the design and performance of the next generation of drivers, the older models become less marketable and therefore decline in value. Suppose that in the current year, Ping (a manufacturer of golf clubs) introduces the MegaDriver II, the new and improved version of the MegaDriver. Below are year-end amounts related to Golf USA’s inventory. Inventory Quantity Unit Cost Unit NRV Shirts 38 $55 $73 MegaDriver 18 390 330 MegaDriver II 33 410 450 Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardTF 4 of 4 Sharon Lee, CEO of Carla Vista Industries, is concerned about the recent volatility in the company’s operating income. She believes that since the number of units sold has been fairly stable over the past three years that operating income also should have been stable. Sharon asked Brian Walker, Carla Vista's inventory manager, to help her understand the issue.Brian reviewed the company’s records and compiled the following changes to Finished Goods Inventory (in units) for the years 2019, 2020, and 2021. Year 2019 2020 2021 Beginning inventory 1,000 2,000 500 Production 40,000 38,000 40,000 Sales (39,000) (39,500) (39,500) Ending inventory 2,000 500 1,000 Brian also gathered the 2019 income statements prepared using absorption costing and variable costing, which follow. Income Statement—Absorption Costing Sales $ 4,875,000 Cost of goods sold…arrow_forwardHewlett-Packard and Apple: Inventory turnover and number of days sales in inventory Hewlett-Packard Company (HP) and Apple Inc. are both developers and marketers of Computer equipment and peripherals. However, the two companies follow different manufacturing strategies. HP maintains a significant portion of its own manufacturing capabilities, while Apple outsources manufacturing to other companies. The following financial statement information is provided for both companies for a recent year (in millions): HP Apple Cost of goods sold 73,726 112,258 Inventories: Beginning of year 6,046 1,764 End of year 6,415 2,111 A. Determine the inventory turnover for each company. (Round all calculations to one decimal place.) B. Determine the number of days sales in inventory for each company. (Use 365 days and round all calculations to one decimal place.) C. Interpret the difference between the ratios for the two companies.arrow_forward

- Costing inventory Golden Eagle Company begun operations in 2016 by selling a single product. Data on purchases and sales for the year were as follows: Sales: April 16,000 units May 16,000 June 20,000 July 24,000 August 28,000 September 28.000 October 18,000 November 10,000 December 8,000 Total units 168,000 Total sales 10,000,000 On January 4, 2017, the president of the company, Connie Kilmer, asked for your advice on costing the 32,000-unit physical inventory that was taken on December 51, 2016. Moreover, since the firm plans to expand its product line, she asked for your advice on the use of a perpetual inventory system in the future. 1. Determine the cost of the December 31. 2016, inventory under the periodic system, using the (a) first-m, first-out method, (b) last-in, first-out method, and (c) weighted average cost method. 2. Determine the gross profit for the year under each of the three methods in (1). 3. a. Explain varying viewpoints why each of the three inventory costing methods may best reflect the results of operations for 2016. b. Which of the three inventory costing methods may best reflect the replacement cost of the inventory on the balance sheet as of December 31, 2016:' c. Which inventory costing method would you choose to use for income tax purposes? Why? d. Discuss the advantages and disadvantages of using a perpetual inventory system. From the data presented in this case, is there any indication of the adequacy of inventory' levels during the year?arrow_forwardProblems 6-5A Inventory Turnover and Days’ Sales in Inventory The Eastern Corporation installed a new inventory management system at the beginning of 2015. Eastern reported an inventory turnover of 2.80 in 2015. Shown below are data from the company’s accounting record as reported by the new system: 2015 2016 Sales Revenue $19,000, 000 $20, 000, 000 Cost of Goods Sold 8,500, 000 8, 900,000 Beginning inventory 2, 500, 000 2, 530, 000 Ending Inventory 2, 530,000 2, 600, 000 Calculate the company’s (a) inventory turnover and (b) days’…arrow_forwardProblems 6-5A Inventory Turnover and Days’ Sales in Inventory The Eastern Corporation installed a new inventory management system at the beginning of 2015. Eastern reported an inventory turnover of 2.80 in 2015. Shown below are data from the company’s accounting record as reported by the new system: 2015 2016 Sales Revenue $19,000, 000 $20, 000, 000 Cost of Goods Sold 8,500, 000 8, 900,000 Beginning inventory 2, 500, 000 2, 530, 000 Ending Inventory 2, 530,000 2, 600, 000 Calculate the company’s (a) inventory turnover and (b) days’…arrow_forward

- Exercise 6-5A Calculate inventory amounts when costs are declining (LO6-3) Skip to question [The following information applies to the questions displayed below.] During the year, Trombley Incorporated has the following inventory transactions. Date Transaction Numberof Units UnitCost Total Cost Jan. 1 Beginning inventory 30 $ 32 $ 960 Mar. 4 Purchase 35 31 1,085 Jun. 9 Purchase 40 30 1,200 Nov. 11 Purchase 40 28 1,120 145 $ 4,365 For the entire year, the company sells 111 units of inventory for $40 each. Exercise 6-5A Part 3 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 2 decimal places and all other answers to the nearest whole number.)arrow_forwardExercise 6-5A Calculate inventory amounts when costs are declining (LO6-3) Skip to question [The following information applies to the questions displayed below.] During the year, Trombley Incorporated has the following inventory transactions. Date Transaction Numberof Units UnitCost Total Cost Jan. 1 Beginning inventory 30 $ 32 $ 960 Mar. 4 Purchase 35 31 1,085 Jun. 9 Purchase 40 30 1,200 Nov. 11 Purchase 40 28 1,120 145 $ 4,365 For the entire year, the company sells 111 units of inventory for $40 each. 1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.arrow_forwardProblem 6-7A Prepare a multiple-step income statement and calculate the inventory turnover ratio and gross profit ratio (LO6-2, 6-7) Skip to question [The following information applies to the questions displayed below.]Baskin-Robbins is one of the world’s largest specialty ice cream shops. The company offers dozens of different flavors, from Very Berry Strawberry to lowfat Espresso ’n Cream. Assume that a local Baskin-Robbins in Raleigh, North Carolina, has the following amounts for the month of July 2021. Salaries expense $ 13,000 Sales revenue $ 66,300 Inventory (July 1, 2021) 1,950 Interest income 2,600 Sales returns 1,200 Cost of goods sold 28,350 Utilities expense 3,250 Rent expense 6,000 Income tax expense 5,300 Interest expense 500 Inventory (July 31, 2021) 1,200 Problem 6-7A Part 1 Required: 1. Prepare a multiple-step income statement for the month ended July 31, 2021.arrow_forward

- Problem 6-7A Prepare a multiple-step income statement and calculate the inventory turnover ratio and gross profit ratio (LO6-2, 6-7) Skip to question [The following information applies to the questions displayed below.]Baskin-Robbins is one of the world’s largest specialty ice cream shops. The company offers dozens of different flavors, from Very Berry Strawberry to lowfat Espresso ’n Cream. Assume that a local Baskin-Robbins in Raleigh, North Carolina, has the following amounts for the month of July 2021. Salaries expense $ 13,000 Sales revenue $ 66,300 Inventory (July 1, 2021) 1,950 Interest income 2,600 Sales returns 1,200 Cost of goods sold 28,350 Utilities expense 3,250 Rent expense 6,000 Income tax expense 5,300 Interest expense 500 Inventory (July 31, 2021) 1,200 Problem 6-7A Part 3 3. Calculate the gross profit ratio for the month of July.arrow_forwardProblem 6-7A Prepare a multiple-step income statement and calculate the inventory turnover ratio and gross profit ratio (LO6-2, 6-7) Skip to question [The following information applies to the questions displayed below.]Baskin-Robbins is one of the world’s largest specialty ice cream shops. The company offers dozens of different flavors, from Very Berry Strawberry to lowfat Espresso ’n Cream. Assume that a local Baskin-Robbins in Raleigh, North Carolina, has the following amounts for the month of July 2021. Salaries expense $ 13,000 Sales revenue $ 66,300 Inventory (July 1, 2021) 1,950 Interest income 2,600 Sales returns 1,200 Cost of goods sold 28,350 Utilities expense 3,250 Rent expense 6,000 Income tax expense 5,300 Interest expense 500 Inventory (July 31, 2021) 1,200 Problem 6-7A Part 2 2-a. Calculate the inventory turnover ratio for the month of July. 2-b. Would you expect…arrow_forwardCase Study 4: Inventory Management. (II) A regional distributor purchases discontinued appliances from various suppliers and then sells them on demand to retailers in the region. The distributor operates 5 days per week, 52 weeks per year. Only when it is open for business can orders be received. Management wants to reevaluate its current inventory policy, which calls for order quantities of 440 counter-top mixers. The following data are estimated for the mixer: Average daily demand 100 mixers Standard deviation of daily demand 30 mixers Lead time (L) = 3 days Holding Cost (H) = $9.40/order/year Ordering Cost (S) = $35/order Cycle service level = 92% The distributor uses a continuous review (Q) system What order quantity, Q, and reorder point, R, should be used? What is the total annual cost of the system? If on-hand inventory is 40 units, one open order for 440 mixers is pending and no back orders exist, should a new order be placed?arrow_forward

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning