Concept explainers

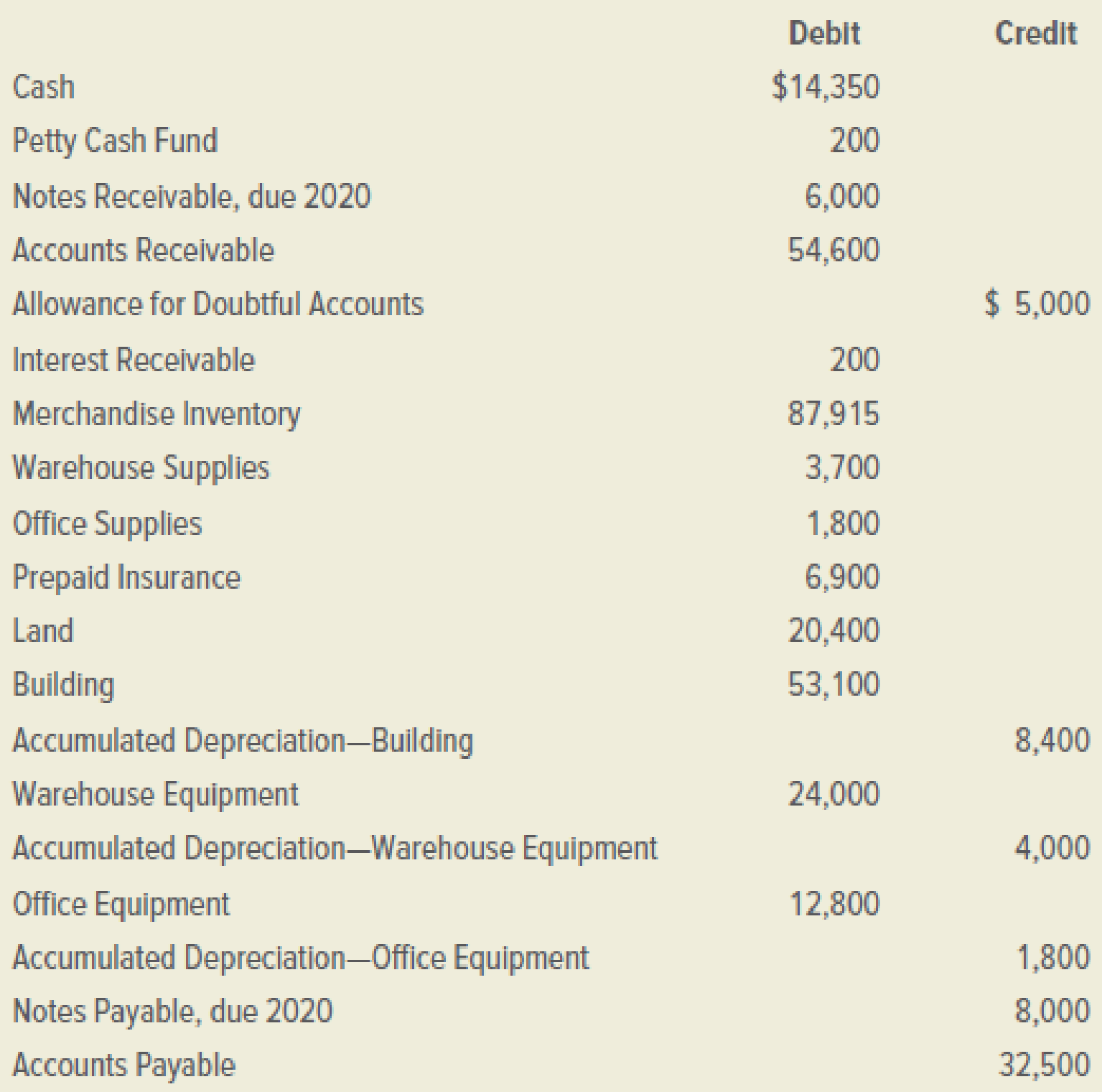

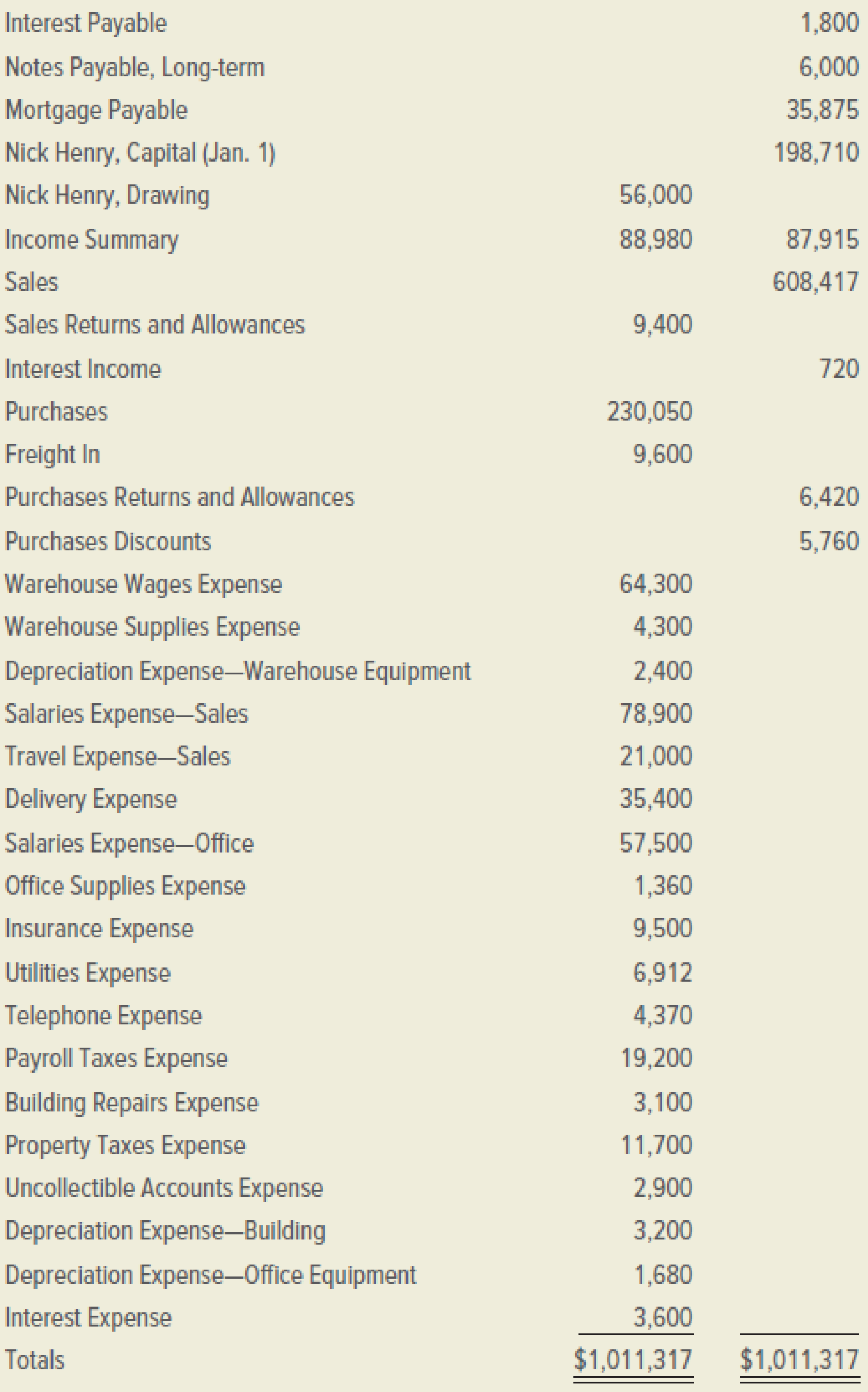

Hog Wild is a retail firm that sells motorcycles, parts, and accessories. The adjusted

INSTRUCTIONS

- 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses.

- 2. Prepare a statement of owner’s equity for the year ended December 31, 2019. No additional investments were made during the period.

- 3. Prepare a classified

balance sheet as of December 31, 2019. The mortgage payable extends for more than one year.

ACCOUNTS

Analyze: What is the inventory turnover for Hog Wild?

1.

Show the Classified Income Statement.

Explanation of Solution

Classified Income statement: The classified income statement is a financial statement that shows the revenues, expenses with various classifications and sub-totals. The classified income statement is used for complex income statement as its more easily understandable.

Prepare the classified income statement:

| Company HW | ||||

| Income Statement | ||||

| Year Ended December 31, 2019 | ||||

| Particulars | Amount ($) | Amount ($) | Amount ($) | Amount ($) |

| Operating Revenue | ||||

| Sales | $608,417 | |||

| Less: Sales Returns and Allowances | $9,400 | |||

| Net Sales | $599,017 | |||

| Cost of Goods Sold | ||||

| Merchandise Inventory, January 1, 2019 | $88,980 | |||

| Purchases | $230,050 | |||

| Freight In | $9,600 | |||

| Delivered Cost of Purchases | $239,650 | |||

| Less: Sales Returns and Allowances | $6,420 | |||

| Purchases Discount | $5,760 | $12,180 | ||

| Net Delivered Cost of Purchases | $227,470 | |||

| Total Merchandise Available for sale | $316,450 | |||

| Less: Merchandise Inventory, closing | $87,915 | |||

| Cost of Goods Sold | $228,535 | |||

| Gross Profit on Sales | $370,482 | |||

| Operating Expenses | ||||

| Warehouse Expenses | ||||

| Warehouse Wages Expense | $64,300 | |||

| Warehouse Supplies Expense | $4,300 | |||

| Depreciation Expense — Warehouse Equipment | $2,400 | |||

| Total Warehouse Expense | $71,000 | |||

| Selling Expenses | ||||

| Salaries Expense—Sales | $78,900 | |||

| Travel Expense | $21,000 | |||

| Delivery Expense | $35,400 | |||

| Total Selling Expense | $135,300 | |||

| General and Administrative Expenses | ||||

| Salaries Expense—Office | $57,500 | |||

| Office Supplies Expense | $1,360 | |||

| Insurance Expense | $9,500 | |||

| Utilities Expense | $6,912 | |||

| Telephone Expense | $4,370 | |||

| Payroll Taxes Expense | $19,200 | |||

| Building Repair Expense | $11,700 | |||

| Property Taxes Expense | $3,100 | |||

| Uncollectible Accounts Expense | $2,900 | |||

| Depreciation Expense - Building | $3,200 | |||

| Depreciation Expense - Office Equipment | $1,680 | |||

| Total General and Admin. Expenses | $121,422 | |||

| Total Operating Expenses | $327,722 | |||

| Income from Operations | $42,760 | |||

| Other Income | ||||

| Interest Income | $720 | |||

| Other Expense | ||||

| Interest Expense | $3,600 | |||

| Net Non-operating expenses | $2,880 | |||

| Net income for the year | $39,880 | |||

Table (1)

2.

Show the Statement of Owner's equity.

Explanation of Solution

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity.

Prepare the Statement of owner's’ equity:

| Company HW | ||

| Statement of Owner's Equity | ||

| Year Ended December 31, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| NH Capital, January 1, 2019 | $198,710 | |

| Net income for the year | $39,880 | |

| Deduct - Withdrawals | $56,000 | |

| Decrease in Capital | ($16,120) | |

| NH Capital, December 31, 2019 | $182,590 | |

Table (2)

3.

Show the Classified Balance Sheet and compute the inventory turnover of Company AW.

Explanation of Solution

Classified balance sheet: The main elements of balance sheet assets, liabilities, and stockholders’ equity are categorized or classified further into sections, and sub-sections in a classified balance sheet. Assets are further classified as current assets, long-term investments, property, plant, and equipment (PPE), and intangible assets. Liabilities are classified into two sections current and long-term. Stockholders’ equity comprises of common stock and retained earnings. Thus, the classified balance sheet includes all the elements under different sections.

Prepare the classified balance sheet:

| Company HW | |||

| Balance Sheet | |||

| December 31, 2019 | |||

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Assets | |||

| Current Assets | |||

| Cash | $14,350 | ||

| Petty Cash Fund | $200 | ||

| Notes receivable | $6,000 | ||

| Accounts receivable | $54,600 | ||

| Less: Allowance for Doubtful Debts | $5,000 | $49,600 | |

| Merchandise Inventory | $87,915 | ||

| Interest Receivable | $200 | ||

| Prepaid expenses | |||

| Warehouse Supplies | $3,700 | ||

| Office Supplies | $1,800 | ||

| Prepaid insurance | $6,900 | $12,400 | |

| Total Current Assets | $170,665 | ||

| Plant and Equipment | |||

| Land | $20,400 | ||

| Building | $53,100 | ||

| Less: Accumulated Depreciation | $8,400 | $44,700 | |

| Warehouse Equipment | $24,000 | ||

| Less: Accumulated Depreciation | $4,000 | $20,000 | |

| Office Equipment | $12,800 | ||

| Less: Accumulated Depreciation | $1,800 | $11,000 | |

| Total Plant and Equipment | $96,100 | ||

| Total Assets | $266,765 | ||

| Liabilities and Owner's Equity | |||

| Current Liabilities | |||

| Notes Payable | $8,000 | ||

| Accounts payable | $32,500 | ||

| Interest Payable | $1,800 | ||

| Total Current Liabilities | $42,300 | ||

| Long Term Liabilities | |||

| Mortgage payable | $35,875 | ||

| Notes Payable - Long Term | $6,000 | ||

| Total Long-Term Liabilities | $41,875 | ||

| Total Liabilities | $84,175 | ||

| Owner's Equity | |||

| CR Capital | $182,590 | ||

| Total Liabilities and Owner's Equity | $266,765 | ||

Table (3)

Inventory turnover ratio: Inventory turnover ratio is used to determine the number of times inventory used or sold during the particular accounting period. Inventory turnover ratio is calculated by using the formula:

Compute the inventory turnover ratio:

Compute the average inventory:

The inventory turnover is 2.58 times.

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardGood Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On November 30, 2019, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions Journalize the seven entries that adjusted the accounts at November 30. None of the accounts were affected by more than one adjusting entry.arrow_forwardReece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services accounting clerk prepared the following unadjusted trial balance at July 31, 2019: The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, 6,400. Depreciation of equipment for the year, 2,800. Accrued salaries and wages at July 31, 900. Unexpired insurance at July 31, 1,500. Fees earned but unbilled on July 31, 10,200. Supplies on hand at July 31, 615. Rent unearned at July 31, 300. Instructions 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable, Rent Revenue, Insurance Expense, Depreciation ExpenseBuilding, Depreciation ExpenseEquipment, and Supplies Expense. 2. Determine the balances of the accounts affected by the adjusting entries and prepare an adjusted trial balance.arrow_forward

- Bonsu is the owner of a retail business. He has employed an inexperienced book-keeper to maintain the accounting records. On 31st December 2020, the end of the business’s accounting year, the book-keeper extracted the following trial balance. Trial balance as at 31st December 2020 Debit (GHS) Credit (GHS) Sales 1,250,000 Purchases 700,000 Discount Allowed 18,300 Carriage Inwards 28,000 Carriage Outwards 31,200 Rent, rate & insurance 61,700 Heating & Lighting 38,000 Postage & stationery 4,200 Advertising…arrow_forwardThe following account balances were included in the trial balance of Ayayai Corporation at June 30, 2023: Sales revenue Cost of goods sold Salaries and wages expense (sales) Sales commission expense (a) Advertising expense (sales) Freight out Entertainment expense (sales) Telephone and internet expense (sales) Depreciation of sales equipment Repairs and maintenance expense (sales) Miscellaneous expenses (sales) Supplies expense (office) Depreciation expense on office furniture and equipment $1,837,150 1,061,770 53,460 99,400 29,230 21,900 15,420 9,930 5,880 6,400 5,315 3,950 7,350 Telephone and Internet expense (office) Salaries and wages (office) Supplies expense (sales) Repairs and maintenance expense (office) Depreciation understatement due to error-2021 (net of tax of $3,300) Miscellaneous expense (office) Dividend revenue Interest expense Income tax expense Dividends declared on preferred shares Dividends declared on common shares $2,920 8,020 5,450 9,830 19,600 7,800 38,800…arrow_forwardThe following account balances were taken from the adjusted trial balance for Laser Messenger Service, a delivery service firm, for the fiscal year ended April 30, 2019. Prepare an income statement. depreciation expense 8,650 rent expense 60,000 fees earned 674,000 salaries expense 336,900 insurance expense 1,500 supplies expense 4,100 miscellaneous expense 3,650 utilities expense 41,200arrow_forward

- Mac Ltd. provides legal advice to customers for fees. On 30 June 2020, Mac Ltd. completed its first year of operations. Some of the ledger account balances of the business, before any financial year end (30 June) adjustments, are provided below: $ Fees Revenue 295,000 Rent Expense 14,640 Electricity Expense 5,640 Wages Expense 108,800 Advertising Prepaid 1,800 No adjusting entries have been made to these accounts at any time during the year. An analysis of the business records reveals the following. The total Fees Revenue recorded includes $1,500 that was prepaid by a client as a deposit for legal advice to be provided in July 2020. The balance in Advertising Prepaid represents the amount paid for an advertising on a legal magazine for 6 months. The agreement with the publisher of the magazine covers the period 1 May 2020 to 31 October 2020. The Electricity Expense ledger balance does not include the amount for June 2020. The account…arrow_forwardOn March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: Accumulated Depreciation-Building $746,350 Administrative Expenses 515,750 Building 2,419,500 Cash 168,150 Cost of Merchandise Sold 3,900,350 Interest Expense 9,750 Kathy Melman, Capital 1,585,350 Kathy Melman, Drawing 180,400 Merchandise Inventory 941,750 Notes Payable 261,150 Office Supplies 21,000 Salaries Payable 7,850 Sales 6,627,450 Selling Expenses 710,900 Store Supplies 93,650 Required: a. Prepare a multiple-step income statement for the year ended March 31, 2019. Be sure to complete the heading of the statement. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon (:) will automatically appear if it is required. In the Other expenses section only, enter amounts that represent other expenses as negative numbers…arrow_forwardPope’s Garage had the following accounts and amounts in its financial statements on December 31, 2019. Assume that all balance sheet items reflect account balances at December 31, 2019, and that all income statement items reflect activities that occurred during the year then ended. Accounts receivable $ 31,300 Depreciation expense 10,200 Land 24,600 Cost of goods sold 87,000 Retained earnings 58,700 Cash 10,200 Equipment 69,000 Supplies 5,400 Accounts payable 23,000 Service revenue 22,500 Interest expense 2,700 Common stock 6,000 Income tax expense 22,830 Accumulated depreciation 40,000 Long-term debt 38,000 Supplies expense 12,500 Merchandise inventory 25,200 Net sales 166,000 Required: Calculate the total current assets at December 31, 2019. Calculate the total liabilities and stockholders’ equity at December 31, 2019. Calculate the earnings from operations (operating income) for the year ended…arrow_forward

- I am having trouble figuring out how to create a proper adjusted trial balance, closing, and post-closing, for this question. Could I get some help on this please? Roth Contractors Corporation was incorporated on December 1, 2019and had the following transactions during December:Part Aa. Issued common stock for $5,000 cashb. Paid $1,200 cash for three months’ rent: December 2019;January and February 2020c. Purchased a used truck for $10,000 on credit (recorded as anaccount payable)d. Purchased $1,000 of supplies on credit. These are expected tobe used during the month (recorded as expense)e. Paid $1,800 for a one-year truck insurance policy, effectiveDecember 1f. Billed a customer $4,500 for work completed to dateg. Collected $800 for work completed to dateh. Paid the following expenses in cash: advertising, $350; interest,$100; telephone, $75; truck operating, $425; wages, $2,500i. Collected $2,000 of the amount billed in f abovej. Billed customers $6,500 for work completed to…arrow_forwardThe following account balances were taking from the adjusted trial balance for laser messenger service, a daily service firm, for the fiscal year ended April 30th, 2019. Depreciation $8,850 Fees earned 684,000 Insurance expense 1,000 Miscellaneous expense 3,650 Rent expense 53,000 Salaries expense 339,500 Supplies expense 3,700 Utilities expense 40,100 Prepare and income statement.is a net loss has been incurred, enter that amount as a negative number using minus sign. Be sure to complete the statement heading.arrow_forwardMac Ltd. provides legal advice to customers for fees. On 30 June 2020, Mac Ltd. completed its first year of operations. Some of the ledger account balances of the business, before any financial year end (30 June) adjustments, are provided below: $ Fees Revenue 442,500 Rent Expense 21,960 Electricity Expense 8,460 Wages Expense 163,200 Advertising Prepaid 2,700 No adjusting entries have been made to these accounts at any time during the year. An analysis of the business records reveals the following. The total Fees Revenue recorded includes $2,250 that was prepaid by a client as a deposit for legal advice to be provided in July 2020. The balance in Advertising Prepaid represents the amount paid for an advertising on a legal magazine for 6 months. The agreement with the publisher of the magazine covers the period 1 May 2020 to 31 October 2020. The Electricity Expense ledger balance does not include the amount for June 2020. The account…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning