Concept explainers

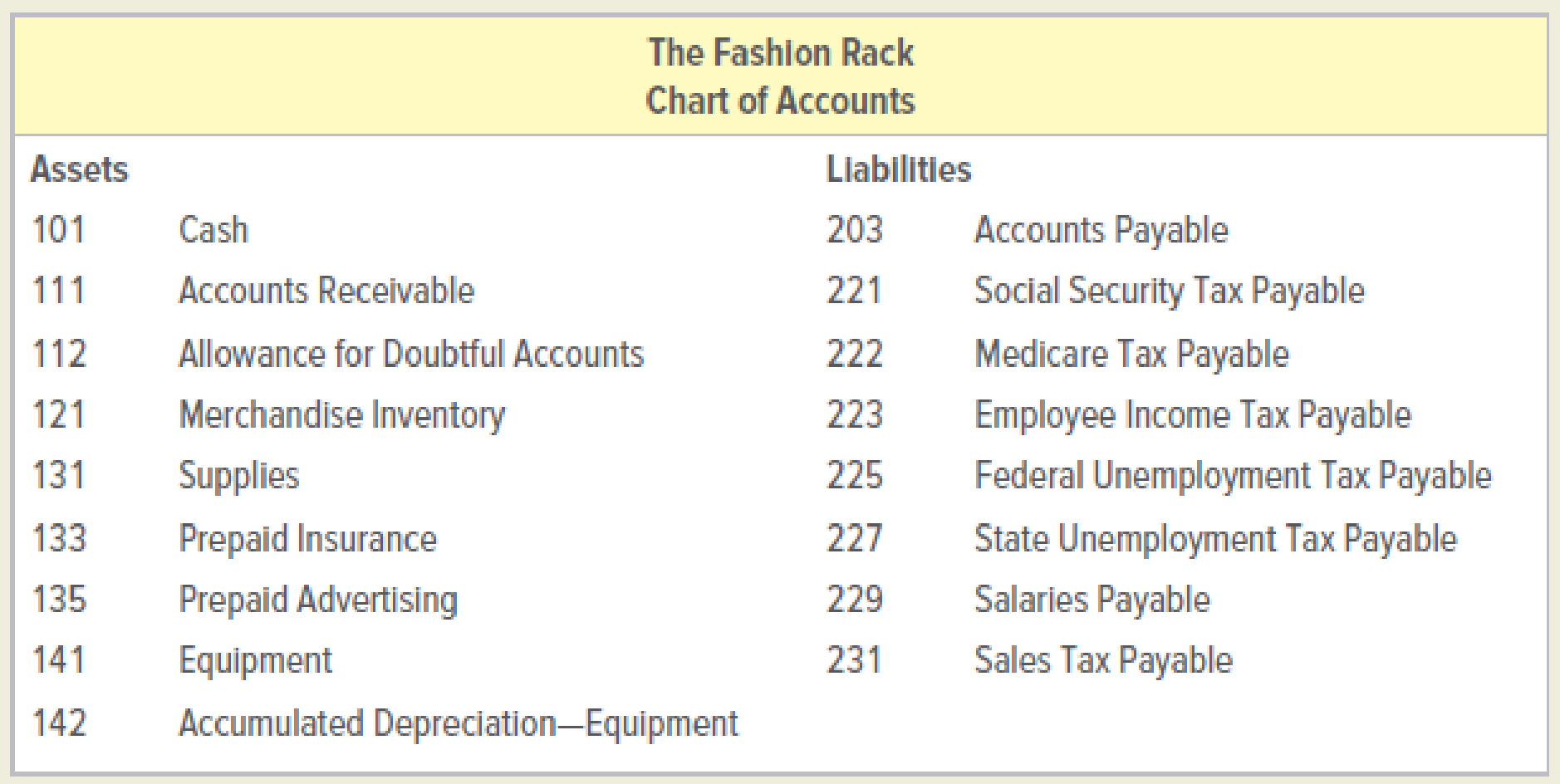

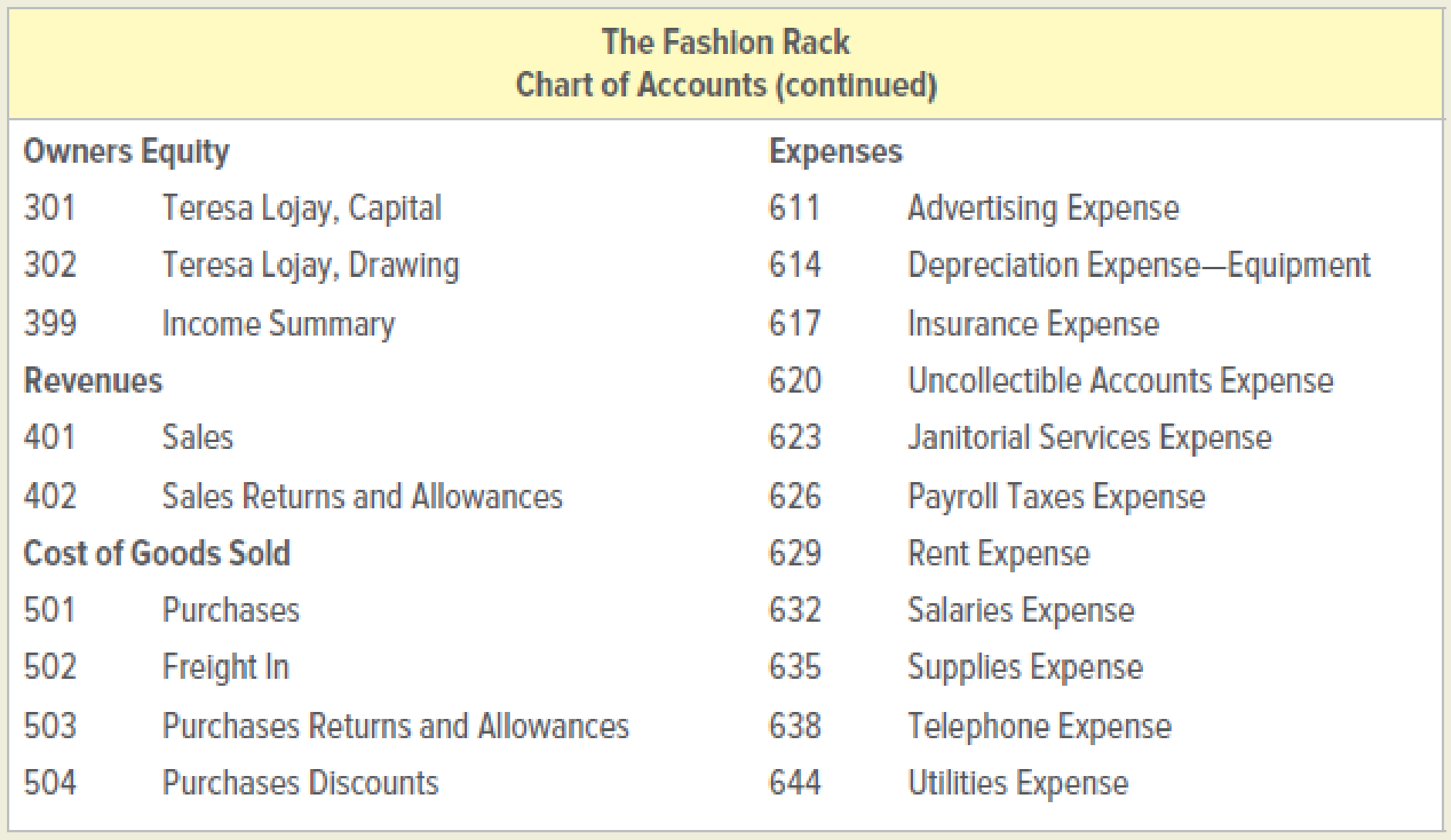

The Fashion Rack is a retail merchandising business that sells brand-name clothing at discount prices. The firm is owned and managed by Teresa Lojay, who started the business on April 1, 2019. This project will give you an opportunity to put your knowledge of accounting into practice as you handle the accounting work of The Fashion Rack during the month of October 2019.

The Fashion Rack has a monthly accounting period. The firm’s chart of accounts is shown below. The journals used to record transactions are the sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Postings are made from the journals to the

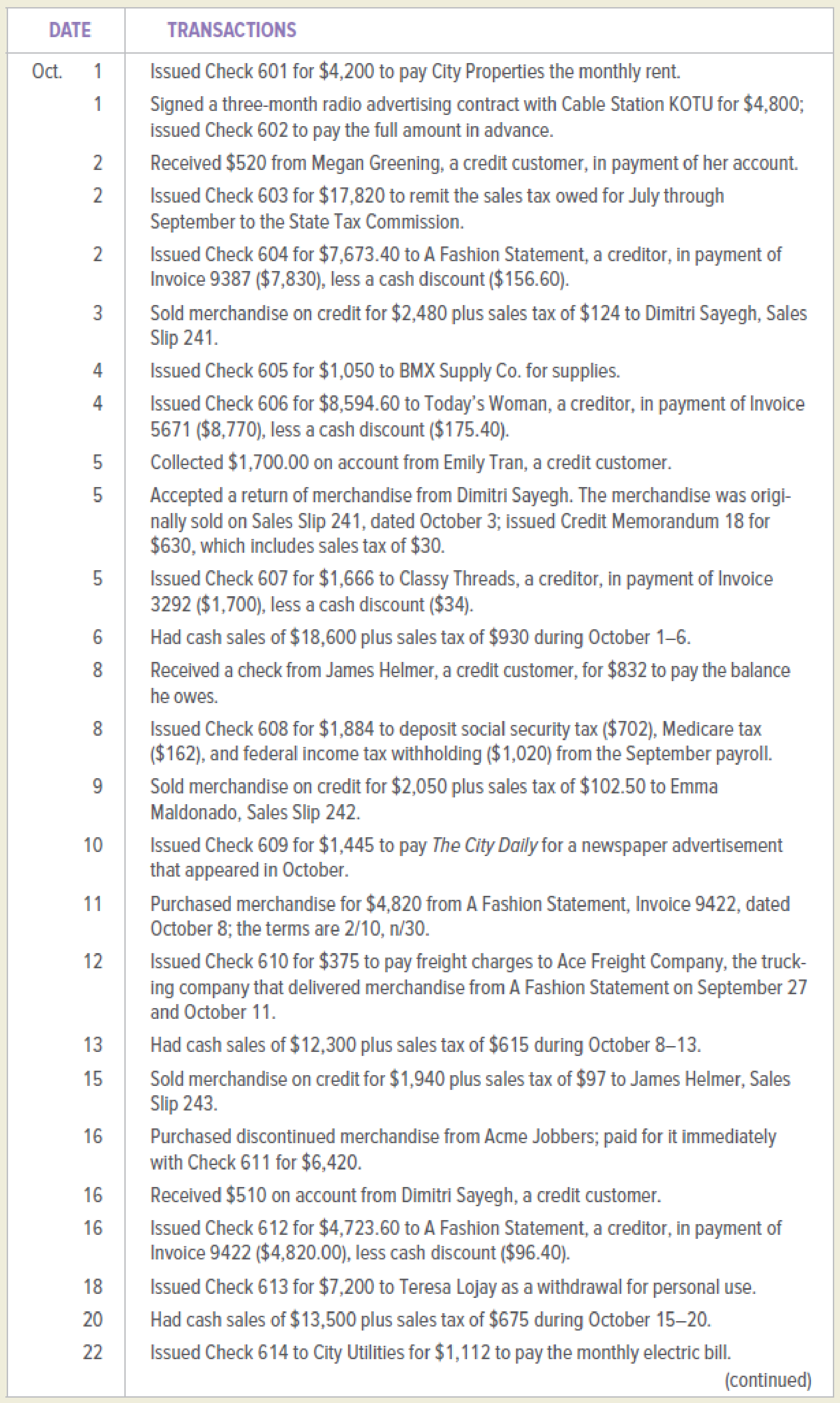

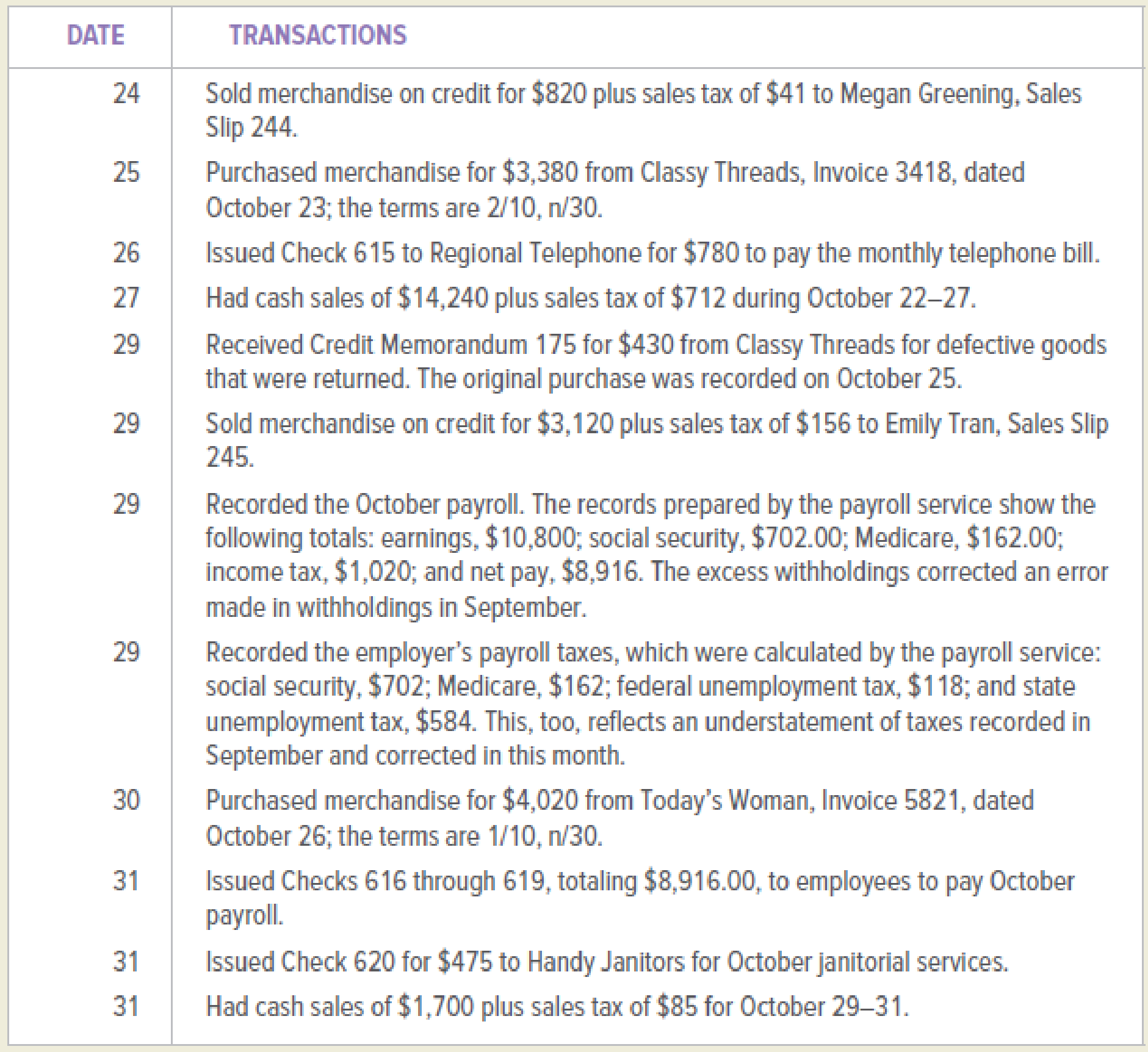

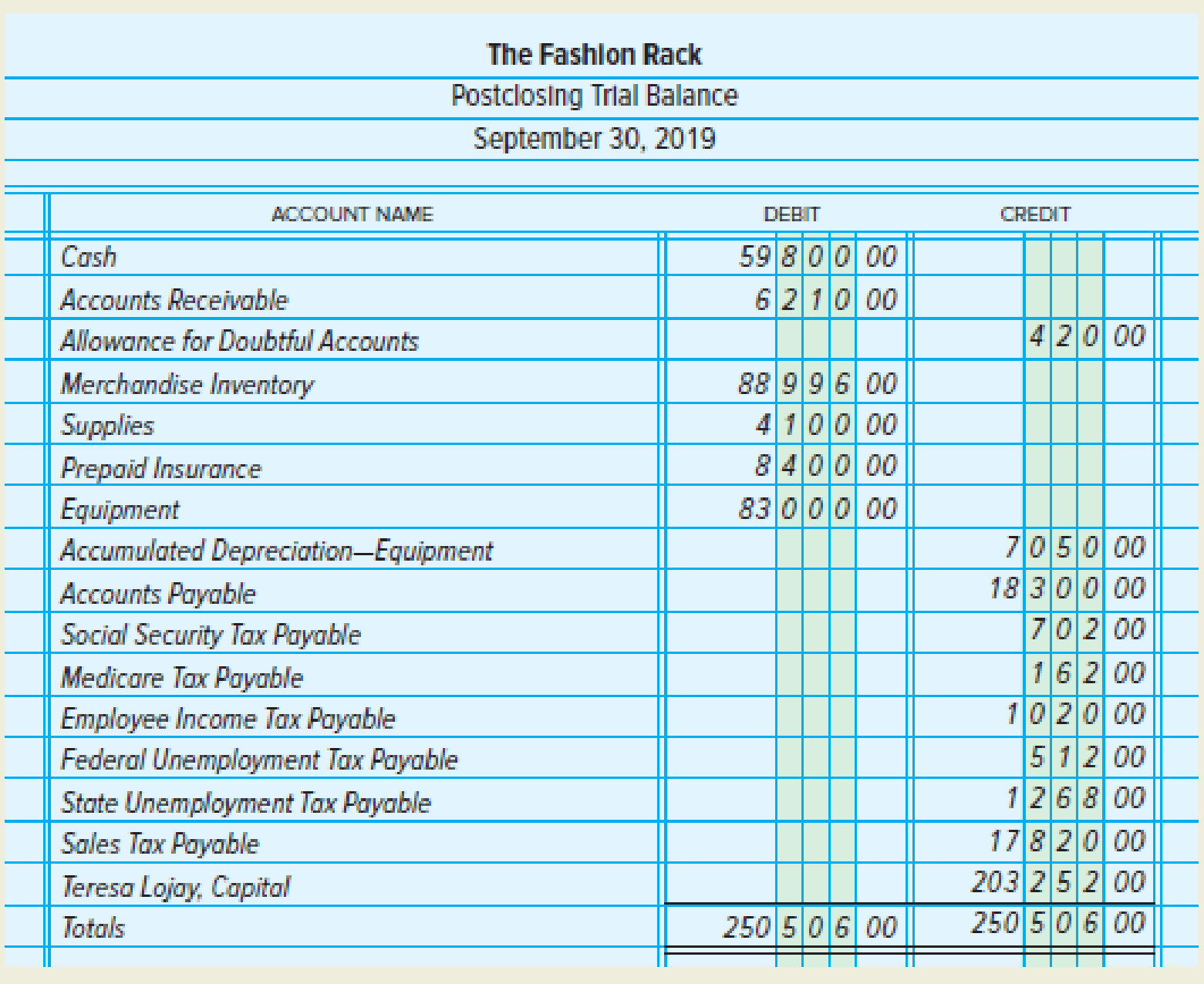

- 1. Open the general ledger accounts and enter the balances for October 1, 2019. Obtain the necessary figures from the postclosing

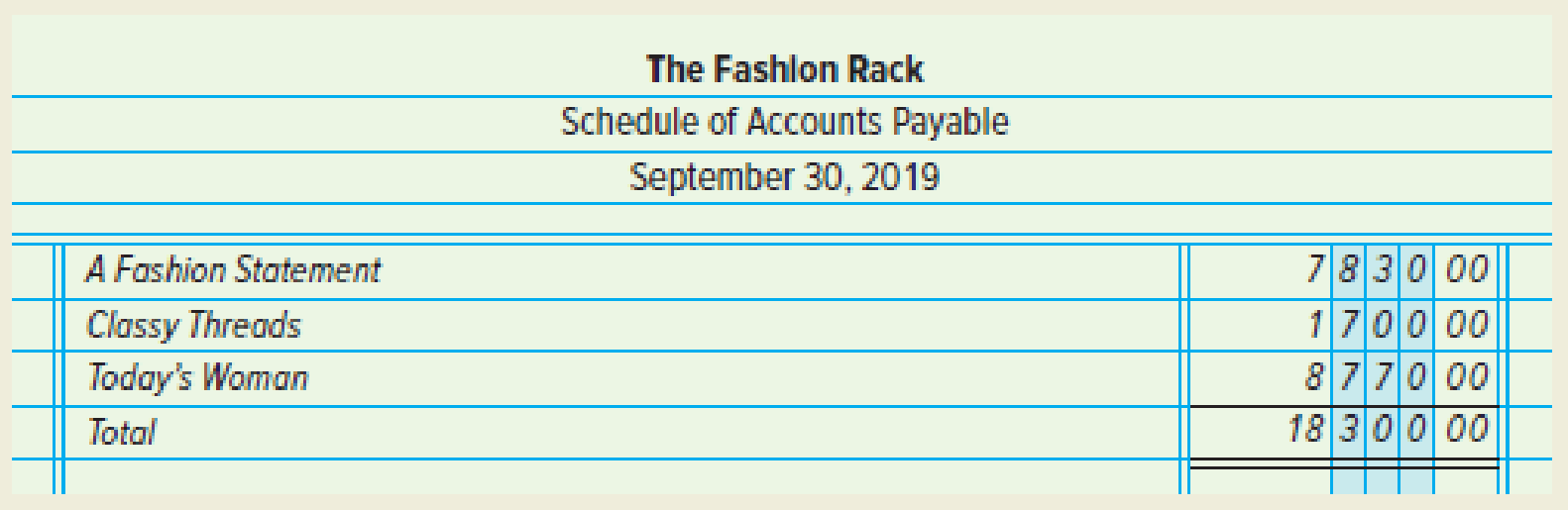

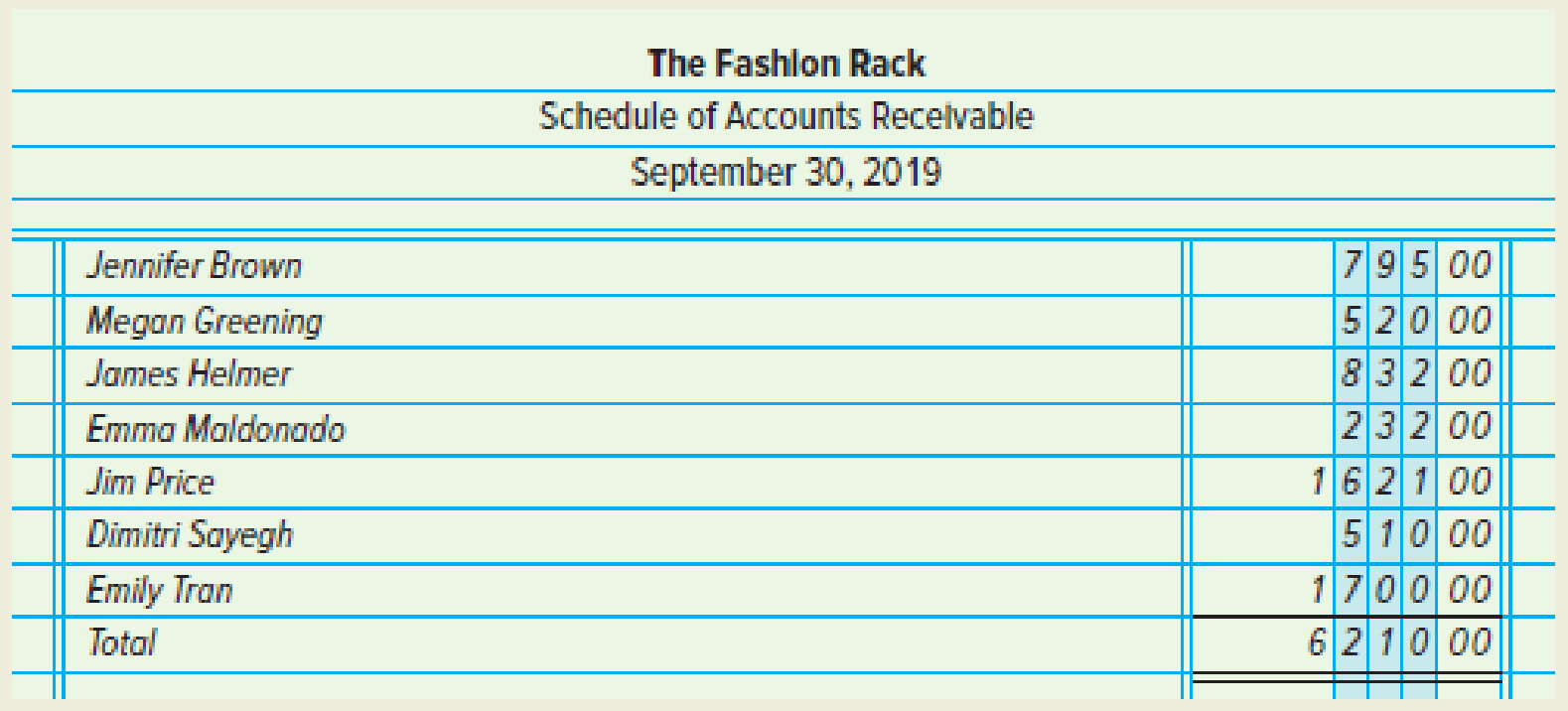

trial balance prepared on September 30, 2019, which is shown below. (If you are using the Study Guide & Working Papers, you will find that the general ledger accounts are already open.) - 2. Open the subsidiary ledger accounts and enter the balances for October 1, 2019. Obtain the necessary figures from the schedule of accounts payable and schedule of accounts receivable prepared on September 30, 2019, which appears below. (If you are using the Study Guide & Working Papers, you will find that the subsidiary ledger accounts are already open.)

- 3. Analyze the transactions for October and record each transaction in the general journal. (Use 16 as the number for the first page of the general journal.)

- 4. Post the individual entries from the general journal to the general ledger and subsidiary ledgers.

- 5. Check the accuracy of the subsidiary ledgers by preparing a schedule of accounts receivable and a schedule of accounts payable as of October 31, 2019. Compare the totals with the balances of the Accounts Receivable account and the Accounts Payable account in the general ledger.

- 6. Check the accuracy of the general ledger by preparing a trial balance in the first two columns of a 10-column worksheet. Make sure that the total debits and the total credits are equal.

- 7. Complete the Adjustments section of the worksheet. Use the following data. Identify each adjustment with the appropriate letter.

- a. During October, the firm had net credit sales of $9,810. From experience with similar businesses, the previous accountant had estimated that 1.0 percent of the firm’s net credit sales would result in uncollectible accounts. Record an adjustment for the expected loss from uncollectible accounts for the month of October.

- b. On October 31, an inventory of the supplies showed that items costing $3,240 were on hand. Record an adjustment for the supplies used in October.

- c. On September 30, 2019, the firm purchased a six-month insurance policy for $8,400. Record an adjustment for the expired insurance for October.

- d. On October 1, 2019, the firm signed a three-month advertising contract for $4,800 with a local cable television station and paid the full amount in advance. Record an adjustment for the expired advertising for October.

- e. On April 1, 2019, the firm purchased equipment for $83,000. The equipment was estimated to have a useful life of five years and a salvage value of $12,500. Record an adjustment for

depreciation on the equipment for October.

f.–g. Based on a physical count, ending merchandise inventory was determined to be $81,260.

- 8. Complete the Adjusted Trial Balance section of the worksheet.

- 9. Determine the net income or net loss for October and complete the worksheet.

- 10. Prepare a classified income statement for the month ended October 31, 2019. (The firm does not divide its operating expenses into selling and administrative expenses.)

- 11. Prepare a statement of owner’s equity for the month ended October 31, 2019.

- 12. Prepare a classified balance sheet as of October 31, 2019.

- 13. Journalize and post the

adjusting entries using general journal page 17. - 14. Prepare and post the closing entries using general journal page 18.

- 15. Prepare a postclosing trial balance.

3, 13 and 14.

Prepare the general journal.

Explanation of Solution

General journal: This is a journal used to record infrequent transactions like adjusting entries, closing entries, accounting errors, sale of assets, or bad debts expense.

Prepare the sales journal:

| SALES JOURNAL | Page - 10 | |||||

| Date |

Sales Slip |

Customer Name | Post. Ref. | Accounts receivable Debit | Sales Tax Payable Credit | Sales Credit |

| 2019 | ||||||

| October 3 | 241 | DS | ✔ | $2,604.00 | $124.00 | $ 2,480.00 |

| October 9 | 242 | EM | ✔ | $2,152.50 | $102.50 | $ 2,050.00 |

| October 15 | 243 | JH | ✔ | $2,037.00 | $97.00 | $ 1,940.00 |

| October 24 | 244 | MG | ✔ | $861.00 | $41.00 | $ 820.00 |

| October 29 | 245 | ET | ✔ | $3,276.00 | $156.00 | $ 3,120.00 |

| October 31 | $10,930.50 | $520.50 | $10,410.00 | |||

Table (1)

Prepare the purchases journal:

| PURCHASES JOURNAL | Page - 10 | |||||

| Date | Description | Invoice Number | Invoice Date | Terms | Post. Ref. | Accounts Payable Credit |

| 2019 | ||||||

| October 11 | AFS | 9422 | 10.8.16 | 2/10, n/30 | ✔ | $ 4,820.00 |

| October 25 | CT | 3418 | 10.23.16 | 2/10, n/30 | ✔ | $ 3,380.00 |

| October 30 | TW | 5821 | 10.26.16 | 1/10, n/30 | ✔ | $ 4,020.00 |

| October 31 | $12,220.00 | |||||

Table (2)

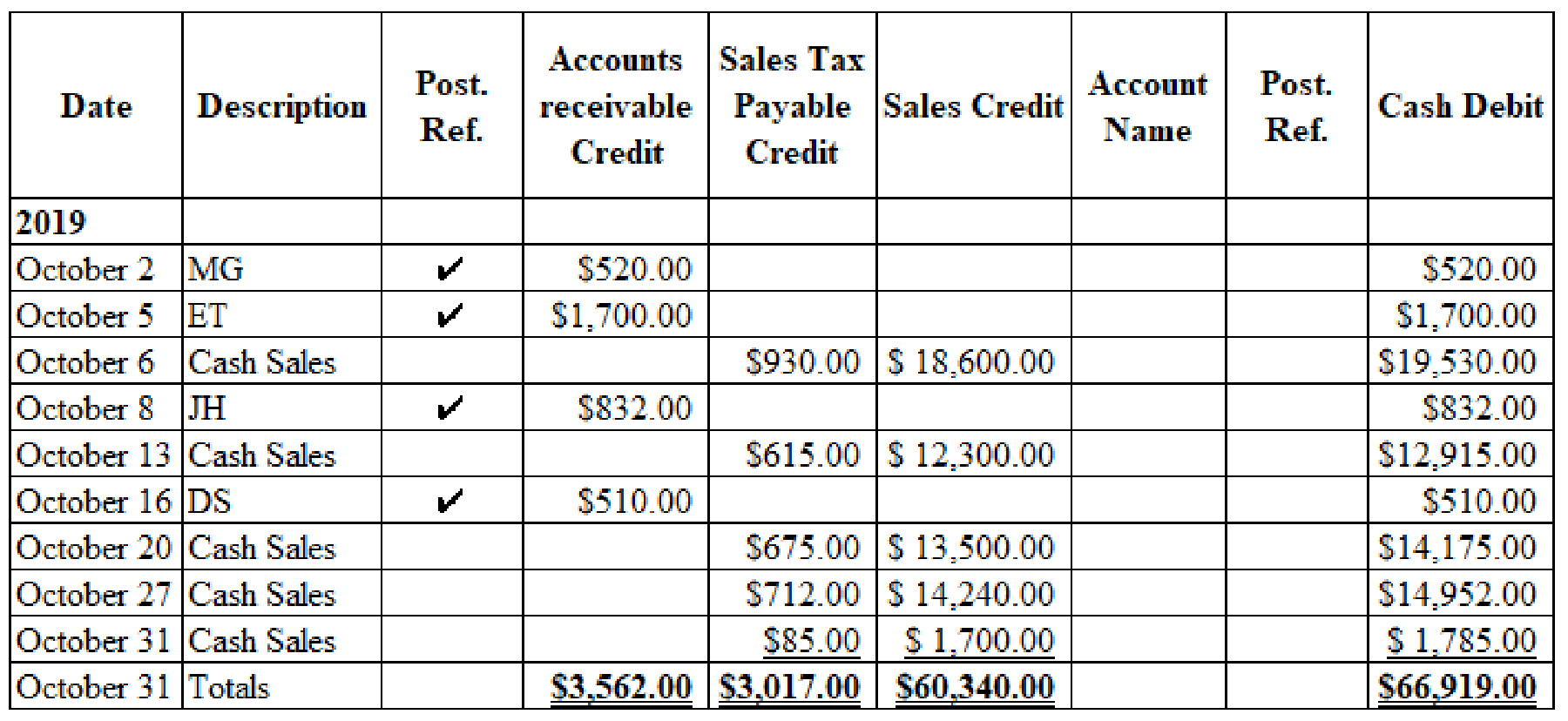

Prepare the cash receipt journal:

Figure (1)

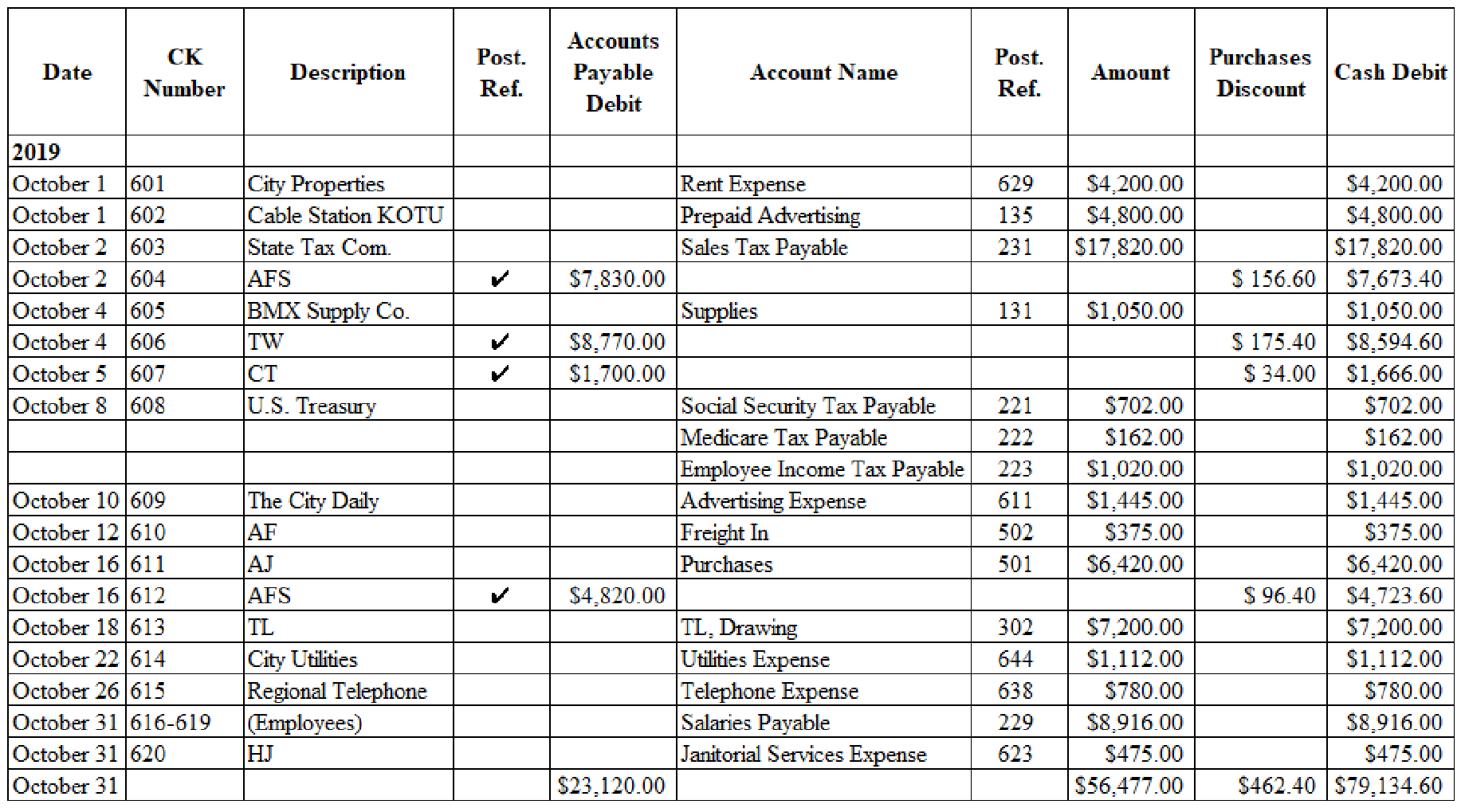

Prepare the cash payment journal:

Figure (2)

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Pass the journal entries for the given transactions:

| General Journal | Page - 16 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| October 5 | Sales Returns and Allowances | 402 | $ 600.00 | |

| Sales Tax Payable | 231 | $ 30.00 | ||

| Accounts receivable | 111 | $ 630.00 | ||

| (To record the sales returns from DS using sales slip 241, the credit memorandum is 18) | ||||

| October 29 | Accounts payable | 203 | $430 | |

| Purchases Returns and Allowances | 503 | $430 | ||

| (To record the return of defective goods purchased on October 25, invoice 37418 and Credit Memo 175) | ||||

| October 29 | Salaries Expense | 632 | $10,800 | |

| Salaries Payable | 229 | $8,916 | ||

| Social Security Tax Payable | 221 | $702.00 | ||

| Medicare Tax Payable | 222 | $162.00 | ||

| Employee Income Tax Payable | 223 | $1,020.00 | ||

| (To record the payroll) | ||||

| October 29 | Payroll Taxes Expense | 626 | $1,566.00 | |

| Social Security Tax Payable | 221 | $702.00 | ||

| Medicare Tax Payable | 222 | $162.00 | ||

| Federal Unemployment Tax Payable | 225 | $118.00 | ||

| State Unemployment Tax Payable | 227 | $584.00 | ||

| (To record the payroll taxes) | ||||

| October 31 | Uncollectible Accounts Expense | 620 | $98.10 | |

| Allowance for Doubtful Accounts | 112 | $98.10 | ||

| (To record the estimated loss on the net credit sale) |

Table (3)

| General Journal | Page - 17 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| October 31 | Supplies Expense | 635 | $1,910 | |

| Supplies | 131 | $1,910 | ||

| (To record the Supplies used) | ||||

| October 31 | Insurance expense | 617 | $1,400 | |

| Prepaid Insurance | 133 | $1,400 | ||

| (To record the prepaid insurance) | ||||

| October 31 | Advertising expense | 611 | $1,600 | |

| Prepaid Advertising | 135 | $1,600 | ||

| (To record the prepaid insurance) | ||||

| October 31 | Depreciation Expense - Equipment | 614 | $1,175 | |

| Accumulated Depreciation - Equipment | 142 | $1,175 | ||

| (To record the depreciation on equipment) | ||||

| October 31 | Income Summary | 399 | $88,996 | |

| Merchandise Inventory | 121 | $88,996 | ||

| (To record the beginning inventory) | ||||

| October 31 | Merchandise Inventory | 121 | $81,260 | |

| Income Summary | 399 | $81,260 | ||

| (To record the closing inventory) |

Table (4)

| General Journal | Page - 18 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| October 31 | Sales | 401 | $70,750.00 | |

| Purchases Returns and allowances | 503 | $430.00 | ||

| Purchases Discounts | 504 | $462.40 | ||

| Income Summary | 399 | $71,642.40 | ||

| (To record the closing entry for the income) | ||||

| October 31 | Income Summary | 399 | $46,176.10 | |

| Sales Returns and Allowances | 402 | $600 | ||

| Purchases | 501 | $18,640 | ||

| Freight In | 502 | $375 | ||

| Advertising Expense | 611 | $3,045 | ||

| Depreciation Expense—Equipment | 614 | $1,175 | ||

| Insurance Expense | 617 | $1,400.00 | ||

| Uncollectible Accounts Expense | 620 | $98.10 | ||

| Janitorial Services Expense | 623 | $475 | ||

| Payroll Taxes Expense | 626 | $1,566 | ||

| Rent Expense | 629 | $4,200 | ||

| Salaries Expense | 632 | $10,800 | ||

| Supplies Expense | 635 | $1,910 | ||

| Telephone Expense | 638 | $780 | ||

| Utilities Expense | 644 | $1,112 | ||

| (To record the closing entry for the expenses) | ||||

| October 31 | Income Summary | 399 | $17,730.30 | |

| TL Capital | 301 | $17,730.30 | ||

| (To record the closing entry for the capital) | ||||

| October 31 | TL Capital | 301 | $7,200 | |

| TL Drawings | 302 | $7,200 | ||

| (To record the closing entry for the capital) |

Table (5)

| General Journal | Page - 19 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 1 | Interest Payable | $325 | ||

| Interest Expense | $325 | |||

| (To record the reversing entry for interest payable) | ||||

| January 1 | Salaries Payable | $2,100 | ||

| Salaries Expense - Office | $2,100 | |||

| (To record the reversing entry for salaries payable) | ||||

| January 1 | Social Security Tax Payable | $130.20 | ||

| Medicare Tax Payable | $30.45 | |||

| Payroll Taxes Expense | $160.65 | |||

| (To record the reversing entry for payroll taxes payable) |

Table (6)

1, 2, 4 and 5

Prepare the general ledger and the necessary subsidiary ledger.

Explanation of Solution

General ledger:

General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements. In the ledger all the entries are recorded in the account order, for which the transactions actually take place.

Post the journal entries in the General Ledger:

| GENERAL LEDGER | ||||||

| ACCOUNT: Cash | Account No.: 101 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $59,800.00 | |||

| October 31 | CR10 | $66,919.00 | $126,719.00 | |||

| October 31 | CP10 | $79,134.60 | $47,584.40 | |||

| ACCOUNT: Accounts receivable | Account No.: 111 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $6,210.00 | |||

| October 5 | Credit Memo 18 | J16 | $630.00 | $5,580.00 | ||

| October 31 | $10,930.50 | $16,510.50 | ||||

| October 31 | $3,562.00 | $12,948.50 | ||||

| ACCOUNT: Allowances and doubtful debts | Account No.: 112 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $420.00 | |||

| October 31 | Adjusting | J16 | $98.10 | $518.10 | ||

| ACCOUNT: Merchandise Inventory | Account No.: 121 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $88,996.00 | |||

| October 31 | Adjusting | J17 | $88,996.00 | $0.00 | ||

| October 31 | Adjusting | J17 | $81,260.00 | $81,260.00 | ||

Table (7)

| GENERAL LEDGER | ||||||

| ACCOUNT: Supplies | Account No.: 131 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $4,100.00 | |||

| October 4 | CP10 | $1,050.00 | $5,150.00 | |||

| October 31 | Adjusting | J17 | $1,910.00 | $3,240.00 | ||

| ACCOUNT: Prepaid Insurance | Account No.: 133 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $8,400.00 | |||

| October 31 | Adjusting | J17 | $1,400.00 | $7,000.00 | ||

| ACCOUNT: Prepaid Advertising | Account No.: 135 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | CP10 | $4,800.00 | $4,800.00 | |||

| October 31 | Adjusting | J17 | $1,600.00 | $3,200.00 | ||

| ACCOUNT: Equipment | Account No.: 141 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $83,000.00 | |||

| ACCOUNT: Accumulated Depreciation - Equipment | Account No.: 142 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $7,050.00 | |||

| October 31 | Adjusting | J17 | $1,175.00 | $8,225.00 | ||

Table (8)

| GENERAL LEDGER | ||||||

| ACCOUNT: Accounts payable | Account No.: 203 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $18,300.00 | |||

| October 29 | J16 | $430.00 | $17,870.00 | |||

| October 31 | P10 | $12,220.00 | $30,090.00 | |||

| October 31 | CP10 | $23,120.00 | $6,970.00 | |||

| ACCOUNT: Social Security Tax Payable | Account No.: 221 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $702.00 | |||

| October 8 | CP10 | $702.00 | $0.00 | |||

| October 29 | J16 | $702.00 | $702.00 | |||

| October 29 | J16 | $702.00 | $1,404.00 | |||

| ACCOUNT: Medicare Tax Payable | Account No.: 222 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $162.00 | |||

| October 8 | CP10 | $162.00 | $0.00 | |||

| October 29 | J16 | $162.00 | $162.00 | |||

| October 29 | J16 | $162.00 | $324.00 | |||

| ACCOUNT: Employee Income Tax Payable | Account No.: 222 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $1,020.00 | |||

| October 8 | CP10 | $1,020.00 | $0.00 | |||

| October 29 | J16 | $1,020.00 | $1,020.00 | |||

Table (9)

| GENERAL LEDGER | ||||||

| ACCOUNT: Federal Unemployment Tax Payable | Account No.: 222 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $512.00 | |||

| October 29 | J16 | $118.00 | $630.00 | |||

| ACCOUNT: State Unemployment Tax Payable | Account No.: 227 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $1,268.00 | |||

| October 29 | J16 | $584.00 | $1,852.00 | |||

| ACCOUNT: Salaries Payable | Account No.: 229 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 29 | J16 | $8,916.00 | $8,916.00 | |||

| October 31 | CP10 | $8,916.00 | $0.00 | |||

| ACCOUNT: Sales Tax Payable | Account No.: 520 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $17,820.00 | |||

| October 2 | CP10 | $17,820.00 | $0.00 | |||

| October 5 | J16 | $30.00 | $30.00 | |||

| October 31 | S10 | $520.50 | $490.50 | |||

| October 31 | CR10 | $3,017.00 | $3,507.50 | |||

Table (10)

| GENERAL LEDGER | ||||||

| ACCOUNT: TL Capital | Account No.: 301 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Balance | ✔ | $203,252.00 | |||

| October 31 | Closing | J18 | $17,730.30 | $220,982.30 | ||

| October 31 | Closing | J18 | $7,200.00 | $213,782.30 | ||

| ACCOUNT: TJ Drawing | Account No.: 302 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 18 | CP10 | $7,200.00 | $7,200.00 | |||

| October 31 | Closing | J18 | $7,200.00 | $0.00 | ||

| ACCOUNT: Income Summary | Account No.: 399 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | Adjusting | J17 | $88,996.00 | $88,996.00 | ||

| October 2 | Adjusting | J17 | $81,260.00 | $7,736.00 | ||

| October 5 | Closing | J18 | $71,642.40 | $63,906.40 | ||

| October 31 | Closing | J18 | 46176.10 | $17,730.30 | ||

| October 31 | Closing | J18 | $17,730.30 | $0.00 | ||

| ACCOUNT: Sales | Account No.: 401 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | S10 | $10,410.00 | $10,410.00 | |||

| October 31 | CR10 | $60,340.00 | $70,750.00 | |||

| October 31 | Closing | J18 | $70,750.00 | $0.00 | ||

Table (11)

| GENERAL LEDGER | ||||||

| ACCOUNT: Sales Returns and Allowances | Account No.: 402 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 5 | J16 | $600.00 | $600.00 | |||

| October 31 | Closing | J18 | $600.00 | $0.00 | ||

| ACCOUNT: Purchases | Account No.: 501 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 16 | CP10 | $6,420.00 | $6,420.00 | |||

| October 31 | P10 | $12,220.00 | $18,640.00 | |||

| October 31 | Closing | J18 | $18,640.00 | $0.00 | ||

| ACCOUNT: Freight In | Account No.: 502 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 12 | CP10 | $375.00 | $375.00 | |||

| October 31 | Closing | J18 | $375.00 | $0.00 | ||

| ACCOUNT: Purchases Returns and Allowances | Account No.: 503 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 29 | J16 | $430.00 | $430.00 | |||

| October 31 | Closing | J18 | $430.00 | $0.00 | ||

| ACCOUNT: Purchases Discounts | Account No.: 504 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | CP10 | $462.40 | $462.40 | |||

| October 31 | Closing | J18 | $462.40 | $0.00 | ||

Table (12)

| GENERAL LEDGER | ||||||

| ACCOUNT: Advertising Expense | Account No.: 611 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 10 | CP10 | $1,445.00 | $1,445.00 | |||

| October 31 | Adjusting | J17 | $1,600.00 | $3,045.00 | ||

| October 31 | Closing | J18 | $3,045.00 | $0.00 | ||

| ACCOUNT: Depreciation Expense - Equipment | Account No.: 614 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | Adjusting | J17 | $1,175.00 | $1,175.00 | ||

| October 31 | Closing | J18 | $1,175.00 | $0.00 | ||

| ACCOUNT: Insurance Expense - Equipment | Account No.: 617 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | Adjusting | J17 | $1,400.00 | $1,400.00 | ||

| October 31 | Closing | J18 | $1,400.00 | $0.00 | ||

| ACCOUNT: Uncollectible Accounts Expense | Account No.: 620 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | Adjusting | J17 | $98.10 | $98.10 | ||

| October 31 | Closing | J18 | $98.10 | $0.00 | ||

| ACCOUNT: Janitorial Services Expense | Account No.: 623 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | CP10 | $475.00 | $475.00 | |||

| October 31 | Closing | J18 | $475.00 | $0.00 | ||

Table (13)

| GENERAL LEDGER | ||||||

| ACCOUNT: Payroll Taxes Expense | Account No.: 626 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 29 | J16 | $1,566.00 | $1,566.00 | |||

| October 31 | Closing | J18 | $1,566.00 | $0.00 | ||

| ACCOUNT: Rent Expense | Account No.: 629 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | CP10 | $4,200.00 | $4,200.00 | |||

| October 31 | Closing | J18 | $4,200.00 | $0.00 | ||

| ACCOUNT: Salaries Expense | Account No.: 632 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | J16 | $10,800.00 | $10,800.00 | |||

| October 31 | Closing | J18 | $10,800.00 | $0.00 | ||

| ACCOUNT: Supplies Expense | Account No.: 635 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 31 | Adjusting | J17 | $1,910.00 | $1,910.00 | ||

| October 31 | Closing | J18 | $1,910.00 | $0.00 | ||

| ACCOUNT: Rent Expense | Account No.: 638 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 26 | CP10 | $780.00 | $780.00 | |||

| October 31 | Closing | J18 | $780.00 | $0.00 | ||

Table (14)

| GENERAL LEDGER | ||||||

| ACCOUNT: Utilities Expense | Account No.: 644 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 22 | CP10 | $1,112.00 | $1,112.00 | |||

| October 31 | Closing | J18 | $1,112.00 | $0.00 | ||

Table (15)

Prepare the Accounts Receivable Subsidiary Ledger:

| ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER | |||||

| NAME: JB | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $795.00 | ||

| NAME: MG | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $520.00 | ||

| October 2 | CR10 | $520.00 | $0.00 | ||

| October 24 | Sales Slip 244 | S10 | $861.00 | $861.00 | |

| NAME: JH | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $832.00 | ||

| October 8 | CR10 | $832.00 | $0.00 | ||

| October 15 | Sales Slip 243 | S10 | $2,037.00 | $2,037.00 | |

Table (16)

| ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER | |||||

| NAME: EM | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $232.00 | ||

| October 9 | Sales Slip 242 | S10 | $2,152.00 | $2,384.00 | |

| NAME: JP | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $1,621.00 | ||

| NAME: DS | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $510.00 | ||

| October 3 | Sales Slip 241 | S10 | $2,604.00 | $3,114.00 | |

| October 5 | Credit Memo 18 | J16 | $630.00 | $2,484.00 | |

| October 16 | CR10 | $510.00 | $1,974.00 | ||

| NAME: ET | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $1,700.00 | ||

| October 5 | CR10 | $1,700.00 | $0.00 | ||

| October 16 | Sales Slip 245 | S10 | $3,276.00 | $3,276.00 | |

Table (17)

Prepare the Accounts Payable Subsidiary Ledger:

| ACCOUNTS PAYABLE SUBSIDIARY LEDGER | |||||

| NAME: AFS | TERMS: 2/10, n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $7,830.00 | ||

| October 2 | CP10 | $7,830.00 | $0.00 | ||

| October 11 | Invoice 9422 | P10 | $4,820.00 | $4,820.00 | |

| October 16 | CP10 | $4,820.00 | $0.00 | ||

Table (18)

| ACCOUNTS PAYABLE SUBSIDIARY LEDGER | |||||

| NAME: CT | TERMS: 2/10, n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $1,700.00 | ||

| October 5 | CP10 | $1,700.00 | $0.00 | ||

| October 25 | Invoice 3418 | P10 | $3,380.00 | $3,380.00 | |

| October 29 | Credit Memo 18 | J16 | $430.00 | $2,950.00 | |

| NAME: TW | TERMS: n/30 | ||||

| Date | Description | Post. Ref. | Debit | Credit | Balance |

| 2019 | |||||

| October 1 | Balance | ✔ | $8,770.00 | ||

| October 4 | CP10 | $8,770.00 | $0.00 | ||

| October 30 | Invoice 5821 | P10 | $4,020.00 | $4,020.00 | |

Table (19)

Prepare the Schedule of Accounts Receivable:

| Company TFR | |

| Schedule of Accounts Receivable | |

| October 31, 2019 | |

| Particulars | Amount ($) |

| JB | $795.00 |

| MG | $861.00 |

| JH | $2,037.00 |

| EM | $2,384.50 |

| JP | $1,621.00 |

| DS | $1,974.00 |

| ET | $3,276.00 |

| Total accounts receivable | $12,948.50 |

Table (20)

Prepare the Schedule of Accounts Payable:

| Company TFR | |

| Schedule of Accounts Payable | |

| October 31, 2019 | |

| Particulars | Amount ($) |

| AFS | $0.00 |

| CT | $2,950.00 |

| TW | $4,020.00 |

| Total accounts receivable | $6,970.00 |

Table (21)

6, 7, 8 and 9.

Prepare the 10 column Worksheet with all the adjustments.

Explanation of Solution

Worksheet: A worksheet is the used in the preparation of the financial statement. It is a pre-defined form, having multiple columns, used in the adjustment process.

The worksheet is a supplementary device which helps to prepare the adjusting entries and the financial statements easier. The worksheet is a working tool of the accountant but it is not a permanent accounting record. The worksheet starts with two columns (debit and credit) of the trial balance, and ends with the income statement and the balance sheet.

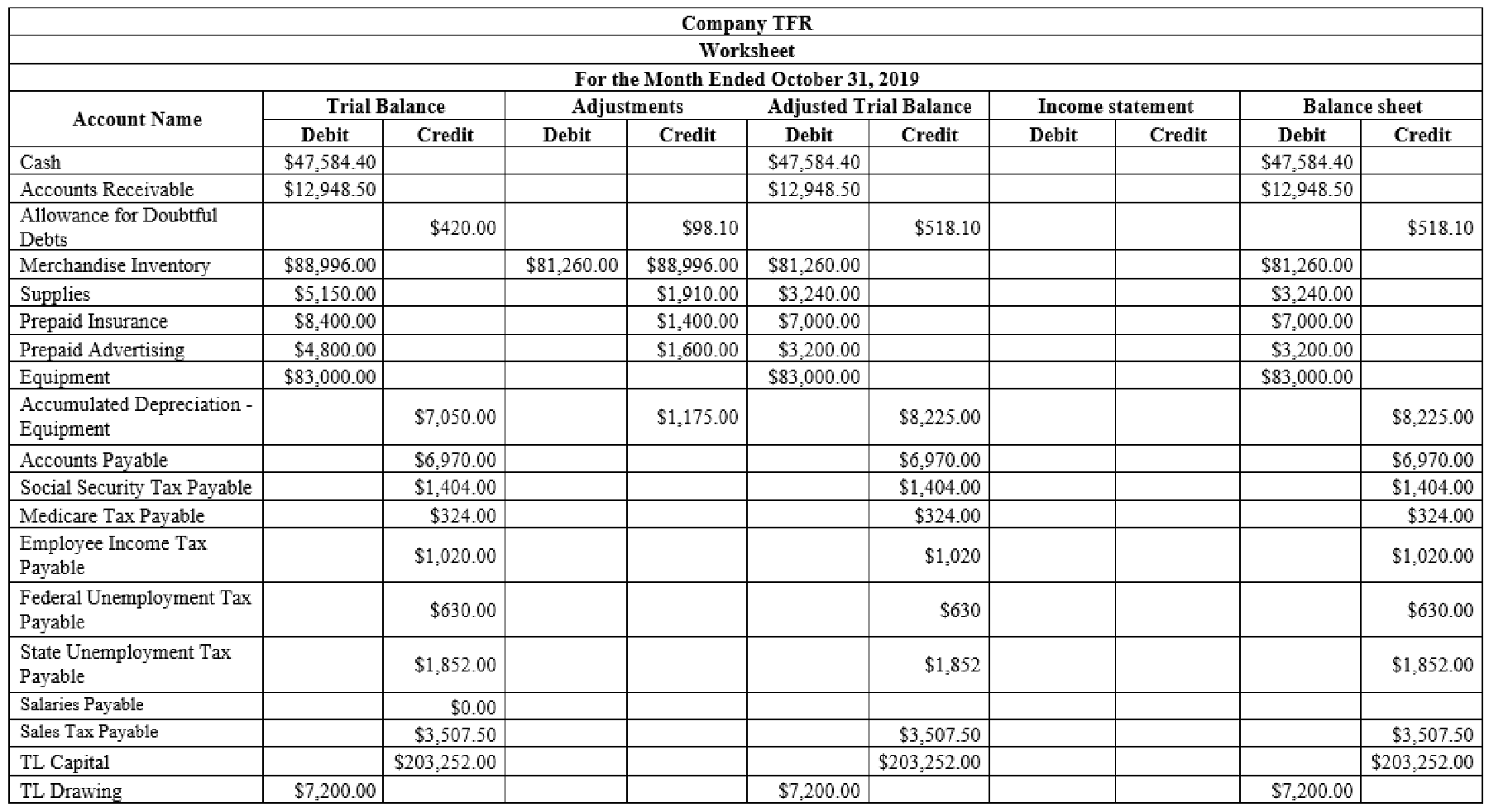

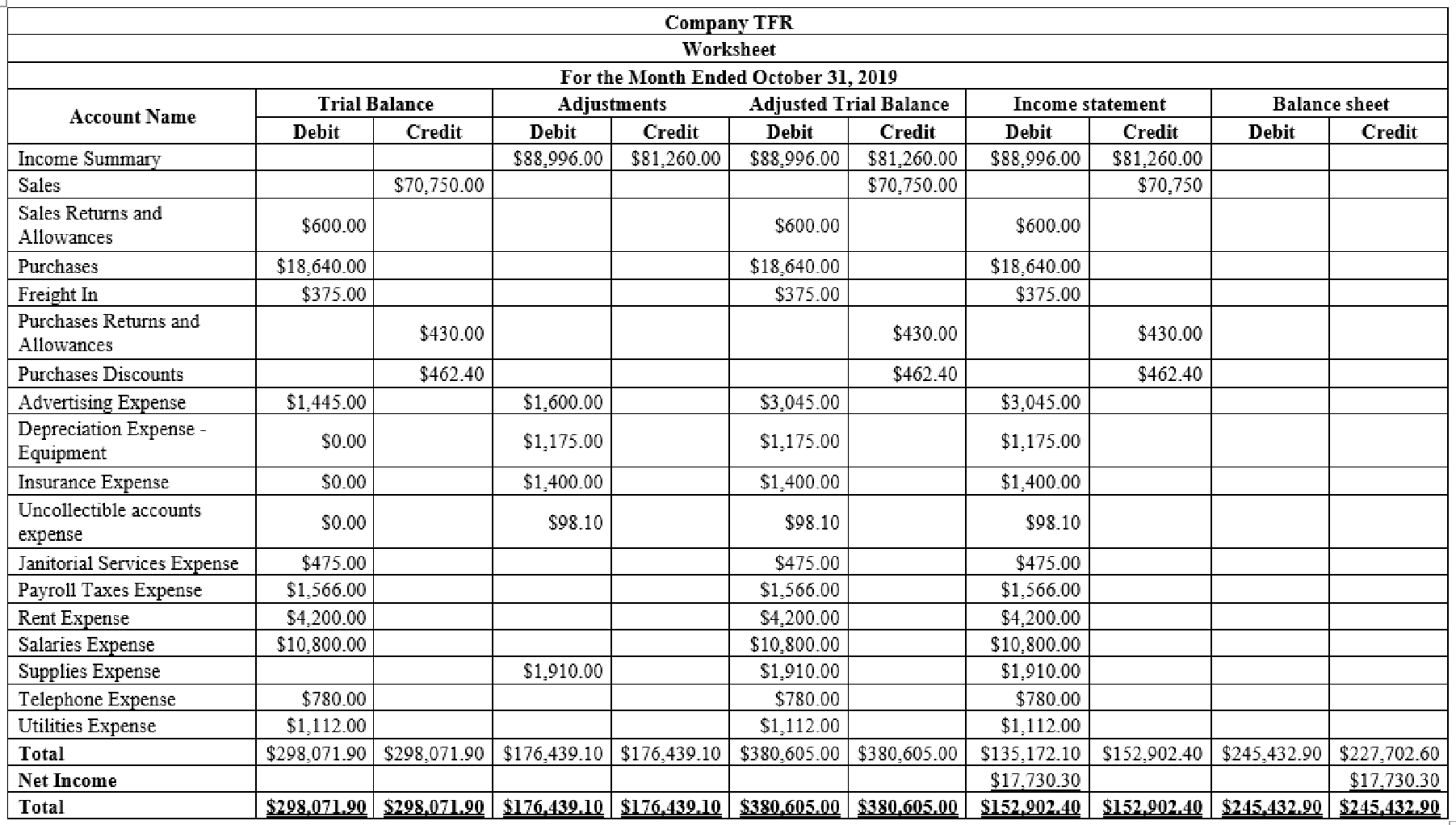

Prepare the 10 column Worksheet with all the adjustments:

Figure (3)

Figure (4)

10.

Prepare the Classified Income Statement.

Explanation of Solution

Classified Income statement: The classified income statement is a financial statement that shows the revenues, expenses with various classifications and sub-totals. The classified income statement is used for complex income statement as its more easily understandable.

Prepare the classified income statement:

| Company TFR | ||||

| Income Statement | ||||

| For the Month Ended October 31, 2019 | ||||

| Particulars | Amount ($) | Amount ($) | Amount ($) | Amount ($) |

| Operating Revenue | ||||

| Sales | $70,750.00 | |||

| Less: Sales Returns and Allowances | $600.00 | |||

| Net Sales | $70,150.00 | |||

| Cost of Goods Sold | ||||

| Merchandise Inventory, October 1, 2019 | $88,996.00 | |||

| Purchases | $18,640.00 | |||

| Freight In | $375.00 | |||

| Delivered Cost of Purchases | $19,015.00 | |||

| Less: Purchases Returns and Allowances | $430.00 | |||

| Purchases Discount | $462.40 | $892.40 | ||

| Net Delivered Cost of Purchases | $18,122.60 | |||

| Total Merchandise Available for sale | $107,118.60 | |||

| Less: Merchandise Inventory, closing | $81,260.00 | |||

| Cost of Goods Sold | $25,858.60 | |||

| Gross Profit on Sales | $44,291.40 | |||

| Operating Expenses | ||||

| Advertising Expense | $3,045.00 | |||

| Depreciation Expense - Equipment | $1,175.00 | |||

| Insurance Expense | $1,400.00 | |||

| Uncollectible accounts expense | $98.10 | |||

| Janitorial Services Expense | $475.00 | |||

| Payroll Taxes Expense | $1,566.00 | |||

| Rent Expense | $4,200.00 | |||

| Salaries Expense | $10,800.00 | |||

| Supplies Expense | $1,910.00 | |||

| Telephone Expense | $780.00 | |||

| Utilities Expense | $1,112.00 | |||

| Total Operating Expenses | $26,561.10 | |||

| Net income for the month | $17,730.30 | |||

Table (22)

11.

Show the Statement of Owner's equity.

Explanation of Solution

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company TFR | ||

| Statement of Owner's Equity | ||

| Year Ended October 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| TL Capital, October 1, 2019 | $203,252 | |

| Net income for the month | $17,730.30 | |

| Deduct - Withdrawals | $7,200.00 | |

| Increase in Capital | $10,530.30 | |

| TL Capital, October 31, 2019 | $213,782.30 | |

Table (23)

12.

Show the Classified Balance Sheet.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

| Company TFR | |||

| Balance Sheet | |||

| October 31, 2019 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current Assets | |||

| Cash | $47,584.40 | ||

| Accounts Receivable | $12,948.50 | ||

| Less: Allowance for Doubtful Debts | $518.10 | $12,430.40 | |

| Merchandise Inventory | $81,260.00 | ||

| Supplies | $3,240.00 | ||

| Prepaid expenses | |||

| Prepaid Insurance | $7,000.00 | ||

| Prepaid Advertising | $3,200.00 | $10,200.00 | |

| Total Current Assets | $154,714.80 | ||

| Plant and Equipment | |||

| Equipment | $83,000.00 | ||

| Less: Accumulated Depreciation | $8,225.00 | $74,775.00 | |

| Total Plant and Equipment | $74,775.00 | ||

| Total Assets | $229,489.80 | ||

| Liabilities and Owner's Equity | |||

| Current Liabilities | |||

| Accounts Payable | $6,970.00 | ||

| Social Security Tax Payable | $1,404.00 | ||

| Medicare Tax Payable | $324.00 | ||

| Employee Income Tax Payable | $1,020.00 | ||

| Federal Unemployment Tax Payable | $630.00 | ||

| State Unemployment Tax Payable | $1,852.00 | ||

| Sales Tax Payable | $3,507.50 | ||

| Total Current Liabilities | $15,707.50 | ||

| Owner's Equity | |||

| TL Capital | $213,782.30 | ||

| Total Liabilities and Owner's Equity | $229,489.80 | ||

Table (24)

15.

Prepare the postclosing trial balance.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the ledger postings and helps preparing the final accounts.

Postclosing trial balance: The postclosing trial balance is the summary of the ledger accounts, showing the debit and the credit balances after the closing entries are journalized and posted.

Prepare the postclosing trial balance:

| Company TFR | ||

| Statement of Owner's Equity | ||

| Year Ended October 31, 2019 | ||

| Account Name | Debit | Credit |

| Cash | $47,584.40 | |

| Accounts Receivable | $12,948.50 | |

| Allowance for Doubtful Accounts | $518.10 | |

| Merchandise Inventory | $81,260.00 | |

| Supplies | $3,240.00 | |

| Prepaid Insurance | $7,000.00 | |

| Prepaid Advertising | $3,200.00 | |

| Equipment | $83,000.00 | |

| Accumulated Depreciation - Equipment | $8,225.00 | |

| Accounts Payable | $6,970.00 | |

| Social Security Tax Payable | $1,404.00 | |

| Medicare Tax Payable | $324.00 | |

| Employee Income Tax Payable | $1,020.00 | |

| Federal Unemployment Tax Payable | $630.00 | |

| State Unemployment Tax Payable | $1,852.00 | |

| Sales Tax Payable | $3,507.50 | |

| TL Capital | $213,782.30 | |

| Total | $238,232.90 | $238,232.90 |

Table (25)

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Just Beachy is a retail business located on the coast of Florida where it sells a variety of beach apparel, T-shirts, and beach-related souvenir items. They purchase all of their inventory from wholesalers and distributors. For the year ending December 31, 2017, they reported these revenues and expenses. Using this information, prepare an income statement for Just Beachy for 2017.arrow_forwardCanine Couture is a specialty dog clothing boutique that sells clothing and clothing accessories for dogs. In 2019, they had gross revenue from sales totaling $86,500. Their operating expenses for this same period were $27,500. If their Cost of Goods Sold (COGS) was 24% of gross revenue, what was their net operating income for the year?arrow_forwardTidy & Cleaning Services provides cleaning and housekeeping services to both households and businesses. The entity prepares financial statements at the end of each month. The following information is provided in relation to the business’s operations in the month of July 2021. On 1 July 2021, the business signed an advertising agreement, that costs $10,800 for six (6) months plus $1 per each click on their advertisements, with an online website to promote its business for the next six months. The agreement stated $1,800 per month will need to be paid in advance at the beginning of each month, $1 per each click on their ads will be paid at the end of the 6th month agreement. A $1,800 advance was paid on 1 July. On 2 July, rent of $39,000 is paid for a 6-months period from 1 July to 31 December 2021. Cleaning supplies account had a debit balance of $750 at the beginning of the month. On 10 July, the business purchased $5,900 cleanings supplies. At the end of the month, a physical…arrow_forward

- Ameena Enterprise is a business management service founded by Madam Ameena in 2019.Mr. Ali is an accountant responsible for preparing the financial statements for AmeenaEnterprise. Miss Maria has been appointed as new account clerk at Ameena Enterprise. Mr. Alihas several tasks planned to test Miss Maria’s ability to work. Firstly, he asked Miss Maria toprepare the journal entries to record the transactions of Ameena Enterprise for the month ofApril 2021. The following are the transactions that occurred in April 2021:Date Transactions1 April Purchased office equipment of RM14,000. 40% of the amount is purchasedon credit basis and the remaining balance is paid by cash.1 April Accrued revenues of RM3,500 previously recorded to accounts receivablewere collected.1 April Paid office rental in advance for RM4,500.2 April Paid all accrued salaries for Mac 2021, RM3,000.3 April Provided services amounting RM2,400 for the customer who made theadvance payment March 2021.10 April Received RM6,500…arrow_forwardAmeena Enterprise is a business management service founded by Madam Ameena in 2019.Mr. Ali is an accountant responsible for preparing the financial statements for AmeenaEnterprise. Miss Maria has been appointed as new account clerk at Ameena Enterprise. Mr. Alihas several tasks planned to test Miss Maria’s ability to work. Firstly, he asked Miss Maria toprepare the journal entries to record the transactions of Ameena Enterprise for the month ofApril 2021. The following are the transactions that occurred in April 2021:Date Transactions1 April Purchased office equipment of RM14,000. 40% of the amount is purchasedon credit basis and the remaining balance is paid by cash.1 April Accrued revenues of RM3,500 previously recorded to accounts receivablewere collected.1 April Paid office rental in advance for RM4,500.2 April Paid all accrued salaries for Mac 2021, RM3,000.3 April Provided services amounting RM2,400 for the customer who made theadvance payment March 2021.10 April Received RM6,500…arrow_forwardAlpha company is a trading company that purchases and sales fruits and vegetables. During the year 2020, the company shows the following transactions and events: 10) The driver of the company has access to the inventory, he delivers the merchandise, receives the cash and has access to the company books. Required: For each case, identify the anomaly and propose the correct accounting treatment/answer:arrow_forward

- Swift Company is a merchandising business organized in 2020. It is located in J. Hernandez Avenue, Naga City, with telephone number 1989-1213, and website tswiftmerchandising.com You were asked by the owner, Ms. T. Swift, to create a simple computerized accounting system for her business which they will use for records keeping, preparation of financial statements, and as substantiation for regulatory requirements. The December 31, 2021 post-closing trial balance for the Swift Company follows: Swift Company Post-Closing Trial Balance December 31, 2021 110 Cash ₱ 240,000 120 Accounts Receivable 210,000 130 Merchandise Inventory 730,000 140 Prepaid Rent 90,000 150 Office Supplies 160,000 160 Office Equipment 1,000,000 165 Accumulated Depreciation ₱…arrow_forwardJoanne is part of the accounts payable team at a local furniture store, responsible for recording invoices received by the business and payments made by the business. The furniture store receives an invoice for internet usage for the amount of $450. The invoice states that payment is due in 30 days, therefore Joanne records the transaction accordingly and sets a calendar reminder to pay on the due date. Based on this information, the journal entry in the furniture store's accounting system would include:arrow_forwardYou are a recent Berkeley college graduate and you are working in the accounting department of Mercy’s. Next week, are required to attend meetings for the stores located in the paramus park small.arrow_forward

- You are to enter up the necessary accounts for the month of June from the following information relating to a small printing firm. Then balance off the accounts and extract a trial balance as at 30 June 2020. June 1 Started in business with capital in cash of $800 and $2200 in the bank. June 2 Bought goods on credit from the following persons: J Ward $610; P Green $214; M Taylor $174; Gemmill $345; P Tone $542 June 4 Sold goods on credit to: J Sharpe $340; G Boycott $720; F Titmus $1,152 June 6 Paid rent by cash $180 June 9 J Sharpe paid us his account by cheque $340. June 10 F Titmus paid us $1000 by cheque June 12 we paid the following by cheque: M Taylor $174; J Ward $610 June 15 Paid carriage by cash $38 June 18 Bought goods on credit from P Green $291; S Gemmill $940 June 21 Sold goods on credit to G Boycott $810 June 30 Paid rent by cheque $230arrow_forwardRusty Spears, CEO of Rusty's Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2017 and 2018:arrow_forwardBefore you begin this assignment, review the Tying It All Together feature in the chapter. Part of Fry’s Electronics, Inc.'s experience involves providing technical support to its customers. This includes in-home installations of electronics and also computer support at their retail store locations. Requirements Suppose Fry’s Electronics, Inc. provides $10,500 of computer support at the Dallas-Fort Worth store during the month of November. How would Fry's Electronics record this transaction? Assume all customers paid in cash. What financial statement(s) would this transaction affect? Assume Fry’s Electronics, Inc.’s Modesto, California, location received $24,000 for an annual contract to provide computer support to the local city government. How would Fry’s Electronics record this transaction? What financial statement(s) would this transaction affect? What is the difference in how revenue is recorded in requirements 1 and 2? Clearly state when revenue is recorded in each requirement.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College