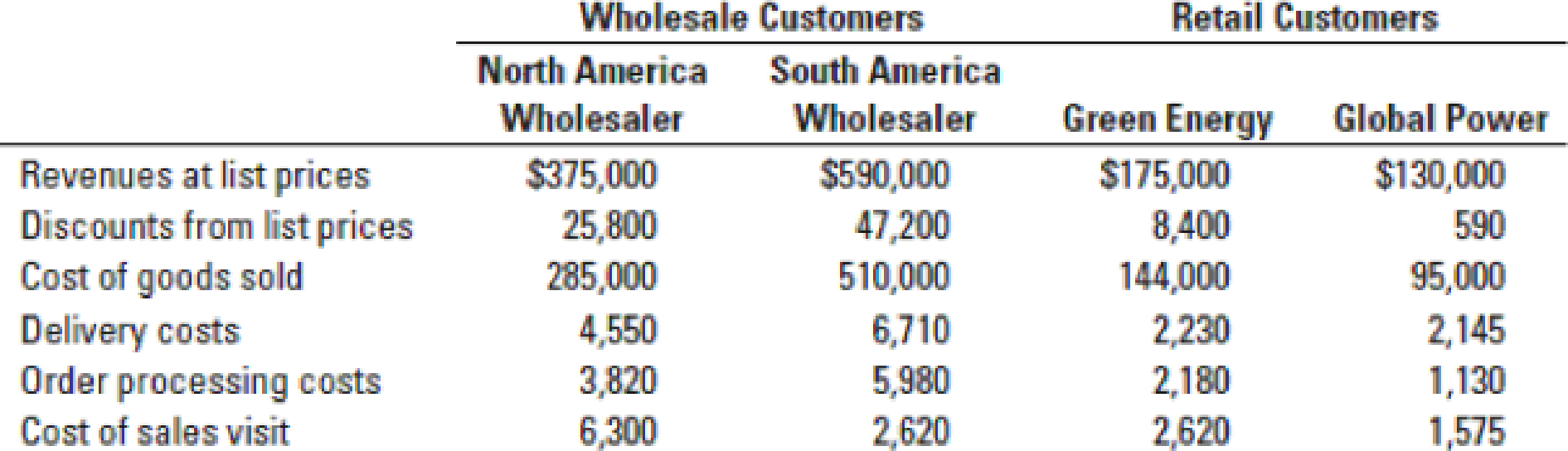

Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands):

Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down.

- 1. Calculate customer-level operating income using the format in Figure 14-3.

Required

- 2. Prepare a customer-cost hierarchy report, using the format in Figure 14-6.

- 3. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $71 million ($33 million + $38 million) for the wholesale channel and $22 million ($12 million + $10 million) for the retail channel. Calculate the distribution-channel-level operating income. On the basis of these calculations, what actions, if any, should Enviro-Tech’s managers take? Explain.

- 4. How might Enviro-Tech use the new cost information from its activity-based costing system to better manage its business?

Learn your wayIncludes step-by-step video

Chapter 14 Solutions

HORNGREN'S COST ACCT >IA<

Additional Business Textbook Solutions

Intermediate Accounting

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (6th Edition)

Financial Accounting (11th Edition)

Managerial Accounting (5th Edition)

Financial Accounting, Student Value Edition (4th Edition)

- The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $540,000 Cost of goods sold 243,000 Gross profit $297,000 Administrative expenses 135,000 Income from operations $162,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,350,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Rate of return on investment % b. If expenses could be reduced by $27,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division? Round the investment…arrow_forwardBovine Company, a wholesale distributor of umbrellas, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales $ 2,070,000 Variable expenses 895,880 Contribution margin 1,174,120 Fixed expenses 1,319,000 Operating loss $ (144,880 ) In an effort to isolate the problem, the president has asked for an income statement segmented by geographic market. Accordingly, the Accounting Department has developed the following: Geographic Market South Central North Sales $ 607,000 $ 806,000 $ 657,000 Variable expenses as a percentage of sales 50 % 36 % 46 % Traceable fixed expenses $ 320,000 $ 480,000 $ 307,000 Required:1. Prepare a contribution format income statement segmented by geographic market, as requested by the president. 2-a. The company’s sales manager believes that sales in the Central…arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,026,000 Cost of goods sold 461,700 Gross profit $564,300 Administrative expenses 205,200 Income from operations $359,100 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,710,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Rate of return on investment % b. If expenses could be reduced by $51,300 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…arrow_forward

- Profit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $1,980,000 Cost of goods sold (891,000) Gross profit $1,089,000 Administrative expenses (594,000) Operating income $495,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $3,300,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $99,000 without decreasing sales, what would be the impact on…arrow_forwardNaylor Company had $210,000 of net income in 2016 when the selling price perunit was $150, the variable costs per unit were $90, and the fi xed costs were $570,000.Management expects per unit data and total fi xed costs to remain the same in 2017. Thepresident of Naylor Company is under pressure from stockholders to increase net incomeby $52,000 in 2017.Instructions(a) Compute the number of units sold in 2016.(b) Compute the number of units that would have to be sold in 2017 to reach the stockholders’ desired profi t level.(c) Assume that Naylor Company sells the same number of units in 2017 as it did in 2016.What would the selling price have to be in order to reach the stockholders’ desiredprofi t level?arrow_forwardOperating results for department B of Shaw Company during 2016 are as follows: Sales $755,000 Cost of goods sold 480,000 Gross profit 275,000 Direct expenses 215,000 Common expenses 123,000 Total expenses 338,000 Net loss $(63,000) If department B could maintain the same physical volume of product sold while raising selling prices an average of 10% and making an additional advertising expenditure of $35,000, what would be the effect on the department's net income or net loss? (Ignore income tax in your calculations.) Use a negative sign with your answer to indicate if the effect increases the company's net loss. If Department B increased its selling price by 10%, the effect on net income (loss) would be $Answerarrow_forward

- 14-19 Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands): Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down. 1. Calculate customer-level operating income using the format 2. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $ 71 million ( $ 33 million…arrow_forwardProfit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $82,500,000 Cost of goods sold 53,625,000 Gross profit $ 28,875,000 Administrative expenses 15,675,000 Income from operations $ 13,200,000 The manager of the Consumer Products Division is considering ways to increase the return on investment a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $55,000,000 of assets have been invested in the Consumer Products Division. If required, round the investment turnover to one decimal place. Profit margin fill in the blank 1% Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3% b. If expenses could be reduced by $1,650,000 without decreasing sales,…arrow_forwardErin Mikell Company was concerned that increased sales did not result in increased profits for 2018. Both variable unit and total fixed manufacturing costs for 2017 and 2018 remained constant at $20 and $2,000,000, respectively. In 2017, the company produced 100,000 units and sold 80,000 units at a price of $50 per unit. There was no beginning inventory in 2017. In 2018, the company made 70,000 units and sold 90,000 units at a price of $50. Selling and administrative expenses were all fixed at $100,000 each year. Prepare income statements for each year using absorption costing. Prepare income statements for each year using variable costing. Explain why the income was different each year using the two methods. Support your explanation with computations.arrow_forward

- Multiple Product Planning with TaxesIn the year 2017, Pyramid Consulting had the following contribution income statement: PYRAMID CONSULTINGContribution Income StatementFor the Year 2017 Sales revenue $ 1,300,000 Variable costs Cost of services $ 420,000 Selling and administrative 200,000 (620,000) Contribution margin 680,000 Fixed Costs -selling and administrative (285,000) Before-tax profit 395,000 Income taxes (36%) (142,200) After-tax profit $ 252,800 a) Determine the annual break-even point in sales revenue. Round contribution margin ratio to two decimal places for your calculation. Round final answer to nearest dollar. (b) Determine the annual margin of safety in sales revenue. Use rounded answer from above for calculation. (c) What is the break-even point in sales revenue if management makes a decision that increases fixed costs by $57,000? Use rounded contribution margin ratio (2 decimal places) for your calculation. (d) With the…arrow_forwardThe accounting firm of Pie and Lowell is examining its client base to determine how profitable its regular clients are. Its analysis indicates that Chico, Incorporated paid $116,000 in fees last year, but cost the firm $124,000 ($106,000 in billable labor, supplies, and copying, and $18,000 in allocated common fixed costs). If Pie and Lowell dropped Chico, Incorporated as a client, and all common fixed costs are unavoidable, how would profit be affected? Multiple Choice Options Increase $8,000 Decrease $10,000 $0 Decrease $116,000arrow_forwardProfit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales $230,000,000 Cost of goods sold (126,500,000) Gross profit $103,500,000 Administrative expenses (64,400,000) Operating income $39,100,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $143,750,000 of assets have been invested in the Consumer Products Division. If required, round your answers to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Return on investment fill in the blank 3 % b. If expenses could be reduced by $3,450,000 without decreasing sales, what…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning