HORNGREN'S COST ACCT >IA<

16th Edition

ISBN: 9780136675464

Author: Datar

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.28E

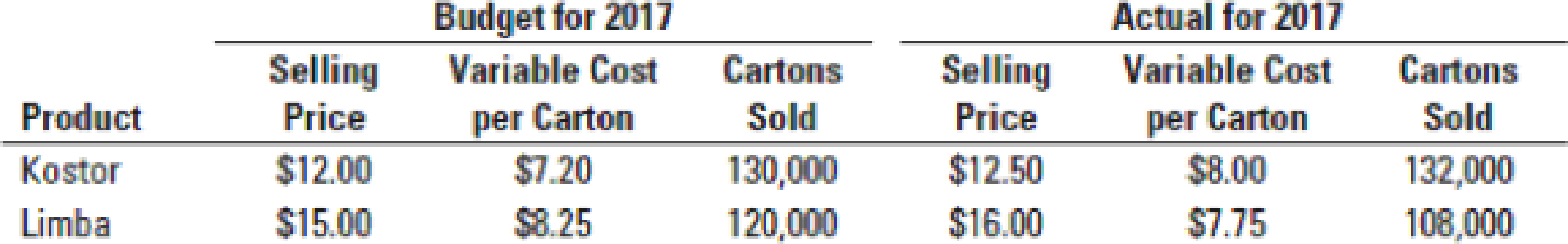

Market-share and market-size variances (continuation of 14-27). Emcee Inc. prepared the budget for 2017 assuming a 20% market share based on total sales in the Midwest region of the United States. The total fruit drinks market was estimated to reach sales of 1.25 million cartons in the region. However actual total sales volume in the western region was 1.5 million cartons.

Calculate the market-share and market-size variances for Emcee Inc. in 2017. (Calculate all variances in terms of contribution margin.) Comment on the results.

14-27

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Market-share and market-size variances (continuation of 14-27). Emcee Inc. prepared the budget for 2017 assuming a 20% market share based on total sales in the Midwest region of the United States. The total fruit drinks market was estimated to reach sales of 1.25 million cartons in the region. However, actual total sales volume in the western region was 1.5 million cartons.

Required:

Calculate the market-share and market-size variances for Emcee Inc. in 2017. (Calculate all variances in terms of contribution margin.) Comment on the results.

Sales Variances

Assume that Casio Computer Company, LTD. sells handheld communication devices for $130 during August as a back-to-school special. The normal selling price is $160. The standard variable cost for each device is $80. Sales for August had been budgeted for 600,000 units nationwide; however, due to the slowdown in the economy, sales were only 550,000.

Compute the revenue variance, sales price variance, sales volume variance, and net sales volume variance.

Top managers of

Cole

Industries predicted

2018

sales of

14,600

units of its product at a unit price of

$7.00.

Actual sales for the year were

14,000

units at

$10.50

each. Variable costs were budgeted at

$2.60

per unit, and actual variable costs were

$2.70

per unit. Actual fixed costs of

$43,000

exceeded budgeted fixed costs by

$4,500.

Prepare

Cole's

flexible budget performance report. What variance contributed most to the year's favorable results? What caused this variance?

Prepare a flexible budget performance report for the year. First, complete the flexible budget performance report through the contribution margin line, then complete the report through the operating income line. Finally, compute the total variances. (Enter a "0" for any zero balances. For any $0 variances, leave the Favorable (F)/Unfavorable (U) input blank.)

Cole Industries

Flexible Budget Performance Report

For the Year Ended December 31, 2018

1

2

3

4

5…

Chapter 14 Solutions

HORNGREN'S COST ACCT >IA<

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000 units per month. In November, Lowell Manufacturing decided to lower its price to 19 per unit expecting it can increase the units sold by 16%. a. Compute the normal revenue with a 20 selling price. b. Compute the planned revenue with a 19 selling price. c. Compute the actual revenue for November, assuming 135,000 units were sold in November at 19 per unit. d. Compute the revenue price variance, assuming 135,000 units were sold in November at 19 per unit. e. Compute the revenue volume variance, assuming 135,000 units were sold in November at 19 per unit. f. Analyze and interpret the lowering of the price to 19.arrow_forwardBudgeted unit sales for the entire countertop oven industry were 2,500,000 (of all model types), and actual unit sales for the industry were 2,550,000. Recall from Cornerstone Exercise 18.6 that Iliff, Inc., provided the following information: Required: 1. Calculate the market share variance (take percentages out to four significant digits). 2. Calculate the market size variance. 3. What if Iliff actually sold a total of 41,000 units (in total of the two models)? How would that affect the market share variance? The market size variance?arrow_forwardSaginaw Company is a garden products wholesale firm. In December, Saginaw Company expects to sell 30,000 bags of vegetable fertilizer at an average price of 5.30 per bag. Actual results are 30,600 bags sold at an average price of 5.20 per bag. Required: 1. Calculate the sales price variance for December. 2. Calculate the sales volume variance for December. 3. Calculate the overall sales variance for December. Explain why it is favorable or unfavorable. 4. What if December sales were actually 29,800 bags? How would that affect the sales price variance? The sales volume variance? The overall sales variance?arrow_forward

- Rosenberry Company computed the following revenue variances for January: Revenue price variance (350,000) Favorable Revenue volume variance50,000 Unfavorable Assuming that the planned selling price per unit was 10 and that actual sales were 175,000 units, determine the following: a. Actual selling price of January. b. Planned number of units that were to be sold in January.arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales.arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 50,000. Sales are higher than expected and management needs to revise its budget. Prepare a flexible budget for 100,000 and 110,000 units of sales.arrow_forward

- Uchdorf Manufacturing just completed a study of its purchasing activity with the objective of improving its efficiency. The driver for the activity is number of purchase orders. The following data pertain to the activity for the most recent year: Activity supply: five purchasing agents capable of processing 2,400 orders per year (12,000 orders) Purchasing agent cost (salary): 45,600 per year Actual usage: 10,600 orders per year Value-added quantity: 7,000 orders per year Required: 1. Calculate the volume variance and explain its significance. 2. Calculate the unused capacity variance and explain its use. 3. What if the actual usage drops to 9,000 orders? What effect will this have on capacity management? What will be the level of spending reduction if the value-added standard is met?arrow_forwardThe following data were collected by Bemidji Co. for the month of June:Static budget data:Sales 13,500 units @ 46/unitVariable costs $ 32.00 per unitTotal fixed costs $ 28,350Actual results:Sales 15,000 units @ $45/unitVariable costs $ 34.80 per unitTotal fixed costs $ 26,850Required:1, 2 & 3. Prepare the static and flexible budgets and show the variances by completing the table given below. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable,and "None" for no effect (i.e., zero variance).)arrow_forwardThe following data is for the month of June for the Sylvie Co. Master Budget: Sales of $8,000,000, variable cost of $4,000,000, and fixed cost of $2,000,000 and sales of 200,000 units. Actual Results: Sales $9,000,000, variable cost $6,000,000, fixed cost $2,500,000 and 450000 units. Required: Calculate the sales activity and flexible budget variances for the month of June ( 5 column variance analysis ).arrow_forward

- Squillace Corporation uses customers served as its measure of activity. During October, the company budgeted for 38,000 customers, but actually served 35,000 customers. The company has provided the following data concerning the formulas used in its budgeting and its actual results for October. Required:Prepare the company's flexible budget performance report for October (calculate both activity variances and revenue and spending variances). Label each variance as favorable (F) or unfavorable (U). Use the templates given below.arrow_forwardFarad, Inc., specializes in selling used trucks. During the month, Farad sold 52 trucks at an average price of $9,400 each. The budget for the month was to sell 47 trucks at an average price of $9,800 each.AQ = Actual QuantitySQ = Standard QuantityAP = Actual PriceSP = Standard PriceCompute the dealership’s sales price variance and sales volume variance for the month and classify each as favorable or unfavorable.arrow_forwardThe following data pertain to Inyange Cannery for the month of February. Static Budget Actual Units sold 14,000 12,000 Sales revenue $ 182,000 $ 151,200 Variable manufacturing cost 5,000 39,000 Fixed manufacturing cost 18,000 18,000 Variable selling and administrative cost 14,000 9,000 Fixed selling and administrative cost 14,000 14,000 Required: Compute the sales-price and sales-volume variances for February. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY