Concept explainers

Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company in Problem 12.5A at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

- 1. Record

adjusting entries in the general journal as of December 31, 2019. Use 25 as the first journal page number. Include descriptions for the entries. - 2. Record closing entries in the general journal as of December 31, 2019. Include descriptions.

- 3. Record reversing entries in the general journal as of January 1, 2020. Include descriptions.

Analyze: Assuming that the firm did not record a reversing entry for salaries payable, what entry is required when salaries of $6,000 are paid on January 3?

Problem 12.5A

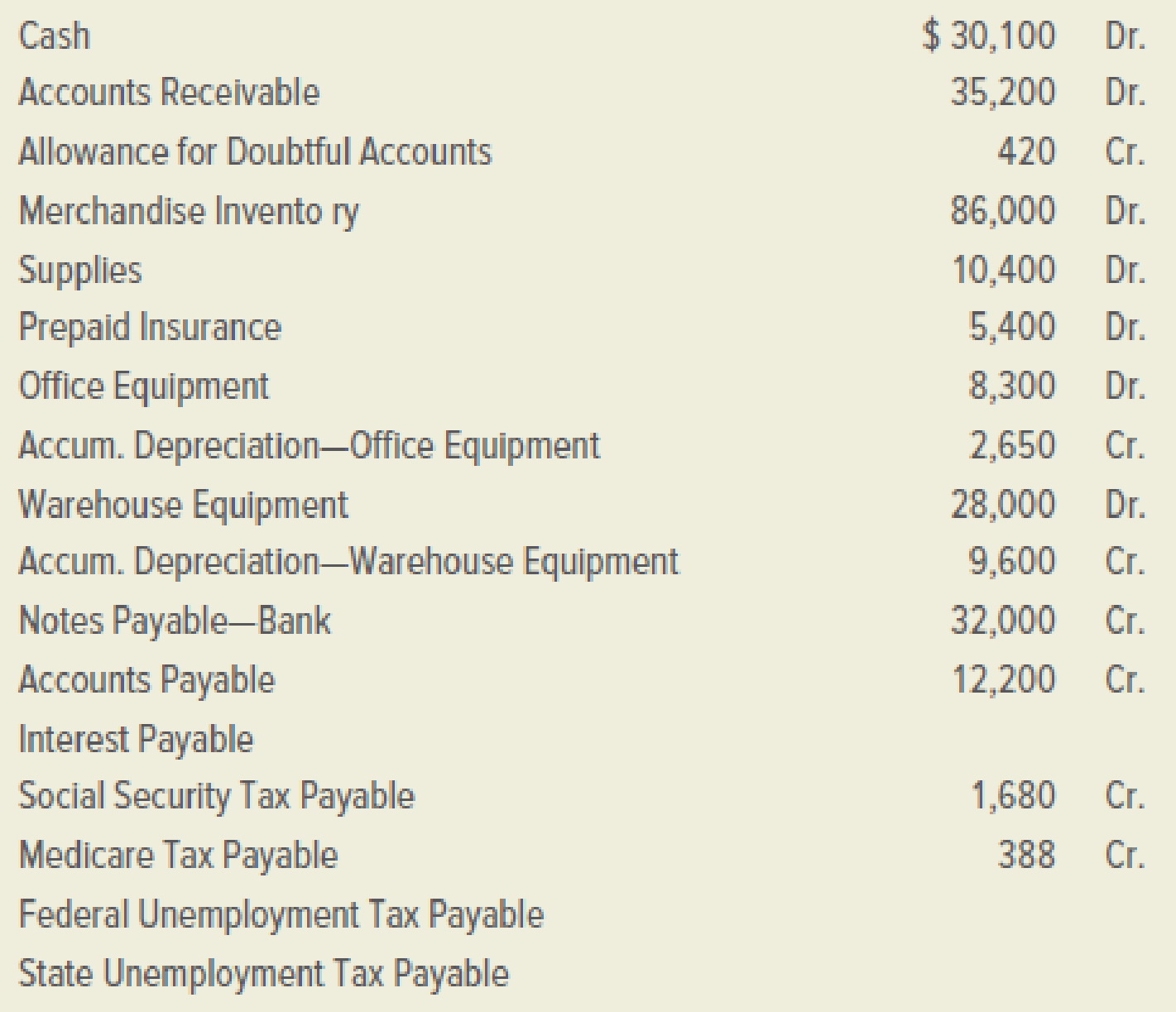

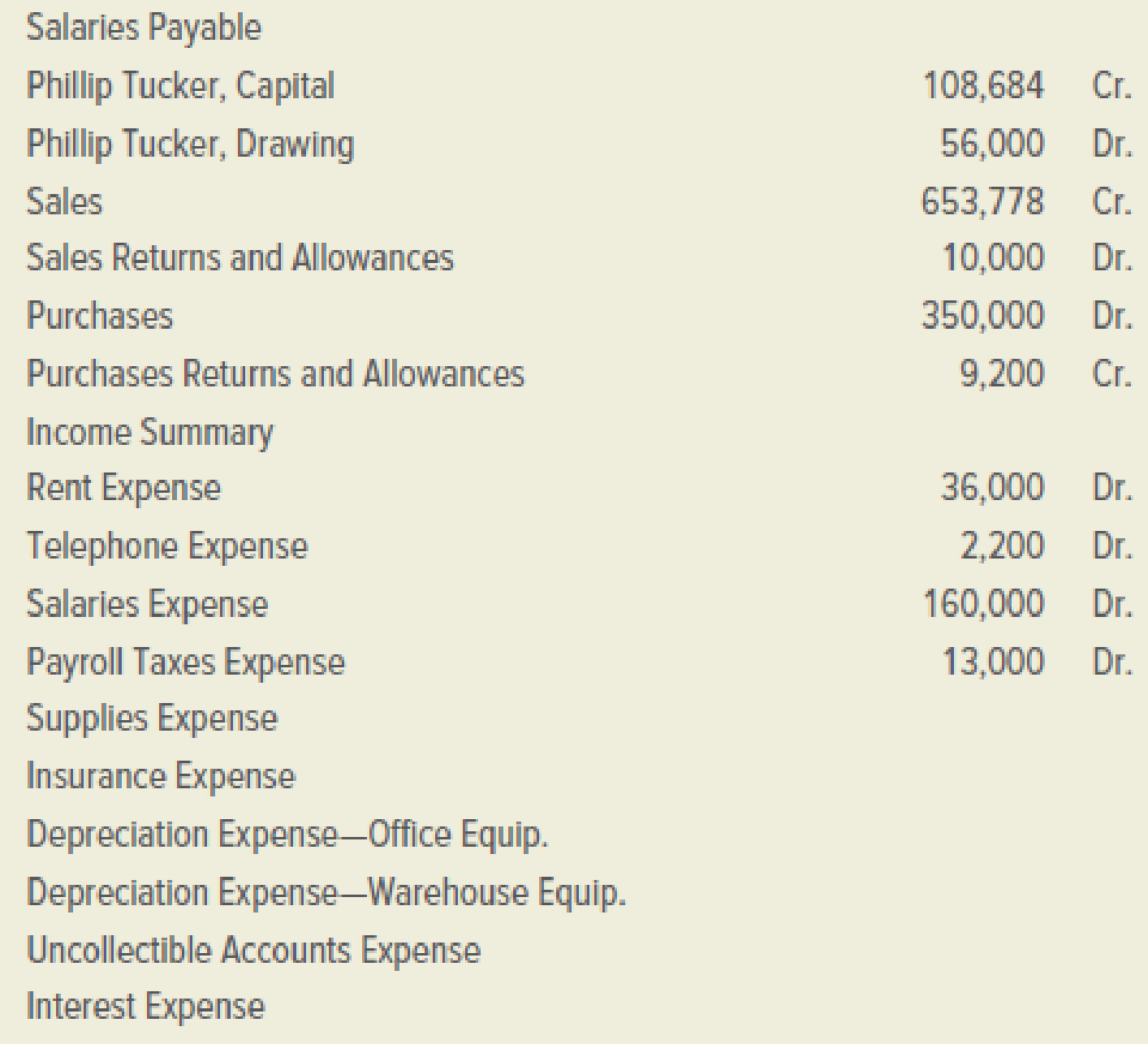

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 2019, the firm’s general ledger contained the accounts and balances that follow.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

Note: This problem will be required to complete Problem 13.4A in Chapter 13.

ACCOUNTS AND BALANCES

ADJUSTMENTS

a.–b. Merchandise inventory on December 31, 2019, is $78,000.

c. During 2019, the firm had net credit sales of $560,000; past experience indicates that 0.5 percent of these sales should result in uncollectible accounts.

d. On December 31, 2019, an inventory of supplies showed that items costing $1,180 were on hand.

e. On May 1, 2019, the firm purchased a one-year insurance policy for $5,400.

f. On January 2, 2017, the firm purchased office equipment for $8,300. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $350.

g. On January 2, 2017, the firm purchased warehouse equipment for $28,000. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,000.

h. On November 1, 2019, the firm issued a four-month, 12 percent note for $32,000.

i. On December 31, 2019, the firm owed salaries of $5,000 that will not be paid until 2020.

j. On December 31, 2019, the firm owed the employer’s social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,000 of accrued wages.

k. On December 31, 2019, the firm owed the federal

Analyze: When the financial statements for Healthy Eating Foods Company are prepared, what net income will be reported for the period ended December 31, 2019?

1.

Journalize the adjusting entries as on December 31, 2019.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Pass the adjusting entry for the given transaction:

| General Journal | Page - 25 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $86,000 | ||

| Merchandise Inventory | $86,000 | |||

| (To record the beginning inventory) | ||||

| December 31 | Merchandise Inventory | $78,000 | ||

| Income Summary | $78,000 | |||

| (To record the closing inventory) | ||||

| December 31 | Uncollectible Accounts Expense | $2,800 | ||

| Allowance for Doubtful Accounts | $2,800 | |||

| (To record the estimated loss on the net credit sale) | ||||

| December 31 | Supplies Expense | $9,220 | ||

| Supplies | $9,220 | |||

| (To record the Supplies used) |

Table (1)

| General Journal | Page - 26 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Insurance expense | $3,600 | ||

| Prepaid Insurance | $3,600 | |||

| (To record the prepaid insurance) | ||||

| December 31 | Depreciation Expense - Office Equipment | $1,325 | ||

| Accumulated Depreciation - Office Equipment | $1,325 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Depreciation Expense - Warehouse Equipment | $4,800 | ||

| Accumulated Depreciation - Warehouse Equipment | $4,800 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Interest expense | $640 | ||

| Interest Payable | $640 | |||

| (To record the interest payable) | ||||

| December 31 | Salaries Expense | $5,000 | ||

| Salaries Payable | $5,000 | |||

| (To record the salaries payable) | ||||

| December 31 | Payroll Taxes Expense | $682.50 | ||

| Federal Unemployment Tax Payable | $30.00 | |||

| State Unemployment Tax Payable | $270.00 | |||

| Social Security Tax Payable | $310.00 | |||

| Medicare Tax Payable | $72.50 | |||

| (To record the taxes on accrued wages) |

Table (2)

2.

Journalize the closing entries as on December 31, 2019.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Pass the closing entries:

| General Journal | Page - 27 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Sales | $653,778 | ||

| Purchases Returns and allowances | $9,200 | |||

| Income Summary | $662,978 | |||

| (To record the closing entry for the income) | ||||

| December 31 | Income Summary | $55,710 | ||

| PT Capital | $55,710 | |||

| (To record the closing entry for the capital) | ||||

| December 31 | PT Capital | $56,000 | ||

| PT Drawings | $56,000 | |||

| (To record the closing entry for the capital) |

Table (3)

| General Journal | Page - 28 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $599,267.50 | ||

| Sales Returns and Allowances | $10,000 | |||

| Purchases | $350,000 | |||

| Rent Expense | $36,000 | |||

| Telephone Expense | $2,200 | |||

| Salaries Expense | $165,000 | |||

| Payroll Taxes Expense | $13,682.50 | |||

| Supplies Expense | $9,220 | |||

| Insurance expense | $3,600 | |||

| Depreciation Expense - Office Equipment | $1,325 | |||

| Depreciation Expense - Warehouse Equipment | $4,800 | |||

| Uncollectible Accounts Expense | $2,800 | |||

| Interest Expense | $640 | |||

| (To record the closing entry for the expenses) |

Table (4)

3.

Journalize the reversing entries as on January 1, 2020 and identify the journal entry to be passed if Salaries are paid on January 3, 2020.

Explanation of Solution

Reversing entries: Reversing entries are those entries which are recorded at the beginning of the year, to reverse or set right the adjusting entries made in the end of the previous accounting year, in order to maintain the records according to accrual basis principle.

Pass the reversing entries:

| General Journal | Page - 29 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 1 | Interest Payable | $640 | ||

| Interest Expense | $640 | |||

| (To record the reversing entry for interest payable) | ||||

| January 1 | Salaries Payable | $5,000 | ||

| Salaries Expense - Office | $5,000 | |||

| (To record the reversing entry for salaries payable) | ||||

| January 1 | Social Security Tax Payable | $310.00 | ||

| Medicare Tax Payable | $72.50 | |||

| Federal Unemployment Tax Payable | $30.00 | |||

| State Unemployment Tax Payable | $270.00 | |||

| Payroll Taxes Expense | $682.50 | |||

| (To record the reversing entry for payroll taxes payable) |

Table (5)

| General Journal | Page - 30 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 3 | Salaries Payable | $5,000 | ||

| Salaries Expense | $1,000 | |||

| Cash | $6,000 | |||

| (To record the payment of salaries ignoring the payroll taxes) |

Table (6)

Want to see more full solutions like this?

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Based on the data presented in Exercise 6-25, journalize the closing entries. On March 31, 2019, the balances of the accounts appearing in the ledger of Racine Furnishings Company, a furniture wholesaler, are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 2019. b. Compare the major advantages and disadvantages of the multiple-step and single-step forms of income statements.arrow_forwardRequired: Prepare the following, December 31, 2019, financial statements: Income Statement Retained Earnings Statement Balance Sheet December 31, 2019, adjusted trial balance is provided below. Prepare the fiscal year-end closing entries. a. Prepare the January 1, 2020 opening trial balance. b. Prepare the journal entries for the first six months of 2020. provided is a summary of activities accounting entries that need to be prepared 2. The owners would like to know the current (as of 6/30/20) cash and the inventory balance. They would like you to provide a “T” account showing the activity in each account. step by step explanation for number 1 with subparts. (underlined question)arrow_forwardRequired: Prepare the following, December 31, 2019, financial statements: Income Statement Retained Earnings Statement Balance Sheet December 31, 2019, adjusted trial balance is provided below. Prepare the fiscal year-end closing entries. Prepare the January 1, 2020 opening trial balance. Prepare the journal entries for the first six months of 2020. The owners provided a written summary of activities they believe accounting entries need to be prepared (see page 2). The owners would like to know the current (as of 6/30/20) cash and the inventory balance. They would like you to provide a “T” account showing the activity in each account.arrow_forward

- Please solve this question Financial data for Safety Hire as of 30 June 2019 are: Data Prepare an income statement for the month of June and a balance sheet in account format for Safety Hire as at 30 June 2019. Data available in the image thnkxarrow_forwardPrepare the following adjusting entry for December 31,2021: Record the December web hosting expense (use Advertising/promotional expense) and then make the entry recurring for the following eleven months. Dec 7th 2021 Recieved a bill from Webworks for a year of Web hosting for $600. So I created the bill for $600.Dec 21 2021 Pay all the bills due to .... and WebWorks, print later. SO I payed the bill of $600. Is it a Prepaid Advertising expense?How does the journal entry will look?arrow_forwardRecord any five accounting transactions of your own choice for Ali furniture business (AFB) for the year 2019, Starting from the owner investment of $100,000. Post them in General journal, make ledger, and Trial balance for those entries. with explanation and to make it in best formate.arrow_forward

- Victoria Company has following account balances on December 31, 2019, prior to any adjustments: 1. Trarnsfer account balances to a 10-column worksheet and prepare a trial balance.2. Prepare adjusting entries in the general journal and complete the worksheet. 3. Prepare company's income statement, retained earnings statement,and balance sheet. 4. Prepare closing entries in the general journal.arrow_forwardPB&J Cafe has the following transactions that need to be recorded: On April 7, 2019, $250 for peanuts the cafe purchased from The Peanut Gallery to make its patented peanut butter On April 30, 2019 $375 For Rover's Sake paid for catering a corporate event How would Reha record these transactions in the general journals for these accounts? Why does she need to keep separate general journals for each account? Your answer should be at least 100 words.arrow_forwardIn quickbooks I need: Record the appropriate adjusting journal entries on 1/31/2021 based on the following: A bill for $675 was received and recorded in the next month from FixIt, Inc. for advertising placed in the current month. Create a new liability account like you did earlier in the chapter.arrow_forward

- CLOSING ENTRIES Using the spreadsheet and partially completed Income Summary Account on page 598, prepare the following: 1. Closing entries for Gimbels Gifts and Gadgets in a general journal. 2. A post-closing trial balance. EXERCISE 15-5Aarrow_forwardAdjusting Entries At the end of 2019, Richards Company prepared a trial balance, recorded and posted its adjusting entries, and then prepared an adjusted trial balance. Selected accounts and account balances from the trial balance and adjusted trial balance are as follow: Required: 1. Next Level By comparing the partial trial balance to the partial adjusted trill balance, determine the adjusting; entries that the company made on December 31, 2019 Prepare your answer in general journal form. 2. Assuming that the company uses reversing entries, indicate which adjusting entries should be reversed.arrow_forwardKelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closingtrial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a twocolumn journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage