COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

4th Edition

ISBN: 9781260255157

Author: Haddock

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 1FSA

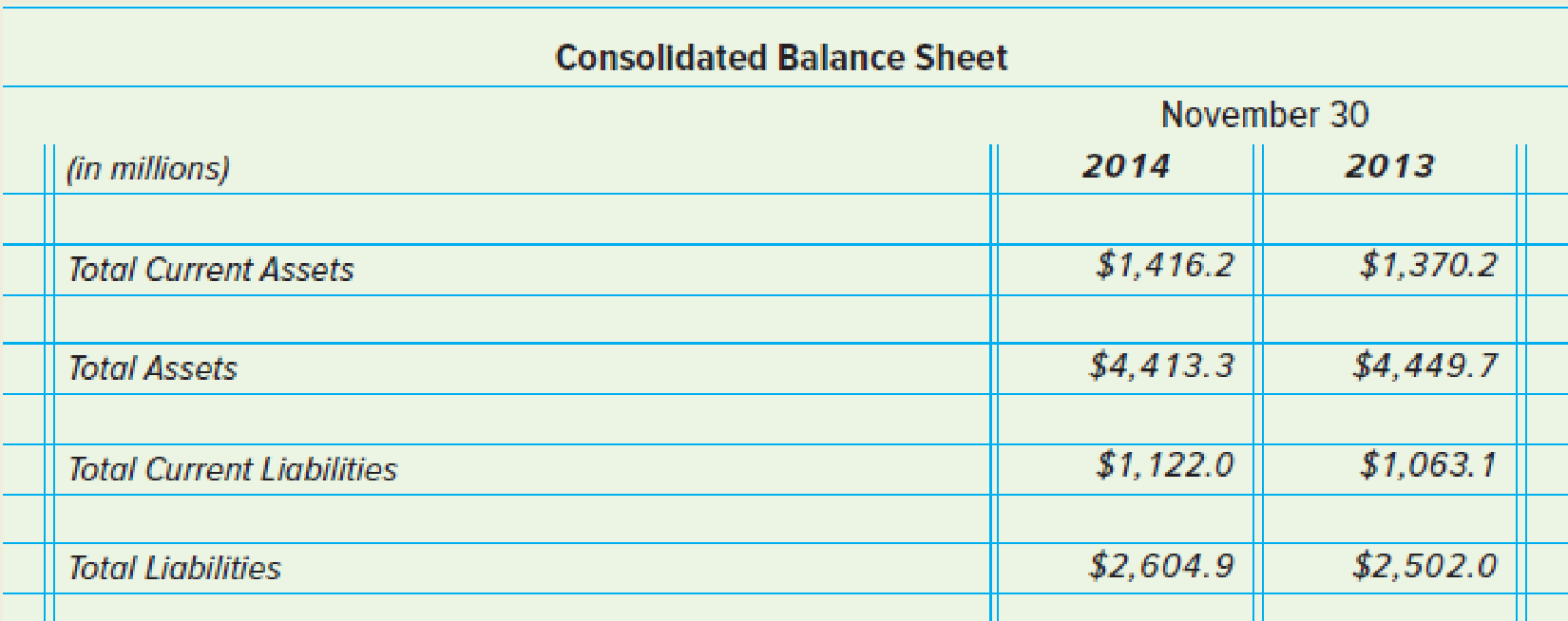

McCormick & Company, Incorporated, is a global leader in the manufacture, marketing, and distribution of spices, seasoning mixes, condiments, and other products to the food industry. McCormick & Company, Incorporated, reported the following in its 2014 Annual Report:

Analyze:

- 1. What is the

current ratio for both 2014 and 2013? - 2. Did the current ratio improve or decline from 2013 to 2014?

- 3. The company reported net sales of $4,243.2 million and gross profit of $1,730.2 million for its fiscal year ended November 30, 2014. What is the gross profit percentage for this period?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In 2014, Apple reported profits of more than $50 billion on salesof $182 billion. For that same period, Microsoft posted a profitof almost $30 billion on sales of $88 billion. So Apple is a bettermarketer, right? Sales and profits provide information to compare the profitability of these two competitors, but between thesenumbers is information regarding the efficiency of marketingefforts in creating those sales and profits. Answer the questions using the following information from the two companies’ incomes statements (all numbers are in thousands): Apple MicrosoftSales $182,795,000 $86,833,000Gross Profit $70,537,000 $59,899,000Marketing Expenses $8,994,750 $15,474,000Net Income (Profit) $52,503,000 $27,759,000

Calculate profit margin, net marketing contribution,marketing return on sales (or…

Tech Company is a medium-sized consumer electronics retailer. The company reported $155,000,000 in revenues for 2007 and $110,050,000 in Costs of Goods Sold (COGS). In the same year, Tech Co. held an average of $16705510in inventory.

Inventory cost at Tech Co. is 27 percent per year. What is the per unit inventory cost ($) for an MP3 player sold at $46? Assume that the margin corresponds to the retailer’s average margin.

According to the producer price index database maintained by the Bureau of Labor Statistics, the average cost of computer equipment fell 3.8 percent between January and December 2016. Let’s see whether these changes are reflected in the income statement of Computer Tycoon Inc. for the year ended December 31, 2016.

2016

2015

Sales Revenue

$

120,000

$

150,000

Cost of Goods Sold

70,000

79,500

Gross Profit

50,000

70,500

Selling, General, and Administrative Expenses

38,000

41,000

Interest Expense

700

575

Income before Income Tax Expense

11,300

28,925

Income Tax Expense

2,500

7,000

Net Income

$

8,800

$

21,925

Required:

Compute the gross profit percentage for each year. Assuming that the change from 2015 to 2016 is the beginning of a sustained trend, is Computer Tycoon likely to earn more or less gross profit from each dollar of sales in 2017?

Compute the net profit margin…

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

Ch. 13 - Why are financial statements prepared in...Ch. 13 - What is the distinction between current...Ch. 13 - Prob. 1.3SRQCh. 13 - Which of the following is not a current asset? a....Ch. 13 - How should purchases returns and allowances be...Ch. 13 - Assume that a business listed the Freight In...Ch. 13 - Why do adjusting entries need detailed...Ch. 13 - Which adjusting entries should be reversed?Ch. 13 - Prob. 2.3SRQCh. 13 - A reversing entry is made for an end-of-period...

Ch. 13 - Prob. 2.5SRECh. 13 - At the end of the previous accounting period, an...Ch. 13 - Prob. 1CSRCh. 13 - Prob. 2CSRCh. 13 - Prob. 3CSRCh. 13 - Prob. 4CSRCh. 13 - Which of the following should have a debit balance...Ch. 13 - Prob. 6CSRCh. 13 - Prob. 7CSRCh. 13 - Prob. 1DQCh. 13 - Prob. 2DQCh. 13 - What are operating expenses?Ch. 13 - Prob. 4DQCh. 13 - Prob. 5DQCh. 13 - Prob. 6DQCh. 13 - Prob. 7DQCh. 13 - Prob. 8DQCh. 13 - Prob. 9DQCh. 13 - Prob. 10DQCh. 13 - Prob. 11DQCh. 13 - Prob. 12DQCh. 13 - Prob. 13DQCh. 13 - Prob. 14DQCh. 13 - Prob. 15DQCh. 13 - Prob. 16DQCh. 13 - Prob. 17DQCh. 13 - Gomez Company had a current ratio of 2.0 in 2018...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - The worksheet of Bridgets Office Supplies contains...Ch. 13 - Prob. 4ECh. 13 - Prob. 5ECh. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - The Adjusted Trial Balance section of the...Ch. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - Superior Hardwood Company distributes hardwood...Ch. 13 - Good to Go Auto Products distributes automobile...Ch. 13 - Obtain all data necessary from the worksheet...Ch. 13 - Obtain all data that is necessary from the...Ch. 13 - Prob. 5PACh. 13 - ComputerGeeks.com is a retail store that sells...Ch. 13 - Hog Wild is a retail firm that sells motorcycles,...Ch. 13 - Prob. 3PBCh. 13 - Prob. 4PBCh. 13 - The data below concerns adjustments to be made at...Ch. 13 - Programs Plus is a retail firm that sells computer...Ch. 13 - Teagan Fitzgerald is the owner of Newport Jewelry,...Ch. 13 - Prob. 1MFCh. 13 - Spectrum Company had an increase in sales and net...Ch. 13 - Prob. 3MFCh. 13 - Prob. 4MFCh. 13 - Prob. 5MFCh. 13 - Prob. 6MFCh. 13 - Prob. 7MFCh. 13 - It is standard accounting procedures, or GAAP, to...Ch. 13 - McCormick Company, Incorporated, is a global...Ch. 13 - The Fashion Rack is a retail merchandising...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- From last year to this year, Berry Barn reported that itsNet Sales increased from $300,000 to $400,000 and itsGross Profit increased from $90,000 to $130,000. Was theGross Profit increase caused by ( a ) an increase in salesvolume only, ( b ) an increase in gross profit per sale only,or ( c ) a combination of both? Explain your answer.arrow_forwardOperating results for department B of Shaw Company during 2016 are as follows: Sales $755,000 Cost of goods sold 480,000 Gross profit 275,000 Direct expenses 215,000 Common expenses 123,000 Total expenses 338,000 Net loss $(63,000) If department B could maintain the same physical volume of product sold while raising selling prices an average of 10% and making an additional advertising expenditure of $35,000, what would be the effect on the department's net income or net loss? (Ignore income tax in your calculations.) Use a negative sign with your answer to indicate if the effect increases the company's net loss. If Department B increased its selling price by 10%, the effect on net income (loss) would be $Answerarrow_forwardJames Furnishings generated $2 million in sales during 2016, and its year-end total assets were $1.5 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.75 for every $1.00 increase in sales. James' profit margin is 3%, and its retention ratio is 35%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $2,180,000 100 % Cost of goods sold 1,417,000 69 Gross profit $763,000 31 % Selling expenses $457,800 18 % Administrative expenses 174,400 7 Total operating expenses $632,200 25 % Operating income $130,800 6 % Other income 43,600 2 $174,400 8 % Other expense 21,800 1 Income before income tax $152,600 7 % Income tax expense 65,400 5 Net income $87,200 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Tannenhill Company…arrow_forwardPaladin Furnishings generated $4 million in sales during 2016, and its year-end total assets were $3.2 million. Also, at year-end 2016, current liabilities were $500,000, consisting of $200,000 of notes payable, $200,000 of accounts payable, and $100,000 of accrued liabilities. Looking ahead to 2017, the company estimates that its assets must increase by $0.80 for every $1.00 increase in sales. Paladin's profit margin is 5%, and its retention ratio is 40%. How large of a sales increase can the company achieve without having to raise funds externally? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardJill Barksalot owns Jill's Jams, a condiment conglomerate focused on world dominance. She sells a variety of jellies and jams that are just to die for mwhahaha. Using the provided data on her last several years of sales, prepare a statement of trend percentages using 2017 as the base year. (in millions) 2017 2018 2019 2020 Sales 13,241 14,122 11,957 13,244 Cost of goods sold 8,987 9,534 8,272 9,101 Gross margin 4,254 4,588 3,685 4,143 2017 2018 2019 2020 Sales Cost of Goods Sold Gross Marginarrow_forward

- The following revenue data were taken from the December 31, 2017, Coca-Cola annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales, Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forwardThe following revenue data were taken from the December 31, 2017, General Electric annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales. Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forwardCostco is the largest chain of membership warehouse clubs in the world based on sales volume, and it is the fifth largest general retailer in the United States. Costco focuses on selling products at low prices, often at a very high volume. These goods are usually bulk-packaged and marketed primarily to large families and businesses. Costco became the first company to grow from zero to 3 billion in sales in less than six years. In a recent fiscal year, Costcos sales totaled 76.3 billion, a 29.3 percent increase from 2006, and its net income reached 1.30 billion, an 18.1 percent increase from 2006. This information, and much more, can be derived from the financial statements that merchandising firms such as Costco prepare on a regular basis to provide shareholders and other interested parties information about the companys activities and financial performance. 1. What type of information would a classified income statement provide to shareholders and other interested parties? 2. What type of information would a classified balance sheet provide to shareholders and other interested parties? Why would this information be important for calculating the working capital and the current ratio, for example?arrow_forward

- Costco is the largest chain of membership warehouse clubs in the world, based on sales volume, and it is the fifth largest general retailer in the United States. Costco focuses on selling products at low prices, often at a very high volume. These goods are usually bulk-packaged and marketed primarily to large families and businesses. Costco became the first company to grow from zero to 3 billion in sales in less than six years. In a recent fiscal year, Costcos sales totaled 116 billion, a 2 percent increase from 2015, and its net income reached 2.35 billion, an 1 percent decrease from 2015. This information, and much more, can be derived from the financial statements that merchandising firms such as Costco prepare on a regular basis to provide shareholders and other interested parties information about the companys activities and financial performance. 1. What type of information would a classified income statement provide to shareholders and other interested parties? 2. What type of information would a classified balance sheet provide to shareholders and other interested parties? Why would this information be important for calculating the working capital and the current ratio, for example?arrow_forwardJarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forwardThe Kroger Company reported the following data in its annual report (in millions). January 28, 2017 January 30, 2016 January 31, 2015 Net sales $115,337 $109,830 $108,465 Cost of sales (using LIFO) 89,502 85,496 85,512 Year-end inventories using FIFO 7,852 7,440 6,933 Year-end inventories using LIFO 6,561 6,168 8,178 Instructions a. Compute Kroger's inventory turnovers for fiscal years ending January 28, 2017, and January 30, 2016, using: 1. Cost of sales and LIFO inventory. 2. Cost of sales and FIFO inventory. b. Some firms calculate inventory turnover using sales rather than cost of goods sold in the numerator. Calculate Kroger's fiscal years ending January 28, 2017, and January 30, 2016, turnover, using: 1. Sales and LIFO inventory. 2. Sales and FIFO inventory. c. State which method you would choose to evaluate Kroger's performance. Justify your choice.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License